The Duckhorn Portfolio Bets On Premiumization Of U.S. Wine

Summary

- The Duckhorn Portfolio reported FQ2 2023 financial results on March 8, 2023.

- The firm sells premium quality wines in North America and internationally.

- While NAPA's focus on premium segments may insulate it from a wider economic downturn, I'm not impressed by its downward earnings trend.

- I'm on Hold for NAPA in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Rob Kim

A Quick Take On The Duckhorn Portfolio

The Duckhorn Portfolio (NYSE:NAPA) reported its FQ2 2023 financial results on March 8, 2023, beating revenue and EPS consensus estimates.

The firm sells a variety of premium-quality wines in North America and overseas.

While it may be somewhat insulated from a macroeconomic downturn by its focus on the premium wine segment, I’m concerned about the downward trend of its earnings profile.

I’m on Hold for NAPA in the near term.

Duckhorn Overview

Saint Helena, California-based Duckhorn was founded to own vineyard production facilities and produce premium quality wines, originally bringing the Merlot varietal to prominence.

Management is headed by president, Chairman and CEO Alex Ryan, who has been with the firm since the early 1990s when he started with the firm as Vineyard Manager.

The firm sells its wines direct-to-consumer as well as through a network of wine distribution companies in the U.S. and abroad.

Duckhorn operates under at least ten different wine brands and sells both through a direct-to-consumer model and through retail accounts and the above-mentioned distributor network.

Duckhorn’s Market & Competition

According to a 2020 market research report, the global wine industry was an estimated $327 billion in 2020 and is forecast to reach $434 billion by 2027.

This represents a forecast CAGR of 4.2% from 2020 to 2027.

Also, the Still Wine segment is projected to reach $167 billion and grow at a similar CAGR of 4.2%.

Notably, the Sparkling Wine sector is expected to grow at a faster 4.8% CAGR through 2027.

Major competitive or other industry participants include the following companies:

E&J Gallo

Constellation

Trinchero

Jackson Family Wines

Ste. Michelle

The Wine Group

Duckhorn’s Recent Financial Results

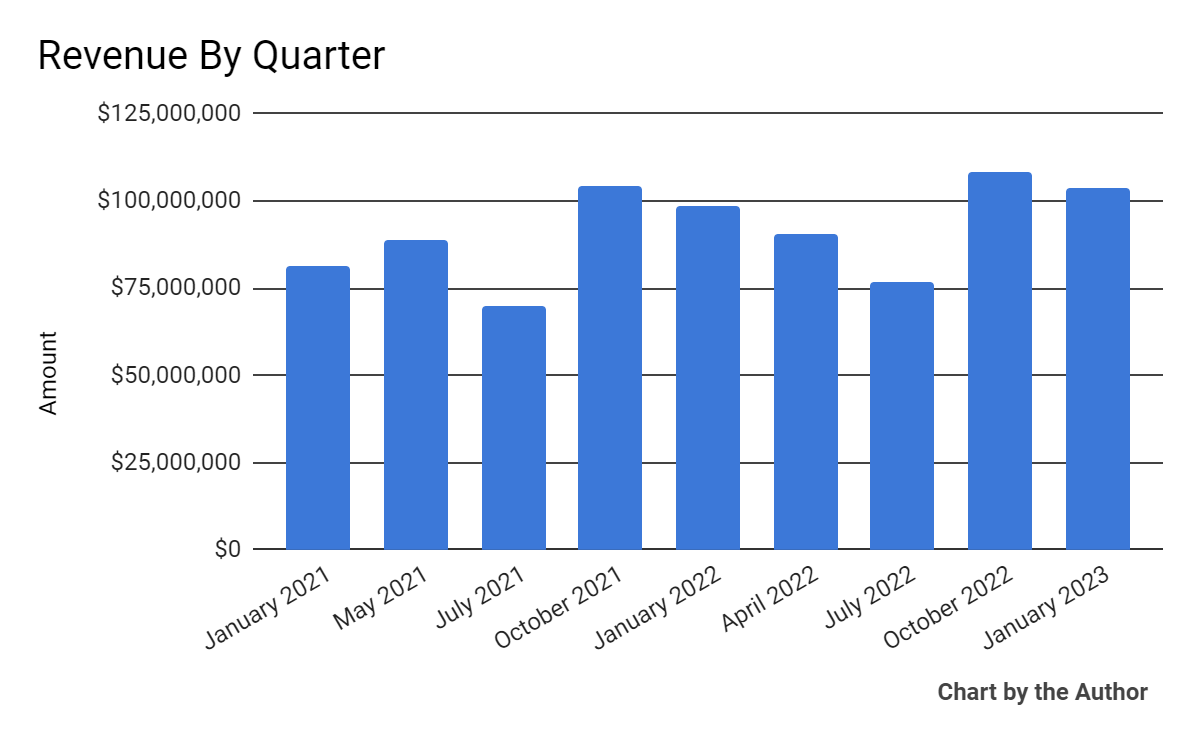

Total revenue by quarter has grown per the following chart:

Total Revenue History (Seeking Alpha)

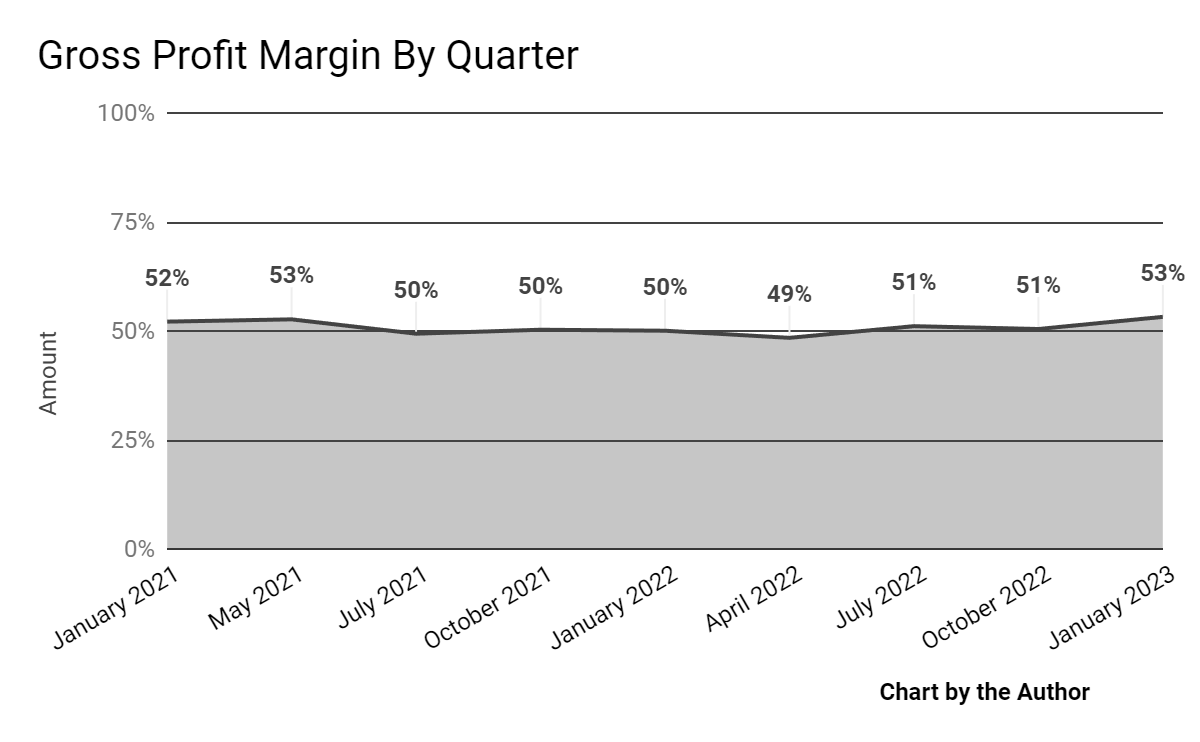

Gross profit margin by quarter has trended slightly higher:

Gross Profit Margin History (Seeking Alpha)

