Easter Is Here: 2 Crude Stocks For Your Basket

Summary

- Surprise! OPEC+ cuts oil production by nearly $1.2B barrels per day, which presents opportunities for investors willing to consider risk and stocks in oil and gas.

- From trough to peak, energy (XLE +13%) continues to outperform over the last year, and dividend-paying energy stocks are a great way to hedge against inflation.

- In light of Fed hikes and inflation, oil and gas stocks allow investors to capitalize on costs that can be passed to consumers.

- Despite more pain at the pump potential, I have two crude oil stocks with Strong Buy quant ratings and possible tailwinds from the OPEC announcement to consider in gassing up a portfolio.

Nuthawut Somsuk/iStock via Getty Images

Spring Brings Crude Futures & Backwardation

When the current price of oil is more than the prices trading in the futures markets, that’s backwardation. And boy, did OPEC’s announcement to cut oil production by nearly $ 1.2B barrels per day convince the markets that oil prices would surge. Goldman Sachs initially forecast that oil could rise as high as $107/barrel on the news but has since revised estimates to $95/barrel.

Panicked investors following the banking crisis are on alert. With fast-growing oil demand, WTI prices that were trading below $80, a fall from their $122/barrel highs in June of 2022, are on the rise. This news prompted Jeff Currie, Goldman Sachs Global Head of Commodities Research, to say, “You are buying the dip at this point…I have never seen a sharp market sell-off but retain a bullish structure.” When exciting opportunities present, and they’re supported with strong fundamentals, in the words of 50 Cent and the title of fellow Seeking Alpha author David Alton Clark, Get Rich or Die Tryin’! I have two top dividend stocks to fuel portfolios.

Top 2 Dividend Stocks to Gas Up Your Portfolio

Big-name oil and gas stocks that offer dividend safety and regular payouts give investors an opportunity for steady cash flow to offset portfolio downside. Here are two of my top oil and gas picks following OPEC’s surprise announcement of production cuts.

1. Marathon Petroleum Corporation (NYSE:MPC)

Market Capitalization: $55.57B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 4/5): 3 out of 248

Quant Industry Ranking (as of 4/5): 1 out of 23

Given its factor grades, Marathon Petroleum Corporation is one of my top quant-rated companies, which has resulted in strong demand. As an oil and gas giant, it’s continued to pay dividends amid the surge in fuel. With OPEC’s drop in fuel production, the question is: Will it lead to increased demand? Bullish momentum, a solid track record, consecutive earnings beats, and undervaluation make Marathon a stock worth portfolio consideration for a portfolio.

Marathon Petroleum Stock Momentum & Valuation

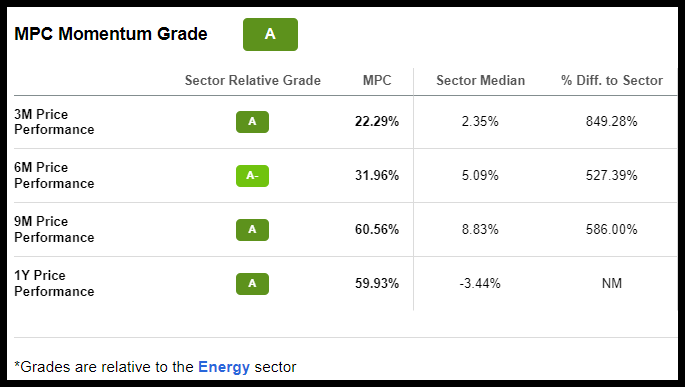

On a longer-term uptrend, shares are moving above their average trading volume. As evidenced in the table below, MPC outperforms sector peers quarterly.

Marathon Petroleum Stock Momentum Grade (SA Premium)

Showcasing grade-A Momentum that boasts a six-month +527% difference to its sector and a 586% nine-month difference in price performance, MPC is proving why YTD, the stock is up ~20% and over the last year +56%.

