Paychex: A Solid And Underpriced HCM Solutions Provider

Summary

- Paychex, Inc. maintains a solid FY 2023 with its steady revenue growth and stable margins.

- It remains well-positioned in the market, given its solid customer base and high liquidity levels.

- Market prospects are enticing as more businesses and individuals go online and cashless.

- Dividend payments are consistent and well-covered with decent yields.

- The stock keeps decreasing but shows enticing upside potential.

Liudmila Chernetska/iStock via Getty Images

It has been quite a while since I first covered Paychex, Inc. (NASDAQ: PAYX). And it's one of the three HCM solutions providers I've been watching since the latter part of 2022. It remains a solid company with its impeccable 3Q 2023 performance. It continues to stabilize revenue growth and margin expansion. Although growth is relatively underwhelming, its efficiency is far better than its close peers. Even better, its financial positioning stays in great shape, given its high cash reserves and stable debt levels. It has adequate capacity to sustain its operating capacity and cover capital returns.

Moreover, dividend payouts continue to increase with better-than-market average yields. The stock is worth its price if we compare it to dividends. It is more enticing today despite the continued downtrend. In fact, it has noticeable undervaluation and upside potential. Investors may find an opportunity to purchase shares at a discount.

Company Performance

The macroeconomic environment remains tough, characterized by elevated inflation and interest rates. Yet, Paychex, Inc. continues to withstand these external pressures while sustaining its growth. Indeed, the labor market transformation and fintech revolution make HCM solutions a staple today. They become more integral to day-to-day business activities across industries. This aspect opens more opportunities to expand its domestic and international market presence.

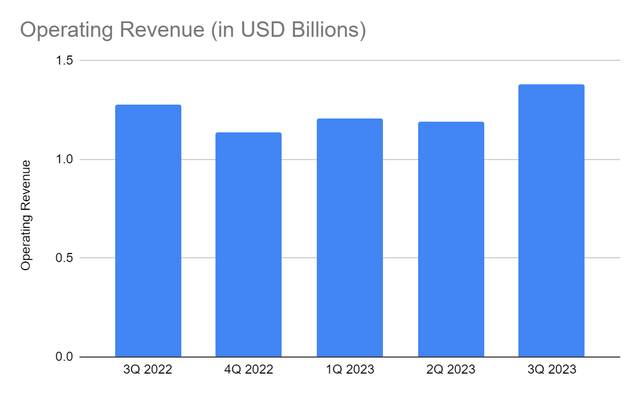

Its operating revenue in 3Q 2023 amounted to $1.38 billion, an 8% year-over-year increase. Thanks to the increased demand for its solutions and services. The increased preference for hybrid work setups made it more appealing to businesses. Also, businesses had to adapt to rising prices and interest rates. Payroll changes, debt stabilization, and other financial changes led to more businesses seeking its assistance.

Operating Revenue (MarketWatch)

The increased number of small businesses was another primary growth driver. As of 4Q 2022, there were 33.2 million small businesses in the US versus 32.5 million in 2021. And since PAYX caters to SMEs, it enjoyed the positive spillovers of small business openings. When inflation peaked at 9.1%, many entrepreneurs were apprehensive, and some thought about closing temporarily. But as it relaxed, things turned 180 degrees. Although it may take more time for clients to adjust their expenses, it had a positive impact on the company. Aside from that, the decreasing inflation helped the company have better pricing strategies. It was well-positioned to enjoy a higher influx of clients, cope with the pricing strategies of peers, and offset higher costs and expenses.

