Trending Topics

Saddled with Rs 23,000 crore debt, Goa banks on staff cuts, GST infusion

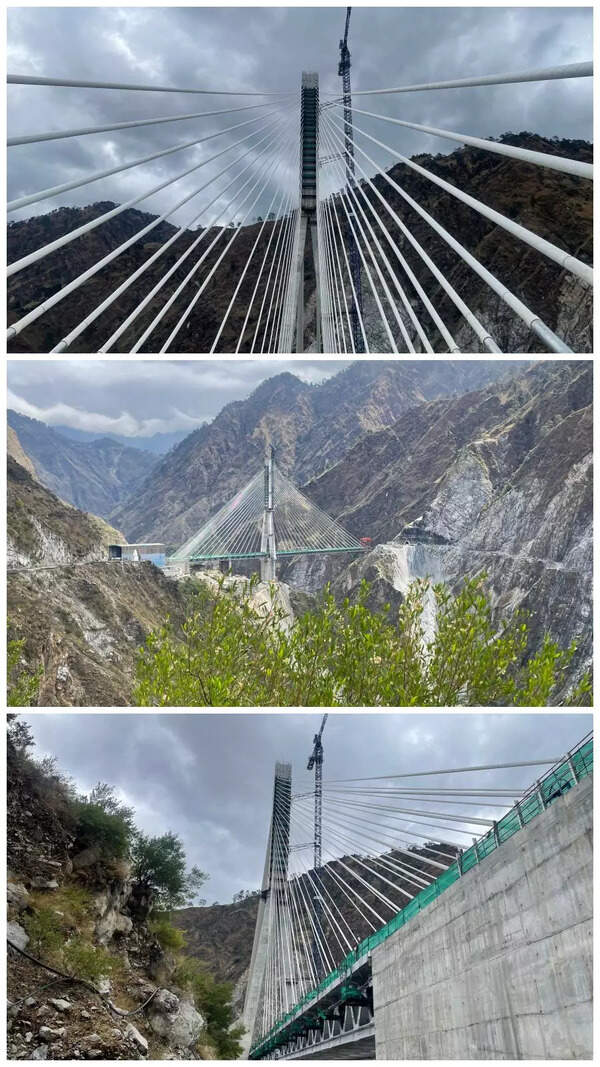

Representative image

PANAJI: Goa will snap prudence on its spending, including staff reductions, to tackle its debt that is projected to be Rs 23,971 crore in 2023-24, as warned by the Comptroller and Auditor General of India (CAG).

The finance department has outlined several measures to bring down the government’s liabilities and improve capital expenditure. Low-interest loans, a reduction in staff strength, and the targeted delivery of subsidies are some of the key strategies outlined in the medium-term fiscal plan (MTFP) that the government seeks to adopt in the coming years.

Chief minister Pramod Sawant is counting on the strategy to help reduce the government’s fiscal deficit from 3.1% in 2023-24 to 2.9% in 2025-26. The state is also banking on higher revenues, austerity measures, strong GST collections, and technology to put it on the path to fiscal health.

“This policy is being adopted with an intention to be revenue surplus over the years and ensure that borrowing can be serviced through our own resources,” says the MTFP that was announced by Sawant in his budget.

The CAG has repeatedly red-flagged Goa’s debt. With nearly half of the state’s debt up for repayment in the next seven years, the government needs to adopt prudent fiscal management, said the CAG in its latest report released in January.

Aware that the government runs the risk of falling into the debt trap, it has started borrowing from sources that offer a lower rate of interest.

“It is assumed that this method of resorting to low-interest rate borrowing will continue over the next financial year,” the MTFP says. “Due to an increase in borrowing over the year, the rate of increase in interest payment has increased substantially.”

Interest payments for 2023-24 itself are estimated to be Rs 1997.6 crore

Hence, the finance department says that the focus will be on rationalising revenue expenditure by introducing the “necessary austerity measures” so that capital expenditure can be increased.

A large component of the state’s annual budget is spent on committed expenditure such as salaries and wages, maintenance, and debt servicing, leaving hardly any funds for development projects.

The finance department has outlined several measures to bring down the government’s liabilities and improve capital expenditure. Low-interest loans, a reduction in staff strength, and the targeted delivery of subsidies are some of the key strategies outlined in the medium-term fiscal plan (MTFP) that the government seeks to adopt in the coming years.

Chief minister Pramod Sawant is counting on the strategy to help reduce the government’s fiscal deficit from 3.1% in 2023-24 to 2.9% in 2025-26. The state is also banking on higher revenues, austerity measures, strong GST collections, and technology to put it on the path to fiscal health.

“This policy is being adopted with an intention to be revenue surplus over the years and ensure that borrowing can be serviced through our own resources,” says the MTFP that was announced by Sawant in his budget.

The CAG has repeatedly red-flagged Goa’s debt. With nearly half of the state’s debt up for repayment in the next seven years, the government needs to adopt prudent fiscal management, said the CAG in its latest report released in January.

Aware that the government runs the risk of falling into the debt trap, it has started borrowing from sources that offer a lower rate of interest.

“It is assumed that this method of resorting to low-interest rate borrowing will continue over the next financial year,” the MTFP says. “Due to an increase in borrowing over the year, the rate of increase in interest payment has increased substantially.”

Interest payments for 2023-24 itself are estimated to be Rs 1997.6 crore

Hence, the finance department says that the focus will be on rationalising revenue expenditure by introducing the “necessary austerity measures” so that capital expenditure can be increased.

A large component of the state’s annual budget is spent on committed expenditure such as salaries and wages, maintenance, and debt servicing, leaving hardly any funds for development projects.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE