Marathon Digital: Has The Storm Been Weathered?

Summary

- Marathon Digital has underperformed peers since I called the stock a sell in September.

- Since then, the fundamental Bitcoin setup appears to be improving and Marathon has continued to grow EH/s capacity despite crypto winter.

- If Bitcoin's rally continues, few public miners are positioned as well as Marathon to benefit from a significant rise in BTC.

- This idea was discussed in more depth with members of my private investing community, BlockChain Reaction. Learn More »

Adrian Vidal

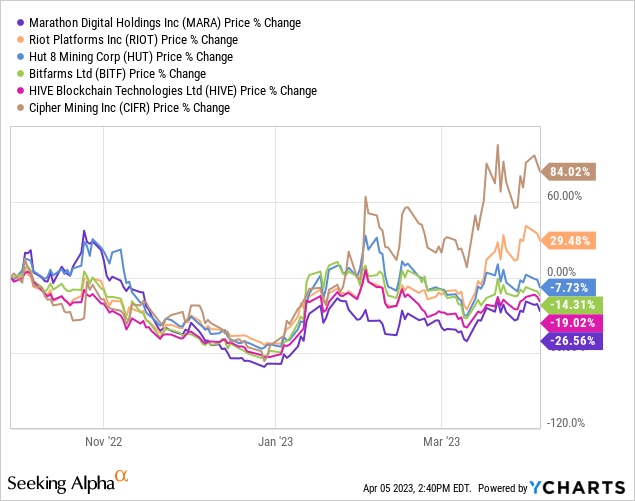

I last covered Marathon Digital (NASDAQ:MARA) in late September when the company's share price was $10.77. The main takeaway from that article was both Marathon's debt position and the company's reliance on third parties would lead to underperformance against peers. While MARA's performance since that piece certainly hasn't been the worst of the public miners over the last two quarters, some of the names that I've liked more than MARA have indeed performed better:

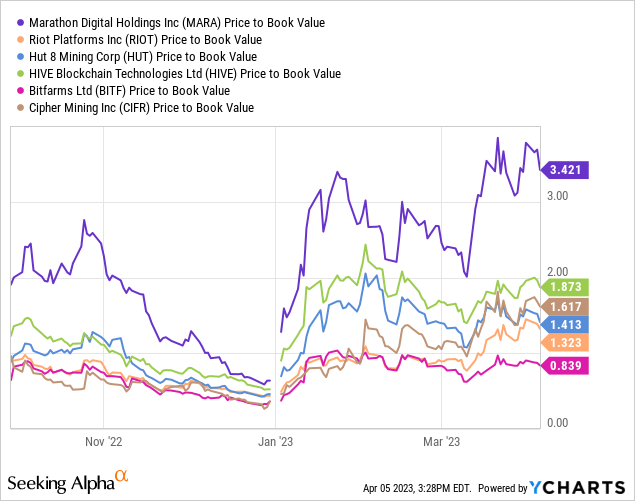

Over the last six months, we've seen Riot Platforms (RIOT) outperform to the point where it is now the industry leader by market cap. We've also seen a small degree of multiple expansion over the last couple quarters as well in many of these names:

In late September, MARA traded at 1.7x book value and has since doubled to over 3x book. But again, this is not unique to Marathon Digital as just about all of the companies in the chart above have seen their price to book multiple roughly double in the last 6 months.

The Bitcoin Setup

It's a very different fundamental setup now for a lot of these companies than it was just a few months ago. For instance, the price of natural gas has come back down which has helped put a temporary floor on mining profitability even as hash rate continues to make new highs. Bitcoin (BTC-USD) itself is benefitting from a banking crisis narrative that saw the price of BTC move from roughly $19,500 up to over $29,000 in a matter of about two weeks.

