Kaiser Aluminum: The 'Hold' Was Correct, Moving Into 2023

Summary

- My last coverage on Kaiser Aluminum saw the company at a rating of "Hold". This has proven to be the correct approach to have had. I'm updating my thesis.

- This is an attractive company in a sector I know well - but I would be careful about company valuation here.

- At the right price, this company is an absolute "Buy". But even after a double-digit drop since my last article, I would say that there are better options.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

normbear/iStock via Getty Images

Dear readers/followers,

Here, we'll update the thesis for Kaiser Aluminum (NASDAQ:KALU). I do quite a lot of investing and studying aluminum and metal companies, so this one is close to home for me, in some ways. Norsk Hydro (OTCQX:NHYDY) is another one that's close to me, and a company where I've made over 150% profit within the past couple of years by strategically buying and selling shares at certain times - and I still hold a small position in the Norwegian company.

I don't currently have a position in Kaiser Aluminum - and I am unlikely to change this in the near term, even with the company now trading 10% lower than during my last article.

Why is this?

That's what we'll look at in this article.

Kaiser Aluminum - An update on the company

75 years of business expertise in a key segment is not a small deal - especially not given how quickly Kaiser grew to become a vertically integrated business in the aluminum segment, combing a very attractive strategy of both Organic and Inorganic growth. The company's quality can easily be seen - because finding "good" company or sector leaders isn't necessarily a hard thing. Just scan for companies in the upper percentiles when it comes to margins, returns on invested capital, debt, revenue, and EPS growth and, as they say, you're likely to strike gold.

Kaiser, while not the best company in the segment (in fact its gross margins are among the lowest in the entire sector), scores a lot of points in terms of RoE, ROA, ROIC, and ROCE (Source: GuruFocus). It's a profitable business in the upper 50th percentile when compared to other aluminum producers and metal businesses. This is a sector where debt is usually low, and where interest coverage is high, in a way that means that even the company's relatively conservative debt to equity of 1.7x is seen as among the worst in the industry. (Source: GuruFocus)

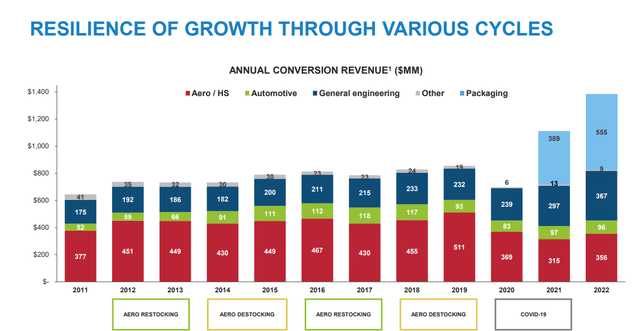

However, Kaiser scores a lot of points in other comparative sectors - including returns and yields. More on that in a bit. First, results. A reminder that Kaiser is actually very good at managing through-cyclic pressure and the addition of packaging to its mix has resulted in some significant upside as well.

Its ability to deliver not only revenues but earnings, is well-established, with solid EBITDA and good margins. Even in 2022, when margins are at a long-time-low, the company is still at an EBITDA margin level of 10.3% - compared to a 24-25% high.

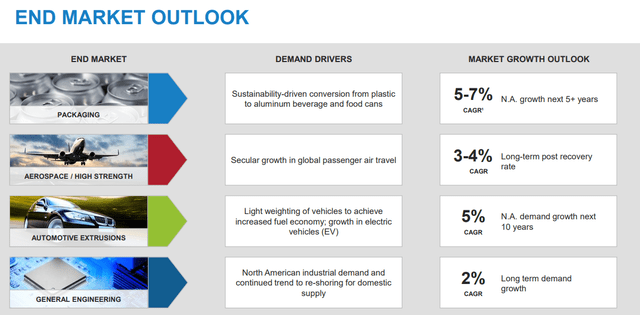

What's more, all of the company's main end markets are expecting growth in terms of aluminum - at least 2% annually, but more likely 3-5%.

This acts as an excellent foundation for future growth - because the drivers that are expected to lift this are all aligned with the current focus on sustainability, lightweight, EVs, and other areas which are likely to remain in focus for the foreseeable future.

Packaging, for instance, is unlikely to see a demand decline even in the event of a downturn, with solid shipments above or close to 150M lbs per quarter. The company's contracts here are multi-year and the demand situation enables Kaiser to push investments in assets and new capacities.

