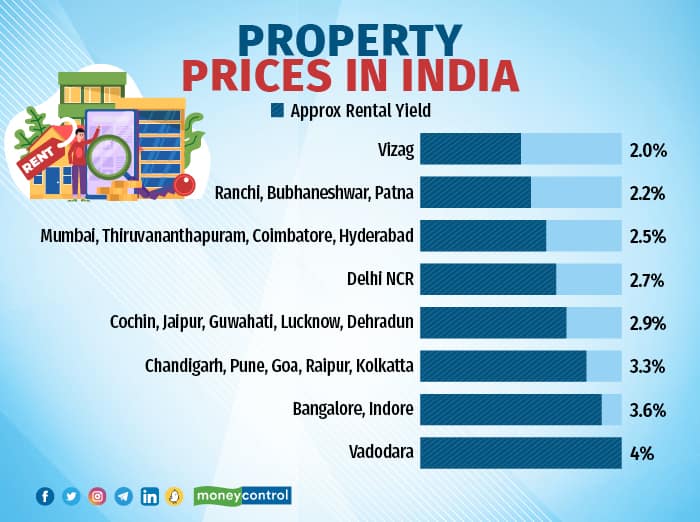

In India, the average rental yields are 2.9%, among the lowest in the world

According to a recent study by Moneycontrol and Liases Foras, the number of months of rent required to buy a home in India ranges from 330 in Bangalore to 606 in Vizag. The corresponding number for Mumbai is 478, for NCR: is 449, and for Kolkata: is 358.

Rental yields — rent divided by property value — is very low in India. The table below translates the same into rental yields across different cities.

Property prices in India

Property prices in India

In India, the average rental yields are 2.9 percent, among the lowest in the world (derived from the above study), in comparison with the USA, Canada or cities such as Dubai, where they are much higher, at 5-6 percent.

Many articles on Rent v/s Buy favour renting rather than buying using the following rationale:

- Rent paid is a fraction of the first year EMI of a home loan.

- The differential amount (EMI minus Rent), if invested over a period of years, will provide returns far greater than the property value.

However, a property, unlike other asset classes, has a very long life of more than 30 years. As with any other make v/s hire or build v/s outsource decisions, one has to compare the benefits of both renting and buying for at least 30 years before reaching a conclusion.

Additionally, there is the emotional intangible value of owning one’s house, which cannot be captured by any formula.

Rent keeps rising each year, while EMIs (or the tenure of the loan) rise / fall with interest rate cycles, when there is a rate hike or reduction by the RBI.

RERA has changed the real estate market and returns

Historically, property prices appreciated at almost double the inflation rate and hence buying always made sense. So ,earlier, despite property being unaffordable, there were buyers at every stage and level.

However, over the last few years, since property prices have not appreciated meaningfully, the scales seem to be tilting in favour of renting now.

This is corroborated by data. As per the RBI, between FY11 and FY18 (pre RERA era), the property price index appreciated by approximately 15% annually. However, between FY19-FY23 (post RERA era) it has appreciated by only about 3% annually.

Average inflation has been in the 6-7% range during the entire period.

Rent v/s EMI: The Math

Whenever an individual buys a residential property, there is often a home loan element, which can have a tenure of up to 30 years.

In the initial few years, when rent paid is a fraction of the property value, a tenant tends to save a lot of money, which he / she would have otherwise spent on EMI. However, by around the 15 to 17th year, due to annual rent escalation, rent and EMI tend to be similar.

The savings during these first 15 odd years are assumed to be invested in investment products providing better returns for the tenant.

Post that period, as the rent tends to be more than EMIs, the owner of the flat has a similar option like the tenant in the initial years to invest the surplus (Rent minus EMI) in an alternate asset such as equity.

That is why it is pertinent to have a cost-benefit analysis of renting and buying over the life of the property, 30 years in this case.

Apart from rental yield, there are other key variables at play in this rent v/s buy decision.

– Annual rent escalation rates, which depend on the age, property type and rental yield

– Property appreciation rates

– Home loan interest rates

– RoI on the downpayment for renting / buying

– RoI on monthly savings (EMI minus rent or vice versa)

Except the rental yield, all other variables are technically linked to each other. The escalation rate and property appreciation rate are likely to be in line. Both of these would be tracking inflation rates. The home loan interest rate is a markup over inflation and RoI is a markup over interest rates.

We have computed the workings based on the six variables mentioned above. The costs associated with renting and buying need to be aggregated over 30 years (life of the asset) and thereby also include incidental costs such as maintenance, registration, shifting, security deposits etc. (as the case may be) and savings.