BTC Daily (TradingView)

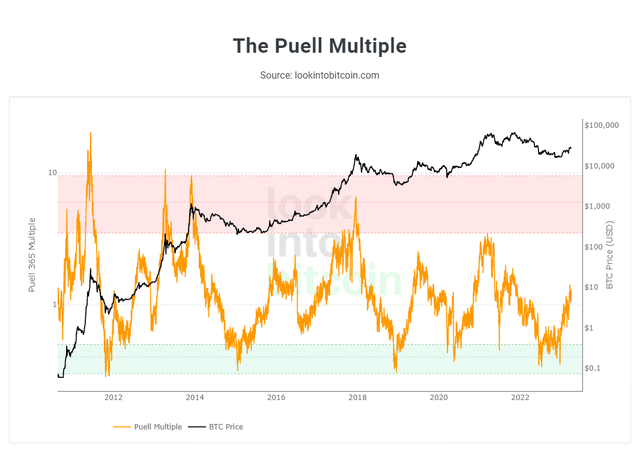

There are positive signs technically as well. We're two months from a golden cross of the 50 day over the 200 day moving average and both are still moving higher. We're four weeks from a test and hold of the 200 day and BTC is now attempting to break over resistance that could see it head well above $30k if this rally can continue. Positive signs can be seen in some of Bitcoin's valuation multiples as well.

Look Into Bitcoin

Bitcoin's Puell Multiple is now well over 1 after being largely beneath 0.5 for the entire second half of 2022. In past cycles, this kind of activity in the Puell Multiple following deep sub-0.5 lows for an extended period of time has often indicated the BTC bottom is in and the next bull cycle isn't far behind. If history repeats, Marathon Digital is well positioned to benefit.

March Production & HODL Stack

Purely from a Bitcoin treasury perspective, no public miner holds more BTC on the balance sheet than Marathon and very few miners are close to MARA in terms of EH/s mining capacity. Riot is close at 10.5 EH/s as of March. Only Core Scientific (OTCPK:CORZQ) has a larger mining operation but that company is going through bankruptcy. Crypto Winter was hard on these companies and the ones that were over-levered were carried out. I suspected Marathon Digital might be a potential casualty as well but I'm less convinced of that if the BTC low is indeed in.

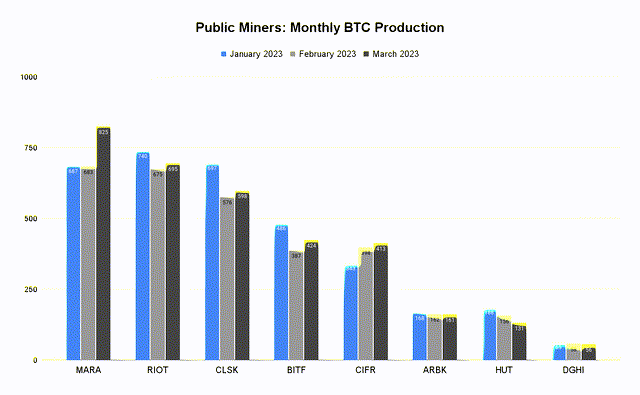

We've been getting the March production figures trickling in from the miners over the last few days and by my count we have eight miners that have updated figures. So far, just two public miners produced more BTC in March than in both January and February: Marathon Digital and Cipher Mining (CIFR):

Monthly BTC Production (Company disclosures)

These gains were largely from big increases in EH/s for both companies. MARA exploded higher from 9.5 to 11.5 and CIFR increased more modestly from 5.2 to 5.7. Riot Platforms, CleanSpark (CLSK), and Bitfarms (BITF) also increased EH/s but to a lesser degree by percentage. MARA didn't just grow production better than peers last month, it had one of the better months by aggregate BTC Treasury growth as well; adding 74 BTC to the balance sheet:

| February 2023 | March 2023 | Mo/Mo | % | |

| RIOT | 7,058 | 7,072 | 14 | 0.2% |

| MARA | 11,392 | 11,466 | 74 | 0.7% |

| HUT | 9,242 | 9,133 | -109 | -1.2% |

| BITF | 405 | 435 | 30 | 7.4% |

| CLSK | 100 | 196 | 96 | 96.0% |

| ARBK | 101 | 85 | -16 | -15.8% |

| CIFR | 465 | 427 | -38 | -8.2% |

Source: Company disclosures

From my vantage, there is a clear standout from March and it's Marathon Digital. It's the only company of the eight that have reported growth in both production over January and HODL stack over February.

