Elbit Systems: 2023 Turnaround Starts With The Record Order Backlog

Summary

- Elbit Systems reported its Q4 results, highlighted by ongoing supply chain disruptions pressuring margins.

- New manufacturing sites to add capacity are expected to drive a new wave of growth later this year.

- The company is well-positioned to capture demand for weapons systems as the U.S. and Europe increase their defense budgets.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

Petrovich9/iStock via Getty Images

Elbit Systems Ltd. (NASDAQ:ESLT) is recognized as Israel's largest defense contractor and a major supplier to U.S. and allied military forces. The company has a leading position across various tactical equipment categories with critical components for fighter jet programs, UAVs, and munitions systems.

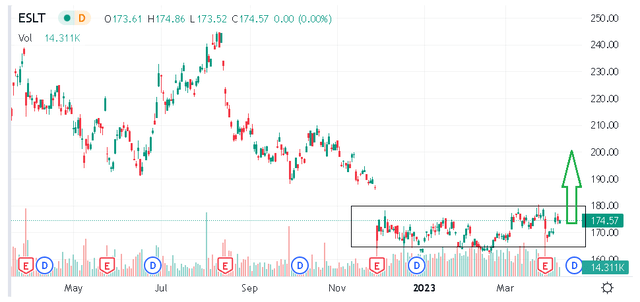

Despite a solid history, the challenge in 2022 was dealing with supply chain disruptions and inflationary cost pressures. Indeed, the company recently reported its latest quarterly result, highlighted by soft margins and disappointing growth. Shares of ESLT are down 20% over the past year.

Still, the attraction here is that conditions can improve going forward based on a record order backlog that will likely translate into a more robust financial performance. Elbit is well-positioned to benefit from increasing defense budgets in both the U.S. and Europe supporting a positive outlook. ESLT is a quality stock we see rebounding from here.

ESLT Earnings Recap

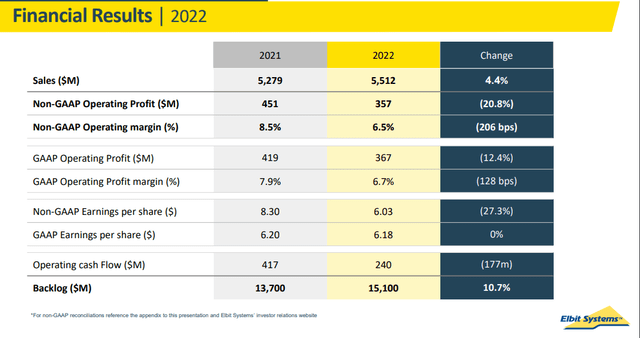

ESLT reported Q4 non-GAAP EPS of $1.68 which missed the consensus estimate by $0.18 and was also down from $2.14 in the period last year. Q4 revenue at $1.5 billion was 1% higher year-over-year, and slightly above estimates. The earnings headwinds are also reflected in a lower Q4 non-GAAP operating margin of 6.8%, down from 8.0% in Q4 2021.

Management is citing the timing of large deliveries for some of the quarterly volatility, along with a decline in sales from the company's smaller medical devices segment. For the full-year 2022, revenues reached $5.5 billion, up 4.4.% y/y, while EPS of $6.03 was down from $8.30 in 2021.

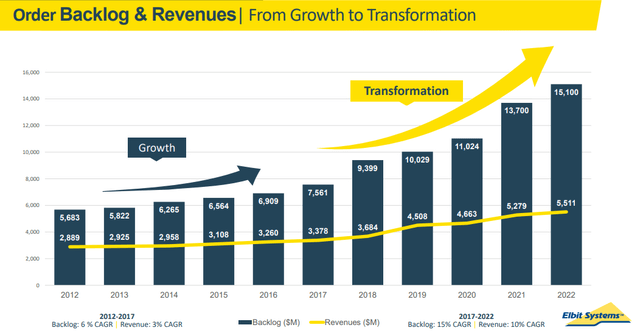

As mentioned, one of the more positive developments has been the growth in the order backlog, climbing 10% from last year to $15.1 billion. The company expects approximately 60% of that total to be captured as sales for 2023 with the remainder through 2025.

Several reported contract awards including a recently disclosed $280 million munitions and defense electronics deal over the next three years mean the backlog will continue to grow. This supports visibility as it relates to cash flow and growth potential.

A large part of the business is related to airborne systems and "C4ISR" applications covering Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance solutions. Keep in mind that Elbit also includes the U.S.-based subsidiary "Sparton Corp", specializing in subsea and marine technologies, as a recent growth driver.

