China Southern Airlines: A Long Recovery Ahead

Summary

- China only re-opened in late 2022, so significant improvements in financial results for airlines remain absent, including China Southern Airlines.

- The rate of capacity recovery will be a watch item this year.

- Investors should be aware of the risks associated with Chinese stocks.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

aapsky/iStock Editorial via Getty Images

With China opening up for business again, Chinese airlines could be an interesting opportunity to explore. However, don't expect that with a reopening in Q4 2022 that the most recent results are pretty. One should also carefully keep in mind any risk related to China. In this report I discuss the results for China Southern Airlines (OTCPK:CHKIF) as well as the risks and the trajectory of the operating statistics in the first two months of the year.

The Risks Surrounding China

I wouldn't say that Chinese stocks do not offer any opportunity, but I do believe that there are significant elements that put a damper on foreign investments to capitalize on the re-opening of the Chinese economy. A concentration of power for President Xi Jinping is one of those and another is the constant fear of an escalation with Taiwan.

Moreover, with conflicts mounting and the Sino-American relation at a low, we see that China and the West are ending on opposing sides more and more, which obviously does not remedy any risks and concern that already exists.

Ticker Risk: Low Volume

The Sino-American tension also has its impact on the ticker risk. Chinese stocks were at a risk of being delisted. As part of this tension the US went after Chinese companies seeking more power to audit Chinese companies with a listing on US stock exchanges. In December, China agreed to this but that wasn't the end of it. Following the agreement, China Southern Airlines decided it would delist from the NYSE. With that any audit or filing requirements associated with a NYSE listing would also lapse.

China Southern Airlines stock now trades over the counter/OTC as a pink sheet which is the least regulated OTC tier. So, that also means that useful disclosures might not be provided as they might not be required.

Beyond that there is a volume risk as an OTC stock. Due to the low volume there might be a lack of liquidity, which makes quick buying and selling and constant prices more challenging. The lack of volume makes buying and selling more difficult and might also increase volatility. Investors should be aware of these additional risks when making investment decisions.

China Southern Airlines: Loss Widens, Q4 2022 Shows Potential

Beyond the quarterly filings and operational output statistics, there is not a lot we can use to assess the performance. A slide deck supporting the quarterly and annual reports is always useful, but China Southern Airlines does not provide it unfortunately. Total revenues dropped roughly 15% in 2022 while losses increased by 127% to 22.5 RMB billion. While useful slide decks are lacking which makes it more difficult to see the bigger picture and the positives, I do think a clear positive is that in the fourth quarter the operating profit only increased by 1.4 RMB billion which shows that as capacity improves, there is a path to profits.

A Look At Operational Statistics For China Southern Airlines

The 2022 results were not pretty. Looking at Q4, we do see some positive signs but to get an idea of how thing will develop, we don't really have a guidance from management. We can look at operational statistics and compare it to pre-pandemic levels while keeping in mind that revenues were at 54% of pre-pandemic levels in 2022 and capacity was at 39% of pre-pandemic levels. It tells us that there is a long road ahead to recovery capacity. In January, capacity had expanded by 92% sequentially and by another 2.2% by February. Comparing to pre-pandemic times, January capacity had 75% recovered and to 81% by February for a 78% recovery over the first two months of the year. The sequential improvement from January to February was not an extremely strong one so it remains to be seen how things progress throughout the year but the capacity recovery does offer a lot of upside which should be visible partially this year and in full in 2024 or possibly 2025.

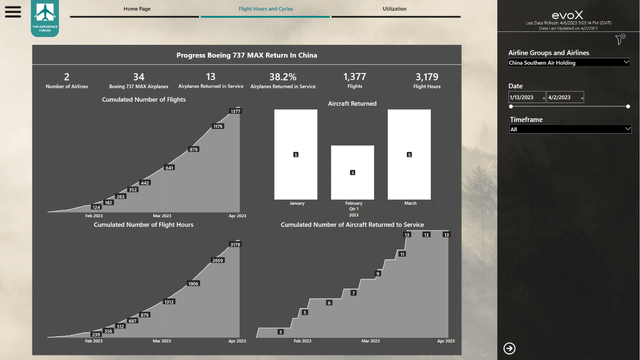

A positive is that China Southern Airlines is ramping up the return to service of its MAX fleet. Data analytics from evoX show that utilization is improving in the MAX fleet and 40% of the fleet is back since the latest data review. Keeping in mind that the MAX was grounded in 2019, that obviously gives a small advantage this year as the fleet is returning to service while we expect significant expansion in international capacity this year. International capacity was 13% recovered in January, 21% recovered in February with a 46% jump sequentially for a total recovery of nearly 17%. It shows that international recovery has a lot of recovery ahead but it is also happening fast.

Conclusion: China Southern Airlines Stock Offers A Way To Capitalize On Reopening

I believe that China Southern Airlines stock offers an opportunity to capitalize on the re-opening of China, but one should be aware of two things. The first one is that, from an operational perspective, there is a ramp up in capacity towards pre-pandemic levels this year and we don't know for sure whether that ramp will accelerate or not, but what we do know is that full annualized effects will only be visible in 2024 or perhaps 2025. So, patience is needed here. Secondly, we should keep in mind that the stock trades OTC with its associated risks, and while I am not generally negative on China, I cannot deny that, with alliance formed around the world, China and the West are not aligned well at the moment which does not really provide the desired stability for putting your dollars into Chinese companies. As a result, I am marking China Southern Airlines stock a Hold.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.