Arch Capital: Remains Overvalued Despite Good Growth

Summary

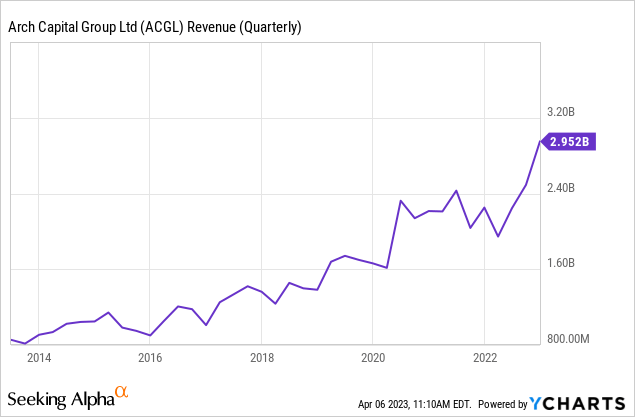

- ACGL reported record-high company revenue in the first quarter of 2023, and has shown a strong upward revenue curve for the last ten years.

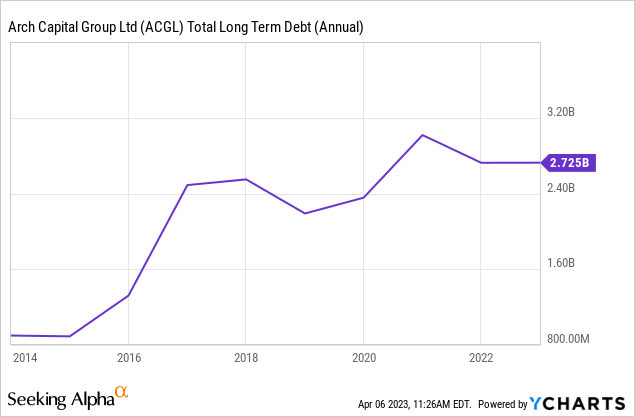

- Debt levels, although they've risen over time, remain serviceable and acceptable.

- Their EV/Sales and Price/Earnings valuations as compared to their peer group indicate ACGL is likely overvalued.

- Because of the overvaluation, I have to recommend a Hold, and not opening a new position at this time.

VioletaStoimenova

Arch Capital Group (NASDAQ:ACGL) is a company based in Bermuda that was formed in 2001. The company writes insurance, reinsurance, and mortgage insurance on a worldwide basis with a focus on specialty lines. The combination of an experienced management team and their strong capital base has enabled Arch to establish a prominent presence in the global insurance markets.

Revenue

Arch Capital Group has shown steady and incremental revenue growth dating all the way back to 2012, when the company reported revenues of around $764 million. In 2014 ACGL revenues topped $1 billion for the first time in company history and the most recent first quarter revenue reports for 2023 show revenues around $3.1 billion.

A notable 53% increase in revenue occurred between the first and second quarter of 2020 but aside from this outlier revenue growth has shown to be steady as you can see in the chart above. Despite a small period of time following the height of the Covid-19 pandemic (Q3 2021 – Q4 2022) and following Hurricane Ian, which negatively impacted the company, Arch revenue has shown a general pattern of meeting or exceeding revenue estimates over the course of its history.

On average Arch has seen an average year-over-year revenue growth of around 4.5% dating back to the beginning of 2015 and investors should have confidence in the leadership of this company to continue the upward trajectory of revenue growth.

Valuation

The EV/Sales multiple currently sits at 2.95x for Arch Capital Group, LTD. Overall this sales multiple is higher than most of ARCH’s peers, but not far off the 2.01x sales multiple average of its’ 14 closest peers.

A significant number of its’ peers EV/Sales multiples sit in the 1.10-1.60 range, which indicates more value can be found outside of ARCH when compared to the peer group as a whole. However, this number is also not near high enough to indicate overvalue and warrant a must-sell approach.

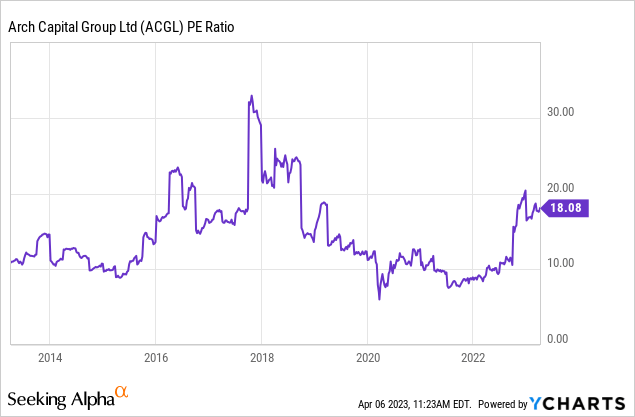

Arch Capital Group, LTD. also checks in on the upper echelon of its’ peers in regards to price-to-earnings ratio as ARCH has a P/E ratio of 13.96. Comparatively, one of its’ peers Markel Corporation has a P/E ratio of 12.31 and an EV/Sales multiple of 1.58, both numbers indicating better value than ARCH can be found amongst peers like Markel Corporation.

