TBF: Definitely Not The Time

Summary

- TBF is a short play against the high maturity, low credit risk Treasury bonds.

- There isn't a strong argument anymore even in the long term for many further rate hikes.

- In the shorter term, there is nothing to catalyse consecutive days of declines in the underlying index to support returns for TBF buyers.

- Things are pointing to lower rates coming, and if that won't be the case, in the short term there should be no reason to believe that rates will rise much further - pass on TBF.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Torsten Asmus

The ProShares Short 20+ Year Treasury ETF (NYSEARCA:TBF) is a short ETF that tracks the daily return of an underlying index of Treasuries with more than 20+ maturity and scales it by -1x. There are some peculiarities about that, compounding is atypical for the TBF, and it could differ from a straight short over longer periods. With these sort of daily factor ETFs, including leveraged ETFs, being primarily designed for shorter term time horizons, TBF is mostly for a bet for rate hikes at a tenor that would break expectations and cause declines in high duration Treasuries. We think that the macro set-up gives no reason to expect the TBF ETF to payoff particularly well, with both longer and shorter term rate expectations tending towards an eventual pause if not a reversal.

Briefly on TBF

The underlying index tracks Treasuries which have a remaining maturity of more than 20 years. In other words, the duration of the underlying index is high, and the main effect that TBF will be tracking in the current environment is interest rates in relation to whatever the priced in expectations are right now. In particular TBF will perform if rates and their expectations continue to go up, particularly able to capture these effects in the short term.

The reason we specify the short term is because instruments like this carry some additional risks. While not a leveraged ETF, 20+ duration is high, and the effect is that the underlying index's performance is multiplied by -1x for each day. This is important because it confounds some compounding and anchoring effects, and can make the returns of TBF differ materially over time from a simple short of the underlying index, held over whatever period the short seller chooses to keep the position open. The expense ratio is 0.9%, which is not too bad a deal considering average borrowing costs for shorting, but TBF is really only suited for speculation over shorter periods. If this concept is not clear, review the prospectus of this instrument and of those like it because it is a feature and risk that needs to be properly understood.

Macro Setup Unfavourable

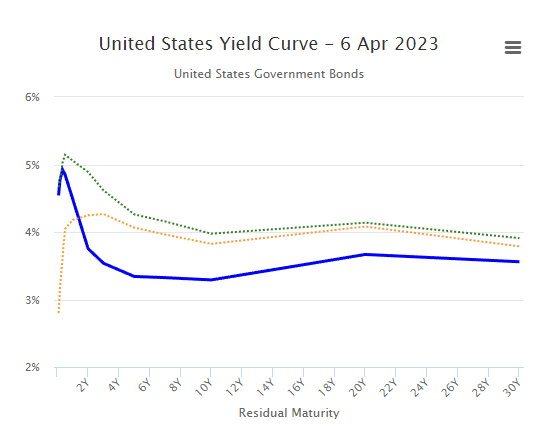

The macro setup for TBF is unfavourable. Observe the current structure of the yield curve.

Yield Curve (worldgovernmentbonds.com)

As opposed to some months ago, the yield curve has flattened with more distant yield actually nearing current ones. This means that rate expectations are really quite high, with an expectation that higher yields will be necessary for the long-term, which was not the case before. In particular, this signals that the bond market is not pricing in a substantial probability of a decline in the economy, triggered perhaps by the banking industry, to warrant a turnaround in rates to the extent previously assumed with an expectations that inflation was passing (markets aren't so confident about that anymore).

We think this is naïve. The risks in the economy are quite meaningful, at least in the US economy. The Fed may not have calculated for higher borrowing and lending costs related to balance sheet asset depreciation in how they've modeled stress tests for the economy. That is what Jamie Dimon asserts. This means that the Fed may have to revise down their rate program in order to fulfil their dual mandate. If credit conditions tighten in an economy that has relied upon easy money for so long, it makes sense that the economy has a ways to fall.

The point is, there is a decent case speculating on lower rates to the detriment of the TBF. In the shorter term, correlation between equity markets and longer duration instruments doesn't help TBF either in this relief rally. While higher rates beyond what the market expects (perhaps one more rate hike) would be positive for TBF, TBF is not an instrument that is effective to sit on for longer periods, and it would be a little while before we get to a Fed meeting that breaks expectations. It is also likely in the meantime that we get more negative headlines around banking. We'd avoid this ETF.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.