MariMed: Positioning Itself To Thrive In A Post-Rescheduling Environment

Summary

- MariMed has healthy financials and was able to secure a loan for $35M.

- The company has clear plans for synergistic expansion through 2023.

- They already have positive operating margins and have been improving net profit margins for the last three quarters.

- MariMed is a Buy.

FatCamera/E+ via Getty Images

Thesis

On October 6, 2022, Biden instructed the DHHS and the Attorney General to begin the process of rescheduling cannabis. The removal of the 280e tax obligation and federal restrictions to shipping it across state lines are opposing forces. Lessening their tax burden will immediately improve the financial situation for every company in the sector. Allowing competition across state lines is likely to begin driving the price of cannabis down, so over time producers will become less profitable.

MariMed (OTCQX:MRMD) currently has better margins than most of its competition and should do well during the coming price war. The company has clearly laid out their plans for expansion in 2023, they include additional retail, manufacturing, and wholesale. This expansion of their capacity ahead of rescheduling leaves them well positioned to benefit from the increase in demand it will bring. I am recommending a Buy for MariMed.

Company Background

MariMed is a vertically integrated multistate cannabis operator. The company was founded in 2011 and is headquartered in Norwood, Massachusetts.

MariMed Company Highlights (March 2023 Investor Presentation)

MariMed is one of the few cannabis companies with strong enough financials to secure loans and was granted one for $35M in January 2023. Within a month, they announced plans to open a third dispensary in Massachusetts by buying one from Ermont. The company has recently secured permission from the Maryland Medical Cannabis Commission to begin selling high dosage edibles.

Forward looking statements made during their most recent earnings call indicate they are planning on expanding in 2023. They expect spending growth will temporarily outpace revenue growth as they plan on hiring 200 additional full-time personnel, bringing the company up to about 800 by the end of 2023. In addition to setting up a new store in Tiffin, Ohio, they plan to expand manufacturing capacity in both Massachusetts and Maryland, and ramp up new wholesale businesses in Illinois and Missouri. All of these separate efforts are likely to contribute to future revenue growth.

Financials

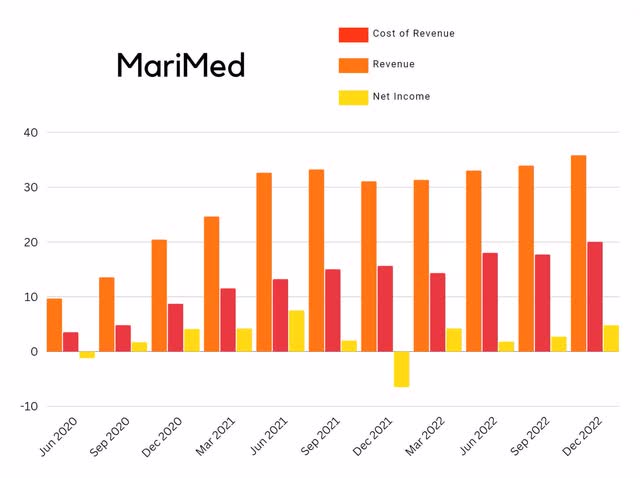

MariMed had strongly growing revenue until Q2 2021. The company experienced a revenue contraction in the second half of 2021, but has returned to growing revenue since then. Over the last 4 quarters, revenue has grown 15.48% from $31M in Q4 2021, to $35.8M in Q4 2022. The company has been Adjusted EBITDA positive for the last 12 quarters and net income has grown for the last three quarters.

