Schwab: A Buffett-Style 'Fat Pitch' That Could Triple In 3 Years

Summary

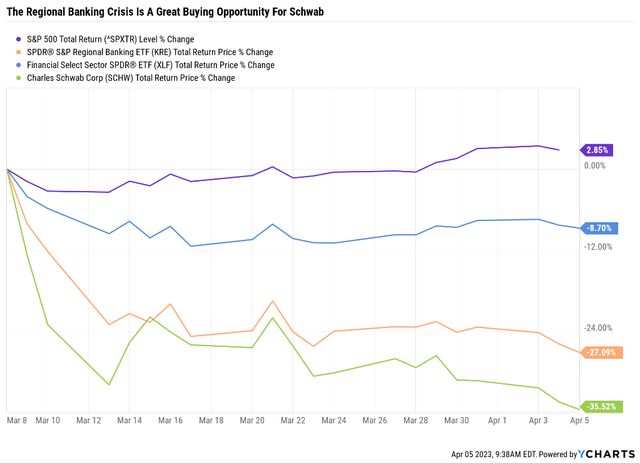

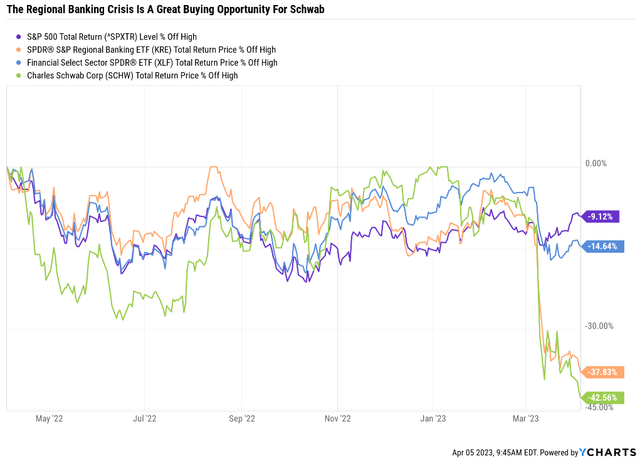

- The recent banking crisis has hammered financials, but few more than Schwab, which is down 35% in three weeks.

- This is the fastest decline for Schwab since 1987, creating a potential generational buying opportunity.

- The bond market estimates a 98.5% probability that Schwab will survive this banking crisis.

- Today, Schwab trades at just 12.5X earnings and 6X cash-adjusted earnings, a bargain by even private equity standards.

- Schwab is priced for negative 5% growth, but analysts expect 16% long-term growth. Schwab is 50% historically undervalued and could triple in three years and deliver almost 400% returns in six. This is a lower risk Buffett-style "fat pitch" than AXP in 1963's Salad oil crisis, when Buffett bought 5% of American Express for $20 million, a position now worth $22.4 billion.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

R&A Studio

This article was published on Dividend Kings on Wed, April 5th.

---------------------------------------------------------------------------------------

Wait for a fat pitch and then swing for the fences." - Warren Buffett

The banking crisis might not have caused a big market sell-off but it certainty hammered financial stocks.

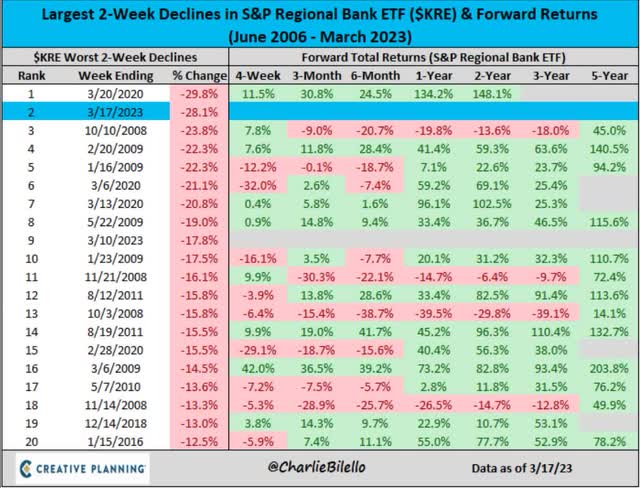

We just saw a two-week collapse in regional banks that was only surpassed during the Pandemic lockdown crisis.

Several Dividend Kings members have asked me to look at The Charles Schwab Corporation (NYSE:SCHW), one of the worst-hit financials in the crisis.