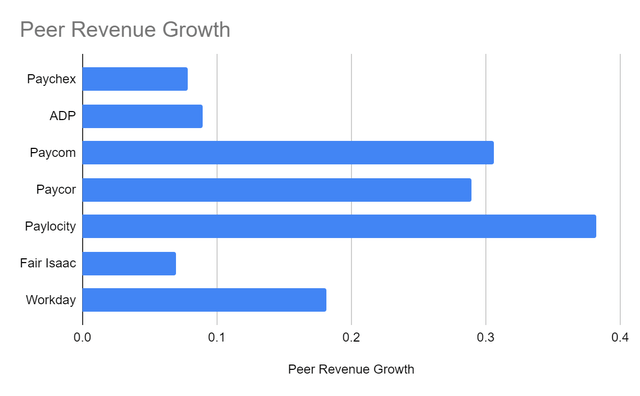

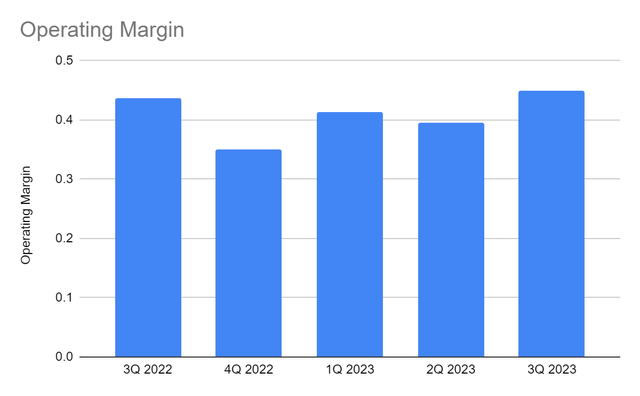

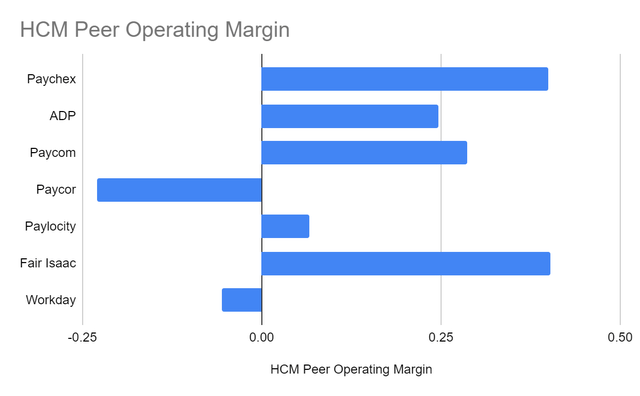

Relative to its peers, PAYX remains a massive company. Its revenue growth is the second lowest among the group. Yet, its impressive operating margin demonstrated its prudent and efficient asset management. Costs and expenses increased as PAYX expanded its operating capacity. They were also in line with inflation, but the pricing strategy, demand, and efficiency offset their impact. The operating margin of the company reached 45% versus 44% in 3Q 2022. It was also the highest in FY 2023, showing more stable operations amidst macroeconomic disruptions. Even better, it was the second-highest among the group. It exceeded some of its close peers like Automatic Data Processing, Inc. (ADP) and Paycom Software, Inc. (PAYC). It remains a durable figure in the HCM solutions industry.

Peer Revenue Growth (MarketWatch)

Operating Margin (MarketWatch)

HCM Peer Operating Margin (MarketWatch)

This year, Paychex may have more stable core operations. As of February 2023, inflation was only 6%, 34% lower than the 2022 peak. The decreasing price level may help the company further improve its pricing strategy. In turn, it may attract more clients as businesses shift to hybrid work business setups. It may also manage its costs and expenses better to keep margins at their current level.

How Paychex, Inc. May Remain A Solid Company

We already saw how PAYX coped with the elevated prices. Its effort to make its product attractive while covering costs and expenses paid off. Fortunately, the labor market changes and the fintech revolution had a more substantial impact. This year, market prospects are becoming more attractive as inflation stabilizes. There may also be increased demand as more SMEs open and go online. We all know that PAYX has a solid customer base and market presence, given its size. In my previous coverage, I focused on the employees' point of view. This time, we will discuss both entrepreneurs' and workers' views of hybrid work setups. Also, we will provide more updated data on the fintech trend in the US.