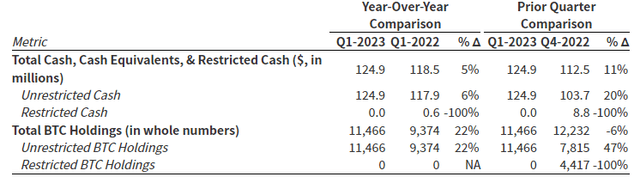

End of March Balances (Marathon Digital)

For Marathon, the stack is down 6% from the end of Q4 but what remains is now entirely unencumbered after the company paid down $50 million in debt.

We exited the quarter with approximately $124.9 million in unrestricted cash and cash equivalents and 11,466 Bitcoin, the market value of which was approximately $326.5 million on March 31.

These are positive signs from a company that still looks pretty rough on paper from a purely fundamental standpoint. However, the fundamentals look much less bad if Bitcoin does continue to rally from here.

Risks

Like many other miners, Marathon's business was punished last year by a combination of margin squeeze, asset impairment, and problems impacting third parties. Marathon lost an enormous amount of money even after slashing stock based-compensation by over $136 million from 2021 to 2022. If Bitcoin's price goes up, Marathon can conceivably claw out of its debt position. But that's still just an "if" and possibly a big one if the Fed continues rate hikes. Which is also another "if" but that's a topic for a different article.

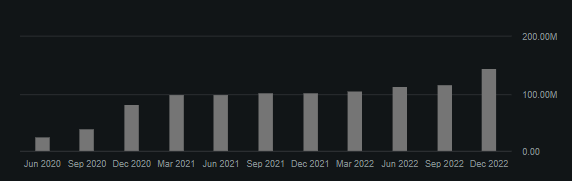

MARA common shares outstanding (Seeking Alpha)

Marathon has just under $125 million in cash as of end of March and much of that came through shareholder dilution to close out the year. Common shares outstanding increased by approximately 25% from Q3 to Q4 after going from 116.8 million shares up to 145.6 million common shares outstanding. One final risk to consider is the coming departure of the company's CFO Hugh Gallagher who will be retiring in May.

Summary

There are several BTC miners that have healthier balance sheets. But there are very few that have the combination of BTC stack and the production capacity that Marathon has. Capacity that the company is continuing to scale through the remainder of 2023. If you're looking for a simple Bitcoin proxy bet that will move up when Bitcoin moves up, MARA should do the trick and possibly to a larger degree than other mining companies that lack the ability to meaningfully scale BTC holdings before the halving.

I am still not personally holding MARA shares and I don't plan to buy any at this point. But I do think Marathon has been showing encouraging signs in recent months. I'll also disclose that I am a shareholder of Applied Digital (APLD). So, I do have exposure to Marathon indirectly as it is Applied's biggest hosting client. There's still a very large short position in this name. While I'm not buying MARA over RIOT, I don't see Marathon as a sell any longer.

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I'll help you find the ones that have staying power. Service features include:

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I'll help you find the ones that have staying power. Service features include:

- My Top Token Ideas

- Trade Alerts

- Portfolio Updates

- A Weekly Newsletter

- Full Podcast Archive

- Live Chat

Crypto Winter can be cold and brutal. But there is value in public blockchain and distributed ledger technology. Sign up today and position your portfolio for the future!

This article was written by

5 years as a media research analyst. Mainly covering crypto, metal, and media equities. I share deep dives on under the radar digital assets through my Seeking Alpha investor group BlockChain Reaction - my approach to crypto coverage leans far more fundamental than technical. I believe the overwhelming majority of crypto coins will go to zero. However, I think there are many that will actually perform very well long term. Those are the assets I aim to help other investors find.

Outside of Seeking Alpha, I write the Heretic Speculator newsletter where I share additional thoughts on finance with more of a social backdrop.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIOT, CLSK, APLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.