Hershey: Good Category, Resilient Growth, But Too Expensive

Summary

- Hershey is a market leader in U.S. confectionery and has growing businesses in U.S. salty snacks and outside the U.S.

- It is a good business that has demonstrated resilience in sales and margins in the face of previous macro headwinds.

- Hershey has set out new medium-term financial targets at an investor day, targeting an EPS CAGR of 7.5-9% in 2023-25.

- Hershey has grown much faster in recent years in a successful turnaround, and we believe it will achieve the new targets.

- At $259.87, shares have a 30.1x P/E and a 1.6% Dividend Yield. We expect a de-rating to 25x and a mid-single-digit annualized return.

Scott Olson

Introduction

We review The Hershey Company (NYSE:HSY) as a potential investment after management held an investor day on March 22 and set out financial targets both for 2024-25 and the long term.

Hershey is the largest seller of quality chocolate in North America, and has been rapidly expanding in salty snacks and outside the U.S. Management's long-term algorithm is for Net Sales to grow 2-4% and Adjusted EPS to grow 6-8% annually on average, but Adjusted EPS growth is expected to be 7.5-9% during 2023-25. Hershey had achieved much higher growth than this in the last 5 years, helped by a successful turnaround as well as COVID-19. The company had demonstrated sales resilience during the Global Financial Crisis and margin resilience during high inflation in 2022. We believe both medium- and long-term targets are achievable. However, Hershey stock is relatively expensive with a 30x P/E and an 1.6% Dividend Yield, which will likely limit annual returns to high-single-digits. We assign a Hold rating to Hershey and wait for a better entry point.

| Hershey Example Products  Source: Hershey investor day presentation (Mar-22). |

Hershey is scheduled to report Q1 2023 results on April 27.

Hershey Company Overview

Hershey is the largest seller of quality chocolate in North America, with a 45% share of the U.S. Chocolate market and a 31% of the overall Candy, Mint & Gum market.

The company has three operating segments:

- The North America Confectionery segment sells a variety of chocolate and non-chocolate offerings.

- The North America Salty Snacks segment sells ready-to-eat popcorn, pretzel snacks and other snacks, and had doubled in size between 2020 and 2022, helped by the $1.2bn acquisition of Dot's Pretzels in December 2021.

- The International segment had its largest volume growth in Brazil, Mexico and India in 2022, but also included other markets including Travel Retail, Malaysia and the U.K. It sold off its Chinese unit, Golden Monkey, in 2018.

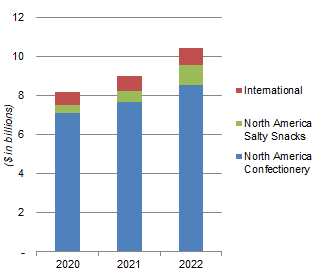

North America Confectionery contributed 82% of group sales in 2022, while North America Salty Snacks contributed 10% and International contributed 8%:

| Hershey Sales By Segment (2020-22)  Source: Hershey company filings (Mar-22). |

The two smaller segments are younger businesses that typically faster than the group average, with North America Salty Snacks having grown sales at mid-teens organically in both 2021 and 2022.

Hershey has two classes of shares, Common and Class B. Only the Common shares are traded, and they are entitled to a dividend that is 10% higher than that for the Class B. Class B shares have 10 times the voting rights (giving them around 80% of total votes) and are entitled to select one-sixth of the directors. The Hershey Trust, though its ownership of Class B shares, retains voting control of the company.

Hershey Financial Targets

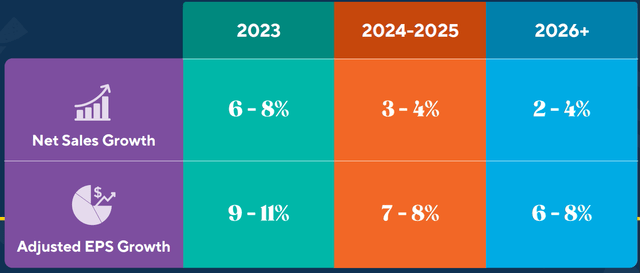

Hershey's long-term algorithm is for Net Sales to grow 2-4% and Adjusted EPS to grow 6-8% annually on average.

At the investor day on March 22, management reaffirmed these for 2026+, but also set out 2024-25 targets with growth rates that were 1 ppt higher at the low end. The 2023 outlook, released with 2022 results on February 2, already included full-year growth rates that were up to 4 ppt higher:

| Hershey Financial Targets (2023 to 2026+)  Source: Hershey investor day presentation (Mar-22). NB. Targets do not assume any M&A. |

The 2023 and 2024-25 targets imply an EPS CAGR of between 7.5% and 9% approximately for 2023-25 overall.

The long-term target of 2-4% sales growth is based on a balance between price growth and volume growth, though with different mixes in different segments. The more mature North America Confectionery is expected to see more price growth, while the other segments are expected to see more volume growth, though with North America Salty Snacks focusing more on scaling the business and International placing more emphasis on "profitable growth":

| Hershey Strategic Priorities By Segment  Source: Hershey investor day presentation (Mar-22). |

Margin expansion is a fundamental part of Hershey's long-term algorithm, and management is targeting more margin expansion in 2023-25. Price will be an important driver. Fixed cost leverage is another key part of this, as many of Hershey's costs do not need to grow in line with sales. As CFO Steve Voskiul said at the investor day:

"For costs that don't matter to the consumer, we want to keep those flat to down as a percentage of sales over time"

More specific targets include $400m+ of cost savings (on a gross basis, some of these may be reinvested) and a 300 bps increase in Gross Margin in the North America Salty Snacks segment by 2026.

Hershey's Track Record

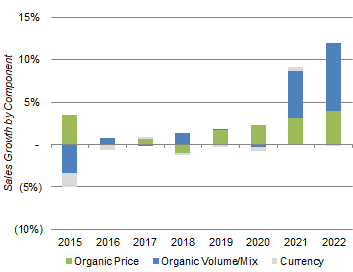

Hershey had achieved much higher growth than its current targets in the last 5 years, with Net Sales having grown at a CAGR of 6.8% (including an organic CAGR of around 5%) and Adjusted EBIT having grown at a CAGR of 9.1%. These have enabled an Adjusted EPS growth of 12.3% (which also benefited from the 2017 U.S. tax cut).

Growth rates in 2017-22 were partly the result of a successful turnaround under current CEO Michelle Buck, who joined was promoted to CEO in March 2017 (having first joined Hershey in 2005). Under her leadership, a significant "business alignment" was carried out, including a 15% reduction in Hershey's global headcount, significant acquisitions and disposals, as well as the reorganization of the company into its three current reporting segments in Q4 2021. Hershey's organic growth clearly re-accelerated after this "realignment":

| Hershey Organic Sales Growth (2015-22)  Source: Hershey company filings. |

Growth rates since 2021 have also been helped by COVID-19, as lockdown restrictions mean more snacking occasions for consumers, especially in the U.S. Much of the benefit from the latter will likely persist as work-from-home has become a permanent feature of the working life at many businesses.

Hershey's Sales & Margin Resilience

Hershey has already demonstrated its resilience during past economic shocks.

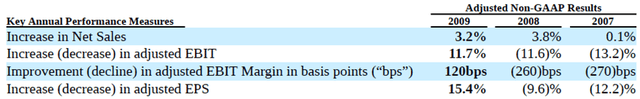

Net sales were resilient following the Global Financial Crisis, growing by more than 3% in each of 2008 and 2009, in each case with price increases and reduced promotions more than offsetting lower volumes:

| Hershey Key Financials (2007-9)  Source: Hershey 10-K filing (2009). |

Adjusted EPS did fall from $2.08 in 2007 to $1.88 in 2008, before recovering to $2.17 in 2009, but largely due to higher Operating Expenses (as Gross Margin rose in both years); this trend was in also place before the crisis (Adjusted EPS was already in decline in 2007, from $2.37 in 2006) and was partly due to Hershey's international expansion.

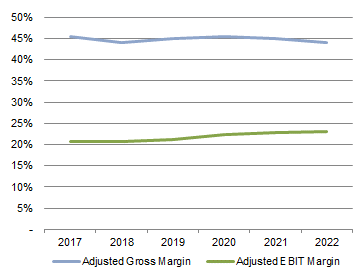

Margins have been resilient during the last few years despite high inflation, with Adjusted EBIT margin growing slightly in each of 2021 and 2022 despite an Adjusted Gross Margin decline of approximately 50 bps each year:

| Hershey Adjusted Margins (2017-22)  Source: Hershey company filings. |

The resilience of Hershey's sales and margin can be explained by the importance of its products to consumers. As CEO Michele Buck explained on the Q4 2022 earnings call:

"Our largest categories, Chocolate and Salty Snacks, rank as two of the top three resilient treats that consumers are not willing to forgo. Chocolate moments are such a heavily integrated part of consumers' weekly routines, from rewarding moments to stress relief to self-care, and everything in between, that they indicate they would rather cut back on other expenses to make room for chocolate because they love it so much and it's affordable. Salty snacks are another regular companion that consumers are hard-pressed to cut back out of their grocery budget. Not only are they affordable compared to other expenses, but they are key parts of both parents' and kids' daily routines. As a result, we believe snacks and confection trends will continue to pace ahead of other food categories."