A 36% decline in three weeks is usually a sign of either a generational buying opportunity or a broken company.

A 43% decline is either a broken company or an A-rated Buffett-style "fat pitch."

In 1963 during the Salad Oil crisis, American Express (AXP) shares fell 50%. Buffett bought 5% of the company for $20 million, confident that this strong financial brand wouldn't go bankrupt. Today that 5% stake is worth $22 billion, representing a 1100X return.

Let me show you why buying Schwab today is likely an even better Buffett-style fat pitch than AXP in 1963.

Let's look at why Wall Street is freaking out over Schwab, what the actual damage to its business is from the crisis, and why it could triple in three years.

In other words, I'll show you why this is a potentially great time to bend it like Buffett and swing at this incredibly fat pitch.

Schwab Isn't Going To Fail

Anyone who tells you, Schwab, is the next Lehman is either ignorant of the facts, a fool (who knows the facts but ignores them), or trying to sell you something (possibly all three).

A single chart can summarize why the market hates Schwab right now.

Bloomberg

In the last few months, almost $400 billion has flowed from traditional bank accounts (like what Schwab has) to higher-yielding money market funds.

- most of Schwab's fund flows have been to its own money market funds

Schwab's collapse isn't because Wall Street is worried about a run on Schwab. It has $71 billion in cash and $152 billion in liquidity vs. $392 billion in deposits.

Schwab's Liquidity Right Now

- $71 billion in cash

- $16 billion short-term credit revolver

- $65 billion long-term credit revolver

- $200 billion in bonds it can borrow against from the Fed

- $352 billion in total liquidity

So if 90% of people with a Schwab bank account wanted their money today, Schwab could give it to them. Schwab is NOT going to go bust like SVB or Signature.

On the regulatory capital front, Charles Schwab had a very healthy common equity Tier 1 capital ratio of 21.9%" - Morningstar

What is the regulatory requirement for Schwab?

Federal Reserve

Schwab's CET1 ratio is nearly 3X the regulatory minimum. This is an outrageously well-capitalized bank.

FactSet Research Terminal

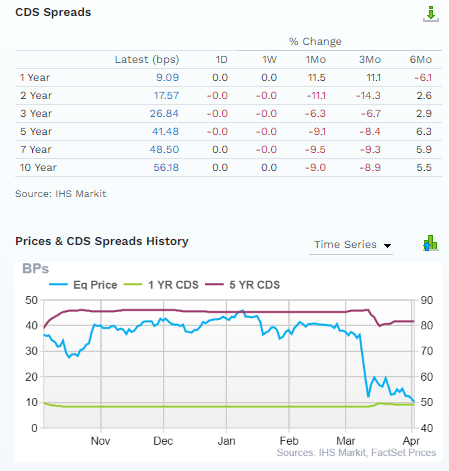

Credit default swaps are insurance policies bond investors take out against potential defaults. Credit Suisse's 12-month CDS hit 40% right before UBS was forced to acquire it.

Today the bond market is pricing in a 0.09% risk that Schwab will go bankrupt within a year.

- About a 450X lower risk than Credit Suisse before its collapse

Schwab Credit Ratings

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | A Stable Outlook | 0.66% | 151.5 |

| Fitch | A Stable Outlook | 0.66% | 151.5 |

| Moody's | A2 (A equivalent) Stable Outlook | 0.66% | 151.5 |

| Consensus | A Stable Outlook | 0.66% | 151.5 |

(Sources: S&P, Fitch, Moody's)

Rating agencies estimate the chance of Schwab failing in the next 30 years at about 1 in 152.

For context, Goldman estimates that the chance of nuclear war with Russia is about 2.5% or 1 in 40.

In other words, the chance of Schwab failing is about 4X smaller than a nuclear apocalypse.

Rather the trouble for Schwab is what management calls "money sorting."

Why Wall Street Hates Schwab

While we believe Schwab is fine from a liquidity and capital perspective, its earnings power will be lower than we previously thought, as it accesses higher cost funding sources and its deposit base shrinks.

