Palm Valley Capital Fund Q1 2023 Commentary

Summary

- The Palm Valley Capital Fund invests in small cap stocks. While our Fund is new, its underlying absolute return-based investment strategy is not. We have practiced the same strategy throughout our careers in investment management.

- Commercial real estate, including multi family and construction loans, represents almost 5x the equity of the average small cap bank.

- Palm Valley’s involvement in the banking sector has been minimal because we prefer to only commit capital to commoditized businesses, like banks, when we believe we can buy their net assets at a discount.

- At the end of the day, we believe asset prices are the tail that wags the dog of Fed decisions.

- For the quarter ending March 31, 2023, the Palm Valley Capital Fund increased 3.01%.

sankai

INVESTMENT PERFORMANCE (%) as of March 31, 2023

Total Return | Annualized Return | |||||

Inception | Quarter | YTD | 1 Year | 3 Year | Inception | |

Palm Valley Capital Fund | 4/30/19 | 3.01% | 3.01% | 4.24% | 9.21% | 7.58% |

S&P SmallCap 600 Index | 2.57% | 2.57% | -8.82% | 21.71% | 6.63% | |

Morningstar Small Cap Index | 4.90% | 4.90% | -8.84% | 19.17% | 5.16% | |

| Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance of the Fund current to the most recent quarter- end can be obtained by calling 904-747-2345. As of the most recent prospectus, the Fund’s gross expense ratio is 1.83% and the net expense ratio is 1.30%. Palm Valley Capital Management has contractually agreed to waive its management fees and reimburse Fund operating expenses through at least April 30, 2024. |

Dancing to the Four Winds

“It’s better to swim in the sea below

Than to swing in the air and feed the crow,

Says jolly Ned Teach of Bristol.”

-Benjamin Franklin, 1719

Dear Fellow Shareholders,

A rapidly growing bank stores most of its capital in government bills. The market price of its shares soars while the money supply expands rapidly. Inflation rages. The bank’s depositors ask for their money back, but the bank can’t easily satisfy the requests. A bank run ensues, and the bank fails spectacularly. Silicon Valley Bank in 2023? No, this is the 1720 fate of Banque Royale, the engine of John Law’s Mississippi Bubble. Law’s money printing scheme to drive down interest rates was conducted on behalf of the financially desperate French government. At the height of the bubble, Law was the richest and most powerful man in Europe—quite a promotion since he was exiled and condemned to be hanged a quarter century earlier.

The difference between 1720 and now is that in the years following the Mississippi Bubble, an uncontrolled explosion of fiat currency was widely recognized as the culprit for the mess. Today, money creation and haphazard government guarantees are irresponsibly viewed as the solution to our crises. Abe Lincoln said, “Whoever can change public opinion, can change the government, practically just so much.” Thomas Paine we’re not, but we’ll still preach that it’s just common sense to end the country’s longstanding love affair with money printing.

Money Printer Go Brrrr

Copper Medal, Germany 1720: John Law expelling paper shares from a giant bellows

As the fire of the Mississippi and South Sea Bubbles were igniting in the early eighteenth century, another villainous flame was extinguished. Ned Teach, better known as Blackbeard, the world’s most famous pirate, met his violent end off the coast of North Carolina at the hands of British navy soldiers in 1718. He perished by a combination of cutlass slashes and bullets. The Governor of Virginia had Blackbeard’s head hung from a pole along the edge of the James River as a grisly warning to those who might consider piracy. However, public opinion in the colonies regarding pirates was not always negative. From the book Black Flags, Blue Waters: The Epic History of America’s Most Notorious Pirates:

The capture of the Pirate Blackbeard, 1718. Painting by J. L. G. Ferris.

"In the late 1600s, pirates were usually welcomed by the colonies because they brought things of great value that colonists desired and needed; and, better yet, they got them by ransacking Mughal ships sailed by "infidels" in a faraway ocean, or by plundering the hated Spanish in the Caribbean. This meant that, from the colonists' perspective, piracy was typically seen as a beneficial activity that had little or no downside...The years after the end of the War of the Spanish Succession, however, were an entirely different situation...The days of plundering Mughal ships in the Indian Ocean, and returning to American ports flush with treasure, were long over. Instead, the vast majority of pirates were attacking American vessels off the coast...Rather than supplementing the local economy, pirates were now damaging it. No longer were the pirates the much-beloved fathers, brothers, and friends of colonists who enriched their communities, but rather they were outsiders who, for the most part, brought nothing but strife. Formerly embraced by the colonies, pirates were now seen primarily as a threat."

