RIET: Narrow Focus On Dividend Yield May Cause Poor Security Selection

Summary

- The RIET ETF is managed by Hoya Capital, a noted researcher and commentator in the REIT space.

- The ETF focuses on high yielding REITs across various market cap segments.

- The RIET ETF pays a trailing 10.0% distribution yield.

- However, by narrowly focusing on distribution yield, the strategy may lead to poor security selection as poor performers often have the highest yields.

FangXiaNuo

The Hoya Capital High Dividend Yield ETF (NYSEARCA:RIET) is an ETF focused on the real estate sector. It curates a portfolio of the highest yielding REITs, across different property sectors and market cap segments.

Although the RIET ETF pays an attractive 10.0% distribution yield, I worry that its narrow focus on dividend yields may cause negative security selection. Remember, high dividend yield stated differently is low stock price. The ETF's narrow focus may lead to a portfolio of poor performers with fundamental reasons driving their stock prices lower, and dividend yields higher. I would avoid this ETF.

Fund Overview

The Hoya Capital High Dividend Yield ETF provides exposure to a curated basket of high dividend yielding real estate securities. The RIET ETF tracks the Hoya Capital High Dividend Yield Index ("Index"), an index designed to measure the performance of the 100 highest dividend-yielding real estate securities in the United States.

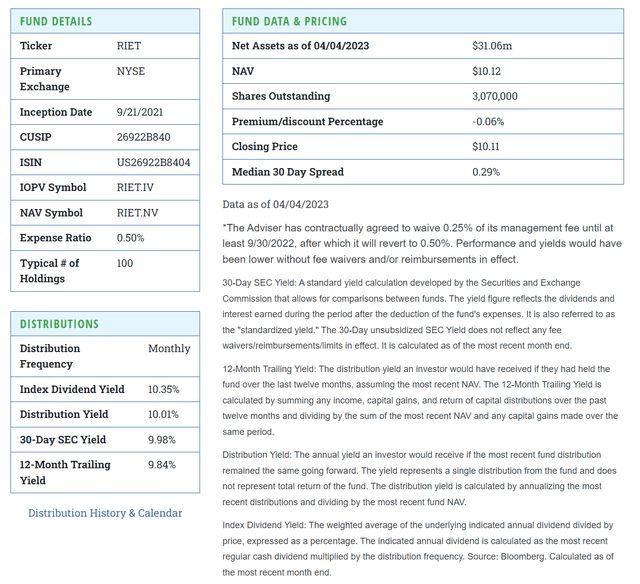

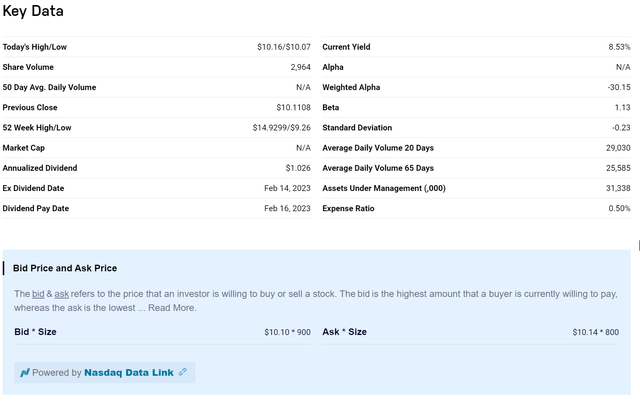

The RIET ETF is a small fund with only $31 million in assets and charges a 0.50% expense ratio (Figure 1).

Figure 1 - RIET fund details (hoyaetfs.com)

Strategy

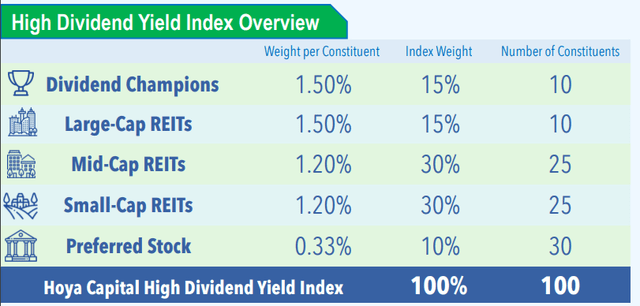

Beginning with a universe of U.S.-listed common and preferred stock of real estate investment trusts ("REITs") and real estate operating companies, the index provider first filters the universe for investability and liquidity requirements such as $100 million minimum market cap and average daily liquidity of $100,000. Then the universe is divided into three equal-sized market cap tiers: Large-Cap, Mid-Cap, and Small-Cap.

The index provider then assigns each company in the universe into one of 14 'property sectors' including Healthcare, Data Center, Storage, Industrial, etc. From each property sector, the index identifies the two largest companies by market cap and chooses the higher dividend yielding company for further consideration. Out of these 14 potential candidates, the two with the lowest dividend yield and the two with the highest debt ratio are dropped, leaving ten 'Dividend Champions' to be included in the index.

After selecting the 'Dividend Champions', the index then proceeds to sort the remaining companies in each market cap tier by their dividend yield and selects the top 10 in the Large-Cap segment, top 25 in the Mid-Cap segment, and top 25 in the Small-cap segment.

Finally, of the 50 most actively traded preferred shares of REITs and real estate companies, the index includes the top 30 by dividend yield.

Figure 2 shows an illustrative composition of the Hoya Capital High Dividend Yield Index.

