Total Energy Services Eyes Further U.S. Expansion

Summary

- Total Energy Services reported its Q4 2022 financial results on March 10, 2023.

- The company provides various oilfield services in Canada, the U.S. and Australia.

- Total has produced gains as a result of investment in its rig fleet during a down period in oilfield services.

- Management intends to take advantage of supply/demand imbalances in certain U.S. markets.

- I'm Bullish on TOT:CA in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Igor Borisenko

A Quick Take On Total Energy Services

Total Energy Services (TSX:TOT:CA) (OTCPK:TOTZF) reported its Q4 2022 financial results on March 10, 2023, growing revenue by 457% (in CAD) year-over-year.

The firm provides various oilfield drilling, storage and related services in Canada, the U.S. and overseas.

The Board of Directors has recently raised the dividend by 33% and management’s strongly positive comments about U.S. demand opportunities leads me to be Bullish on TOT:CA stock at around $8.10 per share.

Total Energy Overview

Calgary, Canada-based Total Energy Services was founded in 1996 to provide a growing number of oilfield services and products to exploration & production companies in North America and internationally.

The firm is headed by founder, president and CEO Daniel Halyk, who had previously co-founded Trident Capital Partners, an investor in the energy and real estate industries.

The company’s primary offerings include the following:

Compression and process servicing - 44% of revenue

Contract drilling services - 33%

Well servicing - 14%

Rentals and transportation - 9%

Total Energy’s Market & Competition

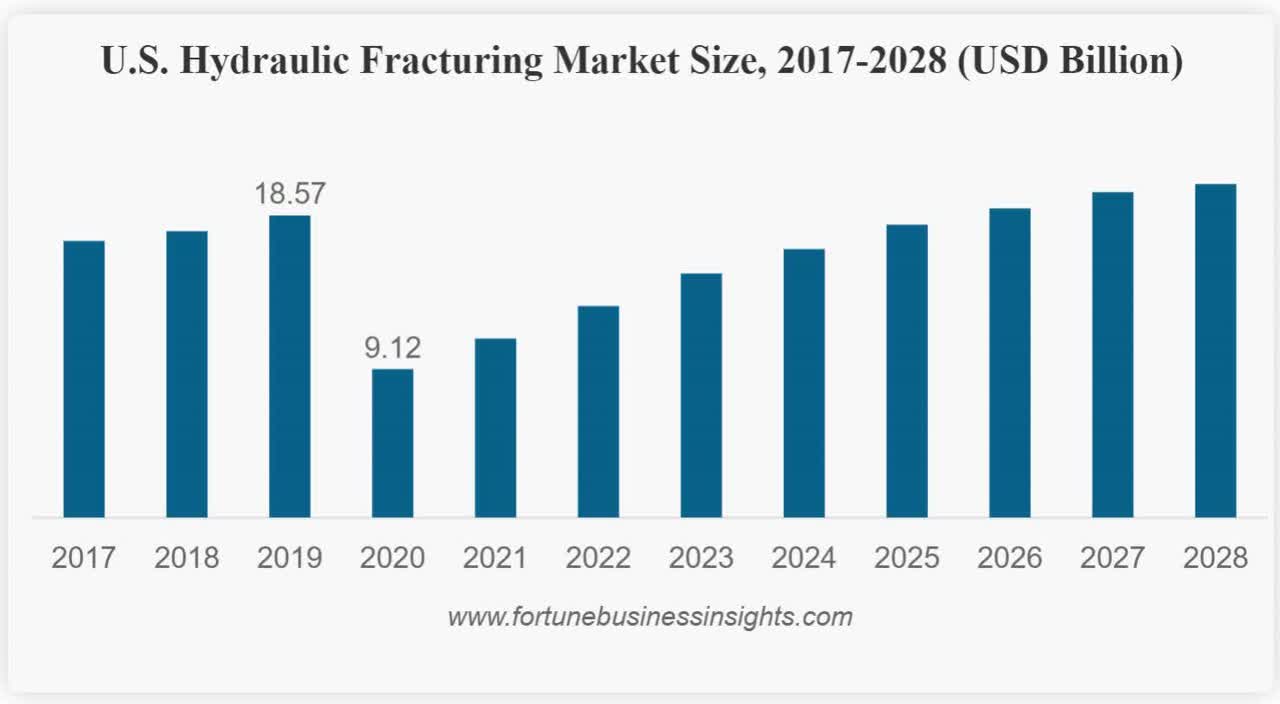

According to a 2021 market research report by Fortune Business Insights, the global hydraulic fracturing market (as a proxy for overall oilfield servicing) was an estimated $11.7 billion in 2020 and is forecast to reach $28.9 billion by 2028.

