Dr. Martens: Challenges Ahead

Summary

- Dr. Martens has seen a significant come-off in price in the past few months, which now makes its P/E look incredibly attractive compared to the consumer discretionary sector.

- However, the company faces softer demand and operational challenges that have also been a drag on its performance. This year posts risks too, with a high recession probability in its key markets.

- With its price already sluggish, this is probably not the best time to buy Dr. Martens. I reiterate a Hold rating on it.

- Looking for more investing ideas like this one? Get them exclusively at Green Growth Giants. Learn More »

jewhyte/iStock Editorial via Getty Images

Since I last wrote about the British boot maker Dr. Martens (OTCPK:DOCMF) its price has tumbled dramatically by over 30%. Even at that time it looked fairly valued prompting me to put a Hold rating on it despite its otherwise good financial performance.

With a fall in price, however, its trailing 12 months price to earnings ratio at 8.9x makes it more attractive than earlier, since it is now far lower than the 15.1x for the consumer discretionary sector as a whole. To recap, in mid-January, it was at 12.8x, not significantly lesser than the sector (see chart below). At the same time, its price-to-sales (P/S) is actually higher at 1.7x compared to 0.8x for the sector. I normally find that the price is better correlated with the P/E, but the P/S is worth considering too. Here I take a closer look at how the story has developed for Dr. Martens in the past few months and whether that calls for a change in rating.

P/E ratio (Source: Seeking Alpha)

Weaker financials expected

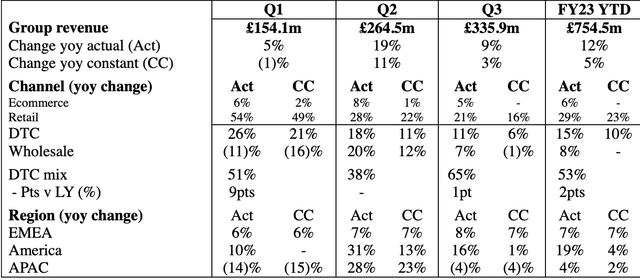

A few days after I wrote about the company, it released its third-quarter (Q3 FY23) trading update, which was not entirely good news. Year to date [YTD] its revenues grew by 12% year-on-year (YoY). This is disappointing since it is it shows a slowing down from the 13% growth seen for the first half of the year and clearly indicates that the company will not be able to meet its earlier full-year expectation of "high teens growth". In fact, in line with its performance so far, Dr. Martens now expects revenue growth of 11% to 13% for FY23 which is a decline of 6 percentage points on average from the 18% growth seen last year.

This is down to slower than expected growth in Q3 FY23 to 9% due to "slower than anticipated Direct-to-Consumer [DTC] growth in America and the impact from significant operational issues at our new LA distribution centre", as per the company.

The DTC business covers e-commerce and retail and contributes to almost half the company's revenues. It grew by 11% in Q3 FY23 which isn't too bad when we look at it in isolation. However, it is a significant come-off from the 33% increase seen last year at this time. Further, the company noted in its last year's statement that DTC growth is typically the highest in Q3 but that has not been the case this year, indicating a slowing down in demand. For context, DTC growth YTD is a higher 15%.

Financial Update (Source: Dr. Martens)

On issues at the LA distribution Centre, the company faced the challenge of excess inventory, which has limited its ability to meet the demand in America. At the time when I last wrote about it, its high inventories already stood out, but at that time for good reason, since the company wanted to be well prepared for a potentially strong Q3 in the past year. However, it appears to have turned into a case of over-preparation at a time of relatively weak demand, which was compounded by other operational challenges.

However, the company does have a plan to deal with the situation. It opened three temporary warehouses near the LA DC, started an extra shift there and accelerated its plans to reconfigure another warehouse on the east coast. The damage is done, though. As a result of this, the company now expects not only a hit to the revenues but also a decline in EBITDA. It now expects EBITDA to be between £250-£260 million compared to £263 million last year.

The upside

With this as the background, it is hardly surprising that Dr. Martens has seen a steady slide in price over the past few months. However, it is not as if there are no upsides in the FY24 financial year. For one it still expects constant currency revenue growth of "mid to high single digits", which could be higher than the 5% YoY growth seen YTD. At worst, it would see flat revenues.

Next, the recovery in China's economy can offer some support. With the lockdown now over in the country, the market has started booming again as became visible recently with retail sales coming in at the fastest since August 2022 during the January to February period. Growth in the company's APAC market has been slow at 4% YoY YTD, compared to 19% in America and 7% in EMEA. In Q3 FY23, the region actually posted negative growth (see table above). Even though its share in FY22 was down to just 14% in revenues, the improvement in the China market could still make some difference.

The risks

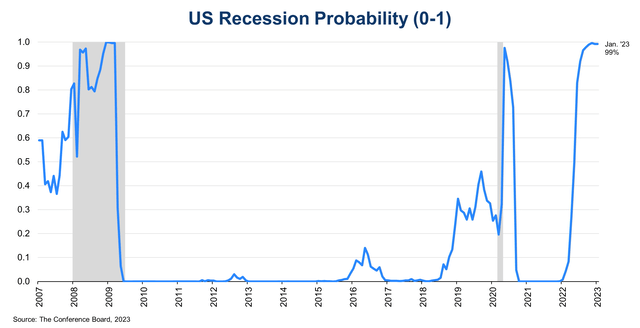

However, there are also persistent macro risks. The biggest of these is the potential recession expected in its massive American market. The Conference Board sees a 99% probability of recession in the US (see chart below), with zero or negative growth expected in the first three quarters. Similarly, the outlook for Europe is not exactly bullish either.

US Recession Probability (Source: The Conference Board)

The risks might not turn out as challenging as now expected, especially if inflation starts coming off faster than anticipated. At the same time, we can reasonably expect some uncertainty on the demand front for both Dr. Martens' European and US markets. That EMEA and America make up 86% of the company's sales put the potential risk in perspective.

What next?

All in all, though, the company is still not doing too badly. But there are macro risks ahead, which just cannot be overlooked. This year could be unfavourable for it with a recession risk and still elevated inflation in its big markets. A slowing down in its revenue growth is already becoming visible, as is the shrinking in its profits. It expects a decent increase in revenue in FY24 but I would not bet on it, not after the downgraded guidance this year.

There can of course be support from a recovery in the China market and also if inflation comes off faster than expected elsewhere. But APAC remains a relatively small contributor to its revenues, and it remains to be seen if inflation will indeed decline at any speed anytime during the year.

Keeping this in mind, I am retaining my Hold rating on Dr. Martens. Sluggish times in the business cycle are typically difficult for discretionary goods companies, and it appears to be no exception so far. But as the cycle starts turning later in the year, I expect that there could be a buy case of it then.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.