ServiceNow: Expect A Cut To Guidance - Moving To The Sidelines

Summary

- ServiceNow closed out 2022 with strong revenue growth.

- The enterprise-tech company generated another year of 30% free cash flow margins.

- The balance sheet is strong, with nearly $5 billion in net cash.

- I expect management to bring back 2024 and 2026 targets, and as a result, I am moving to the sidelines.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Funtap/iStock via Getty Images

ServiceNow (NYSE:NOW) is facing the same tough macro backdrop as any other company but is still nonetheless surpassing expectations. Even as its stock price sits well below all-time highs, NOW is continuing to deliver robust revenue growth coupled with top-of-class profit margins. The tough macro, however, seems to have had some effect on the business and I suspect that management will revise long-term guidance downward when the company hosts its annual investor day in May. With the stock trading at rich valuations relative to peers, I can no longer recommend buying the stock.

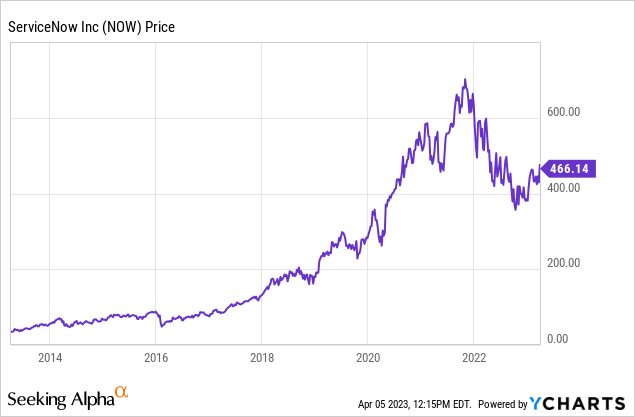

NOW Stock Price

While NOW remains much lower than all-time highs, the stock has not been beat-up nearly as much as many tech peers, largely due to the resilient growth rates and strong cash flow margins.

I last covered NOW last November, where I rated the stock a buy on account of the resilient enterprise-tech revenues. The stock has since returned 17%, but it is now time to take profits.

NOW Stock Key Metrics

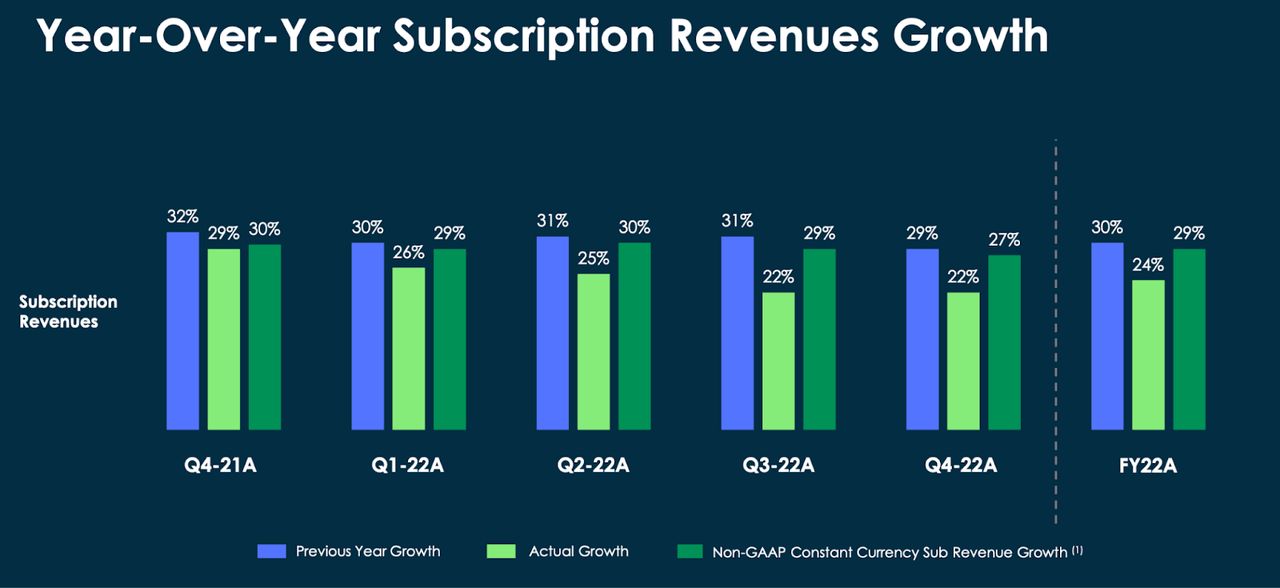

In its most recent quarter, NOW delivered revenue growth in line with guidance, with subscription revenues growing 22% (or 27% constant currency).