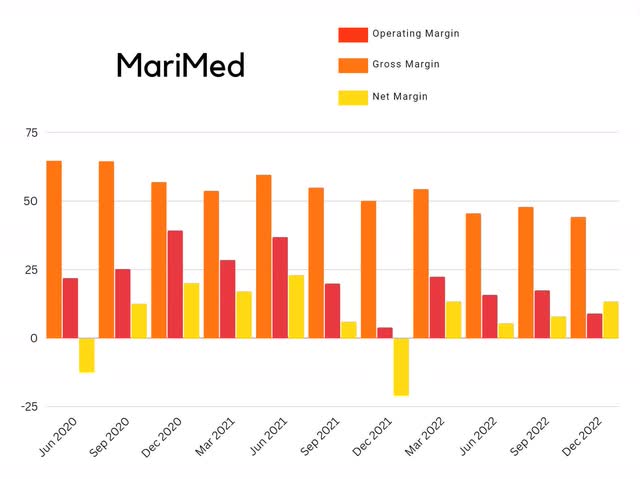

Unfortunately, gross margins have been steadily declining. Operating margins are inconsistent, but have also been declining. The company is clearly improving its efficiency. Even though they have been experiencing both declining gross margins and declining operating margins, net margins have improved for the last three quarters.

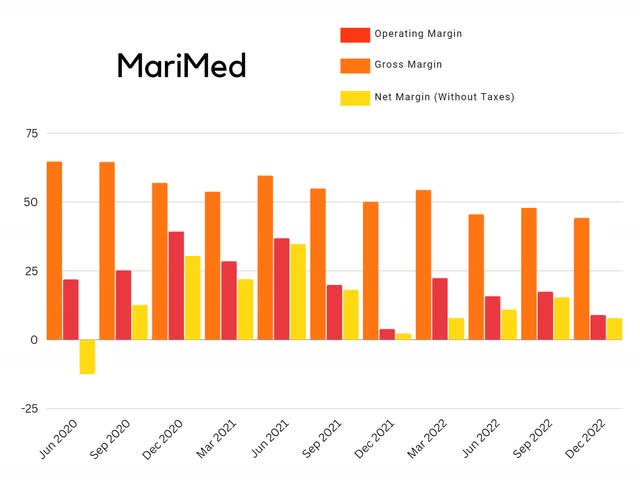

The below chart is what MariMed's margins would look like if they didn't have to pay any taxes. The narrative around United States cannabis companies is that most of the sector is unprofitable because of the 280e tax obligation. MariMed is one of the few companies in the sector that have actually found a business model that allows them to find profit even through the brutal tax obligation. When cannabis is rescheduled, cannabis companies will finally be able to deduct their cost of goods and other operating expenses before they calculate their tax obligation. So the below chart isn't as accurate of a representation of the future as it could be because these companies will have their taxes reduced dramatically, not removed entirely. We can see that even without taxes, Q2 of 2020 had negative net margins. Even during their worst quarter since then, in a tax free scenario Q4 2021 would have posted positive net income. The efficiency improvements I referenced earlier show up more clearly here without the taxes; as we can see that over the last 4 quarters, the gap between net margins and operating margins has narrowed.

MRMD Margins Without Taxes (By Author)

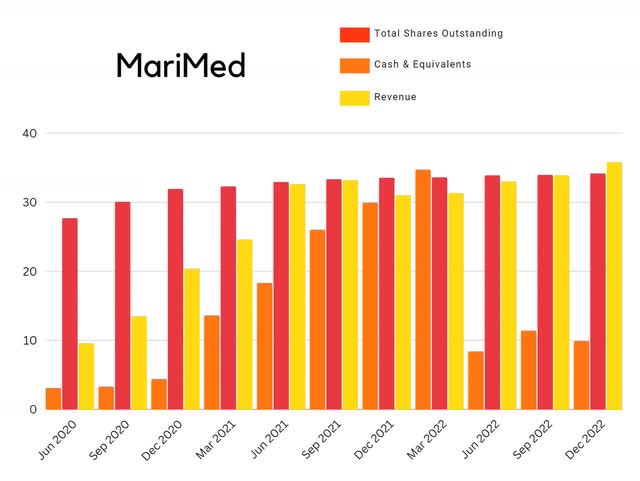

I also like to compare a company's float, cash, and revenue to see how these relationships have been playing out. MariMed was experiencing significant dilution in 2020, but the pace of dilution slowed dramatically after that. In Q4 2020 they had 319.1M shares outstanding. By the most recent quarter that was up to 341.5M shares. This company was diluting in order to grow revenue, and by around the end of 2020, pivoted away from expansion through dilution and started paying for more things with their free cash flow. Over the last 4 quarters share count has grown 1.88% from 33.52M in Q4 2021, to 34.15M in Q4 2022. All of this is healthy and speaks to a company that has shifted out of the introduction/launch stage and into its growth stage.