Following the 2018 acquisition of Andeavor, MPC is the largest U.S. refiner, leveraging a geographically diverse portfolio of crude supply from North America. While OPEC’s cut in production could spell a jackpot for those wanting to optimize crude supplies from North America, MPC’s discounted valuation leaves room for upside.

Marathon’s forward P/E ratio trades nearly 33% below its sector peers. In addition to a trailing PEG ratio at a -93% difference to the sector and consecutive earnings beats to add fuel to the fire, MPC’s growth and profitability have allowed it to consistently pay dividends for more than a decade, offering A+ dividend growth and strong dividend safety to its shareholders.

Marathon Petroleum Stock Growth & Profitability

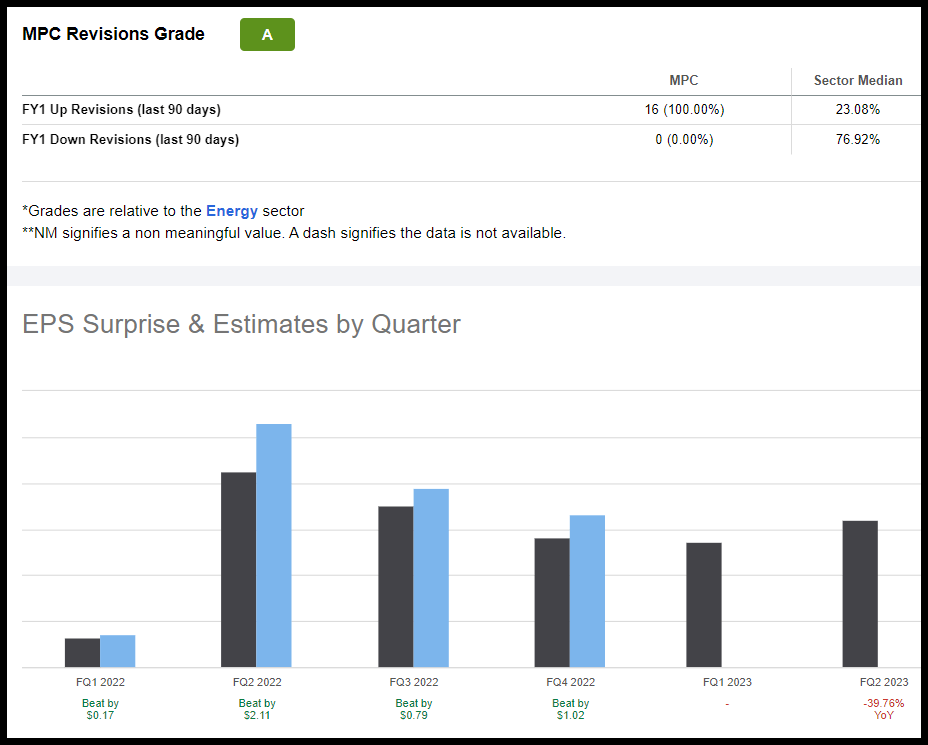

Marathon is a favorite, as evidenced by the 16 FY1 analyst upward revisions over the last 90 days. With an overall A revisions grade, not only did MPC consecutively beat earnings by closing its lower-quality refineries to cut costs, the company is in a better competitive position to invest in strategic initiatives.

Marathon Petroleum Stock Revisions & EPS (SA Premium)

With an EPS of $6.65 that beat by $1.02 and revenue of $40.09B that beat by more than 12% Y/Y in a challenging environment where oil demand is threatened and crude costs fell from highs, MPC’s ability to deliver returns on capital in excess of the cost of capital is tremendous. MPC has capitalized on low long-term natural gas prices to increase margins and capitalize on spreads between U.S. refineries versus European and Asian refineries, which is why MPC is a Strong Buy consideration for portfolios, along with my next pick.

2. Valero Energy Corporation (NYSE:VLO)

Market Capitalization: $46.87B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 4/5): 7 out of 248

Quant Industry Ranking (as of 4/5): 3 out of 23

Valero Energy Corporation is one of my Top 5 Stocks to Own in the S&P 500, a dividend aristocrat, and a top-notch oil and gas refining company. Capitalizing on the manufacture, marketing, and distribution of fuels and petrochemical products worldwide, VLO is favorably positioned to benefit from the supply-demand imbalance after OPEC’s announcement to cut production.