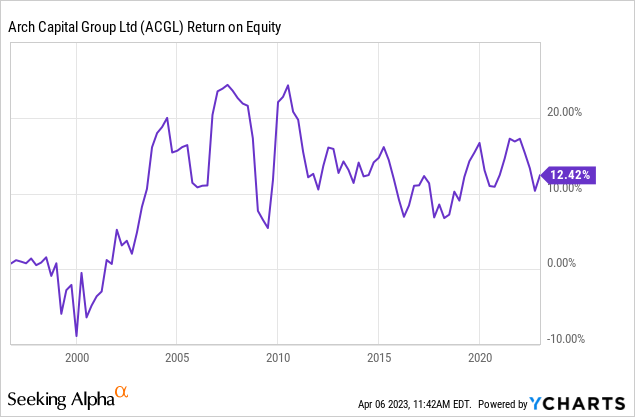

The Return on Equity has moved around quite a bit over time, but is generally in a range of 8% - 20%. I'd like to see a steady mid-teens ROE for an insurance company, and this does seem to average in that area. Generally this will indicate the company is providing a decent return for its investors.

Debt

Total debt at Arch Capital Group is just over $2.7 billion. After debt grew to a record high of almost $3.2 billion in the second quarter of 2020, leadership at ARCH has been incrementally paying down the debt to the current $2.7 billion, where it has stood since 2021. While revenues dipped in the middle of 2021, the company has managed to steadily increase revenue while maintaining debt levels.

They do have enough money held in reserve to cover any potential insurance liabilities, as well as significant long-term investments that if need be could be liquidated to cover losses.

Overall, the potential debt level, and potential insurance losses, aren't at a concerning level and it appears the company has it well in hand.

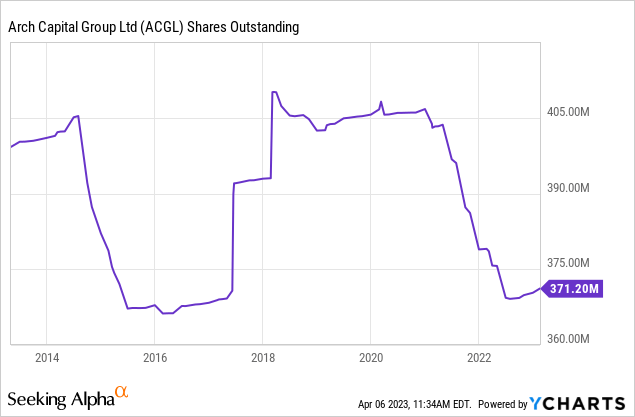

Shares Outstanding

Since 2020 the total number of shares outstanding has continued to decrease. Share issuance can be used to raise interest-free capital for the company, but it dilutes the share float which can lower shareholder values. This isn't an issue if the share price increases, but it's not ideal.

Ideally speaking, I want to see the share float decreasing in a steady trend over time as the company buys back shares. It looks like ACGL has issued shares a few times and bought them back a few times. This isn't the perfect situation, but it's better than just continually issuing them. At least they have buybacks on their mind.

Industry Outlook & Risk

Hurricane Ian negatively impacted the company in 2022 and while natural disaster risk can be obviously unpredictable, the company appears to be positioned well and diversified in enough markets for long-term growth, as it was able to handle the natural disaster in stride. ACGL also has a focus on specialty markets, making it more resistant to general market volatility.

Leadership

Arch Capital Group, Ltd. is led by Chief Executive Officer Marc Grandisson. Marc was promoted to the position of CEO in 2018, when he was also appointed to the Board of Directors, where he serves with twelve other men and women of varying backgrounds. Prior to being promoted to CEO, Marc served as the President and Chief Operator Officer of Arch Capital.

According to Glassdoor, employees seem to be happy with the culture at the company and boast of great benefits. Out of 296 reviews from employees at the company, Arch Capital managed to garner a 4.2/5.0 star average. Happy employees are a good indicator of a strong company culture, and a strong company culture leads to higher employee retention and productivity.

Conclusion

Arch Capital Group, Ltd. has managed to consistently increase revenue while continuing to float or even decrease debt in recent years. They appear to be under strong leadership and are positioned well to survive risk associated with industry volatility and uncertainty. While these are all generally buy indicators and Arch is indeed on the cusp of being a buy stock, I currently consider ACGL to be a hold as the EV/Sales multiple and P/E ratios are not strong enough indicators to warrant a buy alert.

Current investors can rest comfortably knowing there are signs pointing to a profitable future, but at this time Arch is a Hold and doesn’t warrant opening a new position.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.