While Elbit does not provide financial guidance, the tone management has projected is one of optimism. A major theme for the company is its progress in expanding production capacity with the building of new facilities in several countries. This was a topic of discussion from the earnings conference call.

Construction of our new ammunition production site in Ramat Beka is progressing on schedule and should be up in running for 2024. This new state of the art facility should benefit from going demand or munition. We have invested in new production facilities across Europe, in the U.K, Germany and Romania. In 2023, we plan to open a new ground combat vehicle assembly and integration center in Charleston, South Carolina.

Finally, we can mention that Elbit ended the quarter with $211 million in cash against approximately $1.3 billion in total debt. Considering the company generated more than $500 million in EBITDA over the past year, a net leverage ratio of around 2x is stable in our opinion. The company pays a quarterly dividend of $0.50 per share that currently yields approximately 1.2%.

Is ESLT a Good Stock?

It's been just over a year since the start of the Russia-Ukraine conflict, which has worked to shake up the entire defense sector. The building narrative is that while the first stage of the war relied on existing munitions supplies and stockpiled inventory, the demand impulse from new orders is still coming as a 2023 and 2024 story.

For Elbit Systems, the sense is that the conflict shines a spotlight on its portfolio of products that will likely continue to be in high demand for the foreseeable future. These include not only high-profile drones and UAVs, but also loitering munitions, long-range artillery systems, ammunition, and technology platforms.

The growth runway is reflected in an expectation for increasing defense spending from not only the U.S. but also NATO forces that will likely extend over the next decade.

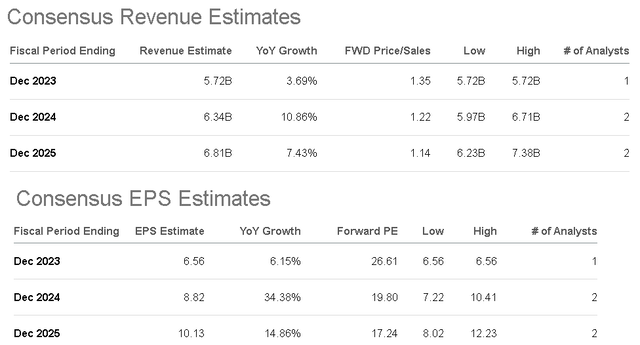

According to the consensus estimates, 2023 is set to be something of a transition year for Elbit with sales and earnings growth just in the mid-single-digits. More favorable is the outlook for 2024 where revenue growth rebounds higher towards 11% growth while EPS accelerates higher towards $8.82, 34% above the current 2023 forecast. This would be accomplished by expanding manufacturing capacity as the new facilities come online, alongside the rollout of next-generation products.

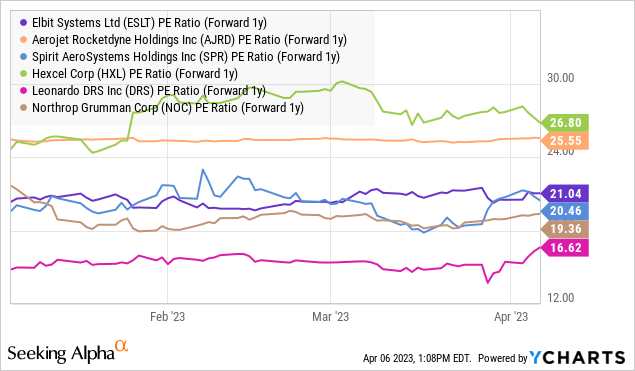

In terms of valuation, ESLT is trading at a 1-year ahead earnings multiple on the current consensus 2024 EPS of around 20x. This level is otherwise in-line with other aerospace and defense peers. That being said, getting into 2024, we'd make the argument that shares are undervalued based on the stronger growth momentum.

ESLT Stock Price Forecast

We rate ESLT as a buy with a price target for the year ahead at $210 representing a 24x multiple on the current fiscal 2024 consensus EPS. Ultimately, we believe the current market estimates are too low, setting ESLT up to outperform expectations.

The way we see it playing out is that a string of stronger earnings reports over the next few quarters, capturing firming margins based on easing supply chain disruptions can help boost sentiment towards the stock. Updates on the company's new facilities build-out along with announcements of new major orders can work as a catalyst for the stock.

On the downside, it will be important for shares to hold the recent low of $160 as an area of support. Weaker-than-expected results or some setback to its R&D programs would open the door for another leg lower. Monitoring points here include the operating margin and cash flow trends.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ESLT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.