Redfin: Another Underperforming Online Property Agent

Summary

- Redfin Corporation is an online real estate brokerage company, providing a platform for buying and selling homes.

- Heightened interest rates and inflation have negatively impacted the housing market, driving down demand. This is expected to continue in 2023.

- Redfin is loss-making again, as its iBuying business swings to a negative GPM for 2 quarters in a row.

- We cannot see any reason for positive price action in 2023, with sentiment likely to remain negative as further losses are incurred.

Stephen Brashear/Getty Images Entertainment

Overview of Redfin

Redfin Corporation (NASDAQ:RDFN) is a real estate brokerage company, providing a platform for buying and selling homes. It operates as an online real estate company, providing services such as home listings, home sales, real estate data, and home buying and selling tools to consumers. Further, the company offers the option to directly purchase homes. The company operates primarily in the United States, with additional operations in Canada.

The current state of play for online retailers

In the last decade, online real estate agents have become prevalent, digitizing a previously outdated industry. These companies offer consumers the convenience of browsing properties conveniently, without the need to work with a traditional agent. Additionally, consumers can handle administrative tasks and even sell their property independently, again at their convenience.

From an economic standpoint, online retailers have the advantage of expanding their geographical reach rapidly, without the need for a large workforce, compared to traditional retailers. Due to the fragmented nature of the property retailing industry geographically, these online businesses have rapidly gained market share.

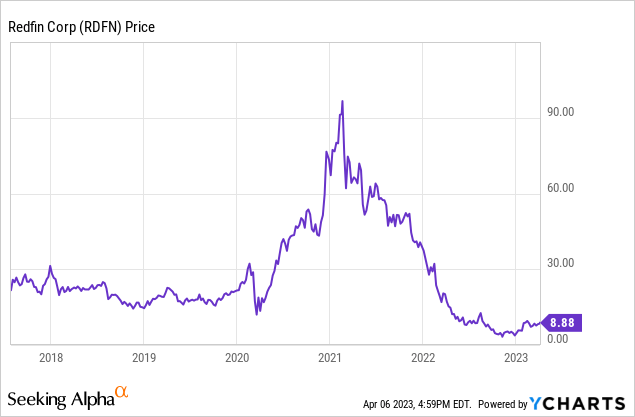

Share price

Following the onset of the pandemic, Redfin's share price experienced a monumental increase as the housing market remained surprisingly robust. Although some struggled, many retained their income and were able to take advantage of Gov't schemes and uncertainty in the market to purchase a home. Naturally, the market has subsequently cooled, with Redfin's share price following suit.

Investment thesis

Following such a monumental decline in share price, it is easy to suggest the business is now undervalued, or worth an investment. Our analysis of RDFN stock will involve a deep dive into the US housing market and how we think it will respond to current economic conditions, as well as an analysis of the fundamentals of the business.

With Redfin's share price declining by such a significant amount, it is natural for whispers to begin about the stock becoming undervalued. The objective of this paper is to consider whether this is the case. Our analysis will involve a deep dive into the US housing market and the key trends impacting it currently, as well as a view of current economic conditions and the fundamentals of the business.

U.S. Housing market

The US housing market has performed fairly well post-financial crisis, with a gradual uptick in house prices. Record low interest rates and a growing economy have been the main contributors to this. As we mentioned previously, the market experienced an unexpected uptick in 2020/2021 and has subsequently cooled since then.

The driving factor behind the decline in activity is 2 factors.

Interest rates:

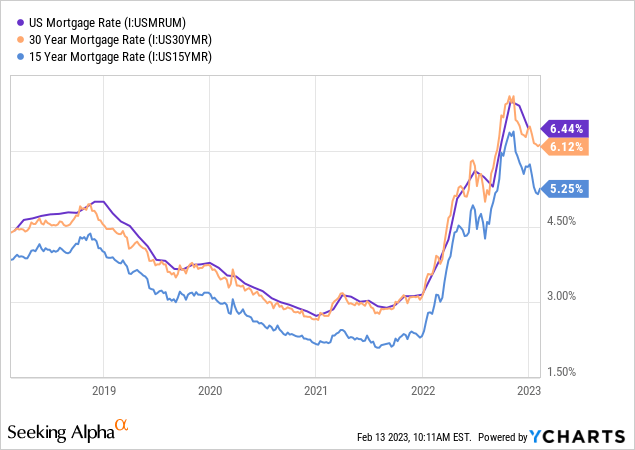

The health of the home-buying sector is closely linked to interest rates in the economy. This is because the majority of home purchases are made through the use of a mortgage, which is based on current interest rates. Interest rates have increased from their historical lows in 2022 to combat high levels of inflation. We forecast that this trend will continue in 2023, with elevated interest rates expected to persist until early 2024.

As illustrated in the accompanying chart, US mortgage rates have more than doubled, drastically affecting consumer affordability. This has resulted in many properties that were previously within reach for consumers in 2021 now being unaffordable, discouraging them from making a move.

