Buffett Loves These 3 Banks, And So Should You

Summary

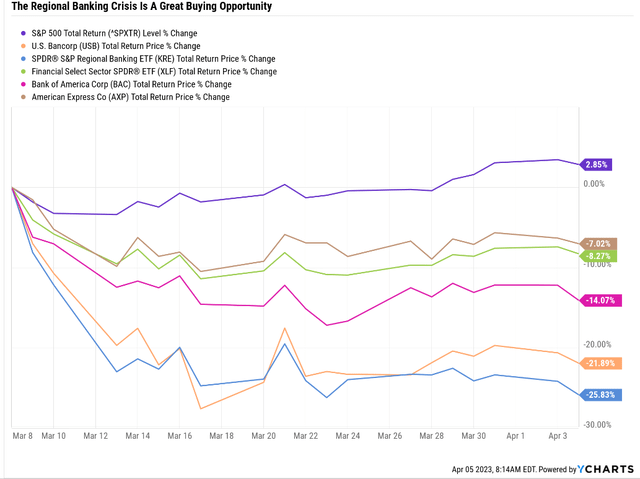

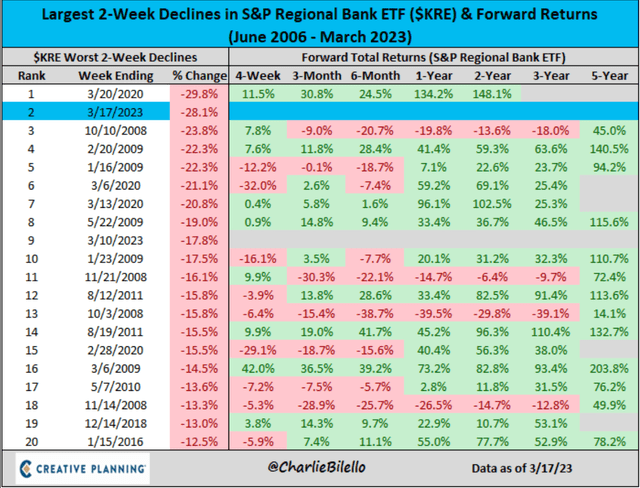

- The regional banking crisis triggered a nearly 30% two-week crash in regional bank stocks, and all financials got hit hard.

- The US and global financial systems are not imploding, which means this is a great time to "be greedy when others are fearful" on top-quality banks.

- Warren Buffett owns $56 billion worth of three banks, all of which are reasonable to table-pounding buys right now.

- All three offer double-digit long-term return potential and up to 135% return potential in the next three years.

- If you want to invest alongside the Oracle of Omaha and take advantage of irrational market panic, BAC, AXP, and USB are three excellent low-risk ways to do it.

- Looking for more investing ideas like this one? Get them exclusively at The Dividend Kings. Learn More »

herkisi

This article was published on Dividend Kings on Wed, April 5th.

------------------------------------------------------------------------

There are many good sources of investing ideas, including legendary investors like Warren Buffett.

While I don't recommend blindly mirroring the trades of Buffett or any billionaire, what they own can be a good pre-screen for quality.

And if those stocks happen to have fallen off a cliff recently? Due to market overreaction to the regional banking crisis? Well, then that creates the opportunity for smart long-term income investors to be "greedy when others are fearful."

How absurd was the recent financial sell-off?

It was the 2nd worst two-week crash in industry history, second only to the Pandemic.

Let me show you why the financial system isn't imploding and why it's a great time to buy Buffett's three favorite banks, Bank of America (BAC), American Express (AXP), and U.S. Bancorp (USB).

There Is No Sign Of An Impending Financial Crisis

Doomsday prophets would have you believe another financial crisis is brewing and that the stock market is about to dive 30% to 88%.

While it's possible for the stock market to fall 30% if we get a bad recession, no financial crisis is imminent.

