Union Pacific: A Great Company That Should Be On Your Watchlist

Summary

- Shares of Union Pacific are down more than 22% from their all-time high.

- Union Pacific is trading for a fair valuation and enjoys an almost monopolistic positioning.

- Investors should consider Union Pacific for long-term stable dividend growth.

ElsvanderGun

Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The industrial sector is one of the sectors I lack exposure to in my dividend growth portfolio. This is an exciting sector since the companies tend to be more cyclical. As the market fears a recession, companies in the industry might have a long-term opportunity as investors prefer safer, less volatile companies. In this article, I will analyze Union Pacific (NYSE:UNP), a railroad company I have owned for almost a decade.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company's fundamentals, valuation, growth opportunities, and risks. I will then try to determine if UNP stock is a good investment.

Seeking Alpha's company overview shows that:

Union Pacific Corporation operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, and other agricultural users, petroleum and liquid petroleum gases, and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

Fundamentals

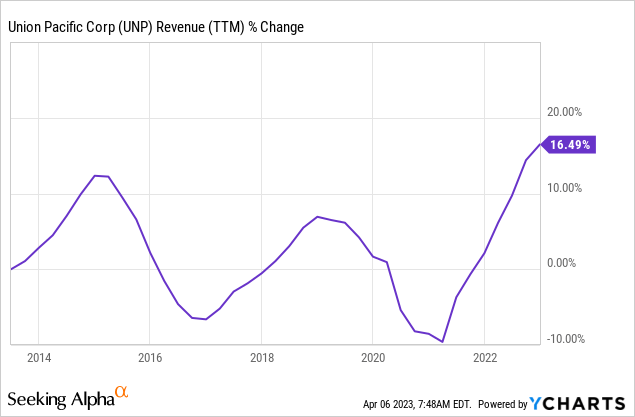

Revenues of Union Pacific have been up 16.5% over the last decade. The graph below shows the cyclical nature of the business. The company is growing sales by increasing transported volumes, raising prices, and building more railroad infrastructure. Due to its size, I believe it is unlikely that there will be an approved merger of Union Pacific, making inorganic growth less likely. In the future, as seen on Seeking Alpha, the analyst consensus expects Union Pacific to keep growing sales at an annual rate of ~2% in the medium term.

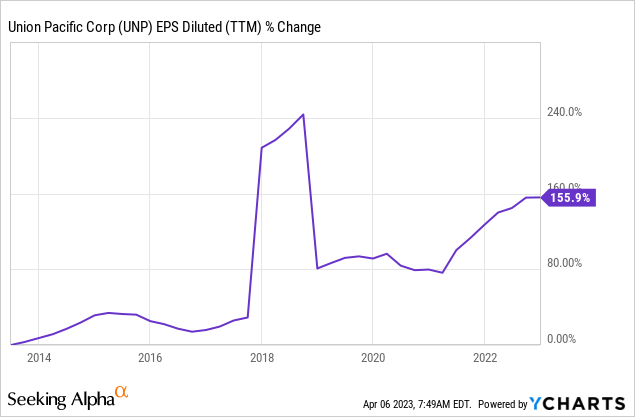

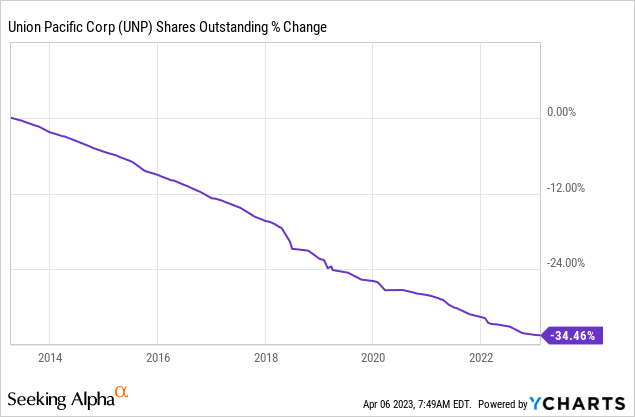

The EPS (earnings per share) increased faster over the same period. EPS is up 156% in a decade, and this is due to a combination of sales increase, efficiency improvement, which lowered costs, and share purchase plans that are constantly executed. In the future, as seen on Seeking Alpha, the analyst consensus expects Union Pacific to keep growing EPS at an annual rate of ~7% in the medium term.

