Toronto-Dominion Bank: Investors Smell Blood In The Water

Summary

- Investors are betting big against TD Bank, with short positions totaling $3.7 billion.

- First Horizon acquisition is looking less and less appetizing, given the current state of regional banks, as well as being able to maintain their Common Equity Tier 1 ratios.

- Variable rate mortgages make up ~40% of total mortgages in Canada, with a recent poll showing ~18% of citizens would need to sell their house in the next 9 months.

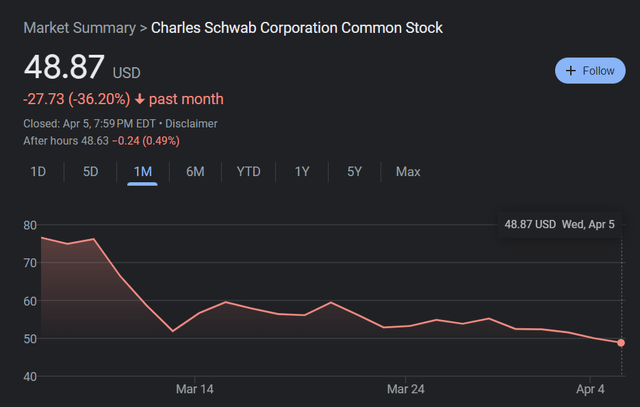

- Charles Schwab has $28 billion in unrealized losses, which TD has a 10% ownership in.

- I believe significant stock price deterioration can occur over the next following months for TD.

Joe Raedle/Getty Images News

Investment Thesis

I believe TD Bank's (NYSE:TD) stock price could see significant declines in the upcoming months. Investors have opened significant short positions against TD Bank, totaling $3.7 billion. Investors are betting big against TD Bank due to their potential First Horizon acquisition, exposure to the adjustable rate mortgage environment in Canada, and a 10% ownership in Charles Schwab who has $28 billion in unrealized losses as of their most recent SEC filing.

Recent News

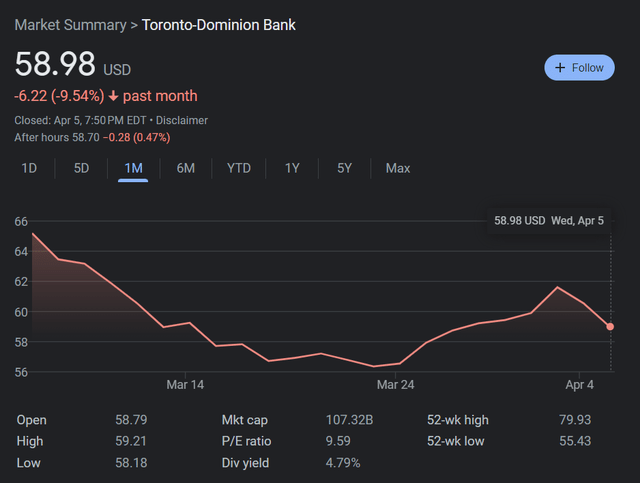

TD Bank can't seem to stay out of the headlines recently. At the end of February, TD Bank finally reached a $1.2 billion settlement from its alleged involvement in a 2009 Ponzi Scheme with Stanford Financial. Additionally, investors are betting big against TD Bank, with shorts totaling $3.7 billion as of recently. As of 4/5/2023, TD Bank is down 9.52% on the month.

First Horizon Merger

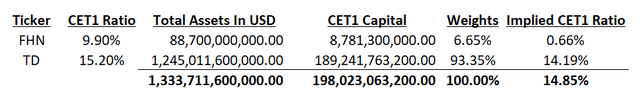

First Horizon (FHN) is a regional bank in the United States. Back in February, TD agreed to buy FHN for $25/share. The problem investors see now is that the current stock price is at $17/share, roughly 30% below their offer. The reason for this drop in my eyes could be for two reasons. First, and most obvious, is that everyone is hesitant of regional banks right now, which is exactly what FHN is. Another reason for the decline in price could be due to the quality of investments that First Horizon holds in comparison to TD Bank. Specifically, I am talking about Common Equity Tier 1 Investments (CET1). As a standard, Canadian banks must maintain at least 11% of their investments in CET1. From TD Bank's most recent filing, they currently maintain a CET1 ratio of 15.2%.

