First Republic Bank: The Self-Fulfilling Prophecy

Summary

- Was Silicon Valley Bank an isolated case just as inflation was supposed to be temporary?

- First Republic Bank does not deserve to fail but it might if government support does not take a turn away from the usual short-term loans and deposits.

- The hypothetical recession could accentuate even more distrust toward regional banks in favor of the usual SIBs, assuming the insurance system is not modernized.

Sohel_Parvez_Haque

After a 90% collapse in just a few weeks, First Republic Bank (NYSE:FRC) went from being a trustworthy bank appreciated by its customers to becoming a falling knife. Sentiment has completely changed, yet it has all happened too quickly and perhaps unfairly.

At the current price, the possible future scenarios in my view can only be two, and there are none in between: either First Republic Bank is currently a unique opportunity or it is a bad investment. Knowing the answer ex ante is obviously impossible, there are too many variables to consider during a time of distrust towards the entire banking system. In any case, we do not necessarily have to make a choice today; on the contrary, we can wait until the next quarterly report (April 13th) to draw more reasoned and less hasty conclusions. Certainly, the return on investment will be reduced in the event of positive news, but at least there is less chance of losing almost everything in a few days as happened to Credit Suisse (CS) shareholders. In short, after such a collapse I don't see this rush to buy First Republic Bank on the lows when the risk of getting burned is still so high.

Why First Republic risks collapse

Before looking at what may affect First Republic Bank's future, it is good to first understand what triggered this sell-off, as the causes are not directly attributable to the bank itself, which is why I spoke of an unjustified collapse at the beginning of the article.

When the collapse of Silicon Valley Bank occurred, negative sentiment quickly spread across the entire banking sector, particularly towards all regional banks.

However, while the Regional Banking ETF (KRE) lost about 28% in a few weeks, First Republic Bank lost about 90% of its value. Why this difference?

As many people will know, FDIC insurance covers all deposits of less than $250,000 from a bank failure, so if you are a company, for example, and you have deposited more than this amount, you may have quite a bit of trouble getting your money back if your bank fails. After the failure of Silicon Valley Bank, which had more than 90% uninsured deposits, fear quickly spread to all banks with a high degree of uninsured deposits. As 68% of First Republic Bank's deposits exceeded the $250,000 threshold, many panicked customers transferred their funds and the bank suddenly experienced a liquidity crisis. In addition, unrealized losses on HTM debt securities due to the Fed's rapid rise in interest rates did not help.

The Wall Street Journal reported that customers withdrew about $70 billion, almost 40% of total deposits, so such a market reaction was inevitable. Unlike non-financial firms, a bank's customers are also its lenders, since through their deposits banks obtain the liquidity they need to invest in long-term financial operations. As long as there is confidence in economic growth and in the banking system, banks can continue to operate without hindrance, but it only takes the slightest problem to stop the gearing as liquidity risk cannot be completely eliminated in banking.

In this case, the problem for First Republic Bank was that a bank with 'similar' characteristics suddenly failed, and this was enough to generate a strong distrust towards banks with a high prevalence of uninsured deposits. Before this sudden event, it was virtually impossible to predict that First Republic Bank would be in this situation within a few weeks.

After all, we are not talking about a bank like Credit Suisse, which has been the subject of numerous scandals over the past 10 years, nor is Deutsche Bank (DB) always in the eye of the storm. Of course, the latter two are systemically important banks (SIBs) as opposed to First Republic Bank, so we are talking about different realities, but it was to be expected that if they continued as they were doing their future would not be rosy.

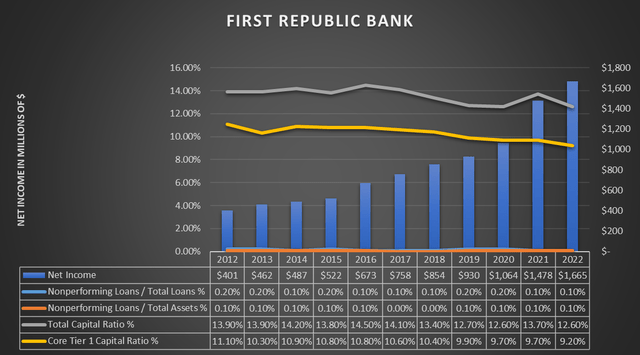

First Republic Bank, on the other hand, had a constantly increasing net profit, almost zero nonperforming loans, and capital requirements above those required by the supervisory authorities. So, this bank was sound, but due to a series of exogenous events unrelated to it, it lost its most important asset: customer trust.