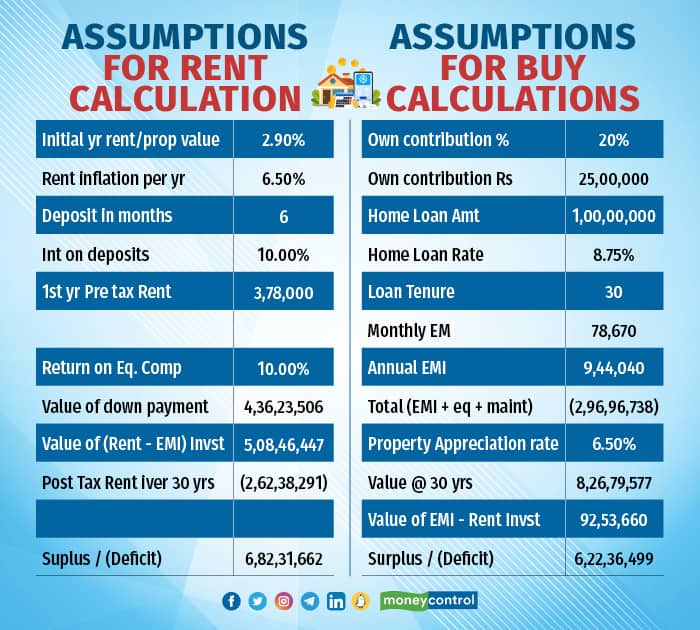

Here is a snapshot of the variables under both options along with an example:

Assumptions:

– Numbers to key in are initial year rent, its escalation rate, and the property value.

– Other variables are linked to each other.

– Property appreciation is the same as the escalation rate.

– The home loan rate is pegged at 2.25 percent more than property appreciation or rent escalation rate.

– Return on equity or interest on 6-monthly security deposits is pegged at 2 percent more than the home loan rate but capped at 10 percent (as the long-term return on equity going forward is assumed to be 10 percent).

– The home loan tenure has been fixed at 30 years to align with property life.

– The tax benefit is assumed to be a uniform rate of 25 percent on both rent as well as EMI.

– We have also included incidental charges such as maintenance (for owners) and registration plus relocation expenses (for tenants).

– We have the taken initial year rent to be Rs 30,000 / month (Rs 3.6 lakh p.a) for a property assumed to be worth Rs 1.25 crore, translating to a rental yield of 2.9 percent (Rs 3.6 lakh/Rs 1.25 crore)

– Rent is assumed to increase by 6.5 % annually, in line with inflation. The tenant will have to pay a 6-month deposit and thereby incur a notional loss of 10 percent returns on the same.

– For the owner, property is assumed to be funded through a home loan at the rate of 80 percent of the value, with interest rates 2.25 percent more than the inflation rate of 6.5 percent, i.e. 8.75 percent.

Summary

In the above example, the following is the summary:

While renting, the tenant pays Rs 2.62 crore as rent+incidental charges and Rs 25 lakh invested at 10 percent grows to Rs 4.36 crore by the end of 30 years. Also, the savings (EMI minus rent), when invested, grow to Rs 5.08 crore at the end of 30 years, resulting in a net surplus of Rs 6.82 crore.

While buying, the total outflow on EMIs and maintenance works out to Rs 2.97 crore over 30 years. The property appreciates from Rs 1.25 crore to Rs 8.26 crore and the savings from surplus funds (EMI–Rent) would grow to Rs 92.5 lakh, resulting in a net surplus of Rs 6.22 crore.