This represents a forecast CAGR of 9.5% from 2021 to 2028.

The main drivers for this expected growth are the continued growth of natural gas and oil products for energy and other uses, along with improved technological aspects of the industry.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. hydraulic fracturing market:

U.S. Hydraulic Fracturing Market (Fortune Business Insights)

Major competitive or other industry participants include the following:

Halliburton (HAL)

Schlumberger (SLB)

Baker Hughes (BKR)

ProFrac Holding (ACDC)

Weatherford (WFRD)

Others

Total Energy’s Recent Financial Results

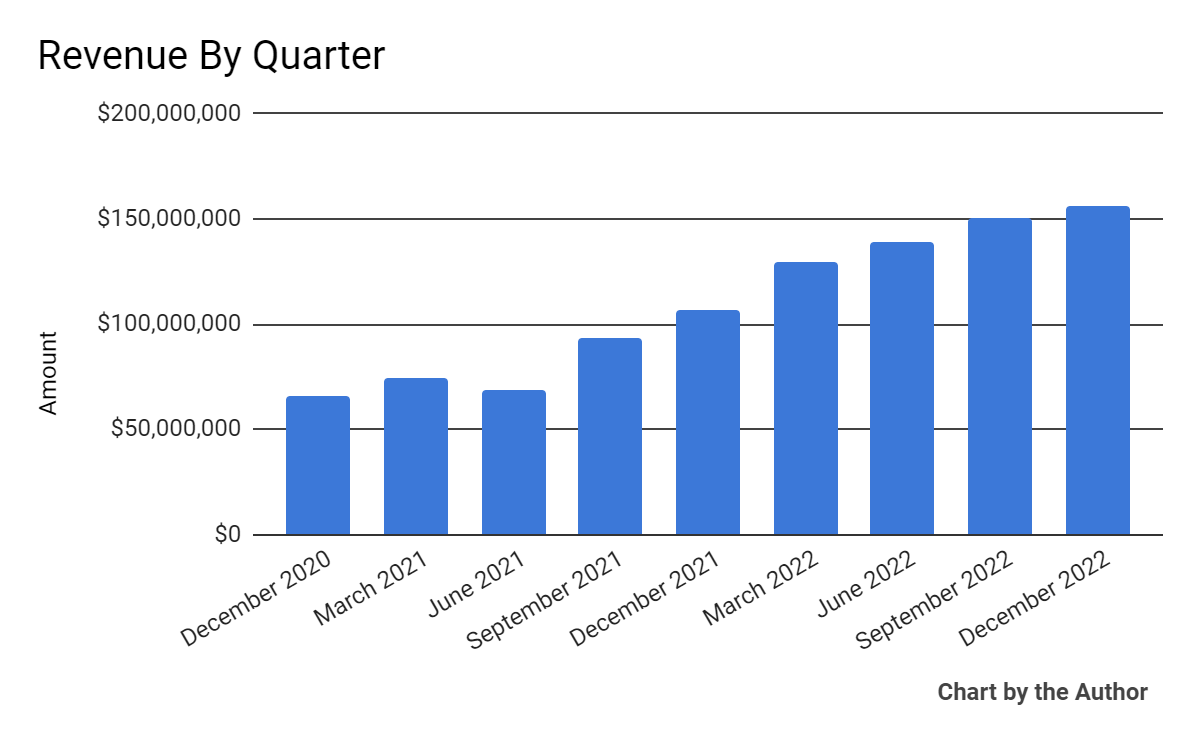

Total revenue by quarter has risen per the following chart:

Total Revenue (Seeking Alpha)

