SL Green: Refinancing Risk And Other Headwinds Are Concerning

Summary

- The company, being a real estate investment trust, is exposed to refinancing risk.

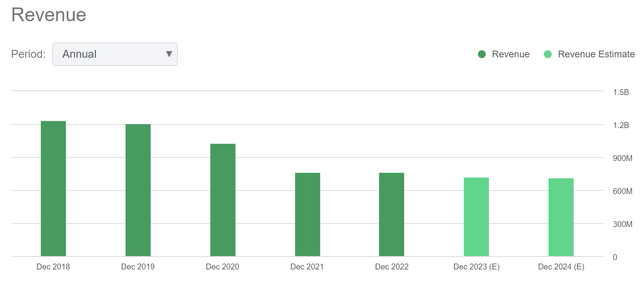

- The revenue has decreased from $1.23 billion in FY2018 to $763.38 million in FY2022, resulting in a 5-year CAGR of -9.1%.

- According to Seeking Alpha, the company's FFO per share for FY2023 and FY2024 might be $5.44 and $5.64, respectively.

kennethnokman

Investment Thesis

SL Green Realty (NYSE:SLG) is a fully integrated real estate investment trust and the largest office landlord in Manhattan, New York. It mainly owns, acquires, develops, manages, and operates commercial real estate properties. The company is currently facing a major headwind due to refinancing risk and employee layoffs, which can lead to a reduction in dividend payment and negative momentum in share price.

About SLG

SLG is a fully integrated real estate investment trust which deals in owning, acquiring, developing, redeveloping, repositioning, managing, and operating commercial real estate properties covering the metropolitan area of New York, mainly in Manhattan, which is a borough of New York City. It had interests in 61 buildings totaling 33.1 million square feet as of December 31, 2022. This included 28.9 million square feet of Manhattan building ownership and 3.4 million square feet of debt and preferred equity investments. As of December 31, 2022, it also owned a consolidated property in Stamford, Connecticut, which comprises seven commercial office buildings totaling approximately 0.9 million rentable square feet. There were also 11 prime retail properties owned or held by the company, which totaled 0.3 million square feet, eight buildings in varying stages of development or redevelopment, and one residential building, which contained 209 units. The company's primary revenue sources consist of tenant rents, escalations, and reimbursement revenues. Revenues are categorized as rental revenue, investment income, and other income. Rental revenues contributed approximately 81% of the company's total revenues in the previous year, whereas investment income and other income accounted for 10% and 9% of the total revenues, respectively.

Refinancing Risk and REIT Headwinds

As a real estate investment trust, the company is exposed to refinancing risk. Generally, office REITs have a higher risk of refinancing due to their tendency to have more short-term loan maturities than other REITS. SLG currently has debt maturities of $2.2B in 2023/2024. The current rising inflation scenario has led to a dramatic surge in the cost of borrowing and has put refinancing pressure on REITs. If the cost of borrowing increases, it can increase the company's refinancing cost and reduce profit margins. In addition, the nature of the company's assets is highly illiquid, making it challenging to sell assets to pay existing debts.

Further, if the cost of financing increases due to rising interest rates, it can also have a negative impact on the company's dividend payout, as the cash flows can decrease to a large extent. Simultaneously, when the interest rate rises, it can lead to lower asset valuation as the cost of capital increases. Reduction in asset valuation can impact the business negatively by reducing the company's net income.

Globally, Hybrid work and employee layoffs have decreased the demand for office REITs. Businesses have been reevaluating how much physical office space they need due to the lockdown, which made employees worldwide work from home, and they have also been cutting staff lately. According to CoStar, The national office market's vacancy rate has increased by 7% year over year, and it is anticipated to rise even further. I believe the corporate companies might increase the use of the hybrid work model, and we can expect more layoffs in the coming years as rising inflation continuously increases these companies' operational and financial burdens.

Financial Trends

The revenue has decreased from $1.23 billion in FY2018 to $763.38 million in FY2022, resulting in a 5-year CAGR of -9.1%. We can observe in the above chart that the company has been experiencing a decreasing revenue trend since the pandemic. The seeking alpha estimates that the revenue might continue to decrease in the coming years. According to seeking alpha, the company's revenue might be $719.99 million and $714.22 million in FY2023 and FY2024, respectively, which results in a CAGR of -2.19%. I believe these estimates of decreasing revenue are accurate as the company is currently facing the headwind of a hybrid work model and rising layoffs which has reduced the demand for office space.

We can observe the same trend in the FFO of the company. The FFO has decreased from $605.7 million in FY2018 to $458.8 million in FY2022, resulting in a 5-year CAGR of -5.4%. According to seeking alpha, the company's FFO per share for FY2023 and FY2024 might be $5.44 and $5.64, respectively.

High Dividend Yield

The company has a long track record of consistent dividend payouts over the past few years. In the previous year, it distributed a dividend of $0.31 per share in the first eleven months and $0.2708 in the last month. This makes the annual dividend $3.68 per share, representing a high dividend yield of 15.56%. The decreased share price of the company is a partial contributor to this huge dividend yield. The company's share price has decreased by 69.48% in the last year. In the current year, it distributed a cash dividend of $0.2708 in each of the first three months. The dividend decrease was mainly driven by the tight labor market, which caused low occupancy levels in the Manhattan office space. I believe the investors can expect the dividend cut in the coming period as well due to the increasing layoffs and rising borrowing costs. According to the seeking alpha, the company might pay a dividend of $3.22 per share, which is 13.79% of the current share price. Looking at the yearly returns of the company, I believe the 13.79% is not attractive as the market conditions do not seem favorable. I believe the news of rising interest rates in the coming period can create negative momentum in the company's share price due to the company's short-term debt maturities.

Conclusion

SLG has experienced a downside since the pandemic due to low occupancy levels. The company faces refinancing risk as the company has debt maturities of $2.2B in 2023/2024. The rising interest rates can increase its financing cost and reduce its cash flows, further contracting its profit margins and dividend payouts. The pandemic has also led to an increasing hybrid work model and layoffs, which is showing a rise in the vacancy rate. The company is currently facing both operational and financial risk, which can reduce dividend payments and negative momentum in share price. After analyzing all the above factors, I assign a sell rating for SLG.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.