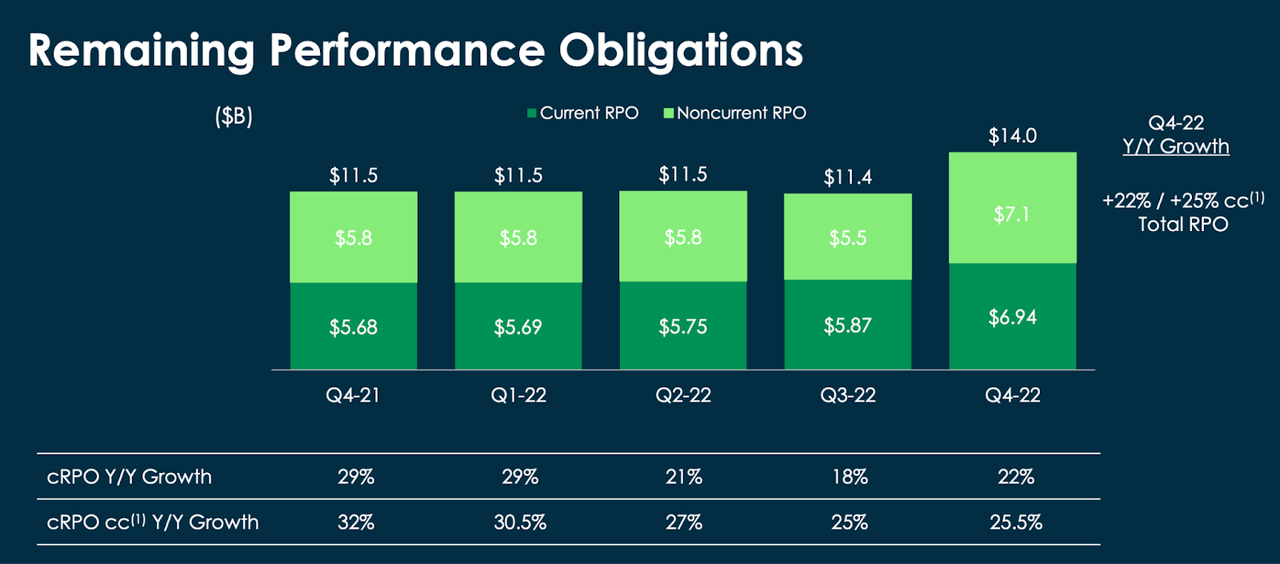

NOW delivered strong growth in remaining performance obligations, with 22% YOY growth (25% constant currency). RPO growth can foreshadow revenue growth, so that strength should reassure investors concerned about future top-line weakness.