The fact that the bank 'didn't deserve' to be in this situation is indeed one of the key points of a bullish thesis towards First Republic Bank, since having been a healthy bank that suddenly ended up in the eye of the storm not due to its own demerits it will eventually overcome this temporary moment of weakness. In any case, I have my doubts about this and will clarify my position on the matter in the following paragraphs.

The support is there, but the market does not agree

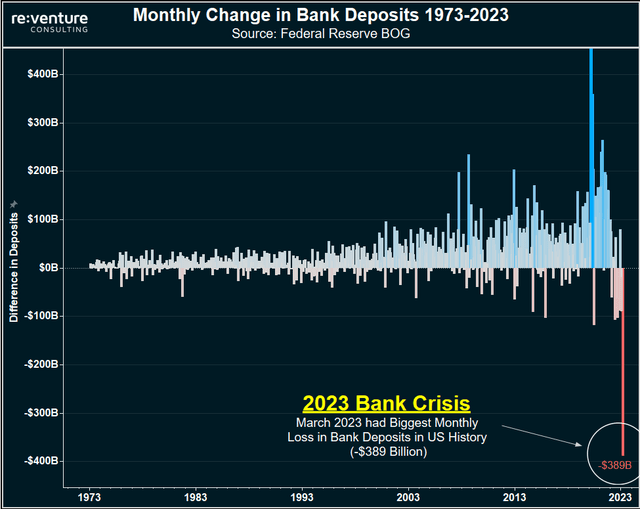

March was an extremely negative month for deposits, a sign that the entire sector is on the verge of a complex period.

Whether this period has only just begun or is already over, we cannot know, but the fact is that the sudden failure of Silicon Valley Bank has raised many concerns about the soundness of US banks and beyond.

In March alone, excluding Silicon Valley Bank, Silvergate Bank and Signature Bank also collapsed; in Switzerland, UBS (UBS), supported by the SNB, bought Credit Suisse in extremis; and in Germany, Deutsche Bank is again causing concern. It would seem that the contagion effect is beginning to spread, but Chair Powell is not of the same opinion:

These are not weaknesses that are at all broadly through the banking system. This was a bank that was an outlier in terms of both its percentage of uninsured deposits and in terms of its holdings of duration risk.

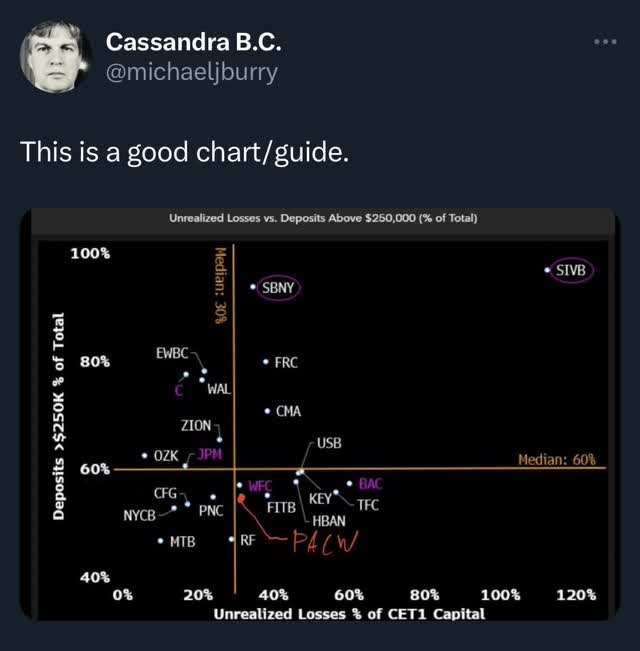

Contextualizing his words with this chart published by Michael Burry, indeed the numbers seem to prove him right: no bank like Silicon Valley Bank had such a high combination of deposits > $250k/total deposits and unrealized losses/CET1 Capital. However, Signature Bank also suffered the same fate despite not having the same amount of unrealized losses, and after all, it does not differ that much from First Republic Bank in terms of deposits > $250k/total deposits.

My hope is that the Fed is right and Silicon Valley Bank was an isolated case, but we cannot be certain now. After all, inflation was also supposed to be a temporary problem.

In any case, no one has been hurt so far apart from the shareholders, as the Fed Board has decided, as an extraordinary measure, to fully protect even the uninsured deposits of Silicon Valley Bank and Signature Bank in order to avert a risk of contagion. But support for the financial system did not end there:

- With the mid-March announcement of the new Bank Term Funding Program (BTFP), banks will be able to apply for loans with a maximum term of one year by pledging high quality securities valued at par as collateral. In this way, should banks need liquidity, they will not be forced to sell their securities at a heavy loss.