Is it farfetched to think that Americans once enriched by the actions of the Federal Reserve and U.S. government in plundering “faraway” people (i.e., future generations) will revolt against these institutions when voters suffer presently? Decisions made in 2020-2021 and prior years contributed to the inflationary upsurge of 2022. Gratifyingly, Fed members finallyexperienced dealing with a semi-hostile audience.

Today, there are numerous signs of an impending recession and an incipient loss of confidence in the financial system, as the higher interest rates required to quash inflation are exposing deep cracks in the economy. While these fissures can be temporarily mended with emergency stopgap measures, this will only compound the severity of ultimate reset, in our opinion. And don’t forget, almost any disruption to the financial machine has been treated as an emergency requiring a rescue. Like any authentic pirate, regulators would rather go out with a bang than suffer the humiliation of surrendering their wrongheaded policies. Argh, matey, cannons have blown holes in our ship, and we’re sinking into the briny deep. Grab ye a bucket and begin to bail out!

| March 19, 2023 Statement by Secretary of the Treasury Janet L. Yellen and Federal Reserve Board Chair Jerome H. Powell: “The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient.” |

Some folks have claimed there was no bailout associated with Silicon Valley and Signature Banks because certain executives lost their jobs (after cashing out millions) and stockholders were zeroed. Of course there was a bailout, and we’re not talking about the depositors of these failed lenders. The Fed stepped in immediately with the Bank Term Funding Program to relieve other lenders’ liquidity stress, ensuring the banks would not have to sell assets for, well, what they’re currently worth. Moreover, it didn’t take much pleading from legions of other bank executives before regulators promised, then unpromised, then re-promised to support the depositors of all U.S. banks to stem fears of more runs. Since the FDIC’s reserve fund was a mere 0.7% of the total U.S. deposit base, before recent failures, pledges of support hinge of the power of the printing press.

We have no desire to see unsuspecting depositors lose their shirts due to either banker greed, shortsightedness, or (if you’re feeling charitable) bank runs that cannot be avoided under a fractional reserve system. However, we’re exhausted by “hair of the dog” solutions that perpetuate this cycle of recklessness. The Fed, the Treasury Department, politicians—they’re a bunch of can kickers who act as if any present benefit from their actions outweighs potentially devastating long-term consequences. They’ll hide behind the refrain of supporting jobs that put food on the table tonight, and who could argue with that? They’ll warn, “If we don’t act, we’ll be in another Great Depression.” On the contrary: the situation becomes more combustible with each bailout, as evidenced by the strain already placed on the banking system by 4% interest rates. None of this ever gets better without broad public ire.

Silvergate…Silicon Valley…Signature. If there’s a lesson to be learned, it’s to not start your bank name with “Si”! Encompassing the second and third largest U.S. bank failures ever, many investors are hoping the downfall of these lenders can be pinned on cryptocurrency or venture capital exposure, an abnormally high percentage of uninsured (and therefore uncomfortable) deposits, or unique asset/liability mismatches. The March distress spread to First Republic Bank, another West Coast lender with significant uninsured deposits, then Credit Suisse, a once-venerable institution that had been foundering in recent years. Credit Suisse was taken over by UBS during a hectic weekend in a rush job arranged by the Swiss government.