Inflation:

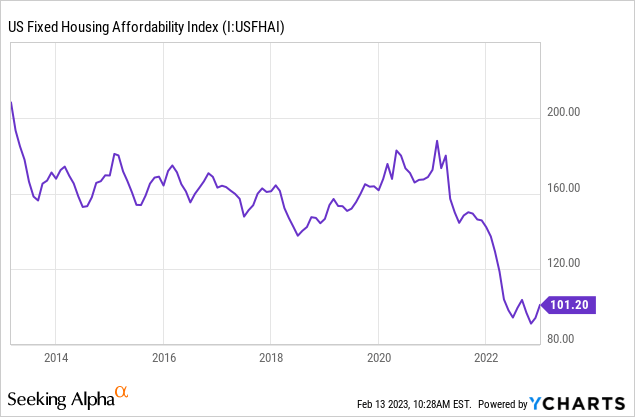

Increasing inflation has been problematic for the housing market as consumers are facing a sharp decline in disposable income due to rising living expenses. This impacts their ability to finance a move and psychologically deters such a big decision. As the chart below illustrates, the affordability of housing is at a 10-year low.

An index value of 100 indicates that a family with a median income has sufficient funds to obtain a mortgage for a home priced at the median. Conversely, an index above 100 signifies that they earn more than required.

Both factors depressing housing market activity are expected to persist in the coming year, which means a short-term bounce back is highly unlikely. More realistically, we would forecast continued difficulty in achieving growth, with the pressure on Redfin to grow its share of a smaller pie. Once rates come down, however, those who have deferred purchases will come to the table.

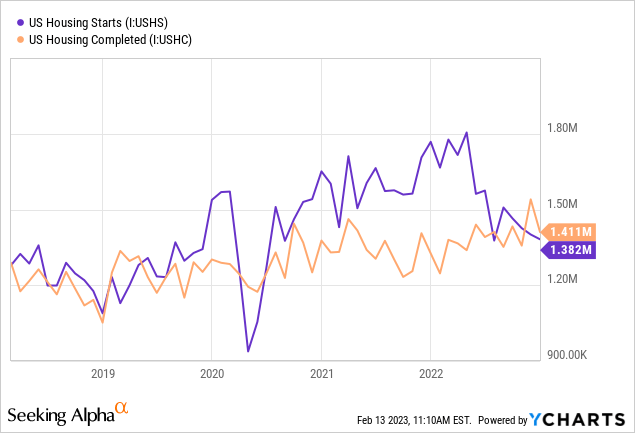

Home building data

Home building data is useful as a leading indicator for the activity in the housing market, as builders will only increase the number of homes built if they are confident that the demand for the properties will meet their profitability objectives. It is important to bear in mind that there is a time lag between the building permits being approved and the final sale, hence builders will generally be risk-averse unless they can reliably estimate conditions once the build is complete, otherwise, they may end up with unsold properties or contracting margins.

The graph below illustrates the number of new home constructions peaked in early 2022 and has since dropped quickly with no apparent end in sight.

Technology

The real estate industry has been undergoing a digital transformation, with more consumers turning to online platforms for information and services. Redfin has positioned itself as a tech-focused real estate company, leveraging technology to improve the home buying and selling experience for its customers. Redfin has made it easier for buyers and sellers to access real estate information, view properties and connect with agents. Additionally, the use of virtual tours and 3D renderings are allowing buyers to get a better sense of the properties without having to physically visit the property.

This very much looks to be a fundamental shift in the industry rather than a short-term trend, with the transition towards online retailers remaining persistent despite the slowing market.

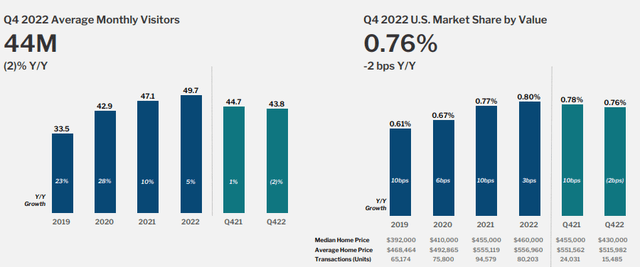

As illustrated by the diagram below, Redfin has experienced a consistent rise in both monthly visitors and market share.

Q4-22 properties results (Redfin)

This is not only the case for Redfin, with Zillow (Z) posting similar results. Things have seemingly tapered off but is more a reflection of the industry as a whole than the technology-driven segment.

Our view is that growth will continue to be positive, though not remarkable until the market gains momentum, at which point growth is expected to experience a substantial increase.

Increase in Remote Work

The pandemic has contributed to many people looking to incorporate working from home into their lives. This has led to a shift away from individuals looking for properties within proximity of their office, which in many cases is an expensive metropolitan city. This has led to a migration from cities to suburban areas, where people have more space and a better quality of life. This has the scope to be beneficial long-term as many who otherwise could not afford to purchase in a big city will now substitute their rental agreements for more affordable housing, driving greater volume.

