My 2 Highest Conviction Buys Of 2023

Summary

- Macroeconomic and geopolitical forces are aligning perfectly to make two particular investments my highest conviction buys of 2023, and it isn't even close.

- We look at these macroeconomic and geopolitical forces more deeply.

- We then share how these forces have driven us to buy our top conviction picks hand-over-fist.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

FotoMaximum/iStock via Getty Images

Macroeconomic and geopolitical forces are aligning perfectly to make two particular investments - Gold-related securities (GLD)(IAU)(GDX) and Virtu Financial (VIRT) - my highest conviction buys of 2023, and it isn't even close. In this article, we look at these macroeconomic and geopolitical forces more deeply and then share how they have driven us to buy our top conviction picks hand-over-fist.

Top Pick #1: Gold-Related Securities

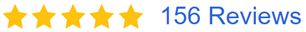

GLD is off to a great start so far this year, beating Silver (SLV) and the S&P 500 (SPY)(VOO) year-to-date:

That said, we believe that the yellow metal is just getting started and that further outperformance is ahead.

The biggest reason for this is that we expect negative real interest rates to be in place for the foreseeable future. Inflation is remaining stubbornly high, and - while we expect it to decline in the coming quarters due to an economic downturn - we also expect it to remain well above the Federal Reserve's 2% target level for the foreseeable future for several reasons.

First, we expect the economy to continue to be plagued by a persistent labor shortage that shows no signs of easing up anytime soon. This in turn puts major inflationary pressure on the economy as it costs businesses much more to produce goods and services since their productive engine (often primarily driven by their work force) is becoming more expensive. With a perennial shortfall in birthrates across the developed economies of Asia (particularly in South Korea, Japan, and China), virtually all of Europe, and North America (Canada and the United States), there are simply not enough bodies becoming available to fill the demand for labor. Furthermore, there is an acute shortage of skilled labor in the trades and other important sectors of the economy that will take quite a bit of time to fix. Ultimately, the best hope for a medium term fix will be the rapid advance of artificial intelligence and robotics, which could displace the need for millions of workers in the more repetitive arenas of the economy. Until then, however, expect inflation to remain elevated.

Second, the developed economies are battling energy shortages that will take years to fix. The massive shift in capital allocation away from hydrocarbon energy production towards green energy R&D and production combined with the soaring geopolitical tensions between the West and major energy exporters in Russia, Iran, and increasingly Saudi Arabia have led to a pretty meaningful energy shortage for the developed economies of the world. This was only further exacerbated when OPEC+ recently announced surprise production cuts. While renewable energy is making rapid strides, it will take many years and many trillions of dollars of investment before it is being generated and stored in sufficient quantities to make a meaningful dent in demand for hydrocarbons. Meanwhile, it will also take substantial investment and several years before production of hydrocarbons can be increased in the West sufficiently to offset the shortages being caused by the frayed relations with Russia, Iran, and increasingly Saudi Arabia. Elevated energy prices will of course have a very inflationary impact on the economy.

Third, we expect government deficit spending to continue unabated into perpetuity. Between the immense political pressure to continue supporting runaway costs on entitlement programs and the urgency (along with substantial lobbying from the defense industrial complex (GD)(RTX)(LMT)(PLTR)) to spend increasingly aggressively on national defense in the face of potential war with China, Russia, North Korea, and Iran, there is simply no way that government spending in the United States or other aligned developed economies is going to be held in check. This will have an inflationary effect on the economy in three ways:

- As the government continues to grow and hires to staff that growth, it will further exacerbate the already very tight job market.

- Additional government spending puts more money into circulation and increases demand for goods and services, thereby pushing inflation higher.

- The ongoing massive deficits and runaway government debts will ultimately force central bankers to keep interest rates in a lower band in order to keep the interest payments at a semi-sustainable level. Otherwise, governments will have to default on their debts and economies will implode.

The combination of elevated inflation and low interest rates indicates that negative real interest rates are bound to stick around for the foreseeable future, a condition which history has shown is very bullish for gold.

Another major reason why we are bullish on gold right now is the geopolitical environment, which is growing increasingly hostile to the U.S. Dollar and also increasing the chances of a major war breaking out involving the United States and any number of a plethora of major military adversaries.

