Safehold: A Potentially 'Safe' Bet On Generational Wealth Accumulation

Summary

- Today I plan to include a second "bottom fisher" pick to the portfolio.

- The wider the margin of safety, the lower the risk and the greater potential for gain.

- Safehold Inc. seems safer than ever.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More �»

mennovandijk

As I mentioned in a recent article, I decided to commence a new "bottom fisher portfolio" for iREIT on Alpha members.

When I was a private real estate investor, I owned a company called "CarpCo" which was designed as a deep value play, much like carp (i.e., fish) that often live on mud-bottomed ponds and eat just about anything for survival.

In that article I selected Medical Properties Trust, Inc. (MPW) as the new first “bottom fisher” pick. As I pointed out:

“For value investors who have a higher risk tolerance profile, now could be one of the best times to back up the truck, given there are catalysts in place (Utah, Connecticut, and Australia) that provide great clarity to the company's short-term debt maturities.”

More recently, MPW filed a lawsuit against short seller Viceroy Research and its members while sending a letter to shareholders. As fellow Seeking Alpha author Steven Fiorillo explained:

“MPW is arguing that Viceroy published baseless allegations to drive down the share price of MPW while reassuring shareholders of the sustainable business and track record of value creation MPW has produced.

I have read all the details, and while I am a shareholder in the red, I feel MPW is undervalued. I have dollar cost averaged several times, and my cost basis is $12.04 without accounting for dividends that have been paid.”

A New Bottom Fisher Pick

Today I plan to include a second "bottom fisher" pick to the portfolio…

Safehold Inc. (NYSE:SAFE) is a pure-play ground lease real estate investment trust (“REIT”). Ground leases bifurcates the building structure from the underlying land in which the building resides.

Ground leases can be looked at as high quality, long duration bonds in that they are structured over long periods with predictable cash flows and have principal protection with collateral backing the investment.

The property is typically leased on a triple-net basis with the tenant generally responsible for taxes, maintenance and insurance, and capital expenditures.

Ground leases have several unique characteristics that differentiate them from traditional leases in real estate. The most apparent, of course, is that the lease is on the land parcel instead of any improvements made on the land.

Ground leases are also structured with much longer lease terms than those for a typical commercial property, with ground leases normally ranging from 30 to 99 years.

The final characteristic I’d like to point out is that the owner of the land - SAFE - gets to keep the building and any improvements made thereon once the lease term expires, or upon default of the lease payments on the land.

This gives the owner or operator of the building a lot of incentive to stay current on their ground lease payments.

Additionally, ground leases are senior in the capital stack, meaning that if the building is owned by a bank and the operator defaults on the payments owed to the bank, then the bank would have to buy the land or negotiate a new lease with the landowner before taking control of their collateral (the building).

What are the advantages to a ground lease?

So why would a building owner or developer be interested in a ground lease? After all, they own or are building a structure that will ultimately go to the land owner.

There are several reasons why a ground lease might be advantageous for a property owner or developer. For one, it can free up capital for a property owner.

It’s really very similar to a sale-lease back transaction where a company like Walmart (WMT) sells its property to a net-lease REIT and then pays lease payments in order to operate the business from that property.

Walmart is in the retail business, not the real estate business, so they may prefer to hand off the risk associated with the real estate and receive the capital to enhance their operations. It essentially provides capital for an operator to focus on what they specialize in, rather than have their money tied up in real estate investments.

The same can be said for ground leases. If an owner of commercial property needs additional capital to expand their operations or make capital improvements, they can sell the land in order to receive the needed capital, while maintaining control of the building.

There are also several advantages for a potential buyer or property developer to do a ground lease. For one, it can make financing a project much more affordable. In their latest investor presentation, SAFE included the illustrative example below:

From the example provided, a fee simple loan for $100 million with a loan-to-value (“LTV”) requirement of 60% would require the investor to put down 40%, or in this case $40 million. What SAFE does is to split up the two assets (building / land) so that the developer takes out a loan for the building, while SAFE purchases the land.

In the illustrative example above, this would take the 40% equity requirement from $40 million to $26 million and would take the debt burden down from $60 million to $39 million.