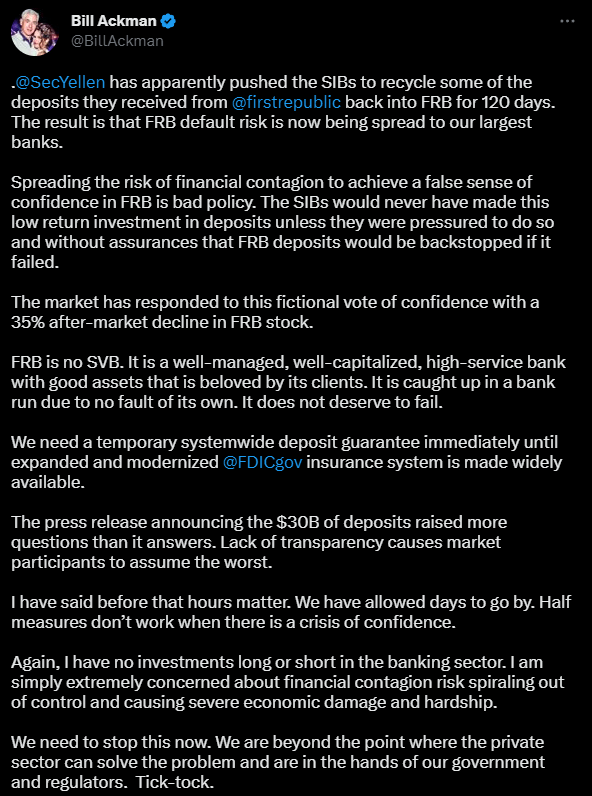

- Furthermore, to support First Republic Bank's liquidity to an extraordinary extent, the top 11 US banks deposited a total of $30bn for at least 120 days on 16 March. The aim of this move was to give a signal of confidence in the banking system and slow down the spread of pessimism among depositors.

Unfortunately, several weeks after the announcement of these maneuvers, which should have lifted the situation, the market does not seem convinced and First Republic Bank is collapsing more and more. But why has this support not worked?

Bill Ackman Twitter

One possible answer to this question is that provided by Bill Ackman that "half measures" do not work when there is a crisis of confidence. The private sector can do little in this particular case; the regulators need to offer a temporary deposit guarantee now until the insurance system is expanded and modernized.

First Republic Bank does not deserve to fail but it might if government support does not take a turn away from the usual short-term loans and deposits. In my opinion, the goal of support should not only be to provide liquidity to the bank but to prevent it from needing it in the first place. In particular, I believe that especially the introduction of the BTFP will not help First Republic avoid collapse since the bank is not as exposed to rate risk as Silicon Valley Bank was.

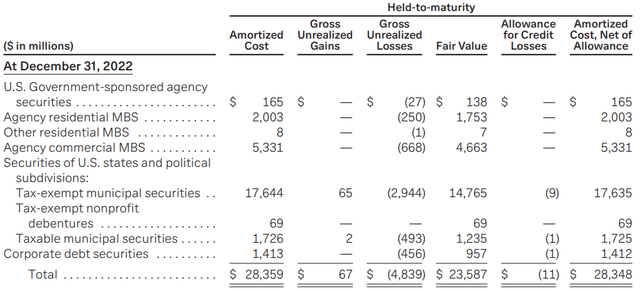

According to the latest annual report, First Republic Bank has unrealized losses of $4.83 billion on its held-to-maturity debt securities. Relating this figure to CET1 of $13.92 billion, the unrealized losses represent about 35% of it. In comparison, Silicon Valley Bank had a ratio of 110%.

In any case, assuming the losses are realized and adversely affect CET1, First Republic would still fully meet the capital requirements imposed by the Basel III capital rules. In fact, CET1 would be 5.98% of risk-weighted assets, higher than the minimum requirement of 4.50%. So, as far as I'm concerned, I don't see how the BTFP can help the bank recover from such a situation. At most it can be a little help, but it is not a game changer. First Republic Bank needs to regain the trust of its customers and as soon as possible.

No bank in the world can withstand a massive bank run, so the phenomenon of the self-fulfilling prophecy applies in banking: if everyone believes it will fail then the bank will fail.