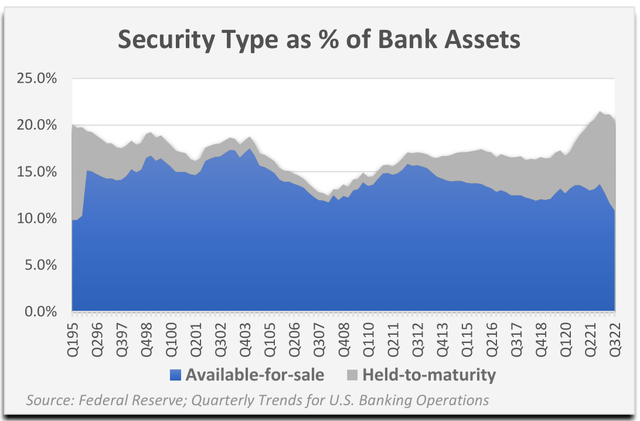

While it was hard to keep up with the pace of developments in the sector, it should be clear that banks are opaque businesses. As one example, over the last decade, the percentage of domestic bank assets represented by held-to- maturity (HTM) securities increased significantly. This phenomenon obscures measures of shareholders’ equity in volatile rate environments, since HTM securities are carried at cost. Although the fair value of these securities can be ascertained by reading financial statements, it's much harder to know the true value of bank assets with credit risk. Loans, as Level 3 assets, are assigned a fair value based on management’s assumptions about the assumptions that market participants would use in pricing an asset or liability. Shiver me timbers!

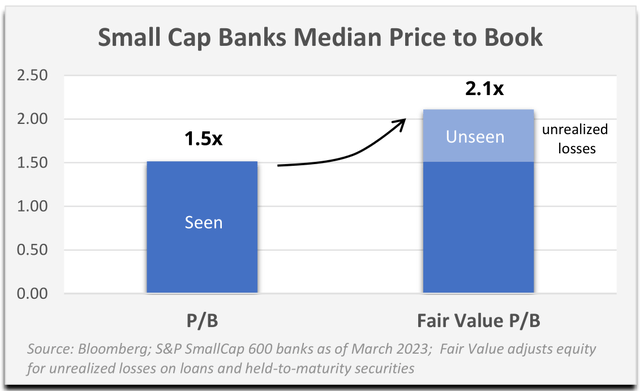

Historically, we have generally only purchased banks trading below book value. We must believe shareholders’ equity is reasonably solid and unlikely to suffer a material impairment in an economic downturn. Given the significant increase in small cap bank exposure to commercial real estate during this market cycle, we believe balance sheet risk has increased considerably. As a result of our criteria, we haven’t owned many small cap banks. Even now, after a threatened banking crisis, the median Price to Book (P/B) multiple for banks in the S&P SmallCap 600 Index is 1.5x. If we adjust book value to account for unrealized losses on held- to-maturity securities and loans, the median P/B ratio grows to 2.1x.

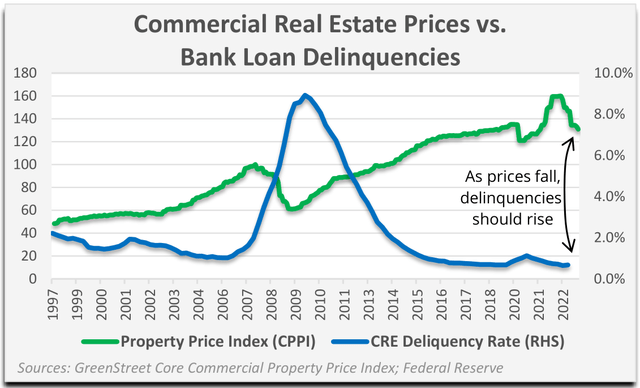

Commercial real estate, including multi family and construction loans, represents almost 5x the equity of the average small cap bank! The Blackstone REIT (BREIT) drama is another recent example of the friction that can occur when you combine an illiquid asset class (real estate) with investors who want their money back immediately. Delinquencies on commercial property loans, as reported by the Fed, were still at record lows in the fourth quarter of 2022 but have begun to creep higher. Several high-profile investors have defaulted on office properties in major cities, a consequence of pandemic work from home trends that never fully reversed. Over $1.4 trillion of commercial real estate (CRE) debt will mature by the end of 2024 (Mortgage Bankers Association), more than 30% of outstanding loans, prompting at least one real estate CEO to shamelessly request an industry lifeline from regulators. We think the smooth sailing is finished. First Republic Bank and Signature Bank have/had the 9th and 10th largest CRE loan portfolios, respectively (Trepp).

