UMH Properties: The 5.5% Yield Could Be Safe But Consider The Preferreds

Summary

- UMH is currently paying out a 5.5% yield to its common shareholders.

- This formed a payout ratio of 102.5% and came with FFO, which declined by 9.1% year-over-year during its fiscal 2022 fourth quarter.

- The Series D preferreds currently offer a 7.25% yield on cost and are trading at a 12.3% discount to par.

saintho/iStock via Getty Images

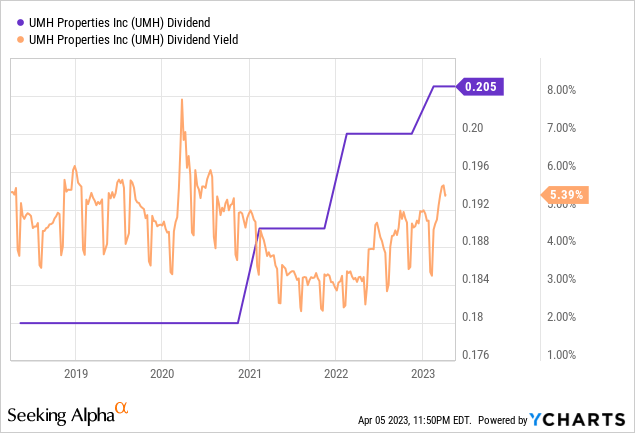

UMH Properties (NYSE:UMH) last declared a quarterly cash dividend of $0.205 per share, in line with its prior payment and for a 5.5% yield. As of the end of the fiscal 2022 fourth quarter, the Freehold, New Jersey-based REIT had built a portfolio of 135 manufactured home communities containing around 25,700 home sites. This was an increase of 7 communities and 1,500 sites from its year-ago comp.

The REIT also owns just over 10,000 rental homes and anticipates adding at least 800 rental homes every year. It recently entered into a $30 million revolving credit line to buy more rental property with its total likely set to top 11,000 homes this year. Growth will also come from internal development with the REIT owning nearly 2,100 vacant acres that can accommodate at least 7,800 future lots with there also being roughly 3,800 vacant units to fill.

Book Value, Funds From Operation, And The Payout Ratio

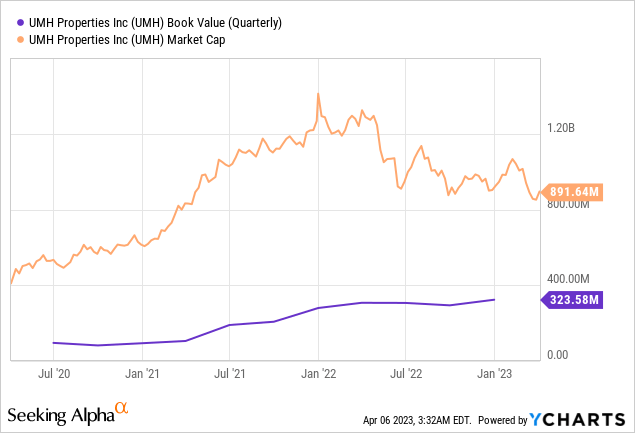

UMH currently trades on a market cap of $891 million with shares currently trading hands at $14.95 per share, falling from a 52-week peak of $25.46 per share. Hence, the commons are currently trading at a marked premium against a $5.62 per share book value. The REIT currently sports a 2.67x price-to-book value which is around 91% higher than the average for its peer group.

Critically, it's the income that matters here and this has been on an upward march since the pandemic. UMH has essentially raised its dividend every year since the pandemic with its 3-year dividend compound annual growth rate at 3.79%, which is almost 4x higher than its peer group median.

FFO per share for its fiscal 2022 fourth quarter came in at $0.20, down around 9.1% or $0.02 versus the year-ago comp and a miss by $0.03 on consensus estimates. Earnings were materially hampered by a still-rising Fed funds rate with 80% of UMH's total debt of $762 million being fixed. The weighted average interest rate on its mortgage debt stood at 3.93% exiting the fourth quarter, up 18 basis points from 3.75% in the year-ago period. Hence, FFO did not cover the dividend for the quarter with a payout ratio of 102.5%. However, management dismissed the risk to the payouts and flagged that their current occupancy at 93.3% is expected to strengthen. This comes as their monthly rent per home increased by 5.9% to $873 per month as of the end of the fourth quarter.

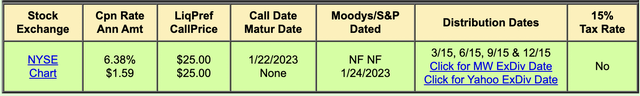

The Series D Preferred Stock

UMH's 6.375% Series D Cumulative Preferred Stock (NYSE:UMH.PD) pays out a $1.59 coupon for a 7.25% yield on cost. Whilst these started trading back in January 2018 and came up for redemption in January of this year, the prospect of a near-term redemption seems low on the back of the marked difference in the Fed funds rate now versus 2018. Hence, with their yield more than 175 basis points more than the commons they present a strong alternative to more risk-averse income investors.

At $21.92 they're trading at a 12.3% discount to their $25 par value with this gap widening in recent weeks on the back of the mini-banking panic that followed the Silicon Valley Bank failure. Critically, this could represent a window of opportunity to build a position in the preferreds at its second-largest discount to par since it started trading. The largest was of course during the pandemic with the current gap likely to close as we head towards summer and once the market is assured that the banking panic is fully in the rearview mirror.

The Series D is up 83.6% on a total return basis over the last 3 years versus gains of around 80.3% on the commons. Over the last year and the preferreds are down 8.67% versus a loss of 35% on the commons. This performance dichotomy is inherent with angst around a hawkish Fed and a rising rate environment pushing REITs to their lowest multiple in years. This dynamic will likely remain through the first half of 2023 with the Fed funds rate likely set for one final 25 basis point hike. With the Series D being perpetual and cumulative its owners are set to receive the $1.59 coupon indefinitely.

The risk to this coupon is minuscule with the preferreds ranked higher than the commons on UMH's capital structure. The biggest disruption would probably come from interest rates moving beyond current market expectations if inflation remains sticky. Preferreds are essentially fixed-income instruments with an equity-like structure. The positive duration effect has already seen lower-interest bonds and preferreds trade at persistent discounts to par since the Fed started its most aggressive hiking cycle in over a decade.

I think both the commons and preferreds offer value here. The preferreds offer a higher yield and a built-in margin of safety against a still uncertain macroeconomic backdrop. The dividend paid to common shareholders is on the up and sports a healthy coverage ratio supported by a growing portfolio of manufactured homes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.