Arbor Realty Trust: Risks Looming But Management Deploys Capital Efficiently

Summary

- Arbor Realty Trust posted strong results with a return on equity of 18% in the fourth quarter of 2022.

- Rising interest rates pose a risk to the company because of the rising cost of borrowing, and this could also cause a downturn in the housing market.

- Management deploys capital efficiently by issuing shares when the share price is high, and repurchasing shares when the shares are favorably valued.

- The dividend yield is high at 14%, and the dividend has increased at an average annual rate of 8% over the past 4 years.

- Arbor Realty Trust is worth buying because the potential risks are not (yet) material, the company is growing strongly, the stock's valuation is in line with the average, and management deploys its capital efficiently.

Kwarkot

Introduction

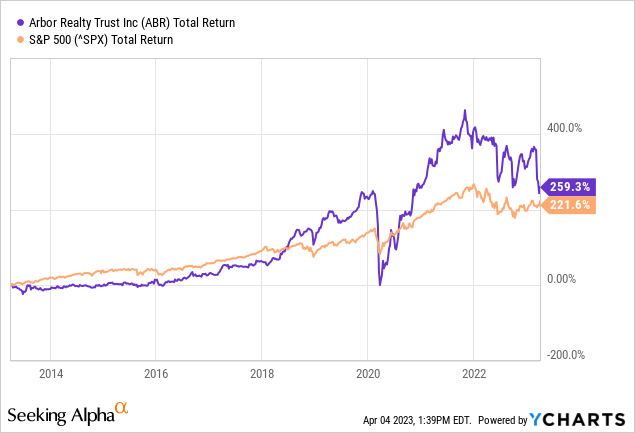

Arbor Realty Trust (NYSE:ABR) is clearly a mortgage REIT that has performed well over the past decade. This is mainly due to its high dividend yield. In the chart from YCharts, I have compared the 10-year total return (including dividends) to that of the S&P 500. What is striking is that Arbor Realty Trust's volatility is significantly higher than that of the S&P 500, making Arbor Realty Trust's beta 1.95.

Arbor Realty Trust has benefitted greatly from rising interest rates, but the rising interest rates also carries risks. Several analysts do not expect a dividend increase next year. However, ABR stock's valuation is in line with the average. I give Arbor Realty Trust a buy rating because the risks are not (yet) material, the company is growing strongly and management knows how to use its capital efficiently.

Strong Earnings, Industry Leading ROE

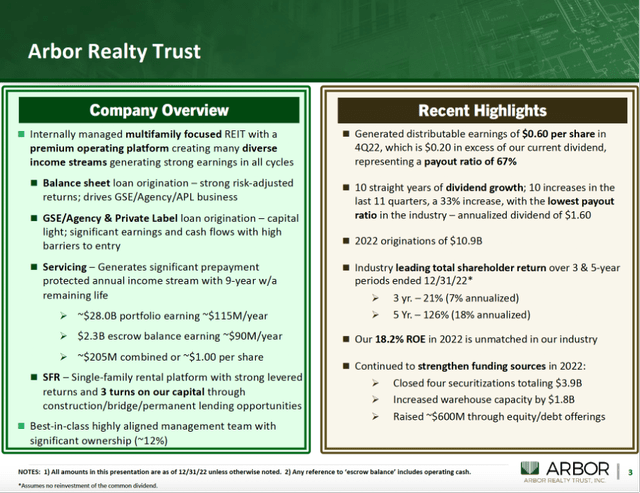

Recent Highlights and Overview (Arbor Realty Trust 4Q22 Investor Presentation)

Arbor Realty Trust has put very strong results on the books with Funds from Operations of $0.49 per share in the fourth quarter of 2022. And the return on equity of 18% is unmatched in the mortgage REIT industry. The strong growth came primarily from sharply higher interest income on their floating-rate loan portfolio and higher income on its escrow balances. They also received more income from sales gains due to stronger Agency volumes and the early settlement of some large Agency loans.