Figure 2 - Illustrative index composition of RIET ETF (RIET factsheet)

Who Is Hoya Capital?

Hoya Capital is an often quoted research and advisory firm based out of Connecticut with a goal of making real estate investing more accessible. The firm's research and commentaries have been featured in the Wall Street Journal, Bloomberg TV, CNN, Forbes, and other news services.

Portfolio Holdings

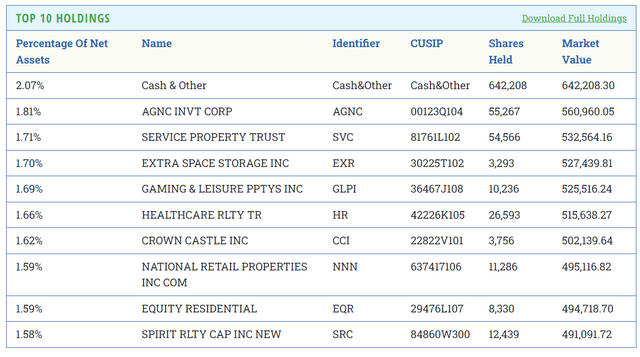

Figure 3 shows the index's top 10 holdings.

Figure 3 - RIET top 10 holdings (hoyaetfs.com)

Distribution & Yield

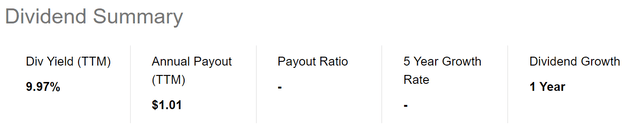

By investing in high yielding REITs, the RIET ETF is able to collect high dividend income and passes them onto unitholders on a monthly basis. The RIET ETF has paid a trailing 12 month distribution of $1.01 / share or 10.0% trailing yield (Figure 4).

Figure 4 - RIET ETF is yielding 10% (Seeking Alpha)

Returns

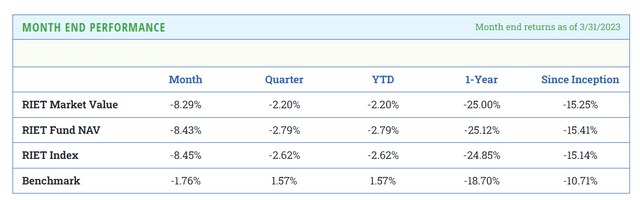

Although the RIET ETF pays a high distribution yield, there are some concerns regarding the fund, as it has lost 25.1% on a 1Yr basis and 15.4% since inception (Figure 5).

Figure 5 - RIET historical performance (hoyaetfs.com)

Both figures have lagged the Benchmark, the Dow Jones US Real Estate Index, which tracks the performance of the broad REIT sector.

Focusing On Dividend Yield May Limit RIET To Poor Performers

The main issue I have with the RIET ETF is that its security selection process seems to be overly focused on the dividend yield. While a high dividend yield is great, especially for income-oriented investors, the selection criteria does not appear to consider the sustainability of the dividends or other fundamental performance drivers.

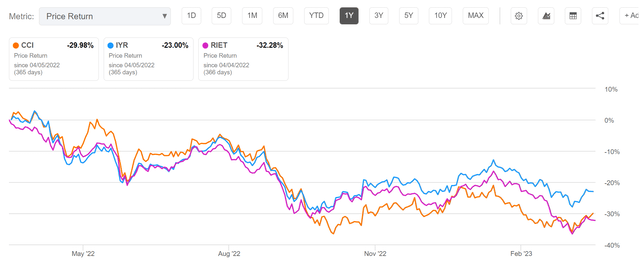

What may happen is that poor stock performers, i.e. Crown Castle (CCI) with a 1Yr price return of -30.0%, ends up having a large weight in the RIET ETF, as its stock declines, driving its dividend yield higher (Figure 6).

Figure 6 - CCI, a large weight in the RIET ETF, has performed poorly (Seeking Alpha)

If the RIET ETF continuously selects the highest yielding REITs (lowest stock price relative to dividend) from its universe, the fund may end up with a basket of poorly performing stocks.

In fact, if we look at the RIET ETF's current holdings, we see the ETF currently holds many healthcare REITs that collectively add up to 10.4% of the portfolio (Figure 7).

Figure 7 - RIET holds many healthcare REITs (Author created with data from hoyaetfs.com)

Healthcare REITs have been under fundamental pressure due to tenant operator issues amid labor shortages and a reduction of government support post pandemic. This has triggered missed rent payments and lease renegotiations, and have driven the stock price of healthcare REITs lower, and thus their dividend yields higher.

Small Funds May Have Poor Liquidity

Another issue with the RIET ETF is that with only $31 million in assets, liquidity can be quite thin for the ETF. For example, the RIET has a $0.04 bid/ask spread and trades on average on 25-30k shares a day or ~$250k-$300k (Figure 8).

Figure 8 - RIET ETF has poor liquidity (nasdaq.com)

Investors looking to buy or sell may suffer from significant slippage when transacting in small funds like the RIET ETF.

Conclusion

While the RIET ETF pays an attractive 10.0% trailing distribution yield, I worry that its focus only on the dividend yield factor may cause negative security selection bias, i.e. it only selects poor stock performers with fundamental reasons driving their dividend yields higher (and stock prices lower). I would avoid this ETF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.