Why Axcelis Technologies May Have Limited Upside

Summary

- We have estimated an intrinsic value $3B or $90 per Axcelis Technologies, Inc. share with a positive 1-Y outlook of $140 per share, implying a 5% upside.

- Key risk factors to consider include export restrictions to Chinese companies, lack of shareholder returns, cyclical industry, and unsustainably high market share.

- Semiconductor manufacturing capacity is expected to grow 56% by 2030, but Axcelis Technologies already holds some 37% of the market share.

- Management's model of $1.3B in sales in the next 2-3 years is reasonable, but the industry may stagnate afterward.

- Appreciating margins are driven by demand, innovation, and price increases.

William_Potter

Axcelis Technologies, Inc. (NASDAQ:ACLS) is an ion implantation distributor in the semiconductor equipment industry. The company experienced a spike in market capitalization resulting from the expanded CapEx spend from semiconductor fabs, which are among the key customers of the business. While we will demonstrate that the company has solid fundamentals, the future demand and political constraints of this industry limit the upside for investors.

We valued the company at $3B or $90 per share, and a 1-Y price target at $140 indicating a 5% upside. As this is a company whose value increases as it grows, we can consider the 1-Y price target as a more informative measure when thinking about the company. Changing small assumptions about the growth and cyclical nature of the industry produces a vastly different valuation, which is why we consider this stock to be high-risk. Investors can copy and tweak the valuation model.

While initially impressed with the company's performance, we discovered multiple constraints that changed our opinion on the potential of the company, and decided to rate it a hold.

For investors considering Axcelis, it may be better suited as a small participant in a diversified portfolio of semiconductor stocks that sell different products across the supply chain.

Business

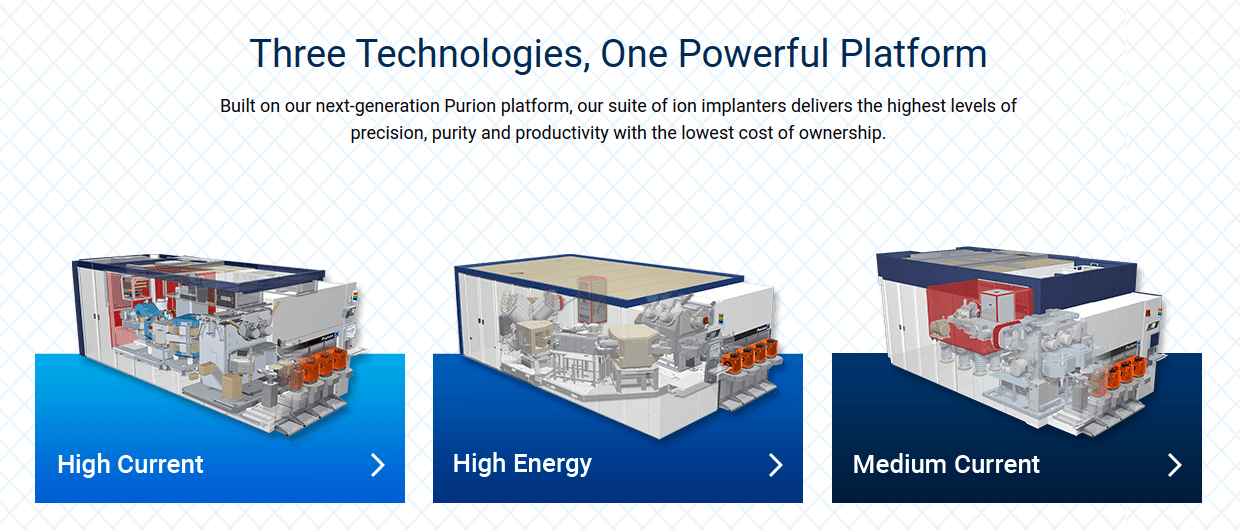

Axcelis Technologies designs and manufactures ion implantation (97.6% of the business) and other processing equipment used in the fabrication of semiconductor chips. These are large equipment systems used by semiconductor manufacturers. Sales can be analogous to selling freight trucks to logistics companies - an expensive CapEx investment that they try to make the most of over many years.

Practically, semiconductor ion implantation helps to control the flow of electricity in electronic circuits, which makes it possible for these devices to work. So we can imagine the wide use it has in producing everyday devices such as smartphones, tablets, computers, TVs, home appliances, etc.

Ion implantation is a process used to modify the electrical, optical, and/or structural properties of a substrate. In this process, ions (atoms or molecules that have an electric charge) are fired at a material, such as silicon, to alter its electrical properties. This helps to create the transistors, capacitors, and other components that make up an electronic device.

Axcelis' Ion Implantation Systems (Company Website)

The company is constantly innovating their process, and in their latest iteration they demonstrated stability improvements and glitch reduction: "The results have shown 50 x reductions in glitches for a BF2 beam throughout source life, reduced W metals contaminant by 5x, and improved ion source lifetimes from 200 hrs to 300 hrs for dedicated BF2." This can help them reduce production glitches, which can have an impact on the gross margin in the future, as well as higher customer satisfaction with their products.

Recap

In 2022, Axcelis achieved a record-breaking $920M in revenue, 43.7% gross margins, and $401.8 in operating profits. Shipments were driven by the rapid growth of mature semiconductor devices, including the electrification of the automotive market. They expanded through multiple evaluation units in the memory, mature process technologies, and advanced logic markets. Additionally, Axcelis saw increased orders for Purion products, device qualification for leading-edge CMOS Image Sensor processes.

The company has two key centers, the Massachusetts facility and Axcelis Asia Operations Center in South Korea. This sets them a degree away from possible geographical risk in Asia.