The future does not bode well

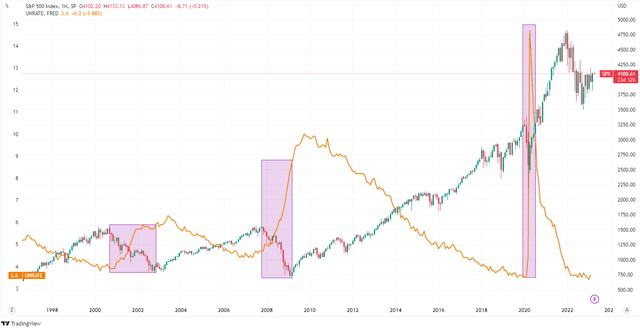

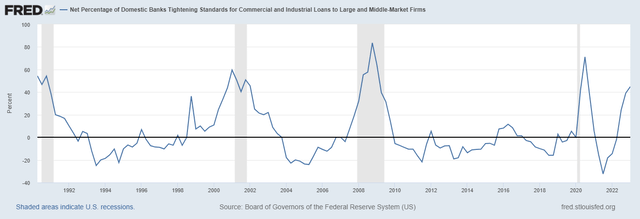

Since the banking sector is cyclical, future economic expectations assume crucial importance in order to understand whether First Republic will recover. In expansionary phases of the business cycle, banks tend to be the first to recover, but in recessionary phases they are the first to be hit hard.

Federal Reserve Bank of St. Louis

Over the past few months we have been witnessing a gradual tightening of standards for lending to medium- to large-sized companies, a sign that something has evidently changed from the past. Banks are more reluctant to lend and prefer cash to long-term investment. After the Fed's sharp rise in interest rates, access to credit has become more difficult, and banks are becoming less and less confident to lend on current terms as they may see their NPLs rise.

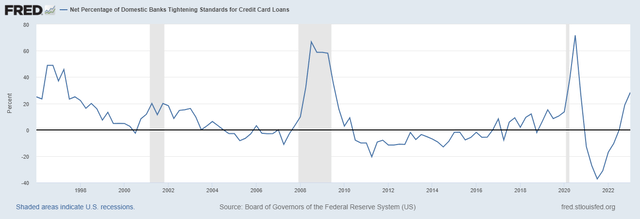

Federal Reserve Bank of St. Louis

Similar discussion can be made for credit card lending, where the bullish trend has started since Q3 2021 and does not seem to be stopping. If banks are more reluctant to engage in their traditional lending activities, they will not only profit less but also hurt companies that want to expand.

According to the FOMC's latest economic projections, the expected Fed Funds Rate for 2023 is 5.10%, while for 2024 it is expected to be 4.10%. If these estimates are correct, this would mean that interest rates would remain high for much longer, severely slowing economic growth and making traditional bank activity difficult. In my opinion, however, these estimates could be revised downward since such a prolonged monetary tightening would solve the inflation problem but create new ones.

In this other graph, however, we note how the rise in the unemployment rate has in the past been a prelude to a new recession. Currently the unemployment rate is at historic lows, however, it is likely to worsen in the coming months due to the Fed's monetary tightening. The FOMC itself predicts that in 2023 this rate will reach 4.50% and then reach 4.60% in 2024. It is impossible to establish a priori the veracity of these estimates, but I believe that in the coming months the unemployment rate theme will replace the inflation rate as the main market mover.

Federal Reserve Bank of St. Louis

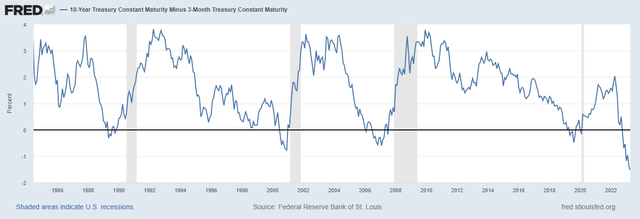

Last, this is the usual chart showing the spread between the yield on 10-year and 3-month Treasuries. It has been discussed extensively about this issue over the past few months, but it is always good to be reminded. This indicator has predicted most past recessions, and it may not contradict itself this time either. In any case, it is good to clarify that graphically a recession does not occur when the spread is negative, but when after being negative it turns positive again. Currently, we have not yet reached the second stage, which is why there has been no recession so far.

The inversion of the yield curve makes it difficult for banks to draw profit since short-term rates (those with which the bank finances itself) are higher than long-term rates (those used by the bank to immobilize capital). So, the economy stagnates and goes into recession.

All these graphs shown so far denote, in my opinion, not a few concerns about future economic trends, and all this makes First Republic Bank's recovery even more difficult. The hypothetical recession could accentuate even more distrust toward regional banks in favor of the usual SIBs, assuming the insurance system is not modernized.

Overall, in light of what has been shown in this article, I consider First Republic's condition to be rather precarious and high risk. The present is difficult and the future may be even more so. Rather than a hold my rating is an avoid, as investing in it would not make me comfortable knowing my level of risk aversion. This does not mean that it is wrong to invest in it, simply that it is not for me right now. As of now, I am waiting for April 13th to have new elements to better assess the situation.

As much as I may like First Republic as a bank, the fact that something as irrational as a bank run could decide its future leads me to avoid investing in it.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article does not represent financial advice, simply my opinion on the matter.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.