These include the escalating conflict between Russia and the West over Ukraine, cautionary statements from Israeli Prime Minister Netanyahu about the possibility of a catastrophic nuclear war with Iran if they continue to pursue nuclear weapons, and growing tensions between China and the U.S. over Taiwan are all factors causing investors to seek refuge in safe options such as gold and even Bitcoin (BTC-USD).

On top of that, it appears that a consortium of nations - primarily in BRICS (Brazil, Russia, India, China, and South Africa) - are increasingly pushing to establish a gold-backed alternative currency to the U.S. Dollar for use in international trade. Both China and Russia have large gold stashes. While it is far from a done deal and a lot of hurdles will have to be overcome to make this a reality, the fact that it is being increasingly discussed and that China and Russia are hoarding gold certainly indicates that it is a possibility. This sort of development would be a huge tailwind to the gold price and be a serious blow to the power - and value - of the U.S. Dollar as it would present a meaningful challenge to its global reserve status.

Top Pick #2: Virtu Financial

Our second highest conviction pick of 2023 is VIRT.

The fist reason for this is simply that it has very weak correlation with major index funds like SPY and in fact, the business generally thrives during rapid market selloffs. For example, VIRT saw its profits soar and - in the case of 2020 - its stock massively outperformed by soaring 60% even as the S&P 500 (SPY) pulled back sharply. In the 2008 stock market crash, VIRT saw its profits soar too (it was privately held at the time, so there is no stock performance to track there).

In addition to its diversification benefits, VIRT remains compellingly undervalued. Its price to earnings ratio is approximately half of its historical average and the company is buying back shares hand-over-fist while insiders remain heavily invested.

In Q4, the company's buybacks reduced the share count by 2.1 million. In fact, simply annualizing the Q4 buyback and combining it with the dividend yield generates an annualized total capital return yield of ~11%. That is incredible for a quarter that was the company's worst in terms of performance and buybacks since 2019! Overall for 2022, the company's buyback yield totaled nearly 15%, bringing the full-year total capital return yield to a whopping ~20%. Since then, management has accelerated their buybacks while continuing to invest in organic growth initiatives.

Last, but not least, VIRT's balance sheet remains in sound shape with little exposure to floating interest rates, zero maintenance covenants on its debt, and maturities that are termed out to 2029.

Investor Takeaway

Between a high probability of negative real interest rates remaining in place for years to come and the increasingly favorable geopolitical environment for gold, the yellow metal and related investments such as silver and precious metals miners like Barrick Gold (GOLD) are one of our highest conviction buys for 2023.

Moreover, with the S&P 500 looking overvalued and the economy headed south alongside the aforementioned geopolitical risks, the conditions are certainly present for a market crash to be ignited if a significant catalyst were to rear its ugly head. As a result, a stock like VIRT provides portfolio insurance while also offering a very attractive dividend, buyback, and long-term organic growth profile even if one does not materialize.

Ultimately, we view both gold-related investments and VIRT as heads-I-win, tails-I-don't-lose-much investments that make for very asymmetric bets for investors. As a result, they are among our highest conviction buys for 2023 and it isn't even close. What is your highest conviction buy right now?

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

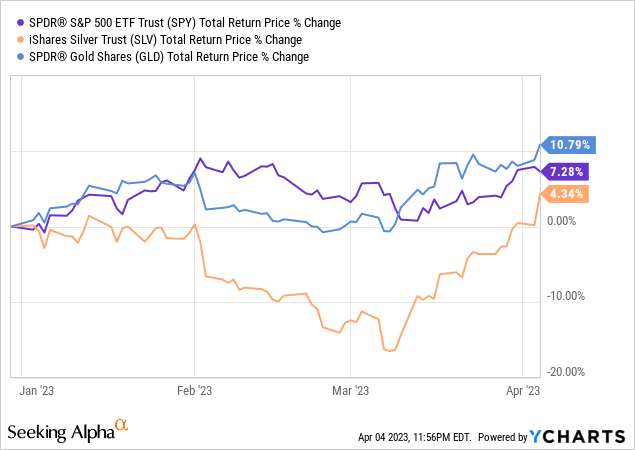

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a $251 discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GLD, SLV, GOLD, VIRT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.