Fairly complicated? Let’s simplify further…

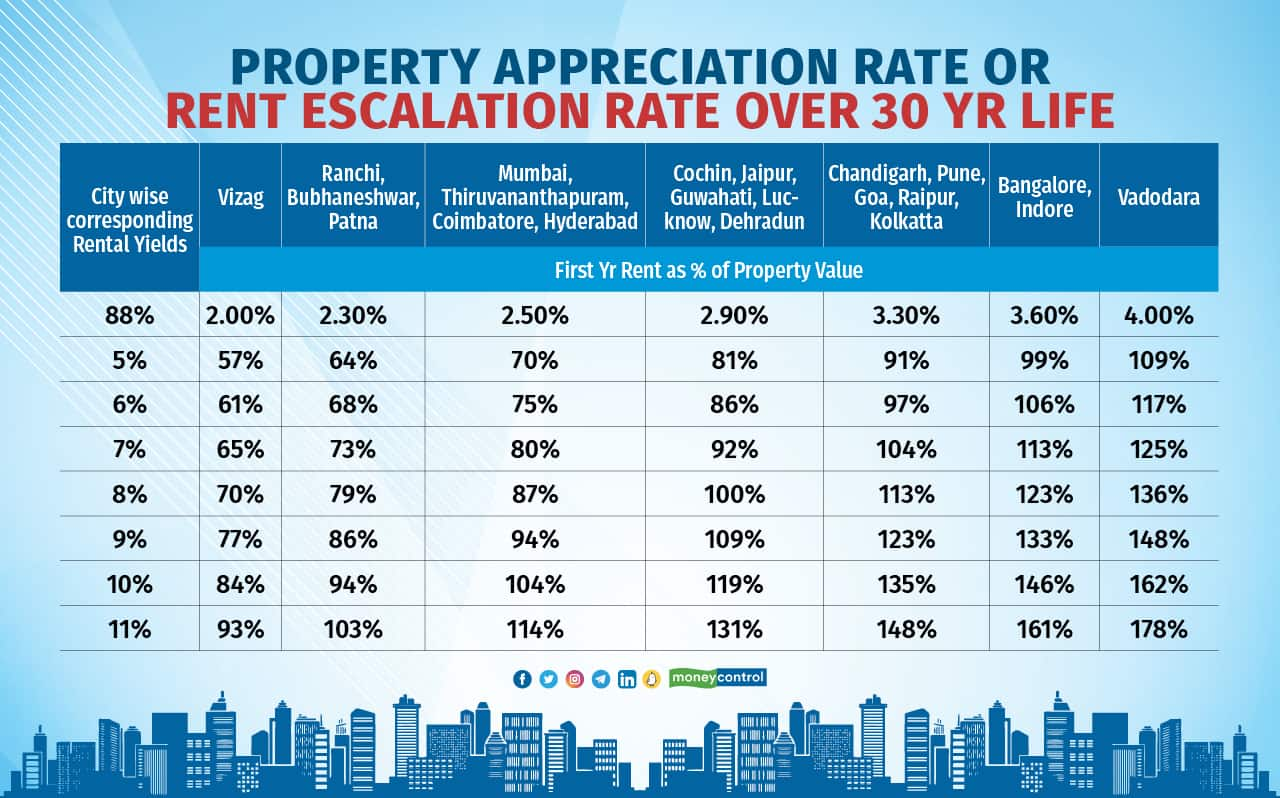

We have derived a simple ratio, Rent / EMI for the entire life of the asset, which can be used to arrive at your decision.

Historically, due to market inefficiencies, the variables impacting the decision were not aligned. Going forward, interest rates and escalation rates are expected to align, especially with RERA being in force.

So, going forward, we need to key in only two variables, Initial Rental yield and Annual Rent escalation Rates. As other variables automatically align, Rent / EMI will become the guiding factor for the rent v/s buy decision.

We have built a sensitivity table detailing the Rent / EMI ratio under different rental yield and annual rent escalation rate scenarios.

The way to interpret the table is that if the initial rental yield is 3.3 percent and the annual escalation rate is expected to be 7 percent, then the Rent / EMI ratio would be 104 percent, which means buying the property should be the choice.

Similarly, if the initial year’s rental yield is 2 percent and the annual escalation rate is 10 percent (over the 30-year span) then the Rent / EMI ratio would be 84 percent, which means renting the property would be a better option.

Based on these linkages, we notice that if the Rent / EMI (over the entire 30-year period) is less than 100 percent, then renting the property is better, whereas if it is greater than 100 percent, then buying a property is better.

In other words, the lower the Rent / EMI ratio, occupying a property on rent is beneficial. A higher ratio works in favour of buying. In the sensitivity table, the green coloured cells indicate Rent is a better option and red coloured cells indicate Buying is better.

In cities such as Vadodara, Indore and Bengaluru, since Rent / EMI is almost equal to or greater than 100 percent, buying in these cities could make greater financial sense.

Post RERA, as the property market gets more organised, there will be more alignment of the six different variables that play a role in influencing the decision. So, instead of property appreciation being at 2x (FY11-FY18) or 0.5x (FY18-FY23) of inflation (as per RBI data), we believe it will be approximately 1x of inflation rates.

Consequently, home demand v/s supply is expected to be better, and in all probability, property prices and rental yields could align, as in other parts of the world.

It should be kept in mind that a person who opts to rent (a tenant) has to build a higher retirement corpus as compared to a person who opts to buy a house (an owner).