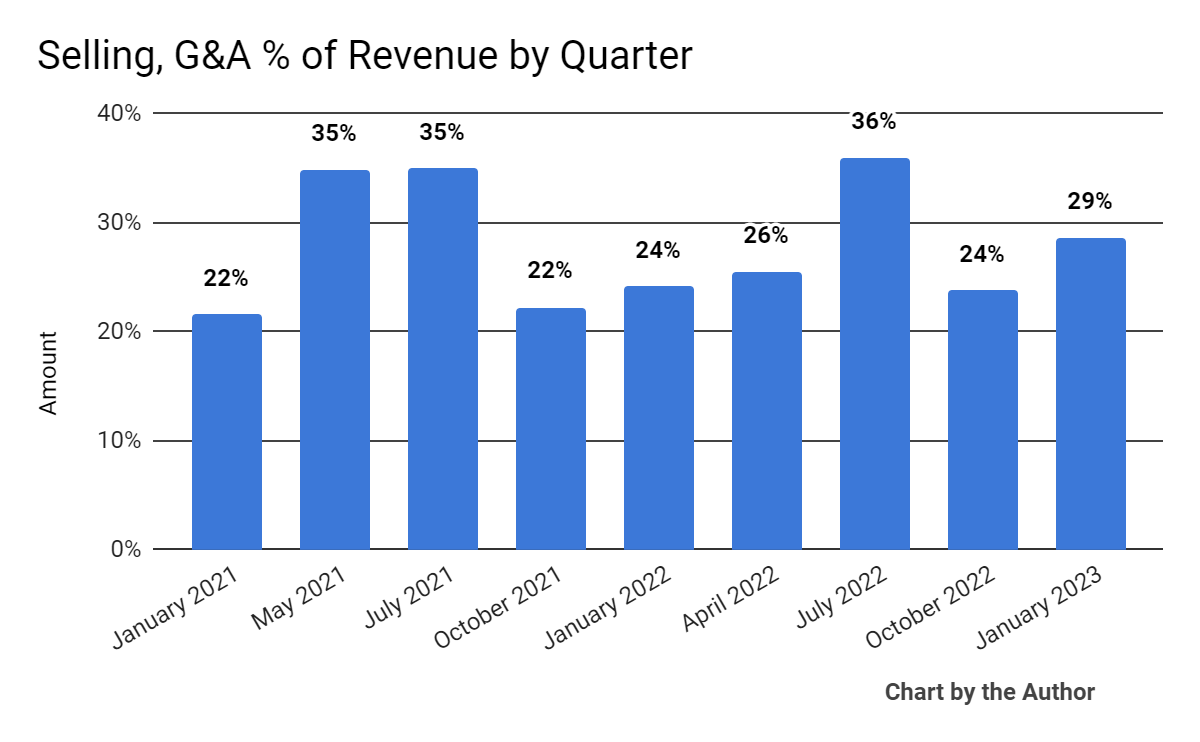

Selling, G&A expenses as a percentage of total revenue by quarter have also trended slightly higher, a negative trend:

Selling, G&A % Of Revenue History (Seeking Alpha)