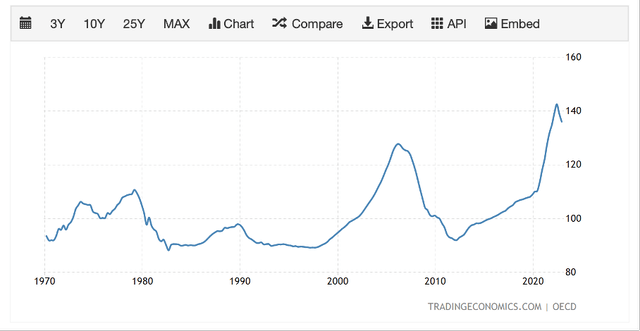

Increased interest rates have provided higher income, but this also carries risks. Not only does it lead to an increase in the cost of borrowing, but it can also cause a downturn in the housing market. A well-known measure of whether it is better to buy or rent a home is the price-to-rent ratio. The rent-to-rent ratio in the United States recently reached a record high. My expectation is that the housing market is going to decline, and that could have negative consequences for individuals who can no longer pay their mortgages and are saddled with residual debt. So that poses a risk to Arbor Realty Trust.

US Price to Rent Ratio (Trading Economics)

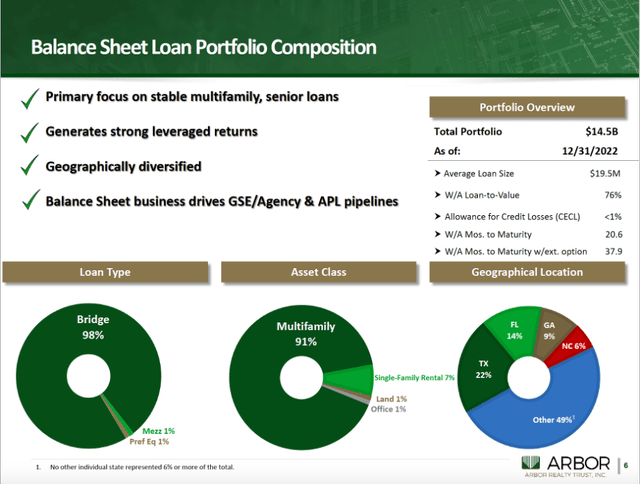

Still, I don't think the risk to Arbor Realty is significant because the composition of the loan portfolio looks fine with a weighted average maturity of 20.6 months and an extended option of 37.9 months. The weighted average loan to value is only 76% and the allowance for loan losses less than 1%. However, I do expect a higher provision for loan losses due to the looming recession.

Loan portfolio composition (Arbor Realty Trust 4Q22 Investor Presentation)

Dividends and Share Repurchases

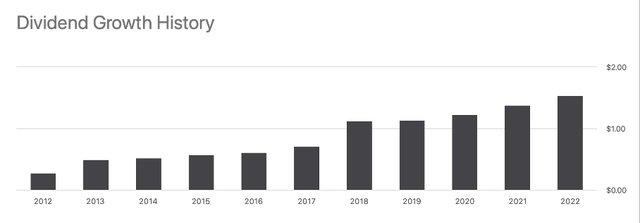

REITs must distribute at least 90% of their taxable income to shareholders by distributing dividends. Investors in Arbor Realty Trust receive a generous dividend yield of as much as 14%. Dividend growth has averaged 8% per year for the past 4 years. However, dividend growth appears to be coming to an end, as 3 analysts expect no increase in 2024.

Dividend Growth History (ABR ticker page on Seeking Alpha)

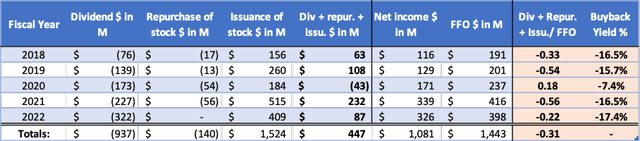

A closer look at the cash flow statements reveals that Arbor Realty raises money primarily by issuing equity, as many other REITs do. In an environment of high interest rates and high stock prices, it is beneficial to issue equity. This is because investors get more rental income at attractive financing.