More than half of S&P SmallCap 600 banks reported a decline in net income in 2022, but the median decrease was only 2%. Small cap bank earnings are still up more than twofold, on average, over the past five years. The current 10x P/E for the typical small bank is deceptive, since it is predicated on low-cost deposits that are now seeking higher yields and/or safer homes. U.S. banks began losing deposits at the fastest pace ever beginning in the second quarter of 2022. Several of those low P/E lenders have no shareholder’s equity at all when assets are marked to fair value (Level 2 and Level 3 accounting basis). Whether or not banks work out as an investment from here, based on our experience, banking is an extremely leveraged business model reliant on government backstops.

Palm Valley’s involvement in the banking sector has been minimal because we prefer to only commit capital to commoditized businesses, like banks, when we believe we can buy their net assets at a discount. While many banks look cheap on trailing profits, most non-financials do not. However, certain highly cyclical sectors may be producing the same mirage of inexpensive valuations that won’t hold up in an average economy, let alone a recession.

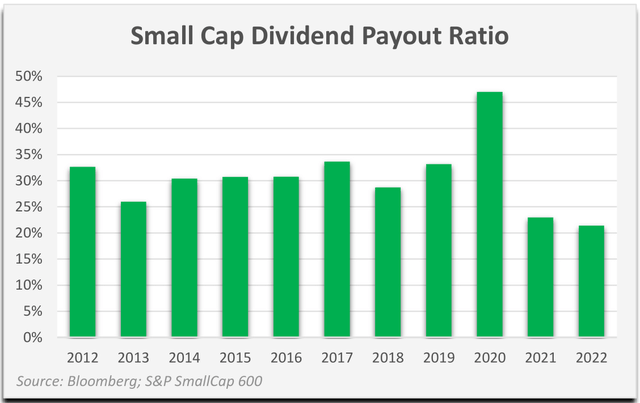

Determining normalized profitability is sometimes more art than science, but we believe it’s still a critical task for absolute return investors. It’s perfectly acceptable to use trailing earnings as a starting point for normalization, since it has the advantage of inflation baked in. Yet, stopping there would often be a mistake. During our diligence, we ask why the past year may not be reflective of typical economic conditions and earnings power for a business. From our perspective, 2021-2022 is an unambiguous outlier of excess profitability driven by record deficit spending. Even management teams do not appear to be buying the sustainability of trailing profits, as average small cap dividend payout ratios are at the lowest levels of the last decade.

The normalization exercise gets trickier when rewinding further. We believe this entire economic cycle has been distorted by low interest rates, debt, and overall financialization. Even so, the further back one goes to search for a so-called normal economy, the more disconnected the business under review might be relative to its present status. Has the company acquired, lost a major customer, developed a new product or service line, etc.? It can help to focus on operating margins over time instead of nominal earnings. We will determine the average full cycle operating margin for a business and apply this to our best estimate of normalized revenue. For many businesses, including some in our Fund, we project normalized sales below what has been achieved for the past twelve months. This may seem noteworthy given the inflation experienced throughout this period and reflects our views on sustainable demand.

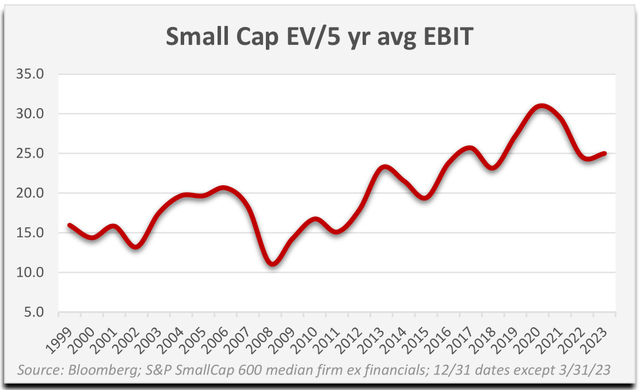

Although we spend a significant amount of time dissecting any company we consider purchasing for the Fund, for the purposes of these letters, we tend to generalize to simplify communication. A crude attempt to normalize operating profits could be to take a five-year average. Honestly, this seems overly generous for many businesses, but it at least includes a temporary dip in earnings in 2020. On those grounds, we submit that higher quality small caps are still far from cheap. The median small cap is trading for 25x its five- year average operating profit (S&P 600). Reported small cap earnings have fallen 7% from their 2022 peak, in contrast to large cap earnings (S&P 500), which may be cresting, but haven’t reversed yet.

