Titan Machinery: No Buying Opportunity Despite Solid Annual Results

Summary

- Titan Machinery posted solid Q4 FY23 and FY23 results.

- The share price of TITN has fallen more than 40% in less than one month.

- They are undervalued, but there are a lot of challenges that they might face in the coming times.

- I assign a hold rating on TITN stock.

Sam Edwards/iStock via Getty Images

Titan Machinery (NASDAQ:TITN) operates in three segments: construction, agriculture, and international. It sells new and used agricultural and construction equipment. In addition, they provide repair and maintenance services and sell replacement parts. It operates in the United States and Europe. TITN posted its Q4 FY23 and FY23 results. I will analyze its financial performance and give my opinion on its future growth potential in this report. I believe it is too risky to invest in TITN right now. Hence, I give a hold rating on TITN.

Financial Analysis

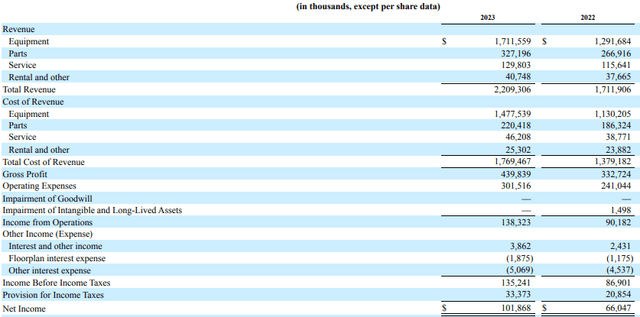

TITN recently announced its Q4 FY23 and FY23 results. The revenue for Q4 FY23 was $582.9 million, a rise of 14.8% compared to Q4 FY22. I believe the main reason behind the rise was strong revenue growth in the agricultural segment. The revenue from the agricultural segment increased by 27.3% in Q4 FY23 compared to Q4 FY22. I believe the three acquisitions they made positively impacted the agricultural segment; the three acquisitions that outperformed were Jaycox Implement, Mark’s Machinery, and Heartland Ag Systems. The strong organic growth also positively impacted the revenue growth in the agricultural segment. I think the acquisitions and strong organic growth were the primary drivers of revenue in the agricultural segment. The net income for Q4 FY23 was $18.1 million, a decline of 19.2% compared to Q4 FY22. I believe the major reason behind the decline was underperformance in the construction and international segments and increased operating expenses. I think the operating expenses increased in Q4 FY23 due to the inclusion of expenses related to their acquisitions.

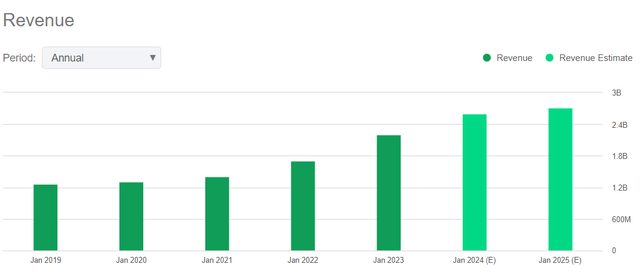

The revenue for FY23 was $2.2 billion, a rise of 29% compared to FY22. I think the strong performance in the equipment, parts, service, and rental businesses was the main reason behind revenue growth. The revenue from equipment, parts, service, and rental businesses grew by 32.5%, 22.6%, 12.2%, and 8.2%, respectively, in FY23, compared to FY22. The net income for FY23 was $101.8 million, a rise of 54.2% compared to FY22. In my opinion, the financial performance of TITN in FY23 was excellent; their revenues and net income grew significantly. A favorable farm economy boosted the revenue growth in the agricultural segment, which in my opinion, was the main reason the company was able to post record revenue in FY23.

Technical Analysis

TITN is trading at the level of $27.7. TITN stock refused to slow down last year in July, trading at $22 and reaching $48 in March 2023. If we look at the chart, we can see that the stock has recently fallen below its 200 ema, which is a bearish sign and might also be a sign of a trend reversal. The stock is showing weakness and is continuously trading below its 200 ema, which shows that the bull run might be over. The next support zone is at $22, and looking at the price momentum, I believe there is a high chance that, in the coming times, the stock might reach $22. So, I believe one should not enter the stock at current levels as I believe the stock might fall further.

Should One Invest In TITN?

The revenue estimate for FY24 is around $2.6 billion, which is 17.7% higher than FY23 revenue. I believe the main factor behind the revenue growth for the company in FY23 was a high farmer income and a favorable farm economy. The record farm income in 2022 was due to high prices of commodities and yields. But I believe the company might not be able to enjoy high farm income in 2023 due to many commodities and yields price having fallen due to recessionary fears and rate hikes by central banks. So I believe farm income in 2023 might remain low compared to 2022. Still, I think it will remain above the historical averages. So I think revenue growth in the agricultural segment might not be as high as in FY23. One more point bothers me if we look at the share price of TITN; despite posting solid annual results, the share price has fallen more than 40% in less than one month. Is the sell-off due to recessionary fears, or is something internally wrong in the company that we don’t know of, causing the sell-off because a stock is 40% down in under a month? This doesn’t happen often. So, I believe one should stay away from the stock for now and let all the headwinds pass. Because with time, we can get a clear picture of the situation, but even if we assume that there is nothing wrong internally in the company still, there are several macroeconomic headwinds currently that might hamper its revenue growth in FY24. In Q4 FY23, it faced supply chain constraints, and they expect that the supply chain issue will affect the company in FY24 to some extent. So I believe they might face difficulties in achieving the revenue targets. Considering all the factors, I believe one should not make any new buying positions in the stock and hold it for now.

After talking about the downside risks, I want to put forward some of the points; if it went right, then it could potentially cause the share to increase. The management has adopted the acquisition strategy To grow the business; in the last 14 months, they have added 22 new stores location. Last month they acquired assets of Pioneer Farm Equipment; this acquisition will add five Case IH agricultural dealerships. These dealerships are located in southeastern Idaho, which will help them expand their business and extend their services to the local growers and commercial applicators of Idaho. If the company successfully integrates its acquisitions into its business, then it might boost its revenue growth, and the company might post solid quarterly results in the coming times. This could result in the share price of TITN surging. Although this is an assumption, I still believe there are more downside risks than upside opportunities.

Now talking about its valuation. I will use PEG and P/E ratios to judge its valuation. The PEG ratio is calculated by dividing P/E by the earnings growth rate. TITN has a PEG (FWD) ratio of 0.23x compared to the sector ratio of 1.54x. The Price/Earnings ratio is calculated by dividing a firm’s share price by EPS. TITN has a P/E (FWD) ratio of 5.72x compared to the sector ratio of 16.34x. After looking at both ratios, I believe they are undervalued.

Risk

The equipment market can be severely disrupted. Its equipment profit margins can be put under strain by the overproduction of equipment by one or more manufacturers or a sudden decline in equipment demand. In addition, customer leasing agreements in the farm and construction equipment sectors could impact the quantity of equipment inventory supplies across the industry. When leased equipment expires, the supply of late-model used equipment may increase, which could lead to an oversupply of inventory, pressure on equipment sales and margins, and a negative impact on the values of their used equipment inventory rental fleet equipment. Similarly, rental house businesses regularly sell off their rental fleets, which can further upset the equilibrium between supply and demand.

Bottom Line

Despite posting solid annual results, their share price has fallen more than 40% in less than one month. I believe there are several headwinds that they might face in 2023, which could affect their financial performance. The technical chart also looks weak. So I think one should stay away from the stock for now. Hence I give a hold rating on TITN stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.