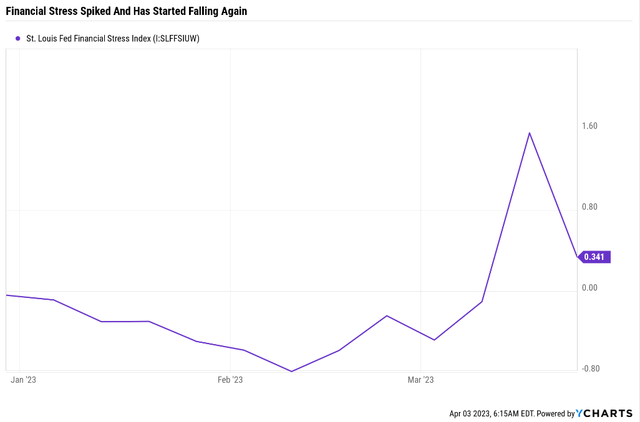

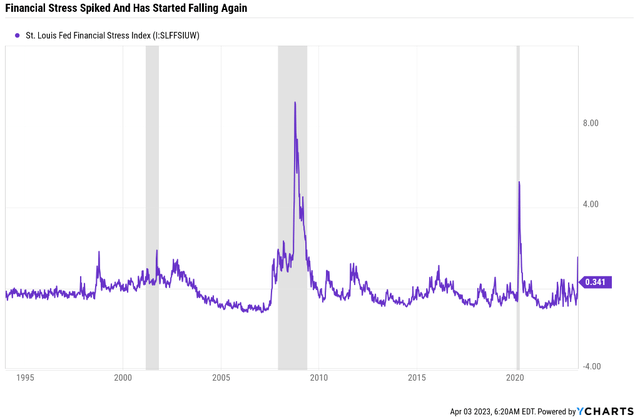

The St. Louis Financial Stress Index consists of 18 financial metrics, including yield curves and credit spreads, and 0 is the average financial stress since 1993.

Immediately following the banking crisis, financial stress spiked to average recessionary levels, and last week it fell back to slightly above-average (non-recessionary levels).

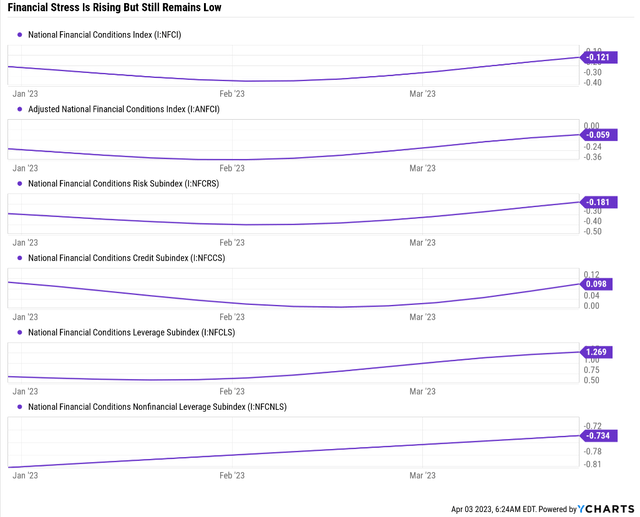

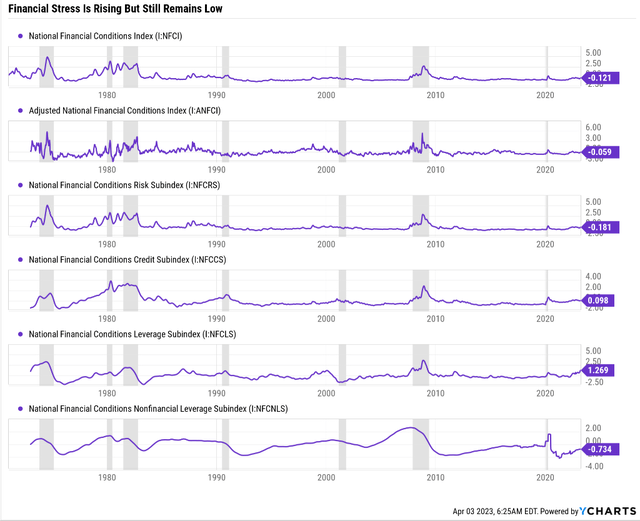

The Chicago Fed National Financial condition index consists of 105 weekly metrics, with 0 being the average since 1971.