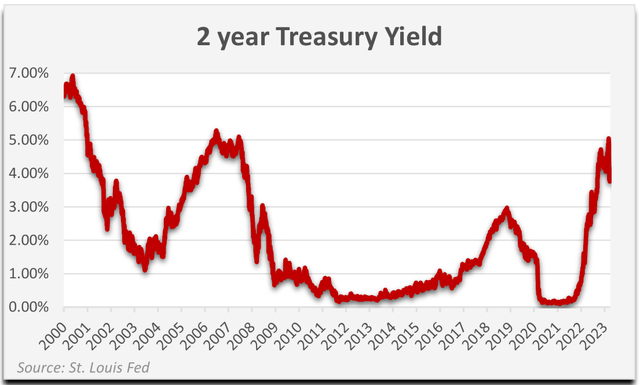

We heard for many years that there was no alternative to owning equities. It’s been harder to make that argument recently with rising short-term risk-free yields, which peaked above 5% in early March before collapsing to below 4% on bank contagion fears (2-year Treasury). Despite telegraphed rate increases from the Fed throughout 2022 and year-to-date, most investors stayed faithful to their equity allocations. Dance with the one that brought you, right? Their core belief is that lower rates are the elixir for all that ails capital markets, and that the alchemists at the Fed will not withhold their magical potion for much longer. Rate cuts could fix bank balance sheets and bring back deposits. ZIRP is manna for equities, bonds, and real estate. Many in Congress are already demanding monetary easing in the name of supporting employment. Concerns about inflation have been displaced by fears of bank runs and economic instability. Meanwhile, the Fed is assuring us it will finish the job on inflation before reversing policy.

At the end of the day, we believe asset prices are the tail that wags the dog of Fed decisions.

Indefatigable equities have not yet exhibited the same volatility as interest rates. We see no credible reason why this business cycle won’t conclude with the decline in corporate profits and the low valuations we’ve seen time and again over history. Batten down the hatches, something has got to give.

For the quarter ending March 31, 2023, the Palm Valley Capital Fund increased 3.01% compared to a 2.57% gain for the S&P SmallCap 600 Total Return Index and a 4.90% rise in the Morningstar Small Cap Index.

Top 10 Holdings (3/31/23) | % Assets |

Sprott Physical Silver Trust (PSLV) | 3.53% |

2.75% | |

Sprott Physical Gold Trust (PHYS) | 2.04% |

Miller Industries (MLR) | 1.69% |

WH Group (ADR) (OTCPK:WHGLY) | 1.50% |

Lassonde Industries (OTCPK:LSDAF) | 1.44% |

Natural Gas Services (NGS) | 1.21% |

Kelly Services (KELYA) | 1.12% |

Oil-Dri (ODC) | 1.04% |

Gencor Industries (GENC) | 0.97% |

The Fund’s performance early in the quarter was far short of its benchmarks, but the gap closed by quarter end, as indexes suffered a rough March while our equities performed solidly. According to our estimates, the Fund’s securities returned 12.2% during the quarter as certain dormant names reacted favorably to earnings. The difference between equity-only returns and overall Fund returns is explained by the Fund’s elevated cash allocation and embedded operating expenses. The Fund ended the period with 79% of assets held in cash equivalents, which are primarily U.S. Treasury bills maturing in six months or less.

