IPO Update: Hanryu Holdings Seeks $36 Million U.S. IPO

Summary

- Hanryu Holdings has filed proposed terms for a $36 million U.S. IPO.

- The firm operates a fan-celebrity platform primarily aimed at Asian audiences.

- HRYU is still a tiny company, with little revenue history and a wide variety of risks.

- The IPO appears excessively overvalued, so I'll pass on it.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Robert Daly/OJO Images via Getty Images

A Quick Take On Hanryu Holdings

Hanryu Holdings (HRYU) has filed proposed terms to raise $36.4 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The firm operates a fan-enabled platform primarily for the Asian entertainment industry.

HRYU is still a very small company with little operating history and presents a variety of risks.

Given the firm's tiny revenue base and excessive valuation assumptions, I'll pass on the IPO.

Hanryu Overview

Seoul, Republic of Korea-based Hanryu Holdings, Inc. was founded to create a fan-oriented online platform to provide culture and entertainment services.

Management is headed by Chief Executive Officer Mr. Chang-Hyuk Kang, who has been with the firm since 2021 and has an extensive financial and tax employment background.

The company's primary offerings include FANTOO, which is a platform that enables the creation of online fan spaces and economic rewards in return for user contributions.

The online fan engagement platform industry is used by celebrities and fandom communities to engage with each other and monetize their fan base.

As of Sept. 30, 2022, Hanryu has booked a fair market value investment of $26.3 million from investors including Paxnet Co. and various individuals.

Hanryu - User Acquisition

The firm markets its social media mobile app via major app platforms and through online media and social media activities.

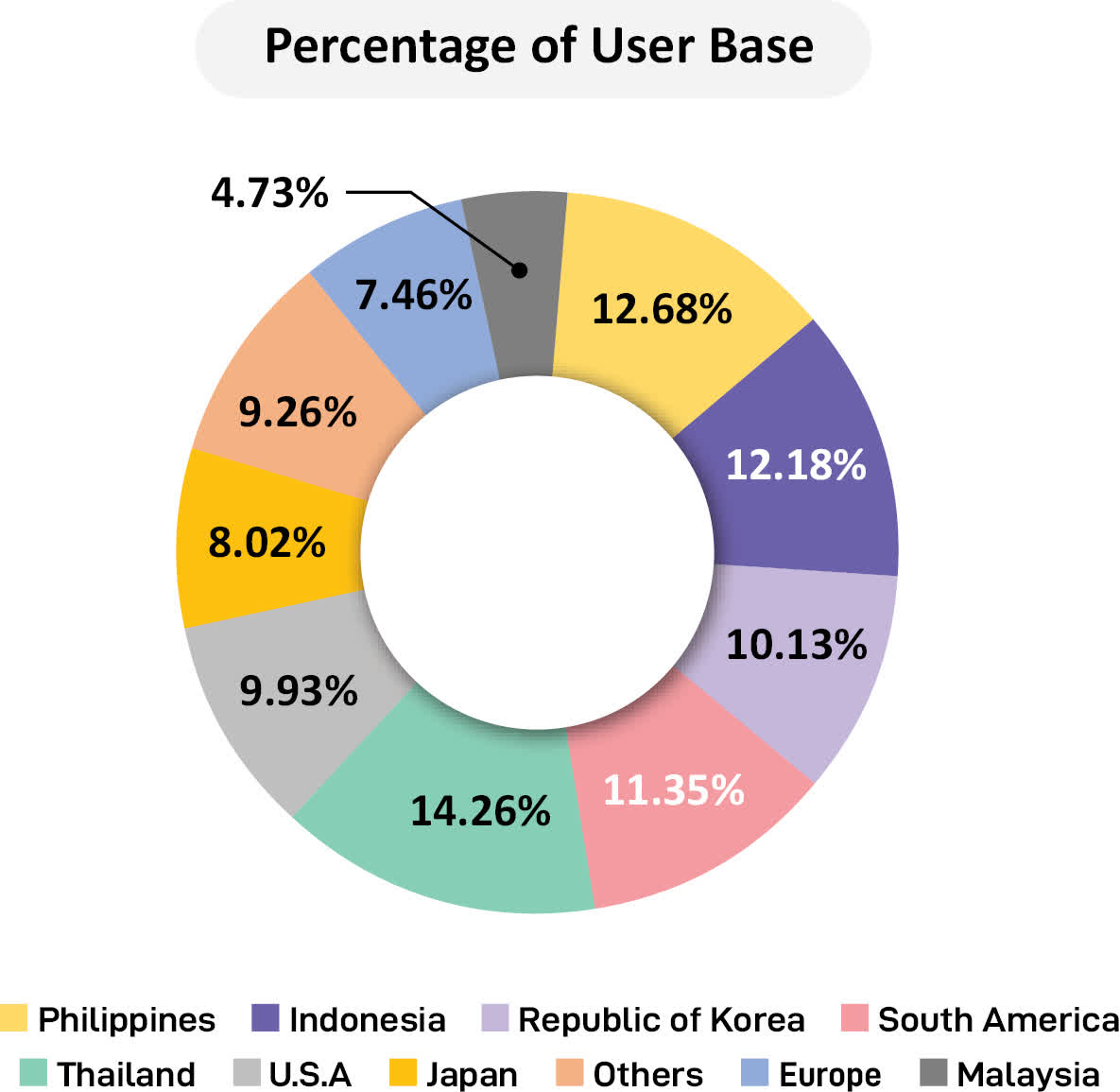

Since the FANTOO site's launch in Mary 2021, it has attracted over 18.9 million users, with the user base percentages from various regions shown below:

User Base By Location (SEC)

Marketing and Advertising expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

Sales & Marketing | Expenses vs. Revenue |

Period | Percentage |

Year Ended Dec. 31, 2022 | 37.0% |

Year Ended Dec. 31, 2021 | 113.0% |

(Source - SEC)

The Marketing and Advertising efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Marketing and Advertising spend, fell to 1.2x in the most recent reporting period. (Source - SEC)

Hanryu's Market and Competition

According to a 2021 market research article by Financial Express, the global market for celebrity-fan engagement is an estimated $10 billion business.

