Intuitive Surgical: Too Expensive To Be Bought Now

Summary

- Intuitive Surgical is a company active in minimally invasive surgery, a surgical procedure which uses dedicated instruments to perform small incisions with an aim to minimise patient traumas.

- Intuitive Surgical is the market leader in the robotic surgery industry - tripling its revenues in the last 10 years, and delivering solid and stable cash flows.

- Despite having a strong business model, ISRG stock is too expensive at today’s prices to represent a good investment opportunity.

hoozone

Investment Thesis

da Vinci is not the Italian genius of the 15th century but is the name of the robotic surgical system developed by Intuitive Surgical (NASDAQ:ISRG).

Intuitive Surgical is a company active in minimally invasive surgery, a surgical procedure which uses dedicated instruments to perform small incisions with an aim to minimise patient traumas, speeding up recovery time, and reducing healthcare institutions’ costs to treat patients.

Intuitive Surgical might seem the perfect company: it is the market leader in the robotic surgery industry, a rapidly growing sub-segment of the minimally invasive surgery industry, has tripled its revenues in the last 10 years, and delivered solid cash flows to its shareholders.

But unfortunately, a great company is not always a great investment.

In today’s analysis, we will assess why, despite having a strong business model, ISRG stock is too expensive at today’s prices to represent a good investment opportunity.

Business Model

Intuitive Surgical develops and manufactures robotic surgical systems under the brand da Vinci which comprises several models from entry-level to top-performing ones like the da Vinci Xi.

Each robotic system is capable of performing a wide range of surgical procedure thanks to its four arms equipped with wristed instruments, an advanced type of surgical instrument which grant a higher range of motion and precision than traditional bistouries and therefore permits to perform less intrusive surgical operations for the patient.

The surgical robot is manipulated by the surgeon which performs the operation comfortably seated in its console from which controls the four arms. The shift from a standing position to a seated one helps to reduce surgeon fatigue and increase accuracy while operating.

Robotic surgery offers incredible increments in both surgeon’s dexterity and precision thanks to the robotic arms and the 3D high-definition cameras whit which each system is equipped which permits the surgeon to have a full and adjustable view of the area where he’s about to operate.

Of course, such advanced technology doesn’t come cheap, with prices spanning from $500 thousand to $2.5 million, which full-fledge represents a significant capital investment for hospitals.

Other than robotic surgical systems, the company has developed the Ion Endoluminal system, a robotic-assisted instrument that performs minimally invasive biopsies of the lung, but so far, its impact on the overall operating performances is not very material.

Nowadays, Intuitive Surgical placed more than 7.5 thousand of its da Vinci models in several hospitals around the world performing more than 1.8 million procedures in 2022.

However, despite its considerable price, Intuitive Surgical generates the majority of its revenues not from the sales of the systems but from the recurring sales of surgical instruments to equip the robotic arms, which have a limited life span and have to be replaced after a certain number of operations.

Another relevant source of recurring revenues is represented by contract services offered to customers at the moment of the system purchase, which grants continuous assistance during the use of the robots, and are usually renewed by customers every year.

If we add the revenues derived from the lease contracts with which customers can buy the systems, the combined recurring revenues account for 79% of total revenues, granting Intuitive Surgical a consistent inflow of cash.

Operating Performance

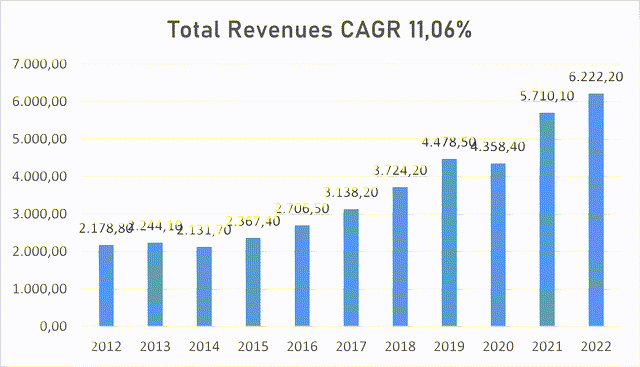

Looking at the past operating performances of Intuitive Surgical, its revenues tripled from $2.1 billion in 2012 to $6.2 billion in 2022 at a compound annual growth rate [CAGR] of 11.06%.