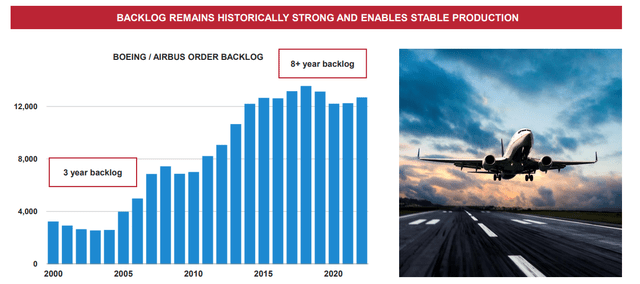

Even more volatile areas such as aerospace and flight are expected to grow - why? Because of the situation with the backlog on a global basis, which are likely to result in significant demand increases over the next few years.

The same, by the way, is true for automotive. Many of the reasons I invest in European aluminum are present in Kaiser as well because the trends are global. The aluminum content in cars and other automotive subsectors is only growing due to increased EV, engine tech, drivetrain tech, and aerodynamics. Lightweight materials are a huge part of enabling this.

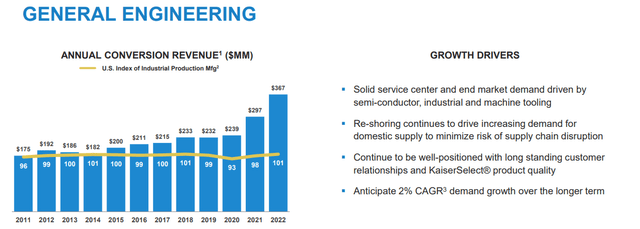

Perhaps most surprising to me though is how well the general engineering sector has continued to perform - almost as a sort of stable, conservative business regardless of the outside macro.

Beyond merely "solid" as I see things here.

Over the long term, Kaiser is targeting and expecting to be able to deliver annual revenues of over $2B, while maintaining a 20%+ EBITDA margin, meaning double the trough we've seen in the latest quarter. This will be done with things like:

- New investments in capacities and expansion.

- Operational efficiencies

- Ongoing expansion projects that support automotive and aerospace recovery.

This description gives you a very positive view of Kaiser - but remember, this company has its volatility. Kaiser is a volatile company in terms of valuation, and it hasn't always been easy making a profit from investing in the business. Since early 2007, your total annualized RoR would be around 3.9% until today, which is below the mark of the market.

However, all these means is that you need to be more calculating and strategic as to when and how much you buy from the company.

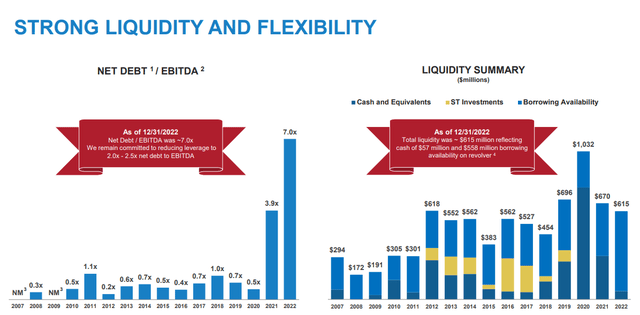

The main risks to the company are very easy to spot at this time and come in the form of the massively increased leverage and financial position the company is in. The company does have borrowing capacity left, but its investments into packaging have left it with a debt load that's massive in the context of where things usually are for the business.

This picture shouldn't imply that KALU is in immediate financial distress because the company is not. Despite this increased debt going into a rising interest cycle, the company recently bumped its dividend.

Think of this company essentially, through pushing investments at this time, securing its future position as leading or as close to the top or favorable in context to other Aluminum companies as it possibly can. Risks, as I see it, do not currently come only from debt, but rather in the form of costs, pass-throughs, and pricing challenges. There is a lag time that depends on market conditions. When metal prices are rising and demand is strong, the lag time is very short - but during a weak demand, the lag time grows. The opposite is true when the situations for pricing and demands are reversed.

This is not unique to KALU, but common for most metal companies, and its part of what causes the extreme ups and downs in valuation, as this affects sentiment.

It's also, as I wrote in my last article, about inflationary cost issues related to alloy, freight, salary, and SG&A which the company can do very little about. The global forecasts, both according to Kaiser Aluminum and publications like Fortune Business, for aluminum and end markets are still positive (Source: Fortune Business, Kaiser Aluminum presentation), but the reason we're down since my last "HOLD" article, aside from valuation at the time being high, is as I see it that the company is still seeing such effects and issues.

Being that the situation is mostly confirmed as of 4Q22, we can now revisit our valuation thesis and see where we put the company - because foundational, there isn't a whole lot that's unclear about the company. It's a strong aluminum player with a very appealing portfolio and a success story in terms of growth.