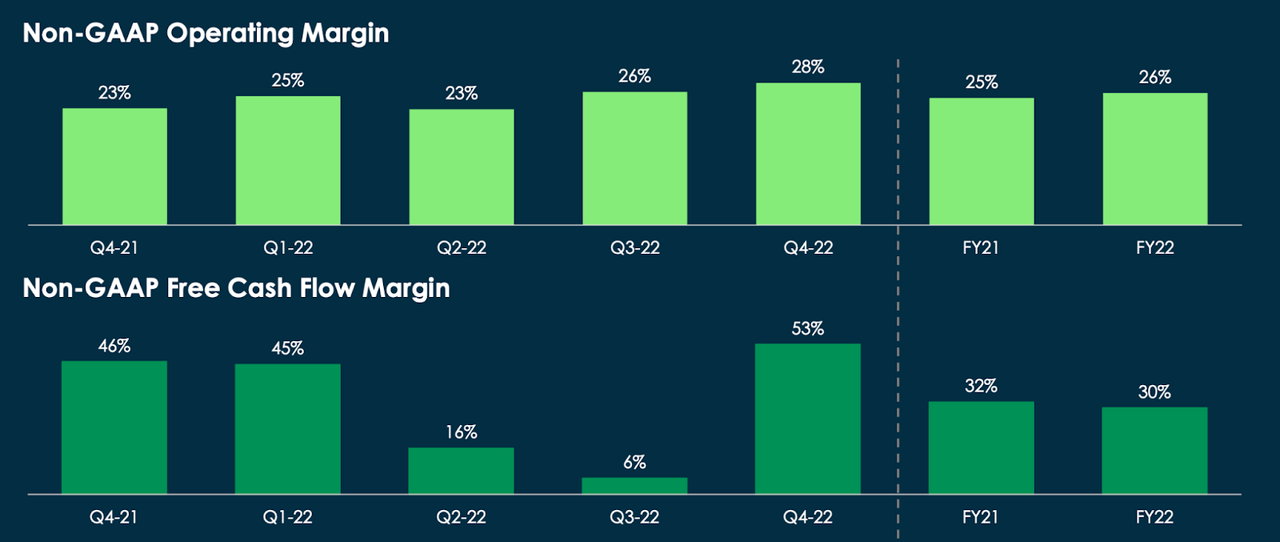

NOW generated 28% operating margins, 200 basis points ahead of guidance, and 30% free cash flow margins, 100 basis points ahead of guidance. These are very robust numbers which undoubtedly are helping to support the stock valuation.

NOW ended the quarter with $6.4 billion of cash and investments versus $1.5 billion in debt. Considering the strong balance sheet and cash flow generation, I would not be surprised to see the company announce a share repurchase program, but I would not personally support such a move due to the stock's valuation relative to peers.

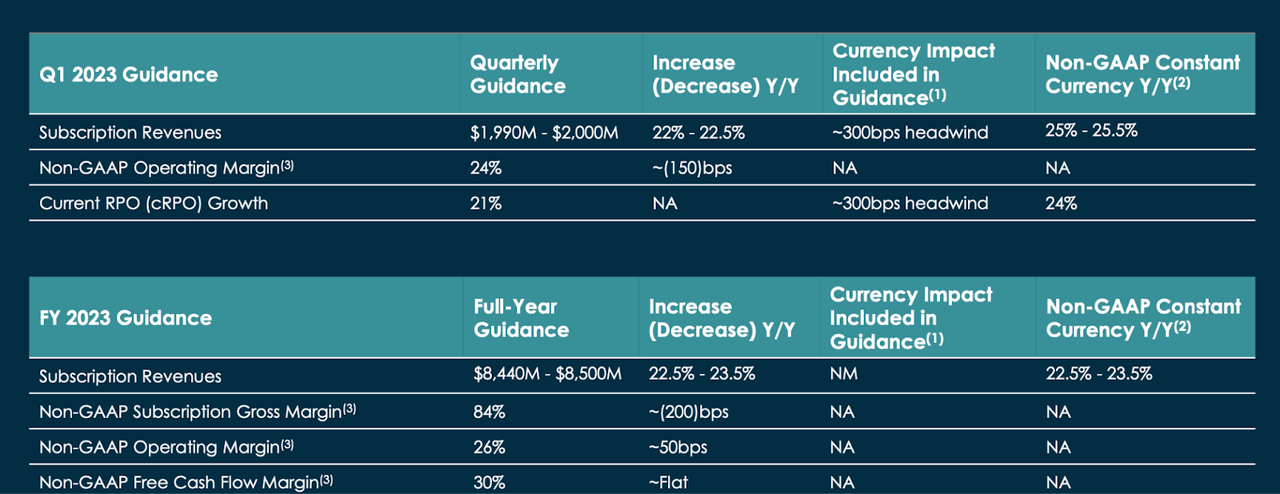

Looking ahead, management has guided for the first quarter to see up to 22.5% YOY revenue growth, with some acceleration for the full year to 23.5% YOY growth. NOW expects operating margins to expand 50 bps to 26% and free cash flow margins to remain flat at 30% for the full year.

On the conference call, management noted that renewals contributed less to their growth rates than historically. That could be due to a combination of customers wanting to hold on to cash a bit longer, as well as the company not needing to be so promotional to encourage renewals. Still, though, management emphasized that they expect any outstanding renewals to complete without issue. In regard to their long-term guidance, management seemed to imply that they retained some doubts. Management stated that while operating margins are "well on the trajectory to hit 27%," their revenue and free cash flow margin targets were being impacted by currency fluctuations and will be updated in May. For reference, their prior guidance was for $11 billion in revenue by 2024 and $16 billion by 2026.