This resilience is expected to continue into 2023. As stated above, management is guiding to Net Sales growth of 6-8%, with price expected to be the largest contributor and volume expected to be "flat to slightly down", and Adjusted EBIT again expected to grow ahead of Net Sales (implying margin expansion). In Q4 2022, the most recent quarter, even the relatively mature North America Confectionery segment grew sales by 10.2% organically year-on-year, including 9.1% from price and 1.1% from volume/mix.

We Expect Hershey to Deliver on Targets

We believe both medium- and long-term targets are achievable, based on the nature of the category, Hershey's strong brands, products and scale, as well as management's record of competent execution.

Hershey Valuation

However, we believe Hershey stock is relatively expensive at present.

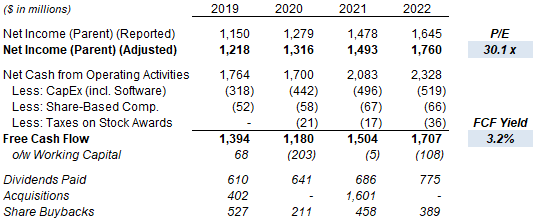

At $259.87, relative to 2022, Hershey shares have a 30.1x P/E and a 3.2% Free Cash Flow ("FCF") Yield:

| Hershey Net Income, Cashflow & Valuation (2019-22)  Source: Hershey company filings. NB. Excludes "Equity Investments in Tax Credit Qualifying Partnerships". |

Management targets a 100%+ cash conversion (FCF / Net Income) and has a record of meeting this. However, FCF will be temporarily impacted in 2023, as CapEx is expected to rise to around 8% of sales (from 5.0% in 2022) for capacity expansion, before falling back to 5-6% in 2024 and around 4% long-term. Working capital may also be worse as inventories are expected to rise in H2 while a new Enterprise Resource Planning system is being rolled out.

The Dividend Yield is 1.6%, based on the current quarterly dividend of $1.036 ($4.144 annualized), which was raised by 15% year-on-year in 2022. Management targets a Payout Ratio of "more than 50%".

Hershey has a policy of retuning surplus capital by repurchasing its own shares, and its basic share count has declined with a CAGR of 0.6% during 2017-22. The Net Debt / EBITDA target range is 1.5-2.0x.

Hershey Share Price History

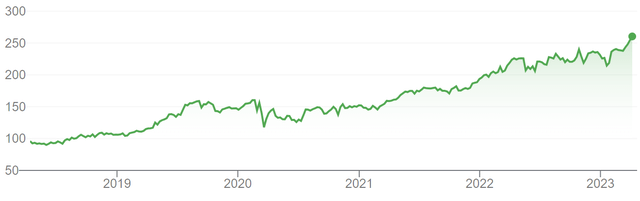

Hershey shares are at a record high, having risen by 171% in the past 5 years with a fairly consistent trajectory:

| HersheyShare Price (Last 5 Years)  Source: Google Finance (06-Apr-23). |

However, the share price did fall by more than a quarter during February-March of 2020 at the outset of COVID-19.

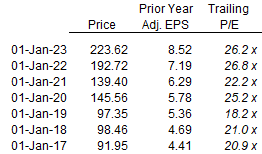

Snapshots of Hershey's share price taken at the start of each year showed that it started each year in 2020-23 with a P/E multiple around the mid-20s, and started each year in 2017-10 with a P/E multiple of around 20x:

| HersheyShare Price & P/E Snapshots (Since 2017)  Source: Yahoo Finance and Librarian Capital. |

We believe the multiples in the more recent years are more indicative of the future, as Hershey's growth has permanently improved under current management. However, growth was higher and interest rates were lower in these years.

On balance we assume Hershey will have an exit trailing P/E of 25x, in line with our assumptions on other consumer stocks with long-term high-single-digit EPS growth.

Hershey Forecasted Returns

Hershey's annual returns will likely be limited to mid-single-digits over the next few years, based on a combination of:

- EPS growth worth around 9% each year (high end of management targets)

- P/E de-rating from 30x to 25x, worth about 6% each year

- Dividends, worth between 1.6% and 2% each year

This is lower than our requirement of at least 10%, and we see more attractive targets elsewhere.

We assign a Hold rating to Hershey stock and wait for a better entry point, specifically for the P/E to fall back below 25x.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.