MRMD Float vs. Cash vs. Revenue (By Author)

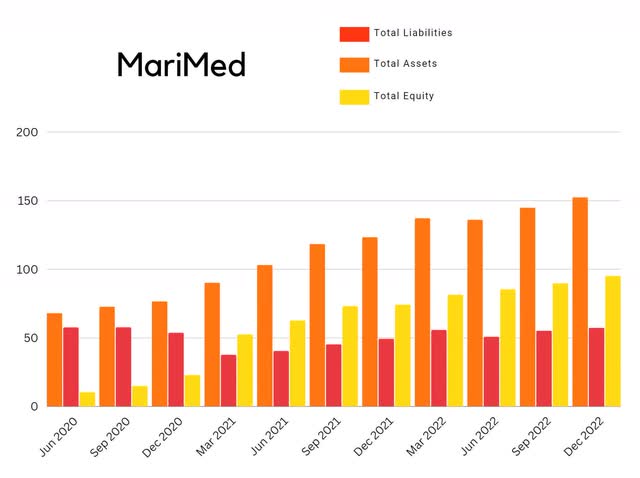

This company also has an attractive equity curve. Unfortunately, most of the cannabis sector has equity curves that are sloping downward. MariMed managed to improve its assets to liabilities ratio during the second half of 2020 and first half of 2021. It has maintained improved ratios since then.

Valuation

As of April 4th, 2023, MariMed had a market capitalization of $135.74M and was trading for $0.38 per share. Instead of producing an estimate for present day fair value, I am going to produce one for a post-rescheduling MariMed. Looking over my data for what margins would be like without taxes, the last four quarters had net margins of 7.82%, 15.34%, 10.91%, and 7.9%. This comes out to an average of 10.4925% pre-tax net margins. Subtracting the 21% federal corporate tax rate from that leaves MariMed with an estimated net profit margin of 8.29%. State taxes vary from 0% to 11.5%, so the actual net profit margin will vary from 7.08% to 8.29%.

Since this is in the 5-10% net margin range, it should trade with a P/S ratio of 1.5x to 2.5x. That translates to a share price in the $0.63 to $1.05 range, with an average of $0.84 per share. This estimate assumes no additional margin improvement and no revenue growth.

Extrapolating out recent numbers to represent another year, including a 15.48% revenue growth and also offsetting that against a 1.88% share count increase, the range becomes $0.71 to $1.19, with an average of $0.95 per share.

MRMD Valuation (Seeking Alpha)

Risks

Although unlikely, it is possible that instead of rescheduling cannabis into the 3 to 5 range, the recent request by Biden results in it being given the same treatment as alcohol or tobacco, and it's removed from the list of controlled substances. If this happens I expect ultra cheap Canadian cannabis to flood the United States market. This will make the U.S. market resemble the Canadian market, and is very likely to drive most of the U.S. based producers out of business.

Catalysts

The obvious thing to cite here is the news of rescheduling. The cannabis industry is incredibly cyclical and prone to euphoria driven rallies that do not care about rational valuations. When this occurs it will provide an opportunity for MariMed to raise cash with at-the-market offerings while the shares are overvalued. Depending on how efficiently MariMed deploys this capital, it could provide a significant boon for the long term competitiveness of the company.

The cannabis industry in the United States is projected to have a CAGR of 14.2% through 2030. This will provide continued sustained tailwinds for MariMed.

Conclusions

Unlike most of the rest of the industry, MariMed is already financially viable. Even without rescheduling, their equity curve is trending upward as their financials improve. I am expecting the removal of 280e to cause sector wide margin expansions, followed by competition driven margin contraction. Since it already has healthy margins, I believe MariMed is well positioned to adapt to the more competitive market that rescheduling is likely to bring.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.