Net income did not grow in 2022, nor did funds from operations. Growth appears to be temporarily stagnant. With total debt of $10 billion, I think the funds from operations of only $400 million is on the low side (factor of 25x). The risk is mainly in the bridge and mezzanine loans, in case of default this high leverage has negative consequences on the operating result. So there is quite a bit of risk.

ABR's cash flow highlights (SEC and author's own calculations)

We also see that Arbor Realty Trust is repurchasing shares. This is beneficial because it increases the probability of a share price increase and, with equal taxable earnings, also increases the dividend per share. In 2022 it did not repurchase any shares (the share price was all time high), but recently Arbor Realty Trust announced that it will repurchase $50 million worth of shares. I think management is making good decisions regarding capital management.

Valuation Is In Line With Its Average

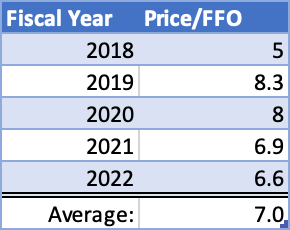

To get insight in its stock valuation, I use the price to FFO ratio for REITs. I compare the current ratio to the historical average to see if the stock price is attractive. I also look at the near future.

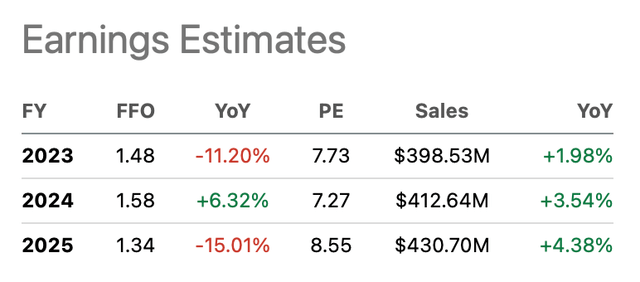

4 analysts have revised their earnings estimates upward and expect an FFO of $1.48 for fiscal 2023. With the current price, the price to FFO ratio is 7.7, just above the 4-year average of 7. Overall, I think the average ratio of 7 is attractive, but remember that there is quite a bit of risk involved in its business.

Price to FFO ratio (SEC and author's own calculations)

Looking at the near future, we see a mixed picture over 2024 and 2025. But note that 1 analyst has shared his insight on the earnings estimates for 2025, so I do not consider them relevant. For 2024, 3 analysts expect a small increase in FFO of about 6.3%, bringing the price to FFO to 7.3. This ratio is slightly higher than the 4-year average, and I think the stock is fairly valued.

Arbor Realty's Earnings Estimates (ABR's ticker page on Seeking Alpha)

Conclusion

Arbor Realty Trust is a mortgage REIT that has performed strongly over the past 10 years. The company posted strong results with a return on equity of 18% in the fourth quarter of 2022. The strong increase in earnings was mainly due to the sharp rise in interest rates. However, rising interest rates pose a risk to the company because of the rising cost of borrowing and this could also cause a downturn in the housing market. As a result, I think the housing market will shrink. This could negatively affect homeowners who can no longer pay their mortgages and are left with residual debt. Still, I consider this risk to be moderate for Arbor Realty.

The dividend yield is high at 14%, and the dividend has increased at an average annual rate of 8% over the past 4 years. Management deploys capital efficiently by issuing shares when the share price is high, and repurchasing shares when the shares are favorably valued. Currently, the management has announced a new share repurchase program. Looking at its stock valuation, we see that the stock's valuation is in line with its historical valuation. Arbor Realty Trust is worth buying because the potential risks are not (yet) material, the company is growing strongly, the stock's valuation is in line with the average, and management deploys its capital efficiently.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.