This has the effect of reducing the developers risk (less money put down), reducing their debt burden, and increasing the cash-on-cash return. In sum, Safehold’s ground lease allows building owners to have a stronger return profile and lower cost of capital, while reducing upfront equity requirements.

What about inflation?

As previously mentioned, SAFE is similar to a long duration bond and is impacted by interest rates accordingly. While SAFE’s lease terms are very long, they do have periodic rent escalations to help offset rising prices.

Some of the escalations are set at a fixed rate, while others are linked to the CPI index. SAFE has a 10-year lookback period where the rent payments are increased based on the lookback period’s cumulative CPI growth (subject to a cap of 3.0 to 3.5%). Additionally, some of their leases are structured so that SAFE can participate in the revenues of the property.

Between the rent escalations and revenue share, this should help mitigate the effects of inflation. If one is to believe that inflation will remain at 6% or so over the long term, then this could be problematic for SAFE. However, if within the next few years inflation reverts to its long-term average of approximately 3.28%, then SAFE’s built-in rent escalations should keep pace with rising prices.

Steady Income Stream and Residual Rights

Safehold has two components through which it can generate a return for its investors. The first is standard for REITs in that it collects a steady stream of lease payments which is passed on to investors with the distributions made.

The second component is specific to ground leases with the residual rights contained within the lease terms. Residual rights enables SAFE to take ownership of whatever structure is on their land upon default or lease expiration with no additional cost to them. This dynamic creates additional potential value for shareholders.

Carets and Unrealized Capital Appreciation

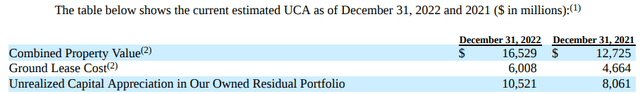

SAFE tracks the value of the land and the properties built on it and categorizes it as their owned residual portfolio. If the value of the land and structure exceed SAFE’s cost basis, it is considered unrealized capital appreciation (“UCA”).

In 2018, SAFE established the Caret program which is designed to recognize the two distinct aspects of the value in their ground leases by separating the “bond component” from the “Caret component.” The “bond component” represents the steam of income from lease payments plus the return of their cost basis in the investment.

The “Caret component” represents the unrealized capital appreciation above their cost basis for the land and structures on it. While the lease is in effect, SAFE does not have title to structures or improvements made upon their land, but once the lease expires (or defaults), SAFE does take ownership.

So as the property (land and structure) appreciates over time, SAFE tracks the value and classifies it as unrealized capital appreciation since someday the combined assets will be in their possession. SAFE sells Caret units to third parties which entitles holders to the net proceeds made from the sale of ground lease assets so long as the net proceeds exceeds the original cost basis.

As an example, in late 2022, SAFE agreed to sell a ground lease from their portfolio to a third-party buyer for $136.0 million. The transaction generated a net book gain of approximately $46.4 million.

After paying closing cost, Caret-related expenses, and deducting their original cost basis, the remaining proceeds were distributed to the holders of Caret units.

As of year-end 2022, SAFE owned 84% of the available Caret units while 16% are owned by third parties. Caret units are not yet publicly available on an exchange, but SAFE intends to have them publicly listed within the next two years.

Property Type and Region

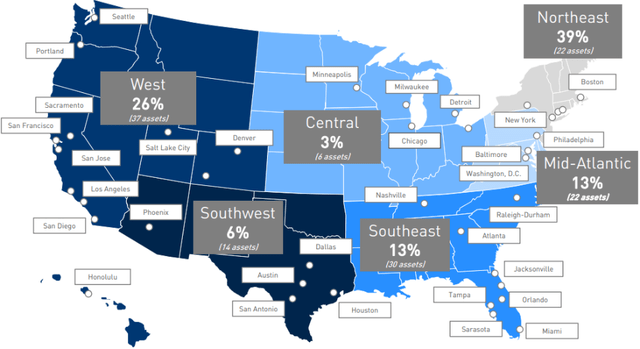

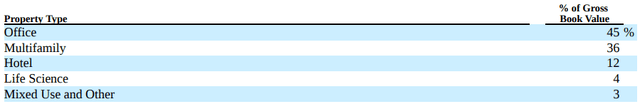

SAFE has a portfolio of properties that is diversified by region and property type.