Intuitive Surgical revenues (TIKR Terminal)

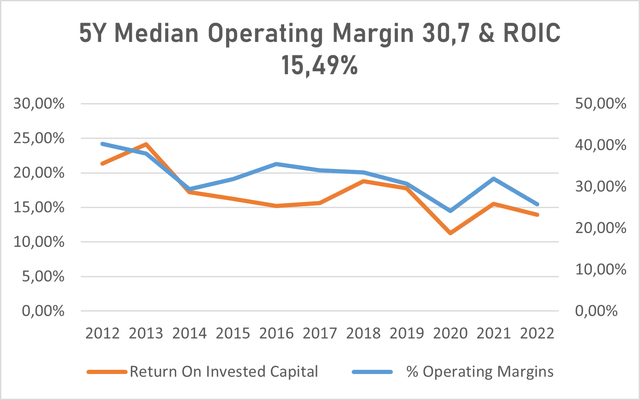

Thanks to its market leadership and a business model based on recurring revenues, Intuitive Surgical achieved remarkable efficiency and profitability over the years, having a 5-year median operating margin of 30.7% and a median return on invested capital [ROIC] of 15.5%.

Intuitive Surgical 5Y median operating margin & ROIC (TIKR Terminal)

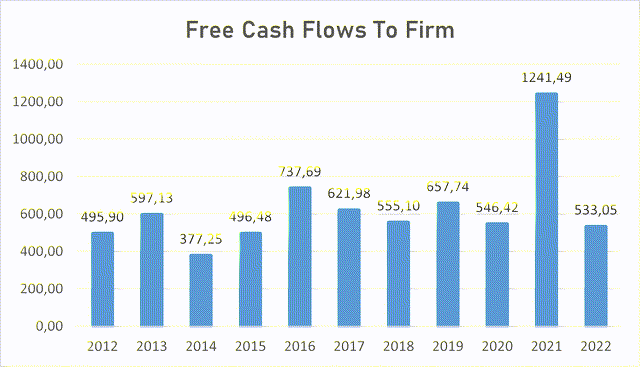

And obviously, that lead to solid and stable free cash flows to the firm (FCFF) equal to $533 million in 2022.

Intuitive Surgical FCFF (Personal Data)

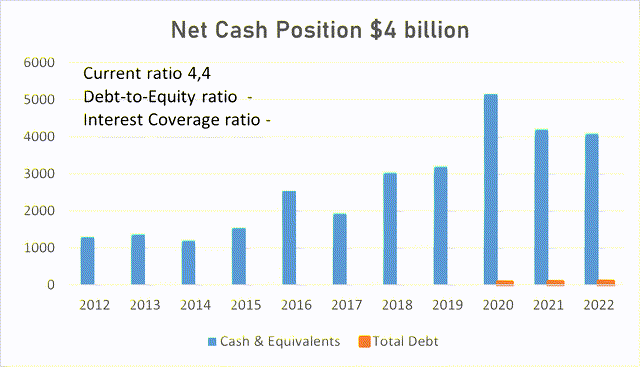

Financially the situation is even more impressive, with a net cash position of $4 billion, and basically no debt outstanding as of December 2022.

Intuitive Surgical financial position (TIKR Terminal )

Growth Drivers

Trying to assume the future growth rate for Intuitive Surgical, as the management underlined during the latest conference call, Intuitive Surgical has to continue investing significantly in R&D expenses, to keep developing new features and capabilities of its robotic systems, and in Capital Expenditures, expanding its manufacture capabilities to be able to meet the growing demand of its robotic systems and don’t lose market shares and opportunities due to operational incompetence to catch up with customers demand.

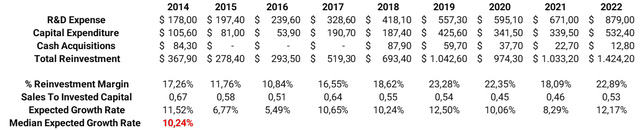

Future growth can be determined by looking at how much and how well a company has invested in its growth drivers. The Reinvestment Margin shows what percentage of revenues has been reinvested into the company, while the Sales to Invested Capital ratio, shows how much revenues have been generated for each dollar invested by the company. If we multiply these two values and take the median value over the years, we obtain the expected growth rate in revenues based on how much and how well a company has invested in its growth drivers.

In our case, Intuitive Surgical’s expected growth rate is 10.24%.