There's significant variation in fan engagement site features and business models.

Also, the rise in the use of NFTs, or Non-Fungible Tokens, also presents the industry with further business model options.

Major competitive or other industry participants include:

Facebook

Instagram

Twitter

Reddit

Lysn

Weverse

Universe

Whattpad

Amazon

eBay

Ticketmaster

Hanryu Holdings' Financial Performance

The company's recent financial results can be summarized as follows:

Growing topline revenue from a tiny base

A swing to gross profit and positive gross margin

Reduced operating losses

Lowered cash used in operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 889,045 | 85.1% |

Year Ended Dec. 31, 2021 | $ 480,224 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 433,266 | -647.1% |

Year Ended Dec. 31, 2021 | $ (79,195) | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | 48.73% | -395.5% |

Year Ended Dec. 31, 2021 | -16.49% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Year Ended Dec. 31, 2022 | $ (6,603,325) | -742.7% |

Year Ended Dec. 31, 2021 | $ (20,453,973) | -4259.3% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Year Ended Dec. 31, 2022 | $ (6,386,503) | -718.4% |

Year Ended Dec. 31, 2021 | $ (12,764,662) | -1435.8% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Year Ended Dec. 31, 2022 | $ (4,096,948) | |

Year Ended Dec. 31, 2021 | $ (7,814,399) | |

(Source - SEC)

As of December 31, 2022, Hanryu had $118,957 in cash and $7.4 million in total liabilities.

Free cash flow during the twelve months ended Dec. 31, 2022, was negative ($4.1 million).

Hanryu's IPO Details

HRYU intends to sell approximately 3.6 million shares of common stock at a proposed midpoint price of $10.00 per share for gross proceeds of approximately $36.4 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company's enterprise value at IPO (excluding underwriter options) would approximate $475.3 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 7.17%. A figure under 10% is generally considered a "low float" stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

For investment in corporate infrastructure;

For the construction of a data center for our AI technology and hiring approximately 23 software engineers;For increasing our engineering team to staff our planned AI technology data center;

To market and host events such as live K-pop concerts;

To develop services within the FANTOO ecosystem such as the fan shop, digital stickers, Augmented Reality filters, and emojis; and

For general working capital purposes, operating expenses, and/or acquisitions of, or investments in, businesses, products, services or technologies.

(Source - SEC)

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm is subject to an ongoing legal proceeding for debt assumed due to its purchase of Marine Island property.

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Valuation Metrics For Hanryu

Below is a table of the firm's relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Measure [TTM] | Amount |

Market Capitalization at IPO | $507,409,580 |

Enterprise Value | $475,290,623 |

Price / Sales | 570.74 |

EV / Revenue | 534.61 |

EV / EBITDA | -71.98 |

Earnings Per Share | -$0.12 |

Operating Margin | -742.74% |

Net Margin | -718.36% |

Float To Outstanding Shares Ratio | 7.17% |

Proposed IPO Midpoint Price per Share | $10.00 |

Net Free Cash Flow | -$4,112,158 |

Free Cash Flow Yield Per Share | -0.81% |

CapEx Ratio | -269.36 |

Revenue Growth Rate | 85.13% |

(Glossary Of Terms) | |

(Source - SEC)

Commentary About Hanryu's IPO

HRYU is seeking U.S. public capital market investment to fund its general corporate growth and working capital requirements.

The firm's financials have produced increasing topline revenue from a tiny base, recent gross profit and positive gross margin, lowered but still high operating losses and reduced cash used in operations.

Free cash flow for the twelve months ended December 31, 2022, was negative ($4.1 million).

Marketing and Advertising expenses as a percentage of total revenue have dropped as revenue has increased from a tiny base. Its Marketing and Advertising efficiency multiple fell to 1.2x in the most recent period.

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into the firm's growth and operating requirements.

Hanryu has spent lightly on capital expenditures despite negative operating cash flow.

Some industry observers estimate the market opportunity for fan-related websites to be $10 billion.

Aegis Capital Corp. is the sole underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (54.0%) since its IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company's outlook as a public company include its tiny revenue base and limited operating history.

Additionally, its growth potential rests on the demand for Korean culture throughout Asia. Should consumer attitudes about Korean culture change in a way that diminishes the appeal of the firm's services, it could be exposed to lower revenue growth potential.

Furthermore, the Delaware-based holdings company operates subsidiaries in South Korea, all of which are subject to South Korean laws and regulations and may impact the ability to transfer profits, if any, to the parent company domiciled in the U.S.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value / Revenue multiple of 535x trailing twelve-month revenue.

Given the firm's tiny revenue base and excessive valuation assumptions, I'll pass on the IPO.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.