By region their largest market is the Northeast, representing 39% of their portfolio’s book value, followed by the West with 26% of their portfolio’s book value. The Mid-Atlantic and the Southeast both represent 13% of their portfolio’s book value, while the Southwest and Central region makes up 6% and 3% respectively.

By property type, Office is their largest category, representing 45% of their book value followed by multifamily at 36%. In addition to their primary property types, SAFE also has ground leases in place for hotel, life science, and mix use properties.

Internal Management

On March 31, 2023, Safehold completed its previously announced merger with its former external manager iStar. Up until now, SAFE has been externally managed, which is typically viewed as a negative.

In SAFE’s situation, though, there was high alignment between SAFE and their former external manager. iStar has been their largest shareholder, owning approximately 54.3% of SAFE’s common stock as of December 31, 2022.

Plus, Jay Sugarman is the CEO of both iStar and SAFE, so there has been a high degree of alignment between the companies, which should help make the merger and internalization of SAFE’s management a smooth transition. The combined company will operate under the name Safehold Inc. and its common stock will trade under the ticker "SAFE" on the New York Stock Exchange.

SAFE - Press Release

SAFE Fundamentals

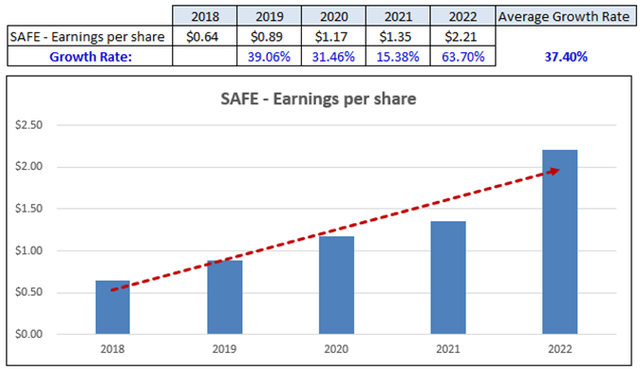

Based on return of assets (Net Income / Total Assets) and Net Margin (Net Income / Revenue), SAFE’s profitability metrics have been improving since 2018. In 2018, SAFE had an ROA of 1.20% vs 2.31% in 2022. REITs are an asset-intensive business, so their return compared to their total asset base is typically lower than that of asset lite business.

Comparisons over time or within the same industry can be more insightful, but with SAFE there really are no comparable companies, as they are the only pure-play ground lease REIT. However, ROA has improved over time, almost doubling in 2022 compared to ROA in 2018.

Net Margin has also shown improvement since 2018 with a Net Margin of 23.61% vs 50.10% in 2022. Both profitability metrics show improvement, which indicates improved efficiency in their business. I expect that trend to continue with internalization of SAFE’s management.

SAFE’s earnings per share (“EPS”) has increased each year since 2018. EPS in 2018 came in at $0.64 vs $2.21 in 2022. Their average EPS growth rate over this period was 37.40%. I expect over the long term the growth rate will normalize, but there can be no question about the strong growth in earnings SAFE has delivered since its public listing.

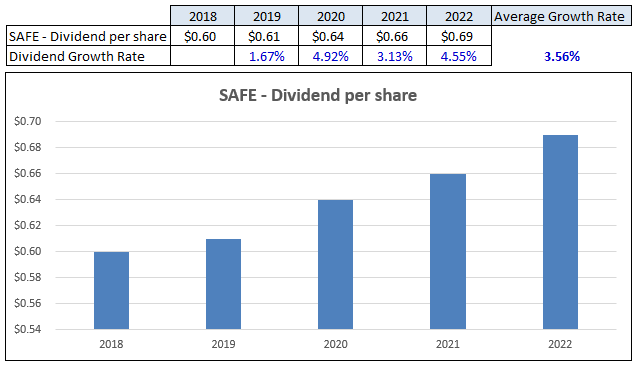

Safehold pays a dividend yield of 2.43% and has an average growth rate of 3.56%. SAFE has increased its dividend each year since its public listing. In 2022, SAFE increased its dividend by 4.55%.