Financials

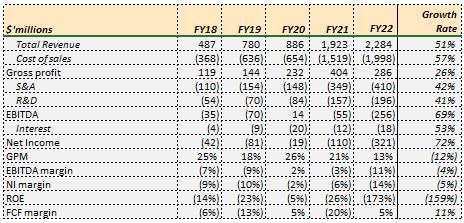

Redfin P&L (Tikr Terminal)

The overarching trend of Redfin's financials is positive, with revenue growing at an impressive CAGR of 51%, with the most recent period growth at 19%. This is driven by the expansion of the brand and growth in the online realtor segment.

Margins have fluctuated, driven in large part by the profitability of Redfin's "Properties" segment (or lack thereof). This part of the business is where they purchase and sell people's homes (iBuying). As we have explained, the US housing market is experiencing lower activity, which has contributed to declining selling prices. For this reason, it becomes far more difficult to exit a property with a profit. Redfin has posted 2 successive quarters of negative GPM in this segment, illustrating the terrible exit it is facing from this segment.

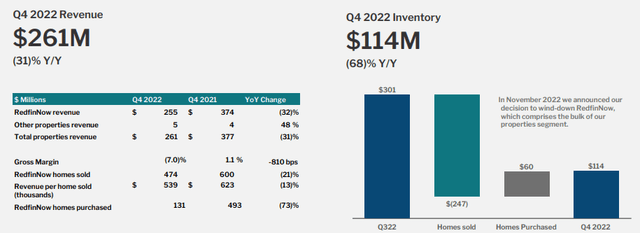

Properties revenue (Tikr Terminal)

This is one of the reasons Zillow has exited the market and OPEN intends to do the same. The industry only really works during a bull market, otherwise, it represents outsized risks for the potential return.

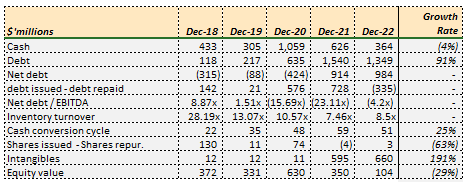

Balance sheet (TIkr Terminal)

Redfin's debt balance has risen significantly in recent periods as the business funds its expansion and inventory. With the business having cash at bank above its adjusted net cash outflow in FY22, we are not concerned about an immediate cash issue. This said, the company will likely need to shore up its finances in the coming 12-24 months.

Unsurprisingly, Redfin's inventory turnover has declined significantly, likely due to the difficulty in selling the current properties they have at a profit. With $114 million worth of stock held on Dec '22, the company still faces some risk in this area. Our opinion is that the company will incur further losses to sell these properties.

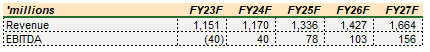

Consensus analyst forecasts (Tikr Terminal)

For these reasons, analysts are forecasting a substantial reduction in revenue in FY23, driven by the worsening of the factors we have highlighted above.

Relative performance

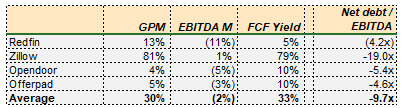

Relative performance (Tikr Terminal)

Redfin's performance is on par with its competitors, which is not a good thing. Among them, only Zillow has managed to achieve a positive EBITDA, after liquidating its iBuying business. The fact is the online real estate industry is facing significant challenges and those with iBuying operations are particularly vulnerable to difficulty until they can sell off their holdings.

We do see some hope for Redfin compared to the others long-term. The business still managed to boast a competitive GPM, despite the poor performance from the Properties segment. Further, Redfin properties on average sell for a higher value and spend less time being listed, when compared to industry averages.

Valuation:

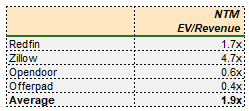

Peer valuation (Tikr Terminal)

Redfin's current financial performance is comparable to that of its peers while trading at a 3x revenue discount to Zillow. With this in mind, we believe Redfin is a relatively attractive investment opportunity. Zillow is certainly the market leader but Redfin is not that far behind. We see an opportunity for further growth at a minimum but not certainty of profitability, which is a similar case to Zillow.

However, we are far from giving this stock a buy rating due to the significant risks stemming from the temporary headwinds and losses that will likely come with selling their current inventory. We anticipate that these disposals will cause a decline in the company's share price and worsen sentiment around the company.

Final thoughts:

Redfin has done well to grow its market share quickly and contribute to the disruption of the industry. Our view is that the short-term will be difficult, with the housing market continuing to slow as heightened interest rates deter purchases. House building and affordability data support this assertion. Redfin's financials do show some promise, but they are highly sensitive to the iBuying segment of the business, which is primed to underperform. Those looking for exposure to the segment should only consider Zillow.

We rate this stock a sell for this reason.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.