Seasoned followers of Palm Valley are aware that we have a shopping list of nearly three hundred names. We have previously owned many of these companies and monitor them on an ongoing basis for an attractive entry price. While we are also open to opportunities outside of this bucket, we can act quickly on these names because we are familiar with them. Unfortunately, most valuations from this group are not enticing today, with a median EV/EBIT of 18x and Price to Free Cash Flow of 39x, excluding financials like banks and insurers. These businesses trade at a median 24x average five-year operating income, which is roughly in line with the S&P 600 and reflects the higher quality makeup of our shopping list. Several stocks that register at lower multiples of average five-year profits are current constituents of the Fund, including WH Group (OTCPK:WHGLY), ManpowerGroup (MAN), Miller Industries (MLR), Lassonde Industries (LAS.A:CA), and Carters (CRI). Others are under consideration for purchase, but just as many of the low multiple names are supported by an earnings stream, that, in our judgment, doesn’t have legs. Alternatively, the company’s balance sheet may need to improve before we will feel comfortable owning it again.

We did not purchase any new holdings for the Fund during the first quarter. In January, we sold one position: Osisko Gold Royalties (OR). Osisko reported record royalty and streaming revenues as it has steadily grown its portfolio of assets, which is skewed toward Canada—considered to be the highest quality jurisdiction for miners. The company recently deconsolidated the results of mining developer Osisko Development from its financials, clarifying Osisko Royalties’ business model for less familiar investors. Each quarter, we update the company’s NAV based on the underlying value of each of its key royalty and streaming interests, in addition to the net financial assets it holds. Osisko’s share price exceeded our estimate of NAV, so we sold the position.

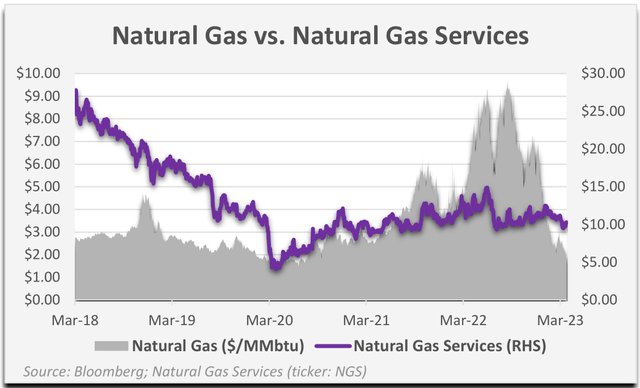

For the three-month period, the Fund had one security negatively affecting performance by more than 10 basis points: Natural Gas Services (NGS). The company’s recent financial results have trended in the right direction. However, the slow pace of improvement has lagged the energy service industry. Many companies in the space have traded down due to falling commodity prices. Natural gas prices touched the lowest levels in over two years a few days ago. In May 2022, the company’s longtime CEO Stephen Taylor retired and was replaced on an interim basis by a director. Six months later, Mr. Taylor returned to lead the company. Since December, two activist shareholders have sent letters to the board, with one demanding the company explore strategic alternatives and the other nominating two candidates as directors. These investors may be pouncing on the firm’s low valuation and perceived opportunity to drive faster operating progress.

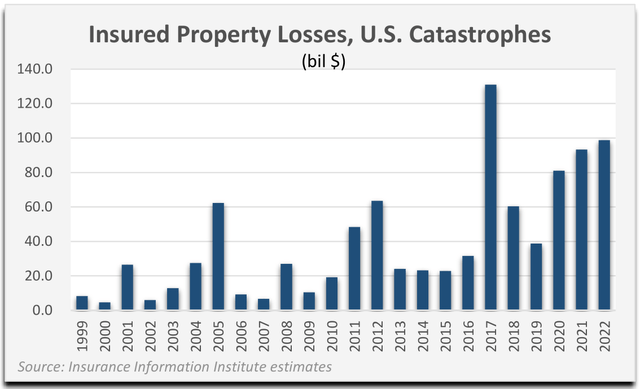

During the quarter, the three securities having the greatest positive impact on the Fund’s returns were Crawford & Co (tickers: CRD/A, CRD/B), Miller Industries (ticker: MLR), and Gencor Industries (ticker: GENC). Crawford’s shares had underperformed since the pandemic but surged in March after the firm’s fourth quarter earnings release. Results for the period were supported by activity related to severe weather, including Hurricane Ian and Winter Storm Elliott. Constant currency revenues jumped 15% in Q4. Operating profit before amortization reached its highest level since the third quarter of 2020, when results benefited from claims activity tied to Hurricane Laura. Management expressed optimism that Crawford’s margin improvement can continue, including from the firm’s struggling International division.