Recently awarded a $905.83M U.S. Defense Agency contract, VLO seeks permission from the Biden Administration to import Venezuelan crude oil. An approval could prove advantageous given OPEC’s surprise production cuts, as Valero, among other energy companies, can fuel up to meet demand, despite being undervalued.

Valero Energy Stock Valuation & Momentum

Trading at a discount, VLO’s forward P/E ratio of 5.49x is a 37% discount to the sector, and A+ trailing PEG ratio highlights a discount of more than 92%. With free cash flow to boot and oil prices rising, although energy stocks experienced a pullback from 2022 highs, VLO is set to take advantage of a surge in WTI prices from the low $70s to triple-digits.

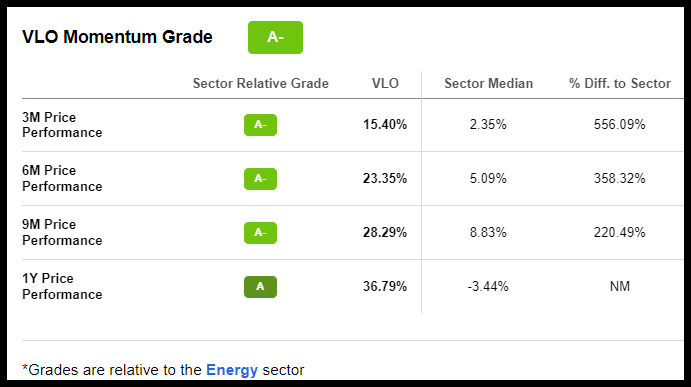

Already on a longer-term uptrend, VLO is outperforming sector median peers quarterly. A- Momentum is supported by second and third-quarter earnings that exceeded market expectations.

VLO Stock Momentum Grade (SA Premium)

Although VLO’s Q4 revenues missed, Valero remains well-positioned to capture the upside in 2023. Its growth is focused on continuing investment and procuring assets in the rich Permian Basin, contributing to substantial profitability.

Valero Energy Stock Growth & Profitability

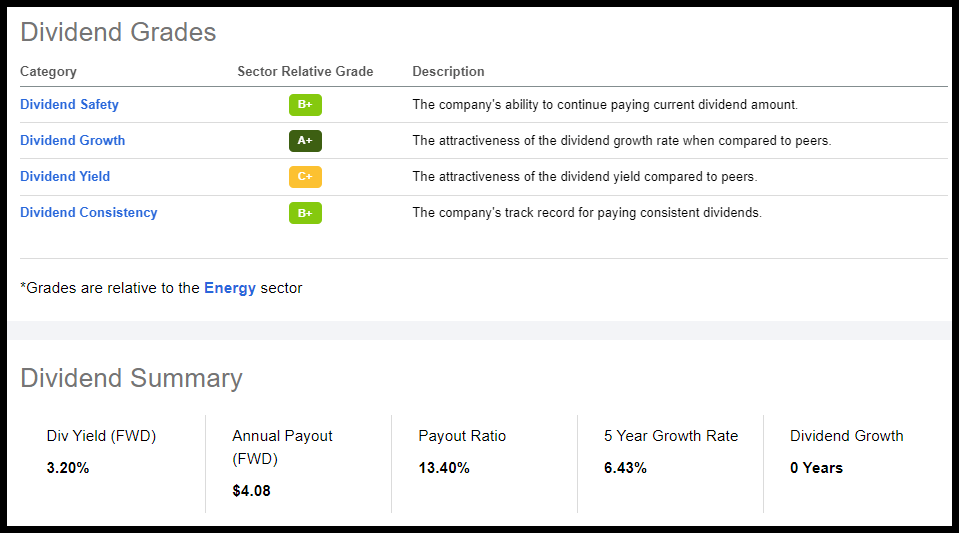

Dividend aristocrat Valero Energy Corp. has a +25-year record of paying its shareholders dividends. With a strong dividend scorecard, not only is its 3.20% forward dividend yield modestly putting a dent in inflation, the company’s ability to sustain and grow its dividends is solid.

