Enthusiast Gaming: Is The Stock A Buy After A 90% Collapse?

Summary

- Enthusiast Gaming is down more than 90% over the last two years with investor concerns around liquidity and cash burn driving this decline.

- The company just reported its best every quarter for its gross profit with a 930 basis point year-over-year move.

- Under a year of cash runway remained on its balance sheet as of the end of the fourth quarter to set the tone for 2023.

zeljkosantrac

Enthusiast Gaming (NASDAQ:EGLX) recently reported fiscal 2022 fourth quarter earnings that saw revenue decline by 5.1% year-over-year but that came with a marked improvement in profitability. The common shares of the video game media company and owner of the esports outfit Luminosity Gaming has been on a more than 2-year long pullback and is down more than 90% since 2021. So I thought it would be prudent to revisit the stock with its current market cap of US$90.47 million set against total fiscal 2022 revenue of US$150 million.

Critically, the company ended the fourth quarter with cash and equivalents of US$5.6 million against cash outflow from operations of US$5.3 million and total debt of US$14.7 million. This near-pertinent flirting with no longer being a going concern has been the defining feature of Enthusiast Gaming over the last two years as rising Fed funds rates pushed down wholesale stock multiples and materially hampered the company's ability to raise funds through the sale of its common shares.

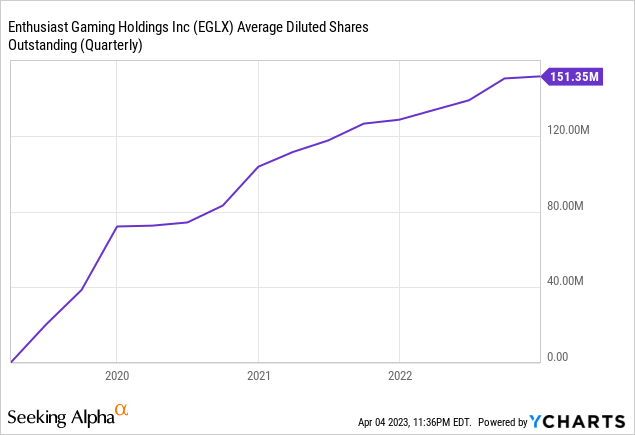

The average diluted shares outstanding have shot up rapidly over the years since the pandemic with shareholders faced with lower year-over-year ownership in a company that still needs more funds to remain a going concern. It's clear that the business in its current form is structurally unsound with shares outstanding up 18.6% over the last year alone and with what now stands as just over a quarter of cash runway left.

Liquidity Constraints, Cash Burn, And Revenue

Enthusiast Gaming reported fourth quarter revenue of C$54 million, a 5.1% decrease from the year-ago quarter but still a beat by C$7.4 million on consensus estimates. Gross profit of C$18.1 million was a 32% year-over-year increase and came on the back of 33.5% gross profit margins, a 940 basis points improvement from the year-ago quarter. This was the highest-ever recorded quarterly gross profit and came on the back of the growth of its direct sales segment and subscription revenue. Direct sales brought in revenue of C$12.8 million, a 45% increase versus direct sales of C$8.8 million in the year-ago comp.

Enthusiast Gaming was upbeat about direct sales growth through 2023 during its earnings call with management stating that they expect gross margins to keep growing through the year. Subscription revenue of C$3.8 million during the fourth quarter was also a 26% increase versus the year-ago comp with paid subscribers reaching 262,000 as of the end of the fourth quarter. This was up 42,000 subscribers versus the year-ago period. The main story from the earnings was the growth of higher-margin direct sales with management expecting to be profitable in 2023 with this moving to constitute an increasingly higher percentage of total revenue.

However, profitability takes many different forms and does not necessarily mean cash flow neutral. This is the critical issue facing Enthusiast Gaming with the company only being able to expand its near-term credit facility by C$10 million post-period end. Hence, the level of near-term liquidity Enthusiast Gaming has access to is not enough for more than a year of operations at its current rate of burn on a best-case scenario.

The 2023 Outlook

Whilst the growth of direct sales and the marked improvement in gross profit has set the backdrop for profitability in 2023, Enthusiast Gaming is likely to see continued pressure on its common shares through 2023 and the specter of a recession, rising rates, and an unstable liquidity base aggregate. Revenue growth rates are a long way away from 2021 when Enthusiast Gaming regularly reported triple-digit year-over-year growth on the back of acquisitions that have become a thing of the past as the company moves to self-preservation mode.

What's the bullish case here? The company genuinely owns valuable gaming assets. These had over 300 million monthly viewership in 2022 and 41 billion impressions. The focus on higher-margin direct sales and subscription revenue should also see gross margins continue to move up to eventually push Enthusiast Gaming to profitability. The only issue is whether they'll be able to reach this without another round of dilution against a stock already trading below the Nasdaq's minimum listing requirement. Whilst a reverse stock split would more than eliminate this risk in the short term, it's not a great look.

Fundamentally, the shift to more direct sales forms Enthusiast Gaming's investment pitch and whilst total revenue will be in a relative state of flux, the company continues to notch new partnerships. This included a tentpole partnership with the NFL back in September to launch Tuesday Night Gaming. I'm not a buyer of the commons here with continued cash run rate uncertainty likely to keep shares depressed for longer than bulls would like. However, it's not clear whether current investors would be best served by selling now with profitability likely sometime this year.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.