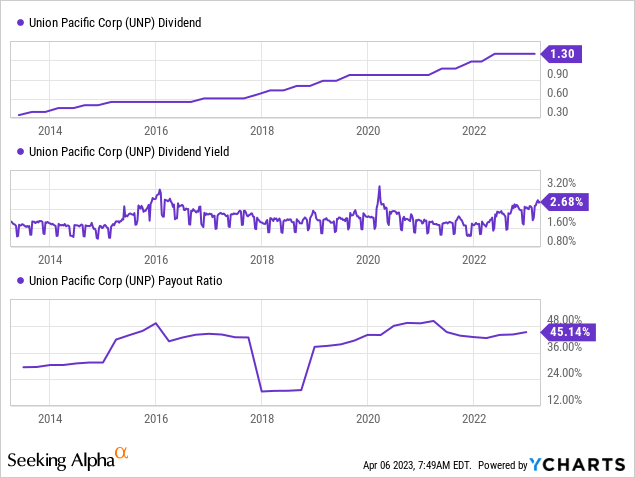

The company has raised dividends every year, sometimes several times a year, for the past 16 years. Moreover, the company has not reduced the dividend for 24 years. The dividend is safe with a payout ratio below 50%, and the current yield is decent at 2.7%. The dividend may seem disappointing compared to treasuries, yet it comes with good growth potential as the five years growth is double digits. Investors should expect mid-single digits growth rate, which will outpace inflation in the medium term.

In addition to dividends, companies tend to return capital to shareholders via buybacks. These share repurchase plans support EPS growth by lowering the number of outstanding shares. Over the last decade, the number of shares outstanding has decreased by almost 35%. It helped EPS growth, maintained a higher share price, and allowed the company to return more capital to its shareholders. Buybacks are highly efficient when shares are cheap, and if the valuation becomes attractive, they will further increase the EPS.

Valuation

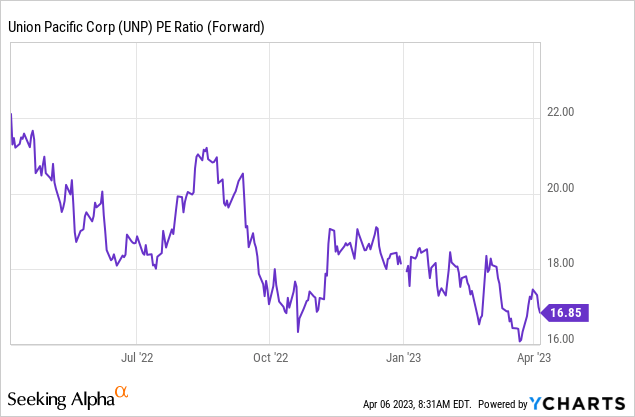

The P/E (price to earnings) ratio of Union Pacific, when using the 2023 EPS estimates, stands at 16.85. This is not a low valuation but decent considering that the company is growing. Over the last twelve months, as EPS has grown and the share price plummeted, the P/E ratio decreased significantly to a point where it is almost at its lowest point over the last year.

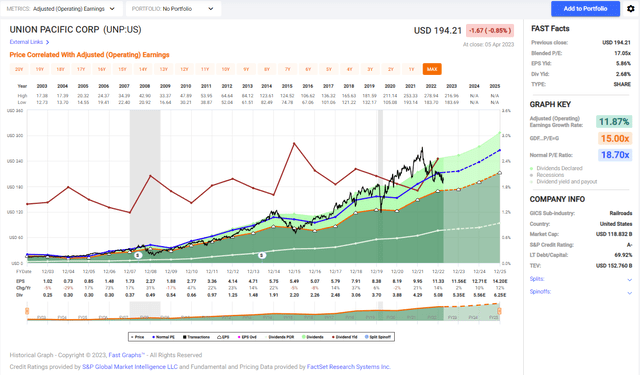

The graph below from Fastgraphs also shows that the shares of Union Pacific are fairly valued. Over the last twenty years, the average P/E of the company was 18.7, which is higher than the current P/E ratio. However, during that time, EPS has grown at a CAGR of 12%, faster than the current estimates. Therefore, the shares, in my opinion, are not cheap, but they are decently valued when considering the growth rate.

To conclude, Union Pacific is enjoying solid fundamentals. The company grows its sales over the long term, translates sales growth into EPS growth, and rewards its shareholders with dividends and buybacks. This great package comes at a decent valuation as the shares are trading for a P/E ratio below the average P/E ratio we have seen this year and in the past two decades.