We believe Crawford’s valuation had been locked in the basement because of the firm’s meandering results, since the company has struggled to grow earnings even though it maintains leading positions in multiple service lines. Crawford’s stock jumped on heavy volume and no material news during the final week of the quarter. While we imagine a path to higher profitability will not be smooth and will be impacted by the frequency and severity of global weather events, we believe recent share price appreciation places the valuation in territory that makes more sense given Crawford’s fundamentals.

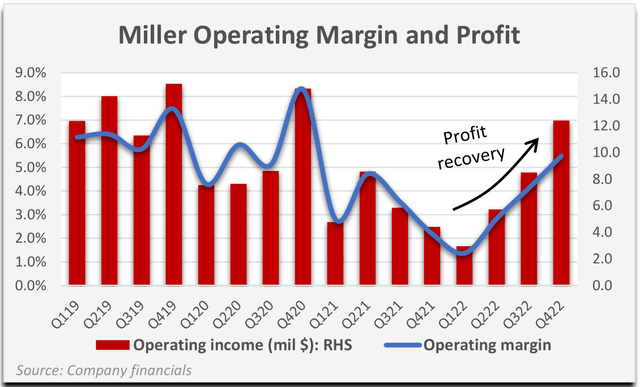

Miller Industries suffered tremendously from supply chain bottlenecks and cost inflation during 2021 and 2022, even as demand for its tow trucks was robust. This pushed down margins and profitability.

Management aggressively raised prices and continued to build unfinished vehicle bodies ordered by customers while waiting on certain scarce parts from key suppliers. Supply chain pressures haven’t disappeared, but they have eased, and the company’s pricing has mostly caught up with its higher costs. As a result, Miller’s profit is recovering sharply. Strong backlogs position the company to deliver over $1 billion of revenue in 2023, which would be an 18% increase over last year’s record. A longtime Miller shareholder also reached an agreement with the firm in March to place several new directors on Miller’s board. We believe this will provide helpful oversight to the firm, which is often operated like a family business even though the Miller family’s ownership is no longer material.

Gencor Industries, a market-leading manufacturer of asphalt plants, posted a strong recovery in profitability in the fourth quarter. Sales grew 28% and gross profit expanded 57% year-over-year from higher pricing and a stabilization of costs. We expect profitability trends to remain favorable due to elevated spending on infrastructure, a healthy backlog, and declining steel prices. Gencor continues to have one of the strongest balance sheets in our opportunity set, with no debt and nearly $100 million in cash and marketable securities, equaling 45% of Gencor's market capitalization.

"There are only two rules: What a man can do, and what a man can't do."

Captain Jack Sparrow

It is virtually impossible to capture all the upside of a bull market while also insulating a portfolio from a significant drawdown. Protecting capital comes with an opportunity cost. We expect the Palm Valley Capital Fund to trail small cap indexes during bull markets when valuations are high and we are conservatively positioned. Conversely, we seek to outperform in downturns, especially when those drawdowns begin from expensive valuations. Our aim is to maximize the Fund’s risk-adjusted returns. Our current desire for lower equity prices is 0% schadenfreude and 100% because we expect it would improve our ability to deliver higher absolute returns for our shareholders. Nevertheless, we firmly believe the primary drivers of stock prices this cycle—artificially suppressed interest rates and excessive borrowing—are corrosive, unsustainable, and dangerous for our country.

On the one hand, tighter monetary policy has caused a reduction in speculative activity. Trading on the online broker Robinhood has fallen precipitously since the pandemic. The number of IPOs is down 90% from 2021. Certain meme stocks, like Bed Bath & Beyond, are approaching the dustbin. On the other hand, investors remain emboldened by strong corporate profits, and equity prices are still fanciful versus most historical comparisons. In 2023, despite interest rate volatility and fears of a brewing banking crisis, speculators are entranced by newish playthings like 0DTE options, which accounted for over 40% of total options activity in March (BankofAmerica). Bitcoin is up over 70% in 2023 after tanking last year. The NASDAQ has gained 17% year-to-date.