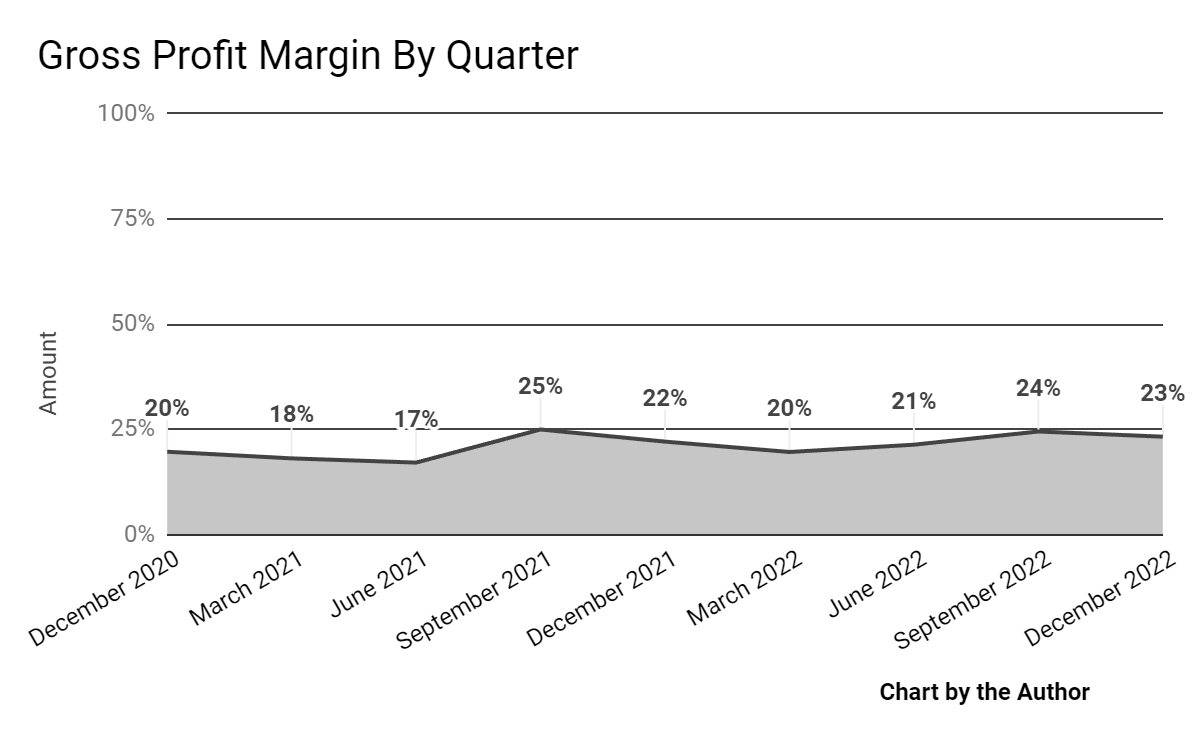

Gross profit margin by quarter has trended higher in recent quarters:

Gross Profit Margin (Seeking Alpha)

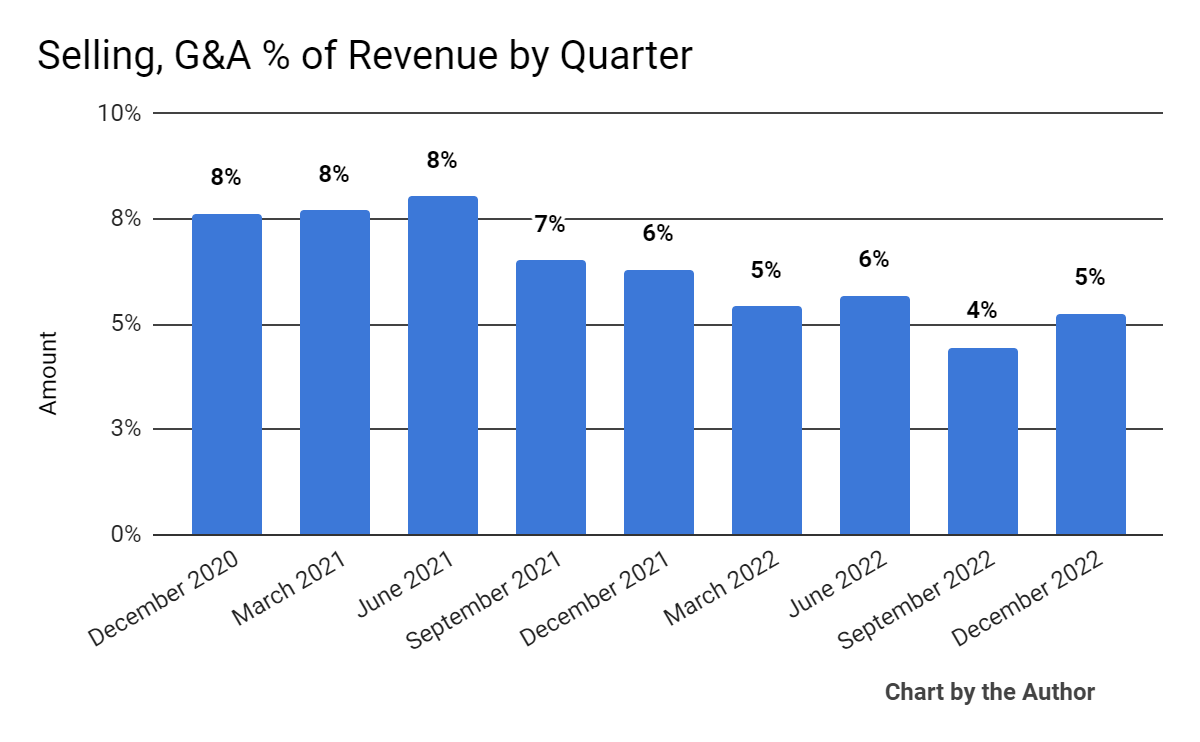

Selling, G&A expenses as a percentage of total revenue by quarter have moved lower more recently:

Selling, G&A % Of Revenue (Seeking Alpha)

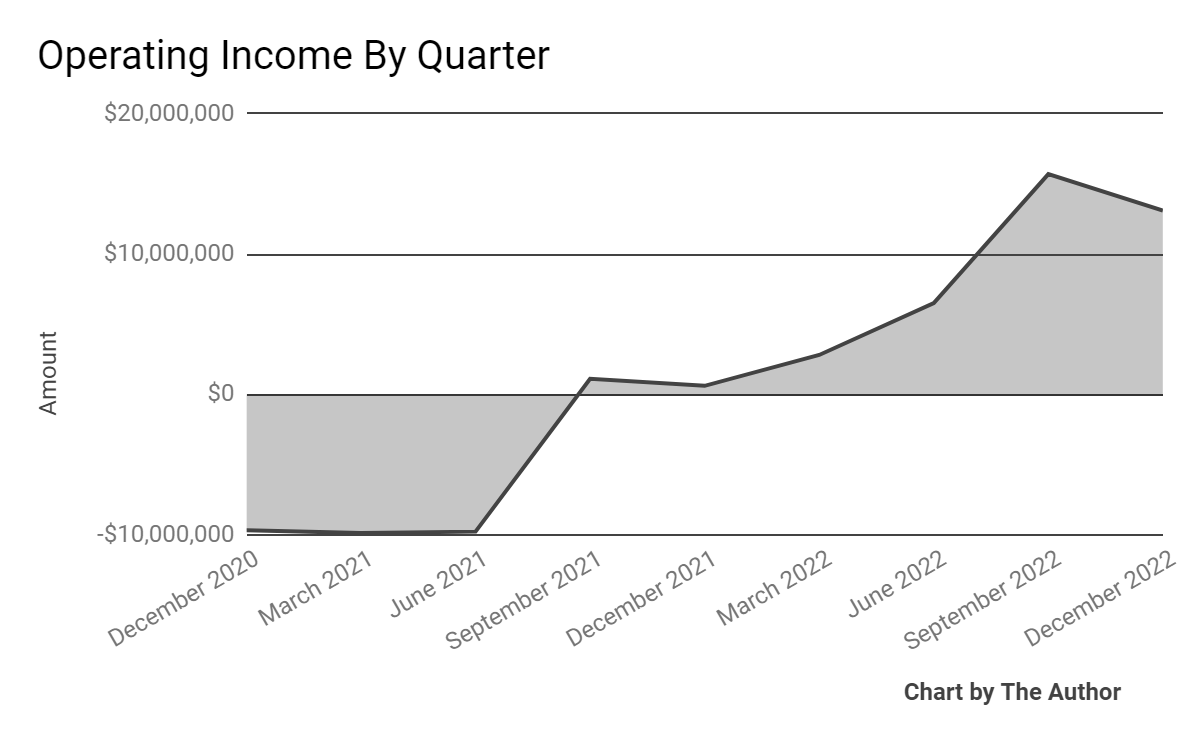

Operating income by quarter has increased materially in recent reporting periods:

Operating Income (Seeking Alpha)