Opportunities

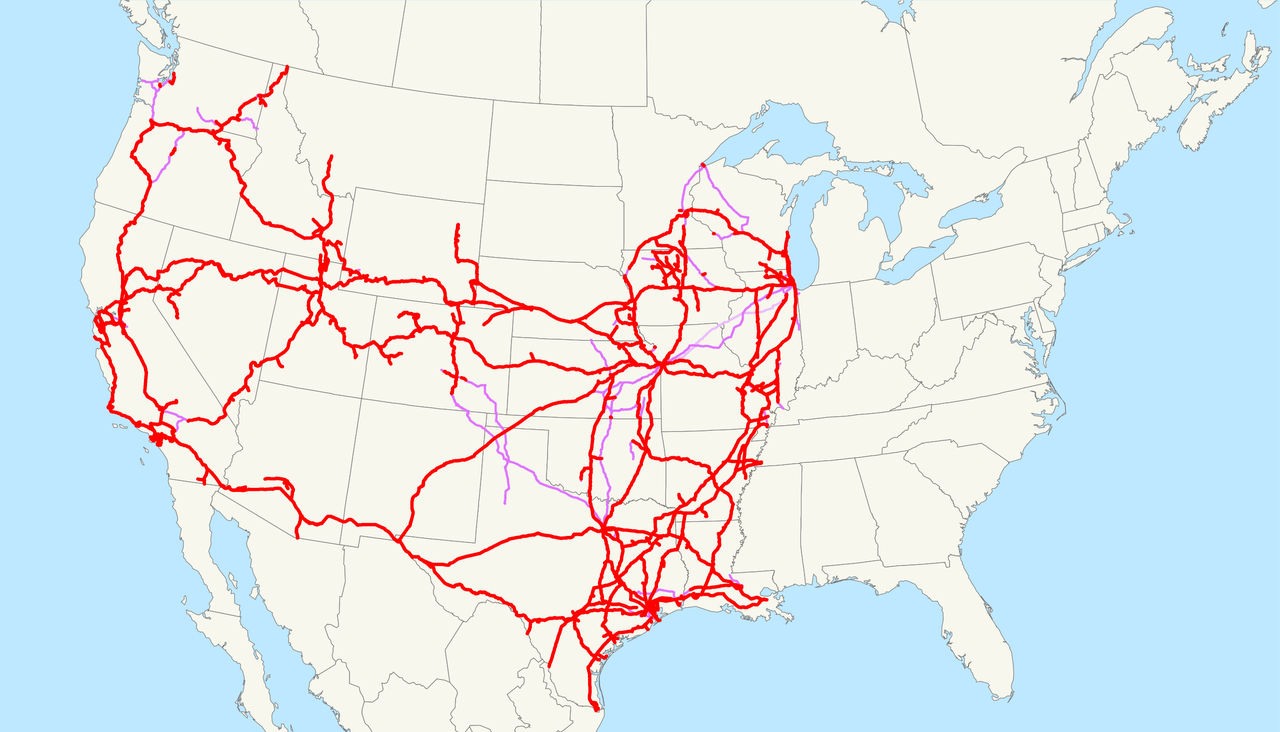

The railroad business is almost a regional monopoly. Union Pacific has over 32,000 miles of roads that it owns and operates. Therefore, only its trains can use the infrastructure that connects strategic areas in the country. Consequently, it is a highly convenient option for companies that need shipping services across the country as it enjoys such a significant span. Moreover, once the infrastructure is in place, there is a limited need for additional investments.

Therefore, since the network is so vast, there are incredibly high barriers to entry for competitors. A company wishing to compete with Union Pacific must acquire significant land and then build an extensive network of railways. It is a costly endeavor and is practically impossible. Therefore, the company enjoys limited competition as trains are still the backbone of transportation worldwide.

In addition, the company is working on improving its efficiency. It will do so by reducing costs and acquiring more technology, allowing the company to save money on workforce and maintenance. The expenses have surged lately, and the management has stated in the Q4 earnings report that it intends to improve the efficiency, and this is a short-term opportunity as if it succeeds, the EPS will increase.

Risks

The 2023 Ohio train derailment in East Palestine may have hurt the short-term sentiment toward railroad companies. The accident happened to Norfolk Southern (NSC), yet investors may prefer to invest their money in different industries until a possible public rage passes away. In addition, this incident may hurt railways other than Norfolk Southern as the regulatory pressure may increase. Regulators' demand may increase expenses and hurt the aspiration of Union Pacific to lower its costs.

The short-term operating ratio is increasing even before the possible regulatory demands. In Q4 2022, the operating ratio stood at 61%, 3.6 points higher than in Q4 2021. The company is already dealing with higher expenses for fuel and workforce, and it also deals with softer demand and harsher weather conditions in Q4 2022. Therefore, this pressure may continue.

A recession is another medium-term risk for Union Pacific. As the revenues graph above shows, the company's sales are cyclical. Union Pacific is already dealing with softer demand from a weaker economy. Yet it will probably still grow its sales in 2023, according to the analysts covering the company. If we enter a recession, we might start dealing with a weaker economy, lower sales, and, consequently, lower EPS for Union Pacific.

Conclusions

Union Pacific is a fantastic company. The company offers investors solid fundamentals across the board. It also returns significant amounts of cash to shareholders. The company is trading for a decent valuation, in my opinion. Moreover, while it has some short-term challenges, the long-term prospects are solid as there will be long-term demand for transportation, especially for industrial and agricultural products.

The risk of recession implies that we may find the company trading for a lower price in the short term. Lower guidance may affect it, and investors should capitalize on share price weaknesses. At the moment, shares are a Hold, in my opinion. However, investors may start a small position to gain exposure to the industry. The shares will be attractive if the forward P/E ratio reaches 14-15.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNP, NSC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.