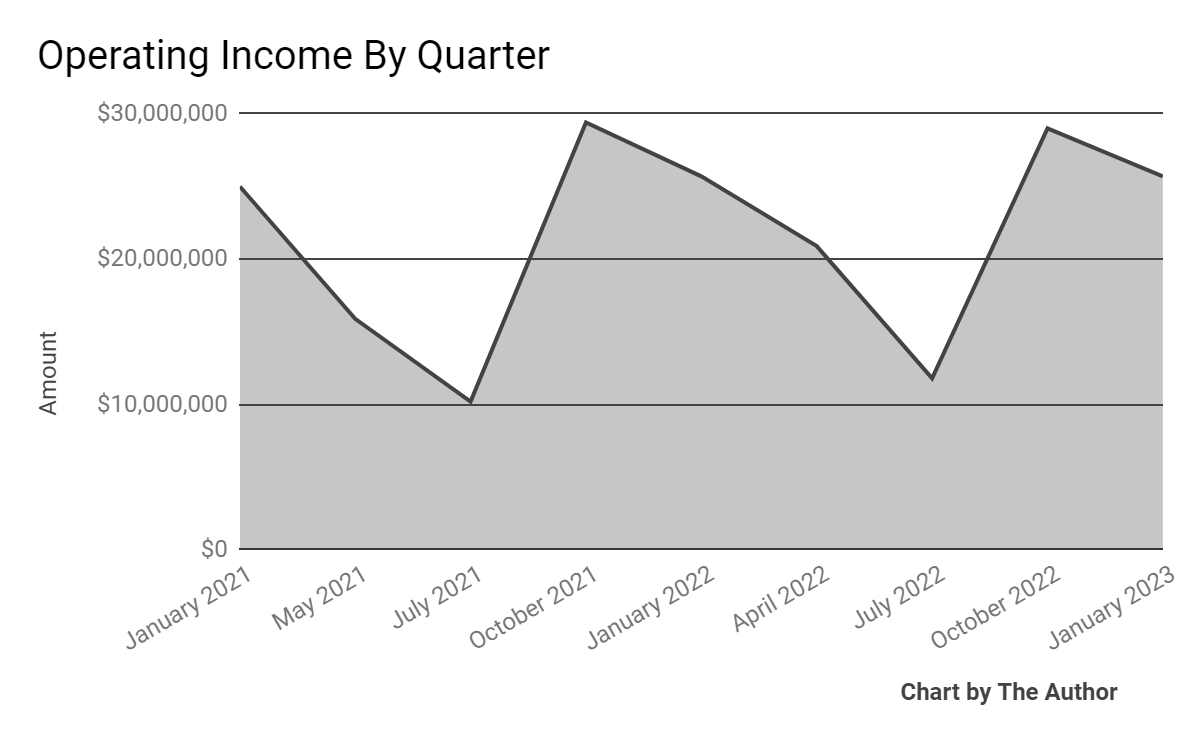

Operating income by quarter has fluctuated within a range:

Operating Income History (Seeking Alpha)

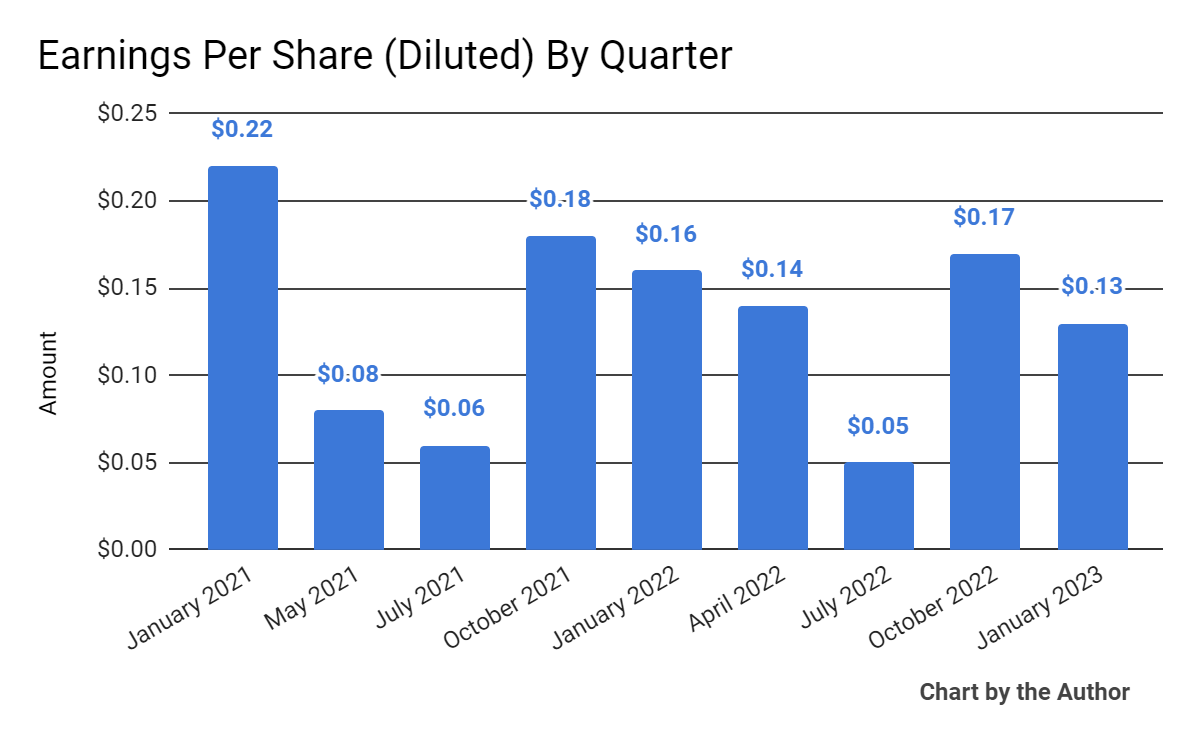

Earnings per share (Diluted) have trended slightly lower:

Earnings Per Share History (Seeking Alpha)

(All data in the above charts is GAAP)

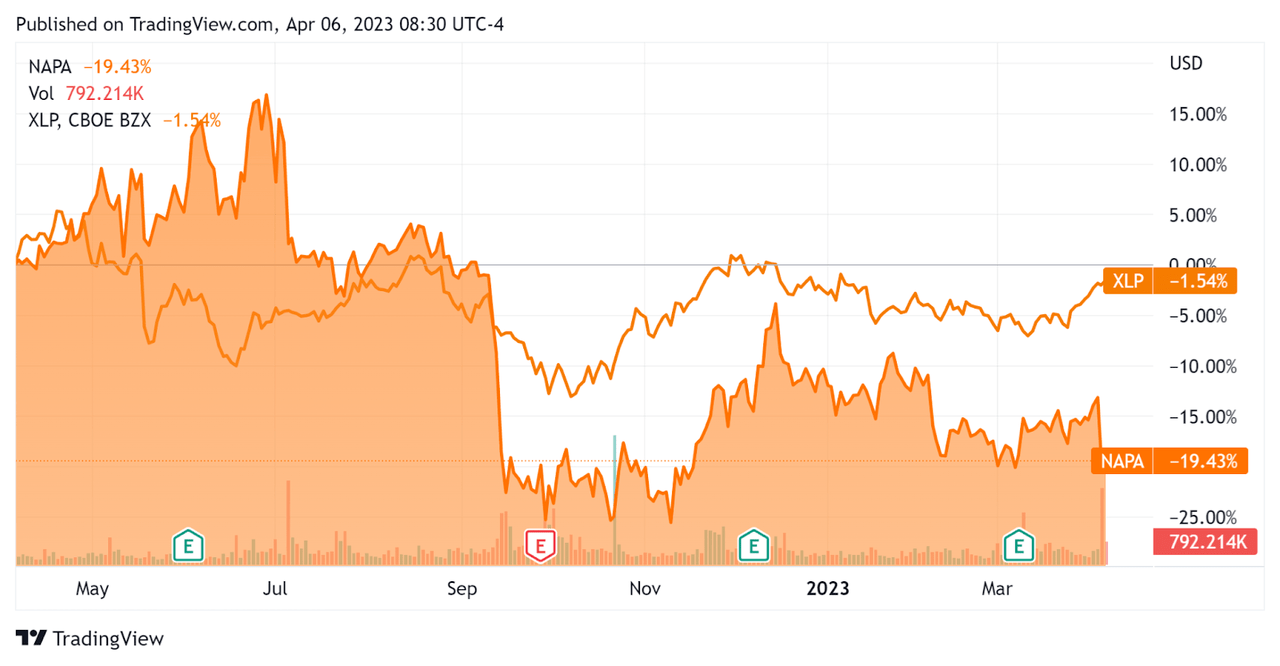

In the past 12 months, NAPA stock price has dropped 19.4% vs. that of the Consumer Staples ETF’s (XLP) drop of 1.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

As to its FQ2 2023 financial results, total revenue rose only 4.9% year-over-year and gross profit margin grew by a notable 3.2 percentage points.

SG&A expenses as a percentage of revenue have trended higher while operating income has broken out of its historical range.

Earnings per share have been trending lower in recent quarters.

For the balance sheet, the firm finished the quarter with cash, equivalents and trading asset securities of only $7.9 million and total debt of $226.9 million.

Over the trailing twelve months, free cash flow was $34.4 million, of which capital expenditures accounted for a hefty $33.7 million. The company paid $5.6 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Duckhorn Portfolio

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 5.3 |

Enterprise Value / EBITDA | 20.4 |

Price / Sales | 4.6 |

Revenue Growth Rate | 4.0% |

Net Income Margin | 14.8% |

GAAP EBITDA % | 25.8% |

Market Capitalization | $1,730,000,000 |

Enterprise Value | $1,970,000,000 |

Operating Cash Flow | $68,100,000 |

Earnings Per Share (Fully Diluted) | $0.49 |

(Source - Seeking Alpha)

