Junk Bonds Conspicuously Quiet In 2023, Spotting Prices To Watch

Summary

- Despite a banking crisis and volatile oil prices, the domestic high-yield market hasn't made big moves this year.

- I see balanced risks with USHY as we head into a positive stretch on the calendar.

- With OAS near 450bps, there's clearly a lack of extreme fear in the credit market.

Byjeng

The domestic junk bond market has been conspicuously quiet over the last few months.

Back in January, I had a buy rating on the iShares Broad USD High Yield Corporate Bond ETF (BATS:USHY) as favorable stock market tailwinds and a few corporate bankruptcies suggested a bullish backdrop for credit-risky bonds coming off a year of rarely seen duration risk. Since then, USHY has traded sideways with a slightly negative total return. That is arguably impressive price action considering that there was a mini banking crisis that took place just a few weeks ago. Treasury buying during the flight to quality and today's drop in yields augured by recession risks haven't really budged high-yield spreads.

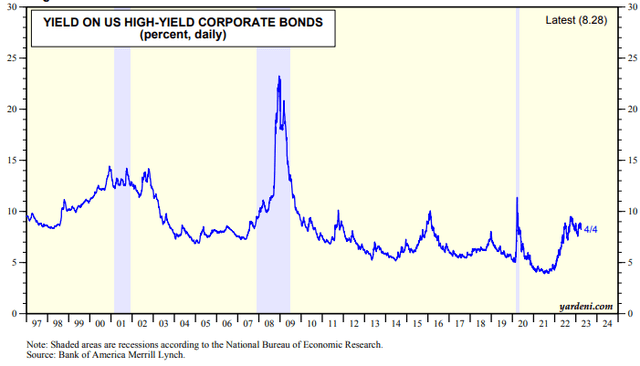

As it stands, the U.S. speculative-grade credit market yields 8.3% - about the same as was seen a year ago. I am a hold on USHY today, and I am awaiting a definitive trend to show itself.

HY Corporate Yield: 8.28%

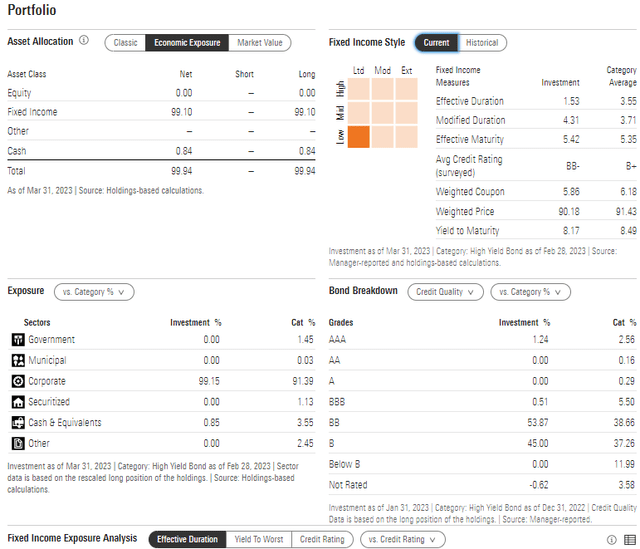

Digging into USHY, the fund offers investors high-yield bond market exposure that is broader than any other ETF, according to iShares. With a 15 basis point net expense ratio, it is a low-cost vehicle to play the junk bond space. It's perhaps best used to complement a fixed income allocation to enhance overall yield. Importantly, though, high-yield bonds move in tandem with equities in many instances.

USHY sports an average yield to maturity of 8.42% as of April 4, 2023, with a 30-day median bid/ask spread of just three basis points. Tradeability is strong with the ETF considering the narrow spread and high 30-day average volume of more than 6 million shares. What's more, the fund is large, with more than $8.5 billion in assets under management.

The current option-adjusted spread is only 450 basis points - not indicative of immense stress in the corporate bond market. It is also crucial to recognize that moves in interest rates do not impact USHY nearly as much as, say, investment grade bonds since the effective duration are under four years compared with more than eight years on the IG index.