Is NOW Stock A Buy, Sell, or Hold?

Before I discuss my reservations on the stock price valuation, we must first consider why NOW trades so richly in the first place. NOW is an enterprise tech company focused on providing its customers with digital workflows. These include things like automating employee onboarding tasks and re-directing customer inquiries. NOW is helping its customers boost their productivity, and that is something that remains valuable, recession or not.

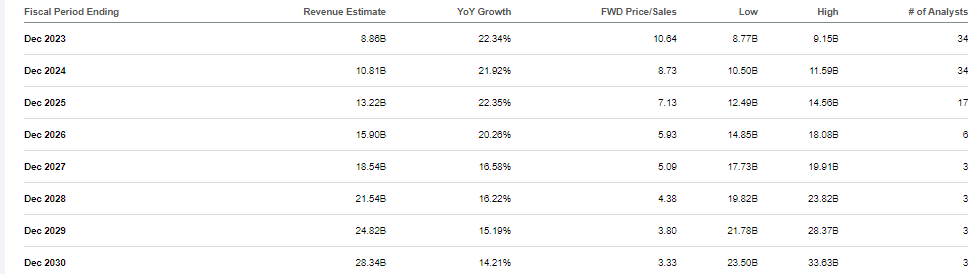

Their attractive business model positioning helps to explain why they have been able to sustain resilient revenue growth in spite of the tough macro environment. Yet the stock may have gotten ahead of itself. NOW stock is trading at 11x forward sales.

Seeking Alpha

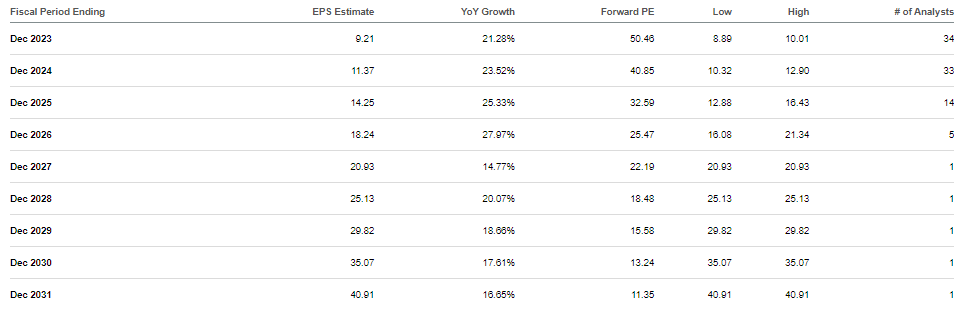

The stock does not look cheap on an earnings basis until many years later - clearly many years of growth have already been priced into the stock.

Seeking Alpha

NOW stock is already richly valued as it stands, but as I referenced earlier, I am of the view that management will reduce their 2024 and 2026 guidance targets for revenue. Consensus estimates have NOW coming just shy of the former targets and may prove too optimistic. Even assuming that NOW can achieve 2026 consensus estimates of $15.9 billion in revenue, the stock does not look too cheap. Assuming 30% long-term net margins, 20% growth, and a 1.5x price to earnings growth ratio ('PEG ratio'), I could see NOW trading at 9x sales in 2026, representing a stock price of $700 per share. That reflects a 12% compounded annual return upside over the next 3.5 years. But I have a feeling that growth may be more around the 16% range exiting 2026, which adjusts that target to $551 per share, reflecting only a 4.6% compounded annual return upside. There may be additional return potential from annual earnings and a 1.5x PEG ratio may prove conservative, but given the attractive valuations seen across the tech sector, I cannot recommend buying the stock given that downside risks seem more likely than upside surprises at this point. To be clear, I see minimal financial risk to the company given the strong balance sheet and cash flow generation, and view the company's product as being top tier with low reason to suspect competitive threats. My reservations are solely based on relative valuation. Those dead-set on owning NOW might want to consider selling covered call options to enhance prospective returns, but I again emphasize that my preferred approach would be to avoid the stock in favor of cheaper peers.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.