During the Golden Age of Piracy, which lasted from 1650 to 1730, convicted buccaneers were hanged in a public square. To maximize suffering for heinous offenders, a short rope was sometimes used so the criminal’s neck wasn’t snapped instantly when the scaffold dropped. They would instead slowly asphyxiate. “Dancing to the four winds,” also known as “dancing the Tyburn jig,” was a colloquialism for the brief period when the condemned pirate remained conscious and their legs would desperately kick. Many investors are praying that bank rescues, a rapid re-expansion of the Fed’s balance sheet, and a rush of inflows back to big tech stocks are embers that can stoke a renewed bull run. Not us. We’re out seeking justice in the town square, hoping we’re watching the final convulsions of the Everything Bubble. The crowd is sparse but growing. For everyone’s sake, we hope the eventual carcass of this market cycle, whose orchestrators have plundered repeatedly from the future, will serve as a lesson that lasts for generations. Dead bubbles do tell tales.

The Pirates Own Book (1837), Charles Elles

Thank you for your investment.

Sincerely,

Jayme Wiggins | Eric Cinnamond

| Mutual fund investing involves risk. Principal loss is possible. The Palm Valley Capital Fund invests in smaller sized companies, which involve additional risks such as limited liquidity and greater volatility than large capitalization companies. The ability of the Fund to meet its investment objective may be limited to the extent it holds assets in cash (or cash equivalents) or is otherwise uninvested. Before investing in the Palm Valley Capital Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. The Prospectus contains this and other important information and it may be obtained by calling 904-747-2345. Please read the Prospectus carefully before investing. Past performance is no guarantee of future results. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund. The S&P SmallCap 600 Total Return Index measures the small cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. The Morningstar Small Cap Total Return Index tracks the performance of U.S. small-cap stocks that fall between 90th and 97th percentile in market capitalization of the investable universe. It is not possible to invest directly in an index. The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC. Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice. |

Definitions:0DTE options: Options contracts that expire in a day. Available for sale: Debt or equity security purchased with the intent of selling before it reaches maturity. Reported at fair value. Bank Term Funding Program: Emergency lending program created by the Federal Reserve in 2023 to provide liquidity to U.S. banks. Basis point: One hundredth of a percentage point (0.01%). Blackstone REIT: Non-listed Real Estate Investment Trust that invests in income-generating commercial real estate in the U.S. Book Value: Shareholders’ equity. Total assets minus total liabilities. Constant currency: Financial results stated as if there was no change in the value of exchange rates over the period. Dividend payout ratio: Dividends paid to shareholders divided by net income. Everything Bubble: Phrase for the correlated impact of monetary easing by the Federal Reserve on asset prices in most asset classes after the Great Financial Crisis of 2008 (Wikipedia). EV/EBIT: Enterprise Value of a company (Market Capitalization – Cash + Debt) divided by its trailing twelve- month Earnings Before Interest and Taxes (i.e., operating income). FDIC (Federal Deposit Insurance Corporation): Government agency created to maintain stability and confidence in the U.S. banking system. Fractional reserve banking: System in which only a fraction of deposits are required to be available for withdrawal. Green Street Commercial Property Price Index (CPPI): An index of unleveraged U.S. commercial property values that reflects current transaction prices. Held to maturity: Security purchased to be owned until maturity. Reported at cost. Level 2 asset: Financial asset without regular pricing but whose fair value can be determined based on other market prices or data. Level 3 asset: Financial asset that is not actively traded and whose value is based on models and unobservable inputs. MMBtu: 1 million British thermal units. A measurement for natural gas. NAV (Net Asset Value): Value of an entity’s assets minus its liabilities. Price to Book (P/B) Ratio: A stock’s price divided by its book value, or shareholders’ equity, per share. Price to Earnings (P/E) Ratio: A stock’s price divided by its earnings per share. Price to Free Cash Flow: Market Capitalization divided by Free Cash Flow. Shareholders’ equity: A company’s total assets minus total liabilities (net assets). S&P 500: The Standard & Poor's 500 is an American stock market index based on the market capitalizations of 500 large companies. ZIRP (Zero Interest Rate Policy): Describes monetary policy of Federal Reserve to keep short-term interest rates near zero. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.