Digging into the portfolio, the index fund holds more than 1,900 pieces of paper, and Morningstar plots the allocation in the lower-left fixed income style box niche. That's indicative of low-quality, low-duration holdings. But USHY is not extremely low grade since 54% of the portfolio is just shy of high grade while 45% is B-rated.

USHY: Portfolio Profile & Bond Breakdown

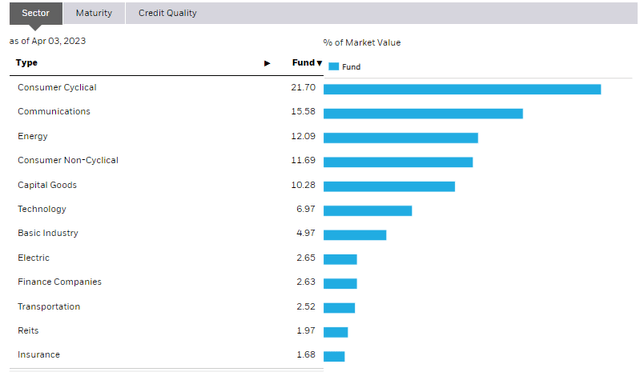

The sector breakout is much different from what you will find in the S&P 500. Consumer Discretionary and Communication Services are the two largest sector exposures, while Information Technology and Financials are small parts of USHY.

USHY Sector Composition

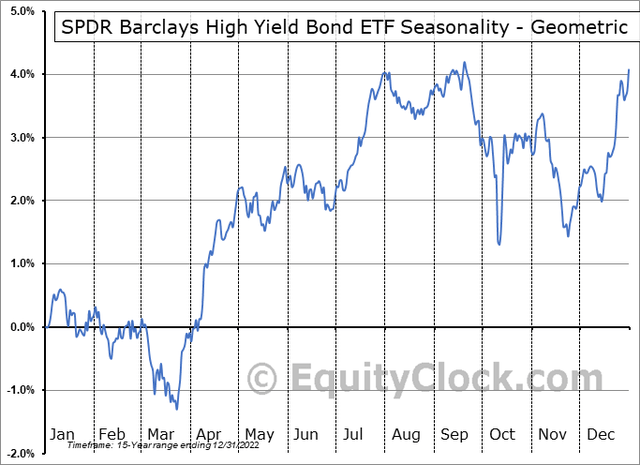

Seasonally, junk bonds tend to perform well now through the end of July, so there could be some tailwinds care of the calendar over the ensuing months, according to data from Equity Clock. (Note: I used the longer-lived JNK ETF to assess seasonality.)

High Yield Bonds Often Rally Through July

The Technical Take

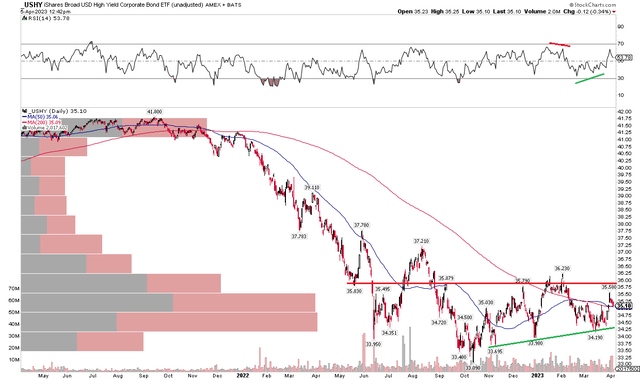

A new technical level of interest has emerged on the chart of USHY. Notice below that $36 has been giving the bulls fits of late. The fund failed to rally to the August peak during a rally to kick off 2023, but there have been higher lows off the October low. Thus, so long as we continue to see higher lows, the uptrend should remain intact.

I like that the fund has climbed above its falling 200-day moving average, but a negatively sloped trend line means the bears have some vigor here. A move above the February zenith would help support a move toward $37.50. Also, there's now heavy volume by price in the $34 to $36 zone, so it is crucial that the ETF maintains the March low, in my view.

USHY: Sideways Action Last 6 Months

The Bottom Line

I am downgrading USHY to a hold. The chart is simply chopping around here, and the yield spread is not particularly high. Strength earlier this year has been lost, but the fund is holding near-term support.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.