SAFE - Dividend History

SAFE’s dividend is very secure with a 31.22% payout ratio based on earnings per share. This metric has improved each year since 2018 and has significantly improved when comparing 2018’s payout ratio of 93.75% to its 2022 payout ratio of 31.22%.

SAFE - Form 10-K / Dividend History

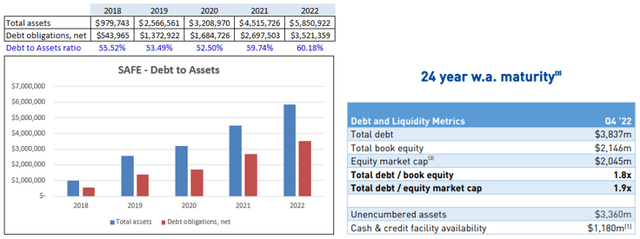

SAFE is investment grade rated by Moody’s (Baa1) and Fitch (BBB+). They have a net debt to total assets ratio of 60.18% and a total debt to book equity ratio of 1.8x. Additionally, they have $3.4 billion in unencumbered assets, a weighted average to maturity of 24 years, and $1.2 billion available to them under their credit facility.

SAFE - Form 10-K / Investor Presentation

SAFE Valuation

SAFE currently trades at a 13.5x P/E ratio based on its price of $29.84 and 2022 EPS of $2.21. SAFE stock has lost -46.94 in value over the last year while the earnings and dividend have increased.

Interest rates and high inflation have probably been the main culprits in the stock's decline, but due to the unique nature of this company I think the overall market has poor understanding of its intrinsic value.

Meanwhile, SAFE stock's performance has historically been inversely correlated with the rising 10-Year Treasury, which could benefit the stock should the Fed cut rates in 2H23.

Further, despite yields decreasing recently ( ~3.5% from 4.2% in recent weeks), SAFE’s diverse high-quality portfolio with long lease terms (WALT is 93 years), long-duration debt (weighted avg duration of 24 years @ 3.2% avg cost), and relative inflation hedge may be better appreciated in the current environment amid growing recession risk.

On the inflation hedge point, the bulk of SAFE's leases have a CPI-linked escalator (capped at 3%-3.5%), which is more protective than most other REITs.

What the market is missing is the residual rights SAFE has to take possession of any improvements on their land. While it might be some time until these assets are owned by SAFE, at the end of the rainbow there is a growing amount of assets that SAFE will own which will unlock a lot of value for this company.

SAFE's Caret Units had a valuation of ~$2B, up from ~$1.75B in 1Q22 with current major investors including MSD Partners (Michael Dell's family office), a leading sovereign wealth fund, and Kevin Durant. The latest round also had no redemption feature, highlighting "stickiness" of recent investors.

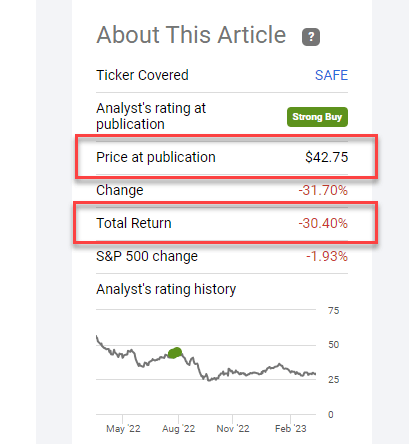

I know that I touted SAFE at $42.75 last year and shares have returned a miserable -30%, and I even added that "a merger between SAFE and STAR could be the catalyst that Mr. Market has been looking for."

Seeking Alpha

My response to that is this quote:

“If you are intelligent, the market will teach you caution and fortitude, sharpen your wits, and reduce your pride. Frank J. Williams.

In other words, the wider the margin of safety, the lower the risk and the greater potential for gain.

SAFE is safer than ever, and while I wish I could have delayed my purchase of shares until now, the time to allocate serious capital is now…

“To buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest ultimate rewards.” John Templeton.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPW, SAFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.