SLV: Bullish Breakout Could Lead To Parabolic Spike

Summary

- Silver's break above downtrend resistance going back to 2021 suggests a potential surge higher for the metal and for the iShares Silver Trust ETF.

- Options markets and speculative positioning suggest there is still significant room for traders to jump on the bandwagon and drive SLV higher following the bullish break.

- In terms of valuations, silver remains priced to return around 10% annually over the next decade.

asbe

Silver's break above down trendline resistance on Tuesday may send silver into a parabolic spike higher as has been the metal's tendency over the past. Options markets and speculative positioning suggest there is still significant room for silver prices and the SLV to move higher. After adding to my positions in the iShares Silver Trust (NYSEARCA:SLV) at the lows in Q3 last year, I had been reducing my position as valuations and the real interest rate picture became less attractive. However, with the strong upside break and rising gold prices, it now makes sense to remain heavily invested with a stop around $22 on the SLV.

The SLV ETF

The SLV ETF has tracked the spot price with very little tracking error and an expense fee of 0.50%, which is far lower than the spreads on buying the physical metal, although slightly higher than some competing ETFs such as the Aberdeen Standard Physical Silver Shares ETF (SIVR). SLV is the largest and most liquid silver ETF with $11.7bn in assets, but despite the rising price of silver, ounces under management have continued to decline from their February 2021 peak. Inflows into SIVR have also been stagnant over recent months, which may be a sign that speculative interest in the metal remains low and therefore has potential to rise, sending SLV higher.

A Breakout To Higher Highs

Earlier this week saw an emphatic bullish breakout in silver prices and the SLV ETF, which took out down trendline resistance from the 2021 highs and posted its first higher high since the downtrend begun. This is a clear technical sign that the long-term silver bull market has resumed.

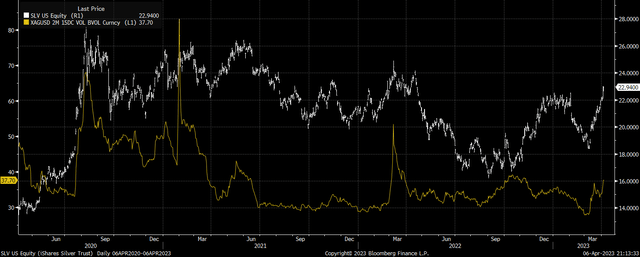

As we saw in 2010/11, and again in 2020, silver has a tendency to experience major spikes once a bullish trend develops and speculative sentiment works together with rising prices to create a positive cycle. By the looks of speculative positioning, sentiment towards the metal remains muted for now. Net bullish futures positioning is positive but below its long-term average. Furthermore, options markets do not show the spikes in call prices that have occurred at market peaks. This suggests there is still score for traders to jump on the bandwagon following the bullish breakout.

SLV And 2-Month Call Implied Volatility On USDXAG (Bloomberg)

Valuations Remain Attractive Thanks To Gold's Rise

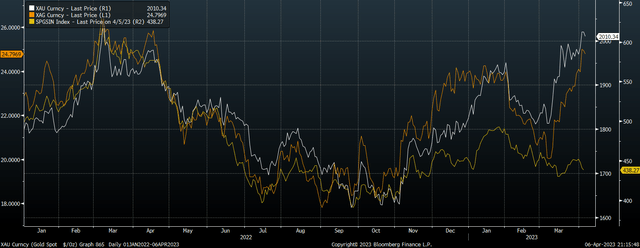

The recovery in silver prices has occurred despite a decline in industrial metals prices, with the strong correlation seen last year completely breaking down since the beginning of the US regional banking crisis. Silver's rally has clearly been driven by a rise in monetary demand for the metal, which has followed gold's lead.

Gold, Silver, And Industrial Metals Prices (Bloomberg)

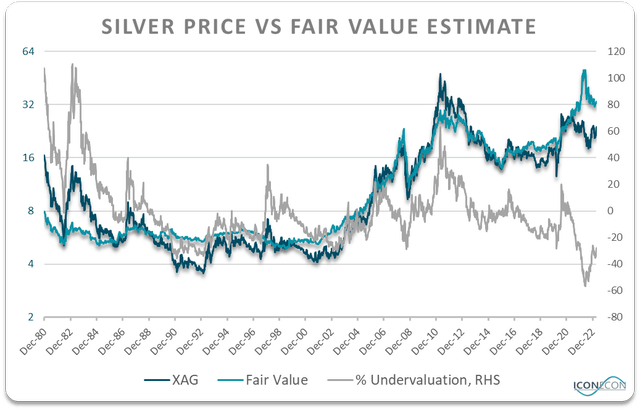

This rise in gold prices has meant that silver remains deeply undervalued from a long-term perspective based on its correlation with gold prices and the commodity complex. As I argued in 'Silver: Short-Term Risks Vs. Long-Term Rewards', the current degree of undervaluation is consistent with 10% annual returns over the next decade. With the recent bullish break there is a growing chance that these returns arrive sooner rather than later.

Bloomberg, Author's calculations

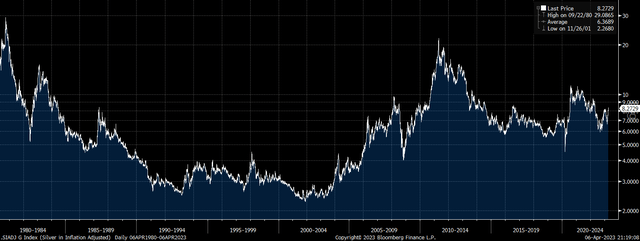

The chart of inflation-adjusted silver prices puts the scale of the recent rally in perspective. In real terms, silver remains 27% below its 2020 peak, 62% below its 2011 peak, and 82% below its 1980 peak.

Inflation-Adjusted Silver Price, Log Scale (Bloomberg)

Remain Bullish Above $22 On SLV

As I have noted in a number of previous articles, the recent rally in precious metals prices has been built on expectations of a return to monetary easing following the failure of two US regional banks. However, real US bond yields remain elevated as lower rate expectations have been joined by lower inflation expectations. Unless we see further declines in US inflation-adjusted bond yields, gold remains susceptible to a downside reversal, which would also weigh heavily on silver and the SLV. I therefore recommend placing stop losses around the $22 breakout area. A break back below here would suggest a return of the sideways-downward trend in place since mid-2020.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.