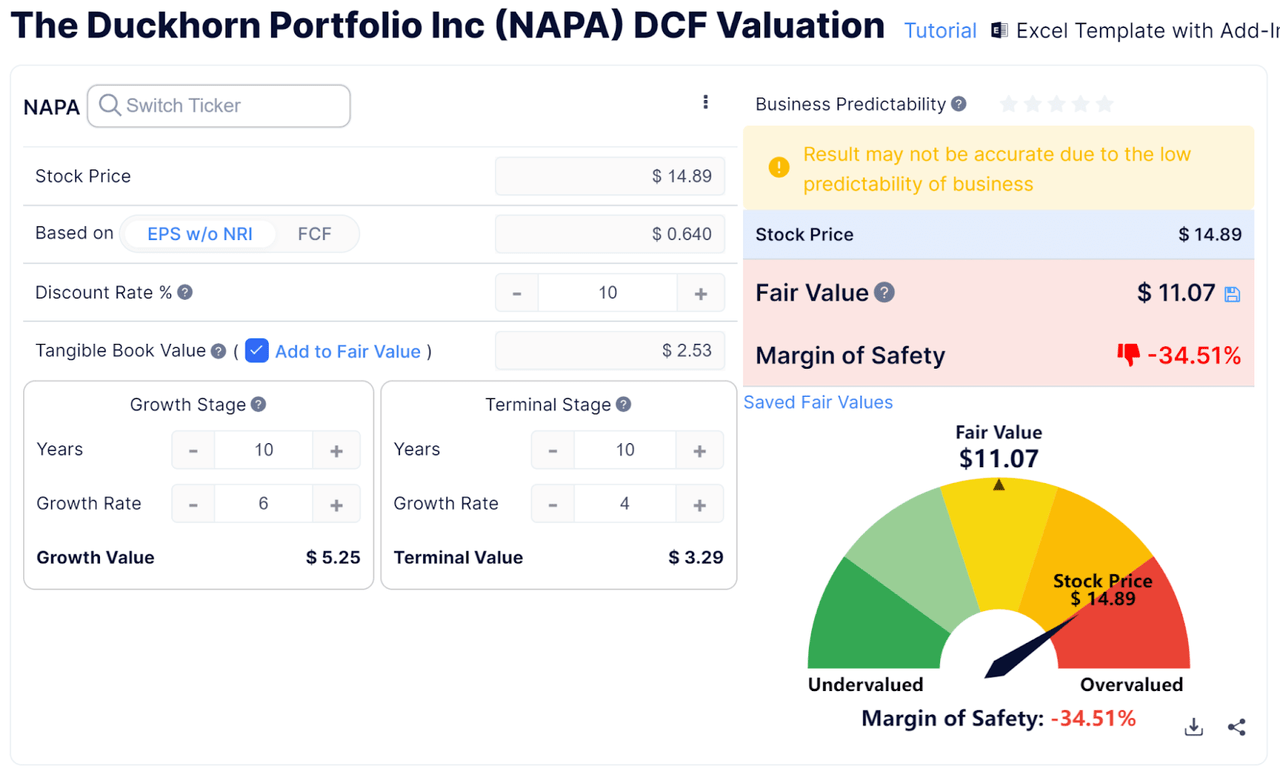

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

NAPA - Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $11.07 versus the current price of $14.89, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Future Prospects For Duckhorn Portfolio

In its last earnings call (Source - Seeking Alpha), covering FQ2 2023’s results, management highlighted demand growth for its luxury wines and depletion growth exceeding shipments during the quarter.

Notably, management asserted that the luxury segment ‘remains the fastest growing sub-segment in wine’, so they believe the company is well-positioned for further share gains in dollars and volume.

The firm also saw 60% growth in its DTC channel, according to its expectations for the quarter.

Looking ahead, management raised fiscal 2023 guidance for revenue growth of 7.8% at the midpoint of the range and adjusted EPS of $0.64. Adjusted excludes stock-based compensation and one-time items.

Regarding valuation, my discounted cash flow calculation, which assumes fiscal 2023 adjusted EPS of $0.64, suggests the stock may be pricey at its current level.

The primary risk to the company’s outlook is the potential for a macroeconomic slowdown ahead.

While the firm’s focus on luxury wines may insulate it somewhat from the worst effects of a downturn, I’m concerned about the downward trend of its earnings profile.

Given the risks, my outlook on NAPA is on Hold in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.