There will likely be some loss of deposits that Schwab will replace with high-cost CDs or loans from the Federal Reserve. Assuming that interest rates stay relatively high compared to the previous 10 years, more clients may hold money market funds or fixed income instead of leaving their cash in Schwab bank accounts." - Morningstar

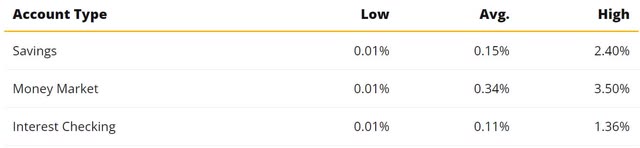

Money sorting just means that Schwab customers are moving money from checking accounts or other low-interest-rate accounts to higher-yielding savings, money market, or CD accounts.

Average Interest Rates February 2023

In the era of free money, banks were able to fund their lending with free money.

Now money costs a lot, and their cost of capital is rising. In some cases, the rates on loans can rise enough to offset the higher cost of capital, preserving a strong net interest margin (such as at USB).

In the case of some banks, NIM is going to get squeezed by money sorting, which in the case of Schwab means having to pay 8X more for deposits than it did before the Fed started hiking rates.

Schwab generates about 67% of its income from net interest income on deposits, so cash sorting is a real potential headwind for it.

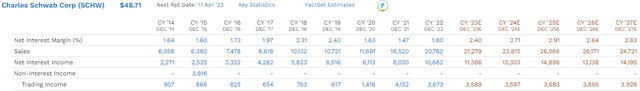

What do all 23 analysts covering Schwab think will happen to its net interest margin in the future?

Actually, analysts currently expect Schwab's NIM to hold up pretty well. Might those numbers fall significantly after earnings are announced on April 17th? Sure. But probably not enough to justify Schwab's 40% plunge this year.

Why Schwab Is A Buffett-Style "Fat Pitch" Buy

There are times in markets where logic is thrown out the window, and emotion takes over, and I feel like this is one of those moments with Schwab," said Adam Sarhan, founder of 50 Park Investments.

He added that the rout is a "historic buying opportunity" for the financials sector as a whole and something not seen since 2008." - Yahoo Finance

Schwab's historic crash, the worst since 1987, creates a wonderful buying opportunity for long-term investors.

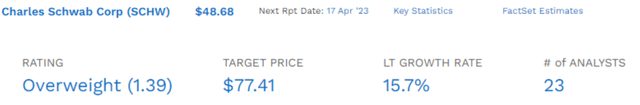

We're reducing our fair value estimate for Charles Schwab to $70 per share from $87.

Our fair value estimate implies a price/2024 earnings multiple of about 20 times and a price/book multiple of about five times. $70 is currently our best assessment of the company's long-term intrinsic value. That said, new data regarding how the financial sector and Charles Schwab were affected by the events surrounding Silicon Valley Bank could materially change our valuation in the following months. We made many adjustments to our prior model. The most impactful changes were a large increase in usage of high-cost, short-term debt in the near term and more client cash being held in lower revenue-yielding money market funds instead of more profitable banking deposits." - Morningstar

Morningstar is using 2.5% long-term Fed Funds rates and 4.5% long-term 10-year yields (similar to what Moody's expects) in its discount cash flow model to estimate SCHW is worth about 20X earnings.

Even Morningstar's conservative model estimates SCHW is about 30% undervalued.

And I would argue that 2.5% Fed funds rates and 4.5% long-term interest rates justify Schwab's historical PE, not 20X earnings.

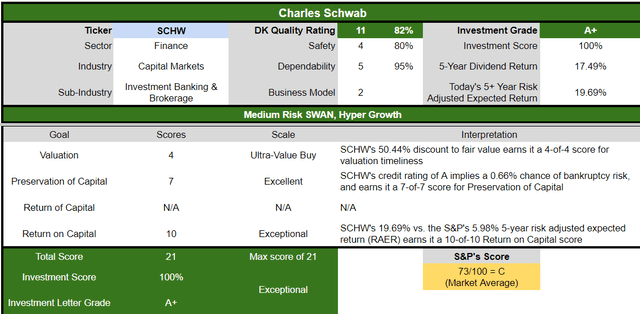

- current price: $48.94

- fair value: $98.46

- historical discount: 50%

- quality: 82% medium-risk 11/13 SWAN (sleep-well-at-night)

- DK rating: potential Ultra Value Buffett-style "fat pitch" table pounding buy

In the last 20 years interest rates averaged pretty much what economists, the Fed, and Morningstar expect them to be long-term.