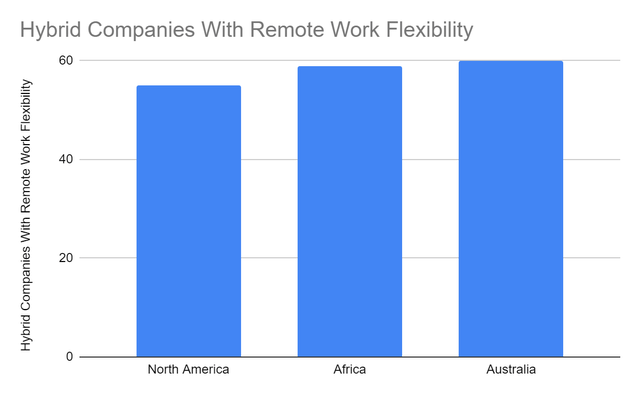

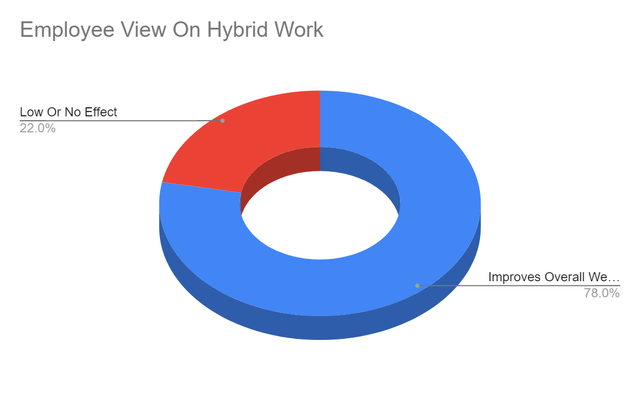

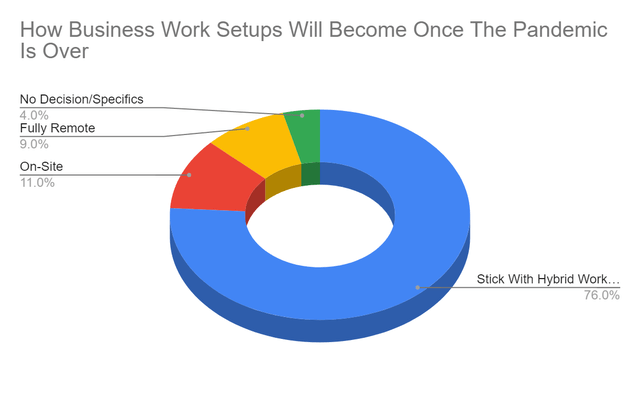

Today, employers and employees alike are geared toward hybrid work setups. These trends may provide more opportunities since only 55% of businesses in North America have remote work flexibility. But things may change this year as more businesses are embracing hybrid work. The same study shows that most companies plan to shift to hybrid work. Also, 76% plan to shift to it after the pandemic. Doing so may help them improve productivity and save more money in the long run. Note that the Great Resignation is still evident, so hiring and training new employees may be costly. Adopting hybrid work can increase employee retention since almost two-thirds of workers said work flexibility could affect their decision. Meanwhile, nearly 80% of them said hybrid work enhanced their well-being. Given this labor market trend, Paychex and other HCM solutions providers may become more vital.

Hybrid Companies With Remote Flexibility (Gitnux)

Employee View On Hybrid Work (Gitnux)

Business Preferred Work Setups Post-Pandemic (Gitnux)