Intuitive Surgical expected growth rate (Personal Data)

Market & Risks

Looking at the market in which Intuitive Surgical operates, despite the number of minimally invasive surgery has surpassed the one of open surgery procedures over the years, the robotic surgery segment represents only a small portion of the total addressable market, which by the vast majority is dominated by traditional Laparoscopic surgery, another name to refer to traditional minimally invasive surgery.

Despite being less precise and more intrusive than robotic surgery, traditional methods still hold a strong grip among hospitals, being far cheaper than robotic systems, not necessitating upfront investments of millions of dollars, without requiring the surgeon to enter further training to be able to manage the robotic systems.

Given the relevance of traditional procedures, the penetration of Intuitive Surgical’s products might not proceed as smoothly as expected, and considering the relevance that the purchase of robotic systems has on hospitals’ capital allocation, during economic downturns, hospitals might be forced to drop the idea to invest in such technology to save costs, harming even further the company’s future performance.

Projections

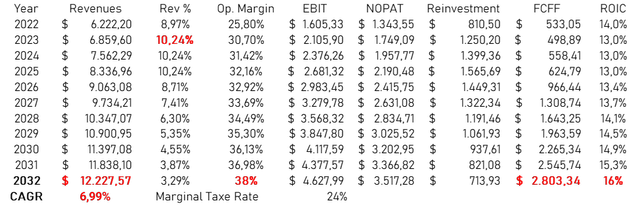

Trying to project Intuitive Surgical’s future performances, the story we are telling here sees Intuitive Surgical growing strongly in the coming years, maintaining high margins, but having lower ROIC in the foreseeable future, as the company has to support growth with heavy reinvestments.

Starting with revenues, for the next 2/3 years we can apply the expected growth rate of 10.24%, based on how much and how well the company has invested in its growth drivers, and then let it slowly decline as the company enters the steady state. With these assumptions, revenues are expected to double in 10 years at a CAGR of 6.99% reaching $12.2 billion.

As regards future efficiency, at first we can expect Intuitive Surgical to maintain operating margins on par with its historical levels, capitalizing on its leading position and the pricing power given by the value that its technologies bring to hospitals. As the company approaches maturity, we can expect its margins to improve as it will benefit from large economies of scale, reaching an operating margin of 38% by 2032.

Moving to future profitability, as we have seen while calculating the expected growth rate, the management expected to invest heavily to support future growth, hence we can assume the ROIC to stay around 13% in the coming years, assuming the reinvestments will increase proportionally more than the operating income. However, as the company gets more mature, and reduces its reinvestments we can expect the ROIC to recover its historical value of 16% by 2032.

With these assumptions, Intuitive Surgical is expected to keep delivery solid and growing FCFF expected to reach $2.8 billion by 2032 growing at a CAGR of 18%.

Intuitive Surgical future projections (Personal Data)

Valuation

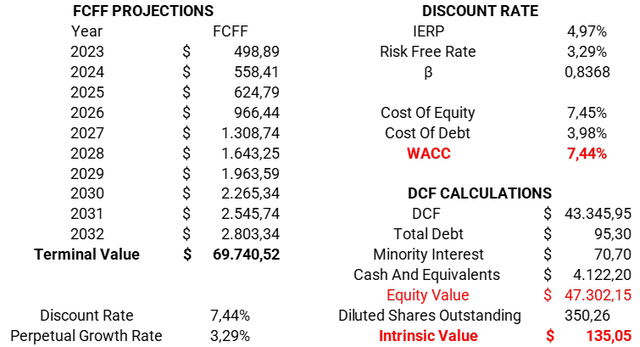

Applying a discount rate of 7.44%, calculated using the WACC, the present value of these cash flows is equal to an equity value of $47.3 billion or $135 per share.

Intuitive Surgical intrinsic value (Personal Data )

Conclusion

Given my analysis and assumptions, Intuitive Surgical stock is highly overvalued at today’s prices.

Intuitive Surgical is surely a magnificent company with an excellent business model able to generate tons of cash flows for its shareholders and operate in a sector that has a large room for future growth in the coming years once its technology will be fully acknowledged by surgeons and hospitals.

Of course, the market is well aware of that, and its current prices reflect it perfectly; however, at these prices, Intuitive Surgical is too expensive to be bought, and does not represent a good investment opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.