Kaiser Aluminum Valuation

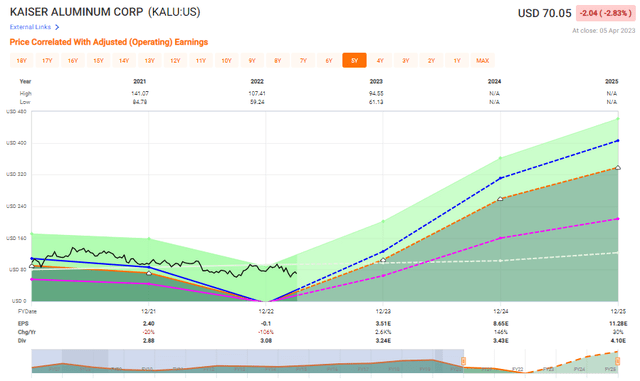

As before, the outlook and thesis we can present here are very mixed. Earnings trends for the current period still make very little sense given that we're at a P/E of over 85x normalized due to updated forecasts. Even with the decline since my last article, that's actually higher than in my last piece.

The company remains BB- rated due to its debt issues - and the sort of leverage that KALU needs to handle or lower is not small - especially not in a rising interest rate situation. KALU is all about the growth we expect to see in 2023-2025, which at the current moment remains incredibly high. This is what things look like in terms of what analysts are expecting to happen.

F.A.S.T Graphs KALU (F.A.S.T graphs)

And if this does happen, the upside or potential RoR for investors is in no way small. If historical trends are anything close to indicative, there could be RoR of upwards of 300-400% if previous valuation trends hold. However, this also assumes a 30x P/E - and that's far too high. A more normalized and standard P/E for this type of business would be around 15x, and there the implied upside until 2025E under current estimates is around 155% or 40.85% per year.

This is a massive upside, for sure. Can we somehow qualify how likely it actually is to materialize?

Forecast accuracy is, unfortunately, lousy. Analysts miss negatively 67% of the time on a 1-year basis with a 10% MoE, which is another way of saying that you have a better chance with a coin toss. Whenever it goes to those levels, I would say that being an "analyst" or several analysts for the company and this is your track record, it's time to change something in the modeling, because something isn't working.

This sort of business is incredibly difficult to accurately forecast. That does not mean, however, that it's impossible to value.

Comps exist. Globally, we're looking at aluminum companies such as Hydro, Alu China, Hindalco, Alcoa (AA), and others. Common for the comps is that aside from the largest one, which is Hydro with a market cap of over $14.5B, the businesses competing are found in Asia. KALU has a market cap of around 1/14th of Norsk Hydro, making it an extremely small competitor in comparison, even if it were to reach its revenue goals.

Analysts following KALU give the company a range from $70/share to $105/share. The average here is $82, meaning that the current upside for the company is around 17.5%, not a bad upside all things considered. If the company didn't have its debt issues and it wasn't so light on the clarity side, it's likely that I would be far more positive about the company and the prospect of investing in it.

However, I want more clarity, or a cheaper price before I would be willing to go in here. For that reason, I'm giving the company a normalized P/E multiple of 15x, coming to a PT of $70/share. That was, by the way, my price target in my last article as well. It also means that at a current price target of $70.05, I don't see a compelling reason to invest in a BB-rated aluminum company, regardless of what theoretical upside there might be in a positive scenario.

The risk/reward ratios do not line up for me here. I set my price targets for a reason, and $70/share is the most that I am willing to pay for Kaiser Aluminum - no more than that. Above that, or even close to $70/share, the ratio makes no sense - and this is even more true given the market we're now in and what else is available.

So despite and improved valuation, I would say that KALU stock is still very much a "HOLD". I hope that we will see valuations of sub-$70, perhaps closer to $60/share so that I can start establishing positions in the company.

Thesis

- Kaiser Aluminum is a not-uninteresting aluminum company active in 4 appealing end markets. It has a solid yield, not a solid credit, and difficult, volatile forecasts. In order to make sure that you have a good upside here, you need to buy the company towards the cheaper end of its usual spectrum.

- I still view this as being around $70/share - and this is unchanged from my previous article back in December.

- For that reason, I wouldn't go higher than "HOLD" at this time - but if the company were to drop enough, I will be investing here.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company, due to BB-, and the current market situation, which is significantly changed, does not fulfill my quality criteria, nor is it cheap. For that reason, I'm only willing to give it a "HOLD" at this time.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NHYDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces. The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.