From FAANG To FANG?: Economic Clarity Sought (Video)

Summary

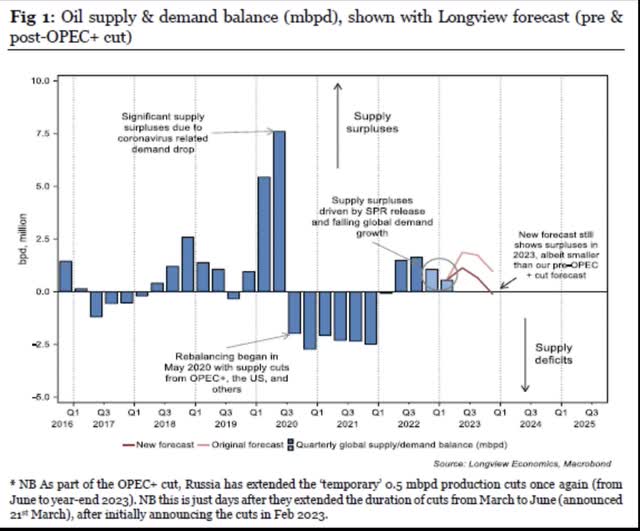

- OPEC's production cut announcement struck the market early in the week but gave way to general uncertainty.

- Permian Basin oil will be influencing the global benchmark Brent given its inclusion as a Dated Brent constituent.

- Thank U.S. shale for lower prices, generally, at times.

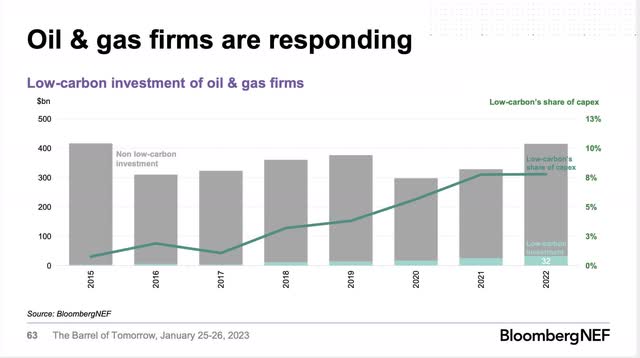

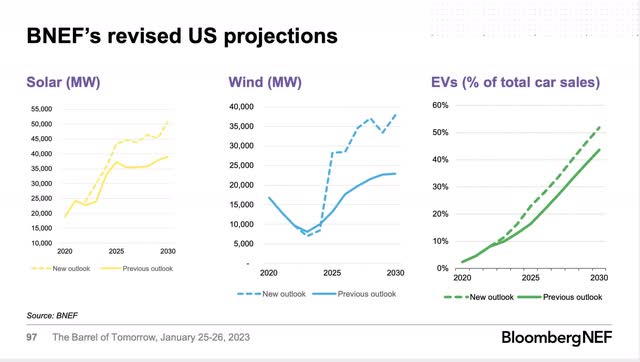

- The low carbon transition has more legs than previously imagined, with oil and gas fully engaged. The Inflation Reduction Act offers tailwinds too.

Energizing the planet imagedepotpro/E+ via Getty Images

OPEC's announcement to cut supply over the weekend trumped my WTI-Brent benchmark musings. Saudi Arabia plans to cut 500,000 b/d, along with the UAE, Kuwait and Russia which shaves a sum of a million-plus - and then roughly 1.6 million after July. WTI futures had been rising again in the latter part of last week as the banking crisis sentiment started to calm somewhat. I think OPEC's pre-emptive cut announcement could possibly overshoot economic reality unless they believe China's demand is not quite materializing. Hard to say...

Oil supply, demand (Oil market supply and demand (Bloomberg))

Jennifer Warren on market trends, energy ((Concept Elemental))

The video:

From FAANG to FANG?: Economic Clarity Sought (Video)

Returning to the longer-horizon benchmarking thoughts…

In recent news, West Texas Intermediate, or WTI, a key U.S. oil price benchmark, is now to be folded into the global benchmark Brent, alongside its other constituents.

After years of wrangling, the world's most important oil price is about to be transformed for good, allowing crude supplies from West Texas to help determine the price of millions of barrels a day of petroleum transactions.

The shift is because the existing benchmark, Dated Brent, is slowly running out of tradable oil for it to remain reliable. As such, its publisher S&P Global Commodity Insights - better known by traders as Platts - has been forced to make a dramatic overhaul.

…Dated, as it's commonly known by oil traders, helps to set the price of about two thirds of the world's oil and even defines the price of some gas deals.

Pioneer Natural Resources (PXD) CEO Scott Sheffield called WTI out in January, saying that the futures curve is not predictive of oil prices. I noticed that on price discovery, but now this…

Five existing grades that set Dated - Brent, Forties, Oseberg, Ekofisk or Troll.

If Platts judges that WTI Midland is the most competitive price on offer - or actually sold - then it could set dated.

So WTI Midland might then influence the price a seller of an Atlantic Basin barrel charges a refinery in China.

Why Is This Important?

This addition to the global benchmark means that U.S. Permian shale is a significant influence in global markets. The price of WTI, often discounted, to Brent, will morph. What happens in the Permian is thus increasingly important. The physical oil of "Brent" is North Seas U.K. That production has reduced considerably over the decade. To me, it's a remarkable development, with U.S. shale oil growing from roughly 2 million barrels per day in 2010 to 12 million by 2019.