VLO Stock Dividend Scorecard (SA Premium)

VLO produced record margins and earnings in 2022, unlikely to be matched in 2023. However, year-over-year EBITDA Growth is +298%. VLO’s operating cash flow is fantastic, and the company has current cash on hand of nearly $13B. Reinvesting into its business which is focused on refining and marketing operating income, VLO has performed well.

Despite a 16.27% Q4 revenue miss, Valero's EPS of $8.45 beat by $1.20. Valero refineries in Q4 were operating at 97% capacity, heights not seen since 2018. In addition, VLO reduced its debt by $442M while maintaining the cost advantages of light crude oil and the ability to process heavy sour crude. Given the backdrop of OPEC and expectations of increasing crude prices, VLO and MPC may see increases in volumes that can offer attractive returns to maintain their dividends, which is why I selected these Strong Buy-rated stocks with tremendous fundamentals to consider. But the macroeconomic environment is challenging. There are fears of recession, volatile price swings in oil and gas, and some risks involved.

Risks to Investing in Oil and Gas Companies

The complexities of the oil and gas business and the current environment bring risks. The most obvious risks on the heels of the latest OPEC news include headwinds in the geopolitical form of cuts to production. Saudi Arabia’s message this weekend involves a plan to cut oil production, which likely leads to raised prices, hence:

Supply & Demand Risks - Interruption to supplies (like OPEC’s announcement) can result in more demand, pushing up prices. Demand destruction results from higher prices due to restricted supplies and consumers changing their behavior. In the case of energy, more pain at the pump may spell problems for the Fed’s attempt at taming inflation.

Price Volatility and Costs - Supply and demand price changes over the last few years have experienced extreme highs and lows. Depending on the macroeconomic and political environment, short and long-term oil and gas demands can change, along with operational costs that can eat into a project and overall picture.

Geological Risks - Extraction difficulties or reserve estimates less than anticipated can be costly.

ESG Risks - Reducing the carbon footprint may lead to carbon taxes on emissions associated with energy operations. These costs will likely be passed on to consumers. And there’s always the risk of a spill.

Without risk, there’s no reward. In my last article, Gas Injection: Cenovus and Suncor Erupt, I mentioned there was a time that I believe energy stocks could have been the next tech stocks. Given the demand and resulting price surge they experienced, from a value investing point of view, energy companies like MPC and VLO are not only high-quality, when they trade at a discount and have diversified product offerings that generate profits throughout industry cycles and offer shareholder value for decades, why not add them to your basket of stocks? Consider MPC and VLO for a portfolio that are fundamentally strong stocks that are Strong Buy-rated according to Seeking Alpha’s quant.

Conclusion

The threat of a surge in oil prices after OPEC’s surprise production cuts, the tightening of monetary policy, and inflation are creating market volatility. In an environment where many resources are already in short supply, energy experiences enhanced volatility, which could prove positive for oil and gas stocks.

Energy stocks performed tremendously last year, especially amid the energy crisis in Europe and despite the Fed’s campaign of interest rate hikes. Speculation on whether the Fed would be less aggressive in hikes may have been curbed, as OPEC’s surprise production cut is likely to push the Fed to take rates hiring, which could force a recession in 2023 or 2024.

The stocks I recommend, MPC and VLO, are legacies, and have seen it all. Rated Strong Buys based on our quant ratings, each of these energy picks maintains growing earnings to pay their hefty dividends, they have solid profitability to offer a hedge against the inflationary environment, given the inherent nature of their businesses allows them to pass on rising fuel costs to customers. Whether fuel prices will again skyrocket remains to be seen, but my picks are great buys with quality characteristics, long-term momentum, and in demand. If you’re not sold on these energy giants, consider other Top Energy Stocks or create your list using Seeking Alpha’s screener tool.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.