Navios Maritime Partners: High Contracted Revenues And Improving Market Condition

Summary

- I don’t expect Navios Maritime Partners' financial results in 1Q 2023 to be strong and attractive.

- However, the company’s increased operating and available days and relatively high contracted revenues mean that, with a better market condition, NMM’s result can improve significantly.

- I expect the demand for dry bulk vessels, containerships, and tankers to increase in 2H 2023 and 1H 2024.

- The stock is a buy.

shaunl

Navios Maritime Partners' (NYSE:NMM) net cash provided by operating activities in 2022 was significantly higher than in 2021, as its operating days and combined TCE rate increased. However, it is important to know that the company's 4Q 2022 net cash provided by operating activities decreased by 36% QoQ. Due to the global economic headwinds, the demand for dry bulk vessels, containerships, and tankers in the first quarter of 2023 was not strong. Thus, the company's 1Q 2023 financial results may be weaker than in 4Q 2022. However, due to the reopening of China, changing trade patterns, and higher demand for oil & products, goods, and dry bulk commodities from the United States and European counties in 2H 2023 and 1H 2024, I expect Navios' financial results to improve. The fleet capacity of NMM is now considerably higher than a year ago and its total contracted revenue of $3.4 billion helps the company to expand its operations further and benefit from a better market condition in the future. The stock is a buy.

Financial results

In its fourth quarter and full-year 2022 financial results, Navios reported full-year 2022 revenue of $1211 million, compared with the full-year 2021 revenue of $713 million, up 70%, driven by higher operating days and increased TCE rates. Due to the acquisition of 36 new vessels from Navios Holdings, the NMCI Merger, the NNA Merger, and the deliveries of newbuilding and secondhand vessels, partially offset by the sale of vessels, the number of Navios available days increased by 56% to 49,804 days. Also, its combined TCE rate increased from $21709 in 2021 to $23042 in 2022.

The company's net income and adjusted net income increased by 12.4% YoY and 18.1% YoY to $580 million and $430 million, respectively. Navios reported net cash provided by operating activities of $506 million in 2022, compared with $277 million in 2021.

"Navios Partners is a leading publicly listed shipping company diversified in 15 asset classes in three sectors, with 176 vessels with an average vessel age of about 9.5 years. We have been rationalizing our portfolio to maintain a younger, technologically advanced fleet and remain focused on reducing leverage rates in the medium term, which we believe we can do naturally in the current charter rate market," the CEO commented.

The market outlook

Navios Partners' fleet includes 83 dry bulk vessels with 10.1 million dwt, 47 containerships with 235414 TEU, and 46 tanker vessels with 5.7 million dwt. As a result of high inflation rates and high interest rates in Western countries, China's zero-Covid policy, and its real estate headwinds, seaborne iron ore trade decreased in 2022. The economic situation of Western countries is not still in favor of the dry bulk market. However, the reopening of China may increase the demand for dry bulk commodities. In the second half of 2023, iron ore, coal, and grain trade volumes are expected to be higher than in the first half. Also, due to the continuing economic challenges in the United States and Europe, world seaborne container trade decreased by 3.8% in 2022, and is expected to decrease by 1.6% in 2023; however, increase by 3.3% in 2024.

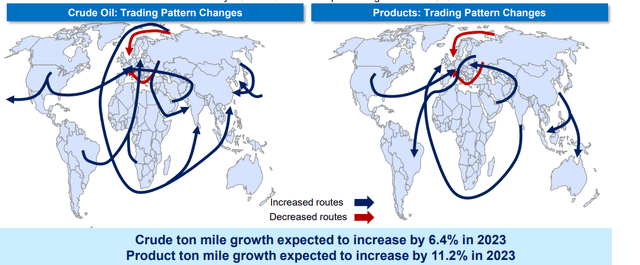

In the United States and European countries, inflation is the main reason for lower demand for goods and a higher inventory-to-sale ratio in 2023. As a result of the continuing tight monetary policies of central banks, inflation in 2024 may decrease, fueling the demand for seaborne container trade. And last but not the least, the tanker shipping market in 2H 2023 may be stronger than in 1H 2023, as the demand for oil and other petroleum products is expected to increase. According to EIA's short-term energy outlook, total world consumption of petroleum and other liquids is expected to increase from 100.60 million barrels per day in 2Q 2023 to 101.56 million barrels per day in 4Q 2023. Also, it is important to know that as a result of the war in Ukraine, the trading patterns of crude oil and products have changed, implying higher ton-mile demand in 2023 (see Figure 1). In 2023, crude ton-mile growth and product ton-mile growth are expected to increase by 6.4% and 11.2%, respectively. Thus, the market outlook is in favor of NMM.