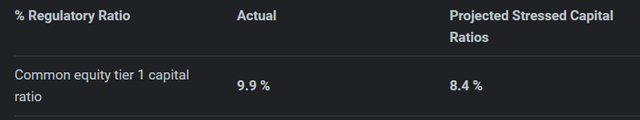

Based on FHN's most recent data, they maintain a CET1 ratio of 9.9%.

A CET1 ratio of 9.9%, while considering the size of their investments, will bring down their CET1 ratio from 15.2% to 14.85%, and will be moving toward that 11% threshold. Hitting this threshold would cause regulatory intervention and a need for liquidity for TD Bank.

Canada's Housing Market

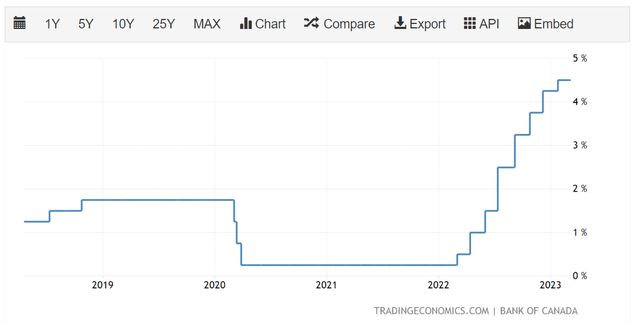

Interest rates have been rising for the Bank of Canada from nearly 0% in 2020 to almost 5% as of 2023.

This is especially important for TD Bank because according to the Canada Mortgage and Housing Corporation, variable rate mortgages represent 44.2% of total mortgages in Canada. With TD Bank being the second-largest mortgage lender in Canada, investors are watching closely as interest rates keep rising and making housing less and less affordable. According to a recent Yahoo Poll, 45% of Canadians with variable mortgages who were surveyed said they would have to sell their house in 9 months due to increased payments from rising interest rates. If 45% of variable mortgage holders can't keep up with rising payments, and 44% of mortgages are variable, then ~18% of Canadian citizens will not be able to meet housing payments in the short term. This could lead to delinquent mortgage payments and tough times ahead for TD Bank.

Charles Schwab Investment

As of 12/31/2022, TD Bank had a 10% holding in SCHW. On 1/19/2023, TD Bank management said the investment should return $285 million in Q1 2023. Due to the rising interest rate environment, SCHW's bond portfolio has taken a massive $28 billion hit in unrealized losses. As of 4/5/2023, SCHW is down 36% on the month, as shown below.

Risks

One risk to point out is that although the short position is quite large, on a relative basis, it only represents 3.3% of the float. Although the increase does show investors are betting big against TD Bank, on a relative basis it is not a huge increase in total shorts as a percentage of the float year over year. As a rule of thumb, usually, 10% is considered high with 20% being considered very high.

Additionally, Canadian banks are structured a lot differently than US banks. For example, the vast majority of Canadian mortgages are insured through the Canadian Housing Mortgage Corporation. This makes it different than the US and a housing collapse less likely in Canada. On top of that, during the 2008 housing crisis, Canadian banks outperformed US banks quite significantly as seen below.

As you can see from the graphs above, TD Bank had a more mild crash when compared to US banks like Bank of America during the 2007 crash.

Conclusions

Overall, I believe that TD Bank's stock can see significant price deterioration in the following months. Investors have accumulated the largest short position in any bank since this banking crisis started, totaling $3.7 billion. Additionally, the problems surrounding regional banks today, coupled with a tight CET1 ratio once acquiring First Horizon's assets, make the deal unappetizing for investors. Furthermore, rising interest rates continue to hurt the adjustable rate mortgage environment in Canada, where TD is the second-largest lender. Lastly, TD Bank maintains a 10% interest in SCHW, which according to their latest SEC filing has $28 billion in unrealized losses as a result from increasing interest rates on their bond portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.