MGK: A Lot To Gain From A Rate Pivot

Summary

- A noticeable thing about this relief rally after the banking scares is that the US market has gone ahead in its recovery compared to other markets.

- A theory on that is that the tech mega-caps are so dependent on their horizon values and already have low WACCs, so changes in risk-free rates make the biggest difference.

- The demand concerns are lessened in US mega-caps because they're so entrenched.

- The upshot is that positioning well for a rate pivot comes down to the simple fact that costs of capital matter, and the US markets have the most to gain from a rate reversal.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Nikada/iStock Unreleased via Getty Images

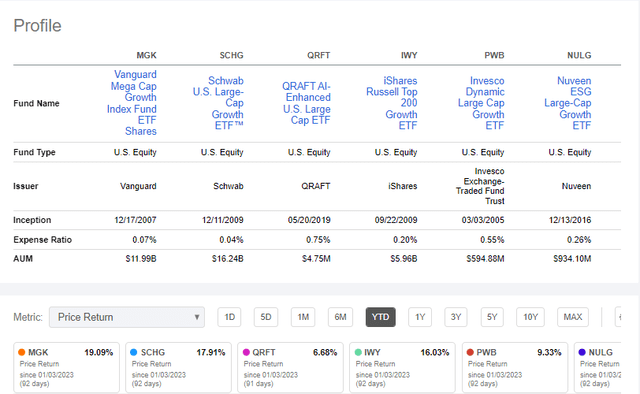

The Vanguard Mega Cap Growth Index Fund ETF Shares (NYSEARCA:MGK) is an ETF with large cap US exposures that would generally be considered growth exposures. Ultimately, the US markets are generally driven by growth issues, so the MGK is a pretty close representation of the actual US market. We think that for technical reasons, the MGK is probably even slightly better positioned than the general market for a rate pivot, which we believe is a likely macroeconomic scenario given not only the current hits we've seen to banks, but also potential hits that could come later. We think that the general recovery in US markets, which has been ahead of other markets, says something about the US market structure and its sensitivity, and is actually relatively justified insofar the assumption markets are making about rate trajectories is correct. While we think ETFs are too non-specific in the current, complex environment, MGK and the US market in general does make sense if you believe that the banking crisis will hit credit availability meaningfully and take down inflation. In general, growth ETFs have the most to gain on a Fed pivot.

MGK Breakdown

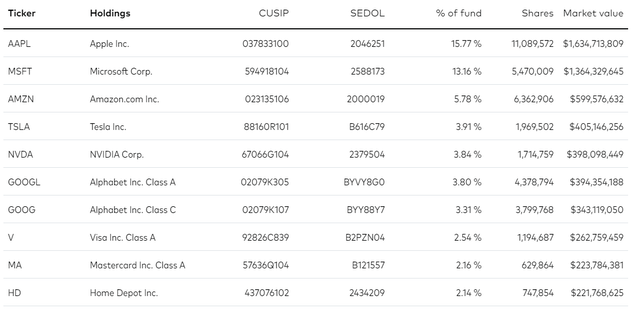

Let's start with the top holdings:

MGK Top Holdings (vanguard.com)

MGK's US growth angle means that technology stocks are substantially overweighted relative to the general market. Since the largest market cap stocks in the US are mostly tech stocks, the top holdings look similar to that of any ETF that tracks the S&P 500 (SPY). Technology has a 50% allocation on a sectoral basis.

The general market has had YTD performance around 7%, including this latest relief rally. The MGK on the other hand has rallied 17%, showing that the relief rally is being driven by large cap tech stocks.

MGK has a low expense ratio of 0.07%.

Bottom Line

MGK is more sensitive to the market assumptions around rates, and with the banking crisis markets have weighted the scenario of a rate pivot with a higher probability. There is a logic to this of course, since it's possible, actually it's likely, that the Fed didn't consider that high quality securities on the balance sheet would be the source of shaken confidence in the banking sector. The issue is that there could be more problems, especially in regional banking which has been more vulnerable, where they in particular carry large balances of commercial real estate loans, many to offices in cities that aren't doing so well as white collar workers continue to largely insist on some degree of work from home benefits. There have been real increases in vacancies and cash flows for these properties, they are not no-brain investments at all.

The greater sensitivity comes from the fact that of any stock in the market, large cap tech stocks, that are valued basically on a growing perpetuity basis by markets because of how entrenched they are, are dependent very heavily on cost of capital levels that affect their 100% horizon value valuation. Since they are relatively recession resistant, and their large cap position is because of their secular growth exposures, their cash flows and growth rates aren't going to be heavily revised over the long-term. It's the compounding effect from changes in cost of capital driven by interest rates, where WACCs were very small to start with because these are among the market's safest companies, that cause the sharpest revisions in valuation.

MGK is a low-expense ETF, and while pretty non-specific, unoriginal and broad, it does make sense for investors who are pretty convinced that the banking crisis is going to have real economic effects. MGK companies will be the least affected broadly speaking by the macroeconomic headwinds, but have the most to gain from the rate pivot, and would be a reasonable broad ETF for that scenario. Where the S&P 500 (SPY) is very correlated to the fortunes of tech stocks, and may be the next best option to MGK, even better might be the Schwab U.S. Large-Cap Growth ETF (SCHG) in keeping with a large-cap growth theme, which has lower expense ratios and very similar allocations to the MGK, but perhaps even better and more levered to a rate pivot in terms of allocations considering there's more healthcare exposure as opposed to MGK's secondary focus on consumer discretionary. SCHG would be a more optimal pick with the same drivers.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.