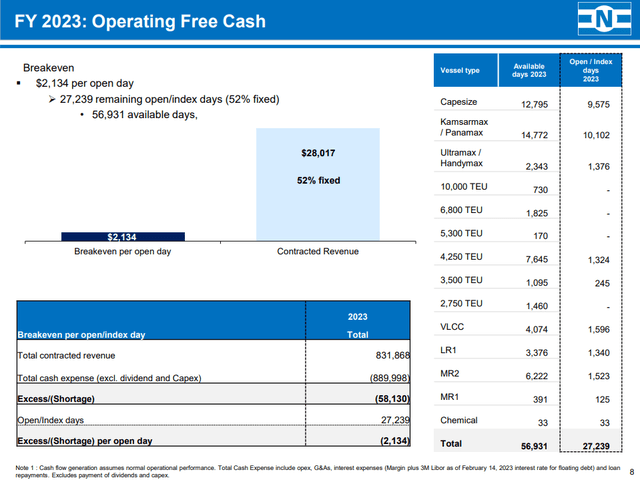

Navios Maritime Partners has entered into short, medium, and long-term time charter-out, bareboat-out, and freight agreements for its vessels with a remaining average term of approximately 1.9 years. The company has currently fixed 52.2% of its available days for 2023. Also, it has fixed 35.0% of its available days for 2024. Thus, I expect the company's net cash provided by operating activities to increase.

According to Figure 2, with an average expected daily charter-out rate of $28017 (for the whole fleet), the company estimates its 2023 contracted revenue to be $832 million and its total cash expense (excluding dividend and capital expenditures) to be $890 million. In 2023, NMM's available days are 56931, and the company has 27239 open days. Thus, with only revenue of $2134 per open day, the company can cover its cash expense (excluding dividend and capital expenditures) in 2023. With the actual revenues for its open days that can be significantly higher than the breakeven revenue per open day, Navios Maritime's cash flow is expected to be more than it needs to fund its investment programs and reward its shareholders.

Figure 1 - Changing trading patterns of crude oil and products

Figure 2 - 2023 operating free cash

NMM performance outlook

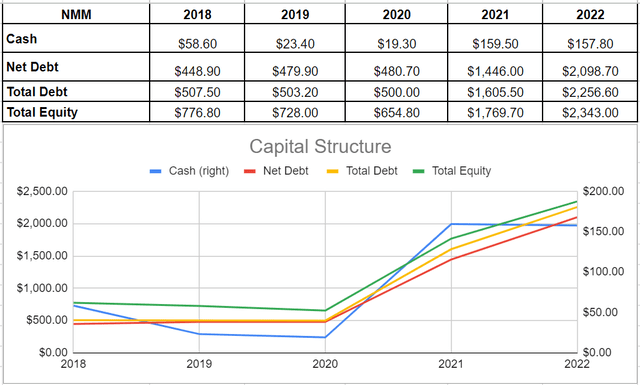

In 2022, the company's cash and equivalents remained relatively stable at $157.8 million, compared to $159 million in 2021. However, the company's debt increased from $1.6 billion in 2021 to $2.2 billion in 2022, resulting in a significant 45% increase in net debt. Specifically, NMM's net debt surged from $1.4 billion at the end of 2021 to over $2 billion at the end of 2022. Despite this high level of debt and low cash balance, NMM's total equity improved to $2.3 billion in 2022, up from its previous amount of $1.7 billion at the end of 2021. It is worth noting that despite the high level of debt, NMM's total equity is still higher than its debt amount (see Figure 3).

Figure 3 - NMM's capital structure (in millions)

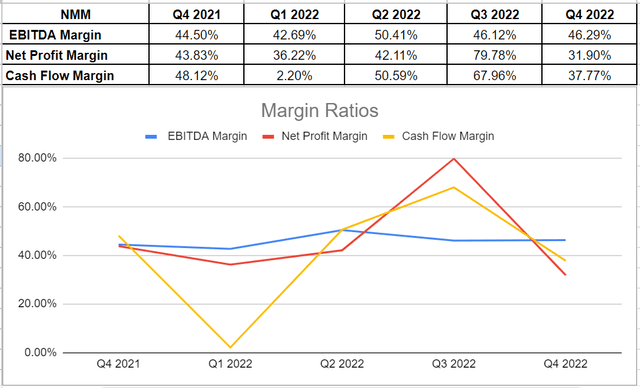

After analyzing Navios Maritime's capital condition, I delved into the company's profitability ratios to determine its ability to generate profits and utilize its assets effectively for investors. To gain a better understanding of the company's financial health, I focused on margin ratios. By comparing these ratios with previous quarters, I was able to provide valuable insights. Margin ratios assess a company's capacity to convert revenue into profits in various ways. Unfortunately, Navios Maritime experienced weaker net profit, EBITDA, and cash flow margins in the fourth quarter compared to earlier periods. Specifically, NMM's net profit margin dropped from 43.8% at the end of 2021 to 32% in the fourth quarter of 2022. Meanwhile, the company's EBITDA margin increased slightly from 44.5% in 2021 to 46% in 2022. Furthermore, Navios Maritime's cash flow margin - which measures the relationship between cash flows from operating activities and sales generation - was 37.7% in the fourth quarter of 2022. This is lower than its levels of 68% and 48% in the third quarter of 2022 and the fourth quarter of 2021 respectively (see Figure 4). However, it is not frightening and NMM's cash flow margin can start improving in the second half of the year.

Figure 4 - NMM's margin ratios

Summary

With its diversified fleet which expanded in 2022, and considerable contracted available days in 2023 and 2024, Navios Maritime Partners can remain profitable, generate huge cash flows, cover its obligations, and reward its shareholders in my view. In the second half of 2023 and the first half of 2024, NMM's revenues may increase as the demand for dry bulk vessels, containerships, and tankers is expected to rise. The stock is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.