Other than the leverage subindex rising to recessionary levels, every other index shows average to below-average levels of financial stress.

If a financial crisis comes, we'll see it in this weekly data and the 123 indicators baked into these numbers.

If someone tells you banks are about to implode, they are either ignorant of the facts, a doomsday prophet, or trying to sell you something, possibly all three.

Why Buffett Loves These Three Banks, And So Should You

I'll go in order of Berkshire's biggest bank holdings.

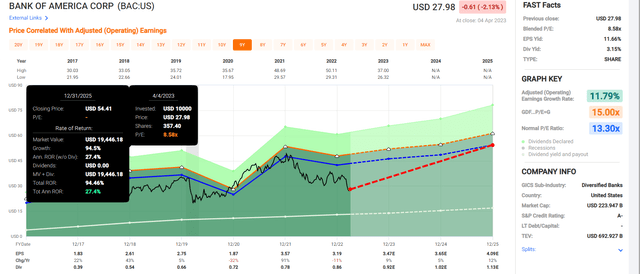

Bank of America: Buffett's Favorite Bank

Further Reading

Summary Of Why Buffett Owns It

BAC is one of the safest US banks with four A or AA credit ratings.

It's the 2nd largest bank in America, with $2.5 trillion in assets.

This is a highly diversified bank with $30 billion in liquidity and the ability to borrow hundreds of billions from the Fed via three liquidity programs.

Investors may never regard CEO Brian Moynihan with the reverence bestowed upon certain peers. Still, he should be given credit for returning the bank to form since taking over the imperiled institution at the height of its troubles. His tenure has not been perfect; initial underestimates of mortgage-related claims, a handful of regulatory missteps, and some questionable operational decisions (such as certain extra fees) stand out. However, his overall record has been decidedly positive, with shareholders reaping the rewards over several years.

With the bank successfully navigating the initial blows of the pandemic-driven recession, its success in improving the quality of its balance sheet has been on full display. We think Bank of America is now a much better business, and Moynihan and the management team should get credit for this." - Morningstar

Summary Facts

- How Much Does Buffett Own: $33.5 billion

- DK quality rating: 84% very low risk 11/13 SWAN (sleep-well-at-night) megabank

- Fair value: $44.82

- Current price: $27.98

- Historical discount: 38%

- DK rating: potential very strong buy

- Yield: 3.2%

- Long-term growth consensus: 9.1%

- Long-term total return potential: 12.3%.

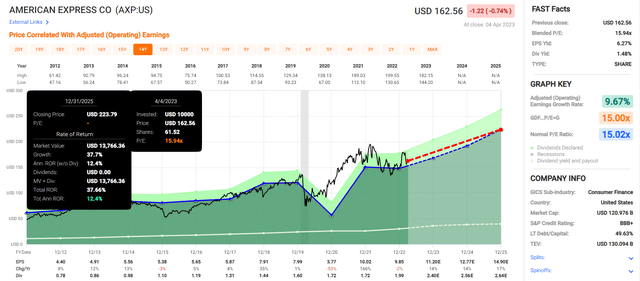

American Express: Buffett's 2nd Favorite Bank

Further Reading

Summary Of Why Buffett Owns It

Buffett bought AXP during the Great Salad Oil Crisis of 1963.

A subsidiary of AXP at the time was involved in providing loans to companies using warehoused goods as collateral. One of these loans to Allied Crude Vegetable Oil Refining Co was backstopped with salad oil, which turned out to be seawater with a small amount of salad oil floating on top.