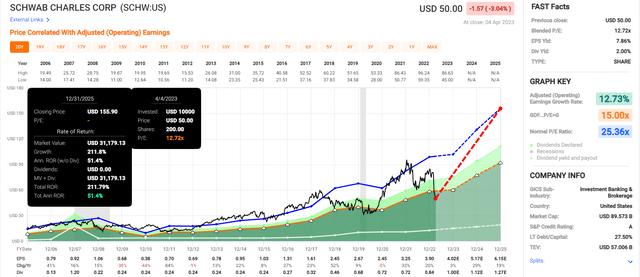

And during this time Schwab averaged 13% growth and a PE of around 25.

Over 20 years, there is a 91% statistical probability that a company's average PE is a reasonable estimate of intrinsic value.

That assumes similar fundamentals, such as growth rates.

At the moment, the long-term median growth consensus for SCHW is almost 16%, certainly justifying its historical market-determined PE of 25.

And what does that potentially mean for patient investors looking to be "greedy when others are fearful"?

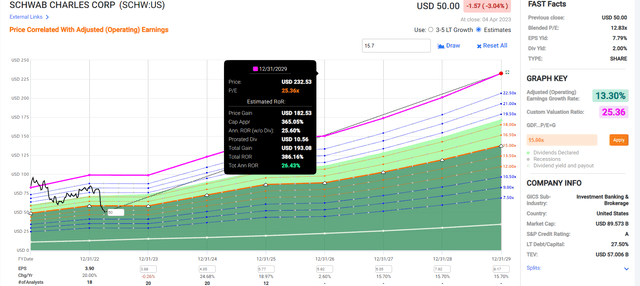

A potential triple in three years and a potential 400% return in six years.

If SCHW grows as expected and returns to its 20-year average market-determined fair value, then it could gain almost 5X in six years.

Think that's overly optimistic?

Total Returns Since 1989

Schwab's historical returns are 18% annually, similar to what analysts expect in the future.

Along the way, it fell as much as 81% during the tech crash. But guess what investors buying SCHW when the market hates it most can make? Gains so strong as to make Warren Buffett blush.

Schwab's Best Rallies Off Bear Market Bottoms Since 1985

- 403% in one year

- 922% in three years

- 2,975% in five years

- 4,729% in seven years

- 160,876% in 10 years (161X)

- 6,314% in 15 years

Buying world-beater blue-chips at a 50% discount can generate life-changing returns.

Bottom Line: Schwab Is A Buffett-Style Fat Pitch That Could Triple In 3 Years

Let me be clear: I'm NOT calling the bottom in SCHW (I'm not a market-timer).

Even SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

While I can't predict the market in the short term, here's what I can tell you about Schwab with today's data.

There is a 99.91% chance that Schwab is not going to fail in the next year.

There is a 98.5% chance Schwab is not going to collapse in the next 30 years.

Anyone telling you that Schwab is the next SVB or Credit Suisse is a fear-mongering fool.

Schwab faces a new headwind of higher costs of capital in the future, at least compared to the last 15 years.

However, those higher deposit costs are expected to be no worse than what it faced from 2000 to 2008 when it was growing at 28% and trading at an average PE of 28.

For 20 years, when interest rates were similar to what we face in the future, and Schwab grew at 13%, the market valued it at about 25X earnings.

Today SCHW trades at 12.5X, a 50% discount.

Even if you think the future PE will be lower, as Morningstar does, buying SCHW at 12.5X earnings is a bargain.

- 6X cash-adjusted earnings

- a bargain by even Shark Tank standards

- never mind private equity

- never mind the public stock market

There is no question Schwab is one of the most trusted names in finance.

There is no question its balance sheet is a fortress, with 3X the capital regulators require.

There is no question that Schwab will survive and grow in the future, the only question is how fast.

But unless you think that Schwab will grow slower than 2% in the future, buying it today is likely a prudent decision.

- 6X cash-adjusted earnings prices in -5% growth according to the Graham/Dodd fair value formula

If Schwab grows as analysts currently expect, it could triple in three years.

In six years, it could deliver almost 400% returns.

Might those estimates fall in the future? Sure. But what if they are cut in half? Then Schwab is a potential triple in six years, which is still 4X better return potential than the S&P 500.

Dividend Kings Automated Investment Decision Tool

For anyone comfortable with its risk profile, Schwab is as close to a perfect dividend growth blue-chip opportunity as exists on Wall Street today.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.