In chronicling the U.S. shale oil boom (gas in its early take-off), and figuring out its impact on global prices and production, I noted that U.S. shale was moderating global prices for a period. This was before OPEC began its market share re-take in 2015-16. And, ultimately, oil prices are inherently volatile owing to geopolitics. There's a large body of academic work that supports this contention, as well as my "practitioner" work from October 15, 2013 through today. However, U.S. shale, its persistence-in spite of the many analysts commentary about its poor investment characteristics and the haters-has endured and become a global benchmark.

Putin's disinformation campaign about keeping U.S. shale out of Europe worked for a long time. This is all documented. Until it hasn't. (See "Chart Heard Around the World" and "Solving Europe…" work.) We know what Russia's Ukraine war has unleashed on the energy front, a redrawing of the energy map with geopolitical and economic consequences.

[Global Energy 2023: War Impacts, Decarbonization And Energy Security Premiums]

At CERA Week, an admittance by a world energy leader about U.S. shale was telling. In the past, U.S. oil was a price taker, now it's a pseudo-price maker. As noted in many articles past, entrepreneurial grit, innovation and perseverance are at the heart of this development. If interested, the run up to the Permian shale boom is documented here.

Influencing Cleaner Barrels

In my November 2021 D CEO energy edition article, the implications of net zero and its impact on cleaner barrels was discussed. This was just eight years after the 2014 break out article about the Permian oil boom, with work commencing on it six months earlier. With the attention to decarbonization and other GHG emissions - owing to the science of global warming, the ESG catalyst and sustainability sentiment - top U.S. producers and the global majors are all focused on their emissions profiles.

Low Carbon Investment (Low Carbon Capex (BloombergNEF))

With the Inflation Reduction Act (IRA) legislation, great attention is directed toward carbon capture and storage as it pairs most easily with oil and gas production. Just recently, the UK has shifted its green ambitions toward a CCS track. I would say Canada too (though they like the minerals value chain as well). This is inflationary, adding additional cost to the production of oil and gas. The credits and subsidies of the IRA are a policy tool to shoulder some of the costs of greening production. While given a 10-year runway in the legislation, clawbacks could occur owing to budget pressures elsewhere in the next years. EVs eligible for the credits have been reduced with local content and supply chain tweaks. Eventually, the taxpayer will decide through elections when the implications are more apparent - pensions, healthcare, and/or cleaner energy. However, these are generational shifts in priorities and investment in the future.

Additionally, and potentially, as a producer of over 10% of the oil market, the U.S. with its newly-minted Brent inclusion, is an influencer in the future of sustainable barrels.

The Energy Transition

The battle between clean molecules and electrons is going through growing pains. This transition also involves technology as reflected in the proxy (QQQ) and its many offshoots... while renewables will grow.

wind, solar, Evs (US Renewables forecasts (BloombergNEF))

The intermittency of wind and solar and the challenges faced by grid are large obstacles to penetration. Texas is a posterchild of this tension, as noted in "Texas Million-Dollar Miles." Having said that, California just announced the need to spend roughly $10 billion to synch up renewables over the coming decade. Texas is not bothering to tally this up just yet. As mentioned, bitcoin mining, well-established in Texas, will be forced to green its power supply source but that is a known. Many believe battery storage will solve the problem. It will take time to develop the market more fully, however, many innovative minds are focused in the space. While we face the risk of time, this leads to technology risk - that another technology steps in such as nuclear or another more efficient way to operate emerges. The IRA legislation has $30 billion slated for this area.

The View Ahead

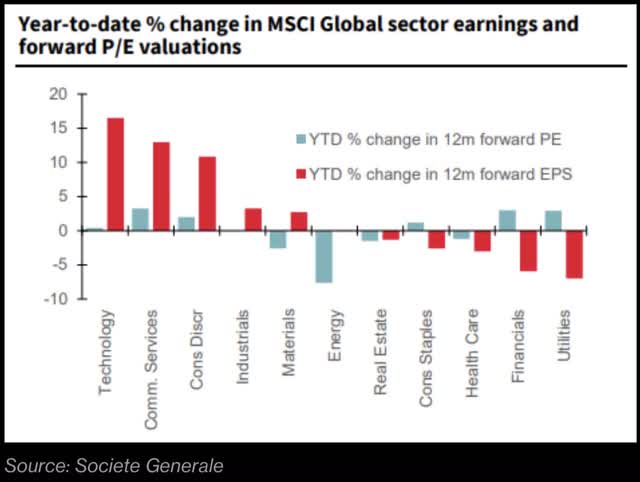

Looking ahead, the earnings season will be telling. And, prognosticators and markets will have terrific fodder ahead.

Earnings (Earnings (Bloomberg))

From the stock charts in my video, we can clearly see the lack of clarity. The FAANG shift (or triple Q) to FANG, Diamondback Energy as my proxy, may be shifting once again. Diamondback (FANG) is a stalwart Permian shale player. The interplay between the two sectors is discussed in relation to the changing interest rate environment with Professor Sean Wang. (Bellwethers and more)

Between geopolitics in oil markets, the unfolding banking saga, and the real effects of interest rates, finding a fixed point on the horizon is difficult. However, the bellwether firms such as Microsoft (MSFT) and Chevron (CVX) offer a longer term investment horizon outlook to see past the volatility. There are other combinations to pass the time however, blending tech with energy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.