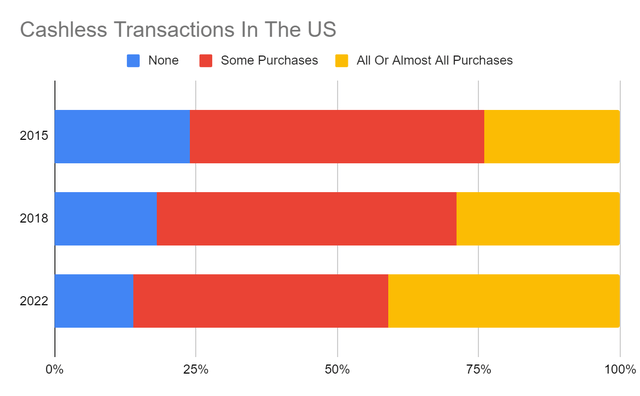

More importantly, the fintech revolution peaks as cashless transactions become more popular. Many companies may use HCM solutions for streamlining payroll services and other financial transactions. Doing so can improve data accuracy and efficiency rather than checking piles of invoices and payslips manually. These changes are more integral in businesses with a huge bulk of online business transactions. Over the years, cashless transactions have been increasing, given the massive drop in cash transactions. But it was most prominent in 2022 when cash transactions for none of the consumer purchases reached 41%. It was proof that more individuals and entrepreneurs are using debit cards, mobile wallets, and credit cards.

Cashless Transactions In The US (Pew Research Center)

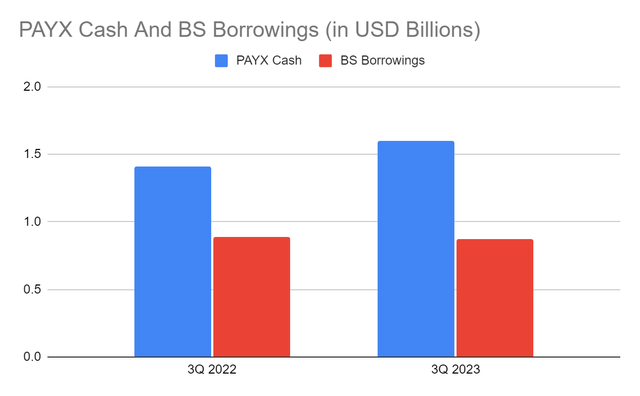

But what makes Paychex attractive is its solid Balance Sheet. It has an impeccable financial positioning that allows it to sustain its operations while covering borrowings and capital returns. It has high cash reserves of $1.61 billion, or 15% of the total assets. It is enough to offset the combined value of borrowings and common stock, making it a very liquid company. Also, the decreasing borrowings make PAYX secure and suitable in a high-interest environment. We can confirm it in its Cash Flow Statement, given the FCF/Sales Ratio of 42%. Indeed, PAYX maximized returns as it translated a substantial portion of revenues into cash.

PAYX Cash And Equivalents And Borrowings (MarketWatch)

Stock Price

The stock price of Paychex, Inc. has already rebounded from its 2020 plunge. But the downtrend happened again. At $108.48, the stock price is 20% lower than year's value. While the decrease can be bothersome, shares are now cheaper with solid upside potential. We can confirm it using the PB Ratio, given the BVPS of 9.44 and PB Ratio of 12.08x. If we use the current BVPS and the average PB Ratio of 13.41x, the target price will be $126.50. The EV Model adheres to it, given the target price of ($38.93 B EV - (-$2.47 Net Debt)) / 360,500,000 shares = $114.84.

Moreover, it has consistent dividend payouts with attractive yields of 2.88% versus ADP with 2.34%. It is also better than the S&P 500 and NASDAQ average of 1.69% and 1.47%. They are also well-covered, given the Dividend Payout Ratio of 59%. To assess the stock price better, we will use the DCF Model.

FCFF $1,892,000,000

Cash $1,620,000,000

Borrowings $880,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 360,500

Stock Price $108.48

Derived Value $120.10

The derived value adheres to the supposition of undervaluation. There may be a 12% upside in the next 12-18 months. Investors may take this chance to purchase shares at a lower price.

Bottomline

Paychex, Inc. is a solid company with sustained revenue growth and stable margins. It has impressive financial positioning\ amidst enticing market prospects. Its adequate capacity allows it to cover its operations, borrowings, and dividends. Even better, the stock price is undervalued if we check its dividends and fundamentals. The recommendation is that Paychex, Inc. is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.