FTAIP: Strong 9% Yield, Leverage Is A Concern

Summary

- FTAI Aviation is an aerospace company that owns aircraft and aircraft engines which it subsequently leases.

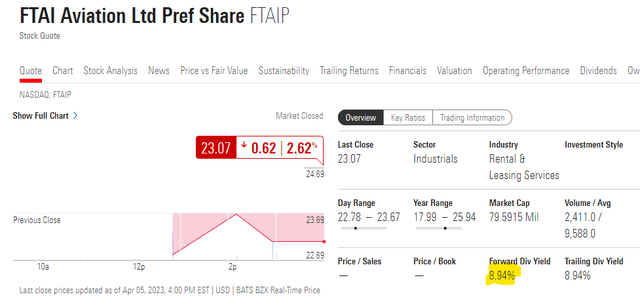

- The Series A preferred shares (FTAIP) currently yield almost 9%, and are set to convert to a floating rate starting in September 2024.

- Starting with September 2024, if not called the preferred shares will pay Libor/SOFR plus 6.88%.

- The company's senior unsecured debt is almost as large as its asset base.

- The company recently raised another $65 million of preferred equity (FTAIM), bringing the total for preferred equity to over $350 million.

Alan_Lagadu

Thesis

FTAI Aviation (FTAI) is a company that owns both aircraft and standalone engines:

FTAI Aviation owns and maintains commercial jet engines with a focus on the CFM56 engine type. Competitive advantage offering customers flexible and low-cost CFM56 maintenance solutions

The company successfully completed a spin-off last year from its sister infrastructure company FTAI Infrastructure:

NEW YORK, Aug. 01, 2022 (GLOBE NEWSWIRE) -- FTAI Infrastructure Inc. (NASDAQ: FIP) (“FTAI Infrastructure”) announced today that it has successfully completed its spin-off from Fortress Transportation and Infrastructure Investors LLC (“FTAI”) on August 1, 2022. Starting on August 2, 2022, FTAI Infrastructure will begin trading on the Nasdaq under the ticker symbol “FIP” and FTAI will resume trading under the ticker symbol “FTAI”.

FTAI Infrastructure acquires, develops, and operates assets and businesses that represent critical infrastructure for customers in the transportation and energy industries. FTAI Infrastructure targets assets that, on a combined basis, generate strong and stable cash flows with the potential for earnings growth and asset appreciation. FTAI Infrastructure is externally managed by an affiliate of Fortress Investment Group LLC, a leading, diversified global investment firm.

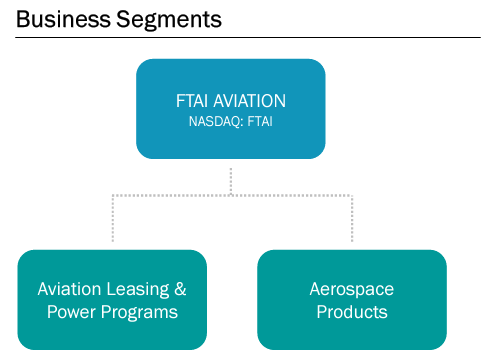

FTAI Aviation has two main business segments:

Segments (Company Presentation)

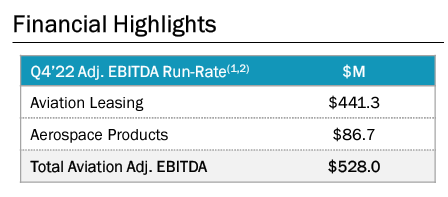

On one hand we have 'Aviation Leasing' which makes most of the revenue, and also as an ancillary business the 'Aerospace Products' division:

Financials (Business Presentation)

Capital Structure

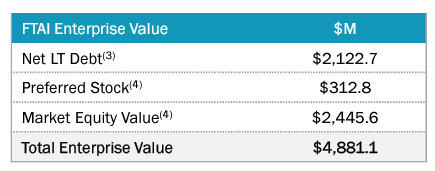

The enterprise is capitalized via both senior unsecured debt as well as preferred equity:

Capital Structure (Company Presentation)

FTAI Aviation is a capital intensive business. The company buys aircraft and aircraft engines and then leases them out, thus creating a steady stream of cash-flows. Just like any capital intensive business, the company needs to borrow heavily in order to buy the assets to be leased.

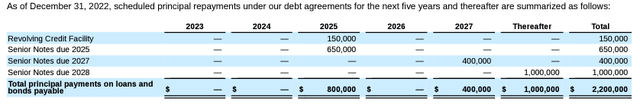

As we have seen in 2023, debt can be a problem if there is a liquidity crunch. FTAI has a nice, well extended senior debt schedule:

Debt Maturity Schedule (Annual Report)

There are no debt maturities until 2025, with the bulk of the senior unsecured debt coming due after 2027. The company has made use extensively of preferred shares, now having four series outstanding. The Series A preferred shares (NASDAQ:FTAIP) are the ones we are going to focus on today:

Holders of the Series A Preferred Shares are entitled to receive, only when, as, and if declared by our board of directors, out of funds legally available for such purpose, cumulative cash distributions based on the stated liquidation preference of $25.00 per Series A Preferred Share at a rate equal to (i) from, and including, the original issue date of the Series A Preferred Shares, being the date of the completion of the merger, to, but excluding, September 15, 2024 (the “Series A Fixed Rate Period”), 8.25% per annum, and (ii) beginning September 15, 2024 (the “Series A Floating Rate Period”), Three-Month LIBOR (as defined below) plus a spread of 688.6 basis points per annum and that sum will be the distribution rate for the applicable Distribution Period. A “Distribution Period” means the period from, and including, each Distribution Payment Date (as defined below) to, but excluding, the next succeeding Distribution Payment Date, except for the initial Distribution Period, which is the period from, and including, the original issue date of the Series A Preferred Shares, being the date of the completion of the merger, to, but excluding, the next succeeding Distribution Payment Date.

Source: Annual Report

Series A Yield

The preferred shares are cumulative and perpetual, and are yielding close to 9%:

Starting with September 2024, if not called the preferred shares will pay Libor/SOFR plus 6.88%, which given where the forward curve is currently gives a forward cash yield of 10%. Rates will flop around, so we are not sure where they will end up, but probably somewhere in the 3% to 3.5% range. We do not think we will be going back to 0% rates in the next five years, with inflation being very sticky this time around.

Large Leverage Component

The company runs very significant leverage (both visible and secondary):

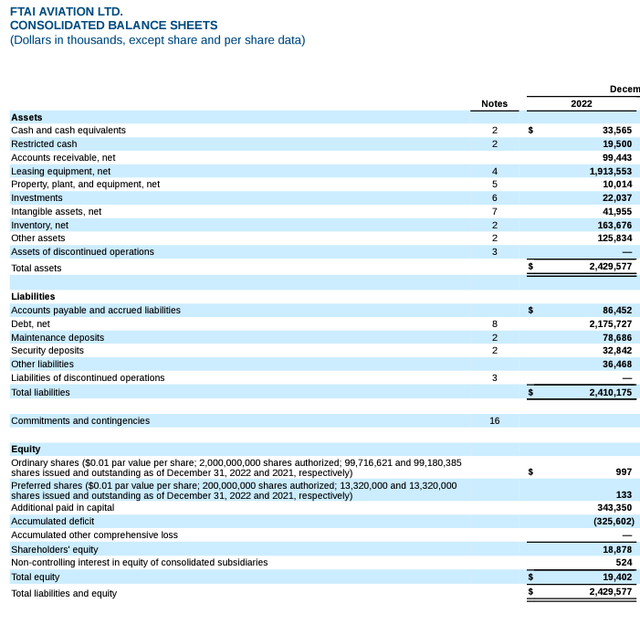

If we look at its balance sheet as of December 2022 we can see $2.4 billion in assets and a $2.2 billion figure for the liabilities issued as senior unsecured debt. Basically all of the company's assets are funded via debt! In a theoretical fire-sale tomorrow there is nothing left for the equity or preferred equity.

This is a cash-flow extraction business run with very significant leverage. The company's debt is visible in the Liabilities section, but it tends to run higher debt via preferred equity. Preferred equity does not count as debt from an accounting stand-point, but from a cash-flow perspective it is just that - an interest based way to raise capital.

The company recently raised another $65 million of preferred equity (FTAIM), bringing the total for preferred equity to over $350 million. So if you add up the long term debt and preferred equity you get a figure much larger than the asset base.

Conclusion

FTAI Aviation is an aerospace company that owns aircraft and aircraft engines which it subsequently leases. The business is very capital intensive, with FTAI having a long term debt figure equivalent to its asset base. Furthermore the company has over $350 million of preferred shares outstanding, which generate a substantial interest expense drag. The company runs a 4.5x debt/EBTIDA ratio but most of its cash-flows are distributed to common shareholders as dividends. The Series A preferred shares, FTAIP, currently yield almost 9%, and are set to convert to a floating rate starting in September 2024, which could bump that up to over 10% depending on where SOFR/Libor is at that point.

We like the dividend here for FTAIP but find the company to be extremely leveraged. We would like to see FTAIP being called in September 2024, but do not think that is the case given what the holding company is doing and where the recent preferred share issuance priced. We feel FTAI Aviation is taking 'stealth' leverage via preferred share issuance, and while currently its cash-flow and EBTIDA are very healthy, it does not take much for things to go south with this much leverage in the structure. We are on Hold with respect to FTAIP which we own as well.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FTAIP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.