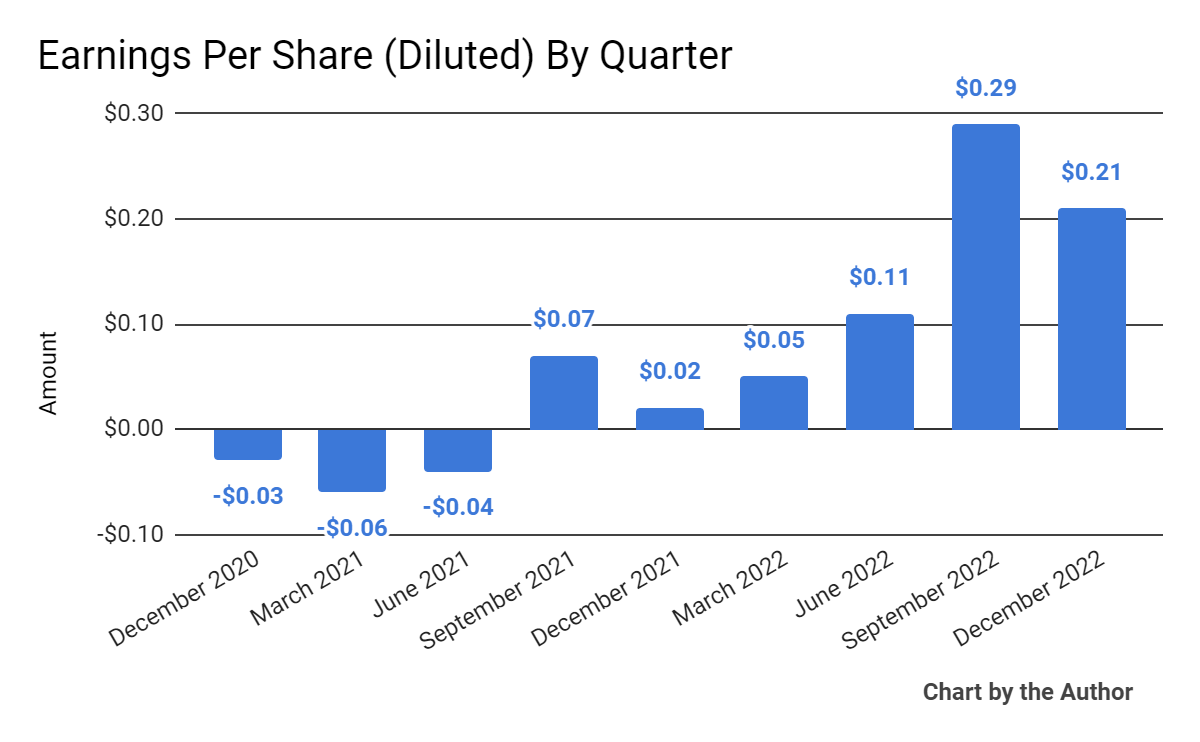

Earnings per share (Diluted) have also grown substantially recently:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP - CAD)

In the past 12 months, TOT:CA stock price has dropped 2.4% vs. that of the Oilfield Services ETF's (IEZ) rise of 2.1%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

As to its Q4 2022 financial results, total revenue rose 46.7% year-over-year and gross profit margin increased by 1.2 percentage points.

Revenue increased partly due to growth in North American operating days and revenue per day.

SG&A expenses as a percentage of total revenue continued their downward trend while operating income remained strongly positive.

Earnings per share were substantially higher year-over-year despite inflationary pressures.

For the balance sheet, the firm ended the quarter with cash and equivalents of CAD34.1 million and total debt of CAD120.0 million.

Over the trailing twelve months, free cash flow was CAD86.7 million, of which capital expenditures accounted for CAD56.7 million. The company paid only CAD1.1 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Total Energy

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 0.6 |

Enterprise Value / EBITDA | 3.6 |

Price / Sales | 0.5 |

Revenue Growth Rate | 76.1% |

Net Income Margin | 5.0% |

GAAP EBITDA % | 16.8% |

Market Capitalization | CAD$258,510,000 |

Enterprise Value | CAD$333,820,000 |

Operating Cash Flow | CAD$105,910,000 |

Earnings Per Share (Fully Diluted) | CAD$0.66 |

(Source - Seeking Alpha)

Future Prospects For Total Energy

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted the growth in its business across all segments, due partly to previous investments in upgrading its rigs as markets increased demand.

Leadership noted the improving industry dynamics of increased demand yet reduced capacity due to contraction and consolidation.

As a result, the company appears well positioned to capitalize on improving conditions, especially in the United States, which surpassed its Canadian region revenue for the first time in the company's history.

Subsequent to the quarter’s end, the Board of Directors approved a 33% increase in the dividend to CAD0.08 per share, resulting in approximately a 2.8% forward annual dividend yield.

Looking ahead, apart from the dividend increase, management’s primary use of excess cash in 2023 will be to reduce debt.

The primary risk to the company’s outlook is the unpredictable nature of oil & gas pricing, which can affect rig demand in the short term.

However, as larger entities ramp up production in the continental U.S., Total’s exposure to such fluctuations may diminish.

Management sees a variety of U.S. markets where supply has not met recent demand and hopes to reposition equipment and resources to take advantage of that imbalance.

While the leadership hasn’t provided specific forward guidance, raising the dividend by 33% combined with management’s comments about U.S. demand opportunities leads me to be Bullish on TOT:CA at around $8.10 per share.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.