Monster Beverage Needs To Get Costs Under Control

Summary

- Monster Beverage is a key player in the growing energy drink market and is expected to see upward of 8% growth per year, just like prior.

- The company has seen costs eat away at margins every year, and in 2022 this trend caused earnings to decline.

- While the company is very stable, the cost issues dimmed growth potential.

- At 47x earnings and a PEG above 4x, I do not see much value in the stock right now.

Justin Sullivan/Getty Images News

Introduction

The energy drink market is poised to grow by over 8% per year for the next decade. Monster Beverage (NASDAQ:MNST) is one of the few dominating players in this space. The company has seen steady 10%+ revenue and case sales growth over the past few years, showing demand for the product is still strong for such a higher market share participant. But the company has a real cost control problem. Every year of the past five, gross margins have declined, and in 2022 cost increases really started to eat away bottom line growth. While Monster can surely withstand this practice, controlling costs better will unlock much more growth potential. Either way, at the current price point, the valuation is too rich, even when factoring in new growth potential.

Where Are The Economies Of Scale?

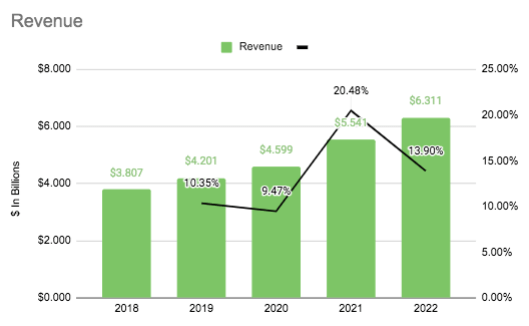

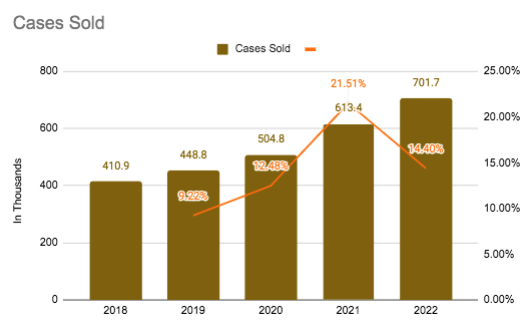

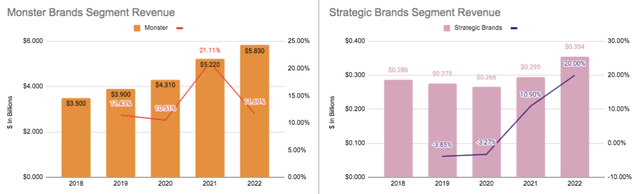

Monster Revenue (SEC.gov) Monster Cases Sold (SEC.gov) Monster Revenue By Segment (SEC.gov)

Monster has seen a strong growth trend over the lifespan of the business. In the past five years the company has seen revenue grow by 10.64% per year. And the past two years have seen revenue growth top that CAGR. Cases sold follow this exact same trend too, posting growth of 11.3% per year. This shows revenue growth is from demand and not pricing changes. The Monster brand has grown at a rate of 10.74%, while the other strategic brands have grown by 10% per year since the low of 2020. So the business on a demand and sales level is doing incredibly well, which is great considering Monster is not a new brand by any means. This solid growth should prevail for more years to come, with research suggesting the energy drink market is primed to grow by 8% per year until 2031.

Monster Operating & Net Income (SEC.gov)

While operating and net income have seen growth, a downward trend has appeared in the last two years. Operating income grew at a CAGR of 8.77% from 2018 to 2020, which is expected, but now sits at 4.3% with the 2022 downturn. On the other hand, net income saw 10.2% growth through the first four years but now is just at 5.02%. So again, while there has been growth, it is inconsistent with the top line and demand growth.

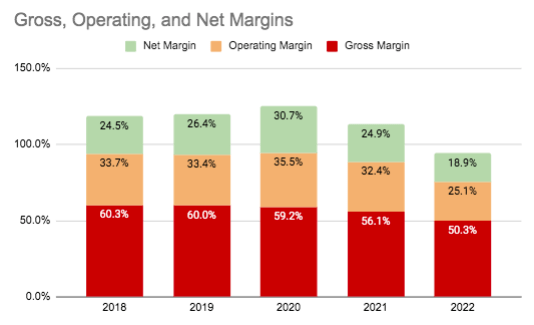

Monster Margins (SEC.gov)

So why have operating and net income not growing at the same rates as revenue? Well, it seems Monster is not really seeing any economies of scale you would expect with such growth. Gross margin has declined every year and is down ten percentage points. Therefore, it has become more expensive to produce products each and every year, even with double-digit growth. This has put pressure on operating and net margins. The past two years have seen higher-than-expected cost pressure, which has created the downward trends in the income above. If Monster can get a handle on costs, the business would unlock significantly more bottom-line growth.

Overall, the operations of Monster are going to be fine, with double-digit growth in an expanding sector. But yearly cost increases that eat away at the gross margin limit growth potential and bring problems when growth slows. Monster needs to figure this out, especially if the costs issues will be as severe as in 2022.

A Very Strong Balance Sheet

Besides this cost overrun problem, Monster is perfect in every sense of the word, with growing operations and a pristine balance sheet. Monster has incredibly high liquidity as well as an extremely low debt load. This makes for a very stable business. The company has current and quick ratios of 4.76x and 3.82x, meaning with just liquid assets the business can pay off current debts almost four times. Monster also has only a 0.18x debt-to-equity ratio, showing just how little debt the business has had to take on to power growth. Monster is in a great position to weather any storm that comes, but the beauty is with 10% revenue growth per year it won't have to. This is a very stable business.

Overvalued For The Expected Growth

As of writing, Monster trades around the $55 price point. The company just underwent a 2 to 1 stock split in March, halving the price point. But this does not affect valuation, and currently Monster is trading at a P/E of 47.68x. With this, the PEG is at 4.77x when extrapolating a 10% growth rate for the future. On top of this, the P/B is at 7.90x. These ratios are very high, and the growth rates don't even support the valuation. Especially if costs will continue to eat away at gross margins each year. At the current price level, I am not a buyer of the business.

Conclusion

While Monster will continue to see top-line growth, I am concerned the bottom-line growth will end up trailing behind as costs increase. This lowers my expectation for high growth rates and therefore makes paying 47x earnings a hefty price. That being said the company is incredibly solid with a growth trend and a strong balance sheet, but I am not a buyer at this point.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.