- Allied claimed to have $150 million in salad oil

- it actually had $6 million

After the scandal broke, AXP shares fell 50%, and Buffett bought a 5% stake in the company at the best price in decades.

- Buffett paid $20 million for that 5% stake

- $200 million in today's money

- today it's worth $22.4 billion

- 12.4% annual return but over 60 years a 1,120X return

- 8.2% inflation-adjusted return or 113X increase in real wealth

AXP, then and now is one of the most valuable and trusted names in high-net-worth financing and credit cards. Rich people love American Express for its legendary customer service.

Summary Facts

- How Much Does Buffett Own: $22.4 billion

- DK quality rating: 93% low risk 12/13 Super SWAN (sleep-well-at-night) bank

- Fair value: $175.35

- Current price: $162.56

- Historical discount: 7%

- DK rating: potential reasonable buy

- Yield: 1.5%

- Long-term growth consensus: 11.5%

- Long-term total return potential: 13.0%.

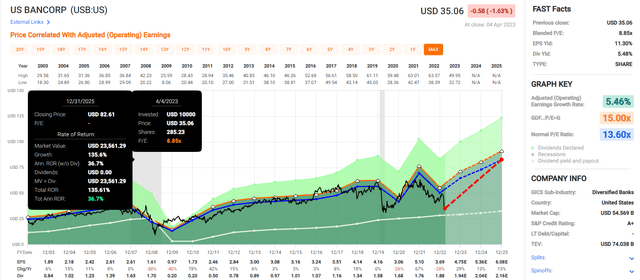

U.S. Bancorp: Buffett's 3rd Favorite Bank

Further Reading

Why Buffett Owns It

The largest and best-run US regional bank. USB is 94 years old and has survived and thrived through:

- 15 recessions

- the Great Depression

- inflation as high as 22%

- interest rates as high as 20%

- 23 bear markets

- the Great Financial Crisis (during which it remained profitable)

USB is built to last and will outlive us all, and our grandchildren.

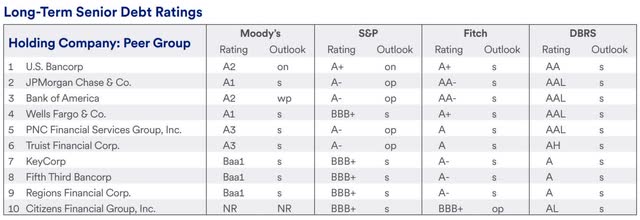

It is an A to AA-rated bank with AA-deposit ratings. Even if USB had to sell 100% of its bonds overnight, it would remain solvent, unlike JPM, BAC, and C.

Summary Facts

- How Much Does Buffett Own: $291 million

- DK quality rating: 78% medium risk 12/13 Super SWAN (sleep-well-at-night) bank

- Fair value: $63.55

- Current price: $35.06

- Historical discount: 44%

- DK rating: potential reasonable buy

- Yield: 5.5%

- Long-term growth consensus: 13.0%

- Long-term total return potential: 18.5%.

Bottom Line: Buffett Loves These 3 Banks, And So Should You

Let me be clear: I'm NOT calling the bottom in USB, AXP, or BAC (I'm not a market-timer).

Even Super SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

While I can't predict the market in the short term, here's what I can tell you about these three Buffett Banks.

- three of the highest quality banks on earth

- A to AA credit ratings

- trusted financial brands with battle-tested management you (and Buffett) can trust

- if they ever fail the world has ended, the living envy the dead, and money is the least of our problems

All three of these Buffett banks are reasonably to outrageously attractively priced.

All offer attractive 30% to 135% return potential over the next three years.

As far as financial brands go, I like American Express the most because of its closed-loop affluent ecosystem.

But if you want to potentially quadruple your money USB represents one of the fattest pitches on Wall Street.

And BAC represents the fastest-growing mega-bank in America if you want the safety and security of a too-big-to-fail financial juggernaut.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own $3400 of USB via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.