Industry

The semiconductor capital equipment industry has experienced cyclical trends over the years, with chip manufacturers adding capacity with capital equipment purchases when chip demand is high, and device manufacturers muting capital spending when chip inventories and prices are low. This means that Axcelis benefited from the chip shortage in the past two years as customers expanded capital investments into semiconductor equipment. To the extent that semiconductor demand will persist, the company will be able to maintain the higher revenue levels, however, if it turns out that many customers over-provisioned on production capacity expansion, prices may decline and future CapEx may be cut.

SIA estimates that despite a short-term drop in demand, global demand for semiconductor manufacturing capacity is expected to grow 56% from $573.2B in 2022 to $895B by 2030. Indicating that demand is expected to persist in the long-term.

The company can benefit from this trend and there are three growth branches where Axcelis is pushing to expand their addressable market:

- Electrification of the automotive industry

- Growth in the Internet of Things (IoT) sector

- Global semiconductor fab expansions.

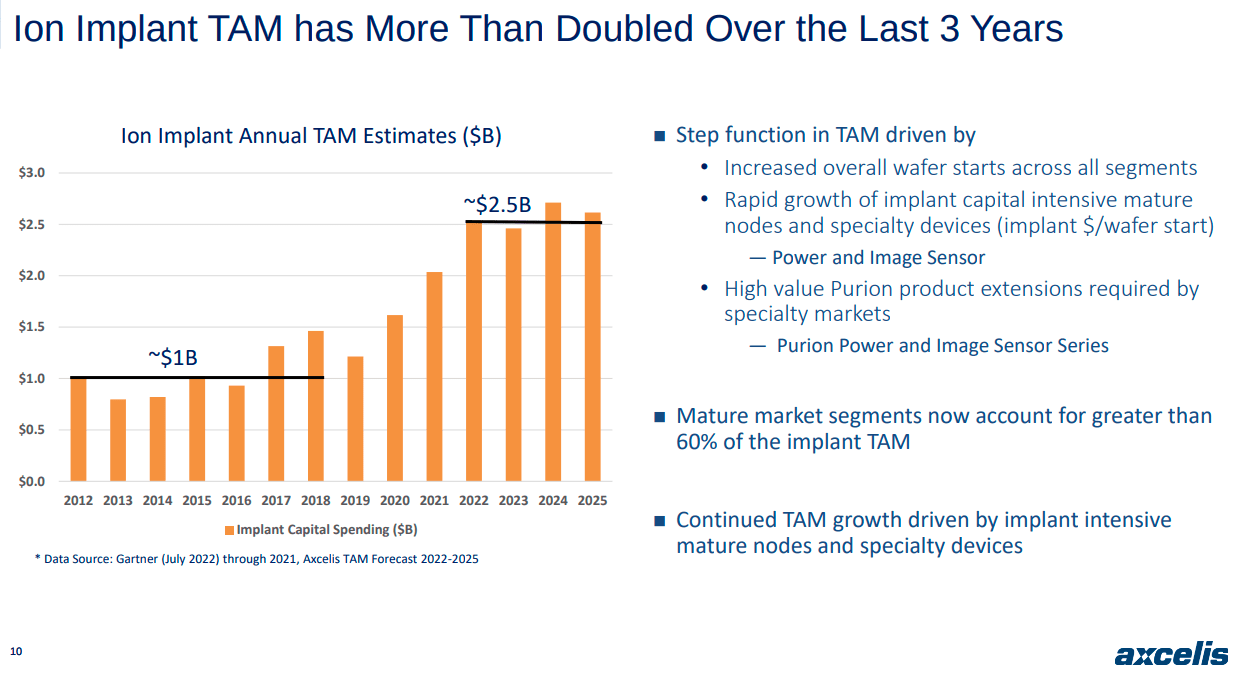

By including these avenues, the company is expecting (p. 10) to increase their (TAM) to $2.5B.

Axcelis' Total Addressable Market (TAM) (Company Presentation)

These trends are particularly beneficial for their Purion power device and image sensor series, Axcelis' highest margin tools. However, given the current revenue of $920M, we can see that Axcelis has a market share of about 37%, which is a fairly high share to sustain.

Competition

Axcelis is in competition with Applied Materials (AMAT) and other non-U.S. players, including Sumitomo Heavy Industries Ion Technology Co. Ltd. (OTCPK:SOHVY), Nissin Ion Equipment Co., Ltd., Advanced Ion Beam Technology, Inc., and CETC Electronics Equipment Group Co., Ltd., in the area of ion implantation. While AMAT is the largest competitor, we may see these smaller companies picking up due to recent export controls regulation for shipments to China, which may put Axcelis at a disadvantage.

One possible reason why Axcelis is gaining market share at the expense of peers is their superior technology in ion implantation that uses the ribbon implant method versus the focused beam, which puts them ahead of AMAT. Ion implantation using the ribbon implant method involves a ribbon of ions being fired at a large area at the same time. This is often used for larger wafers that require a consistent dose across the entire surface. Focused beam ion implantation involves a beam of ions being fired in a concentrated and controlled stream. This method is used for more precise applications, such as when implanting small components.

While the superiority of each technology depends on the application, larger wafers are more in-demand, as they are often used in the production of commercial electronics and other consumer products. Smaller components are still wanted, but their use is more specialized and not as widespread.

Customers

Axcelis has two customers comprising more than 10% of their revenues, Samsung Electronics Co, Ltd. (OTCPK:SSNLF) and Semiconductor Manufacturing International Corporation (OTCQX:SIUIF). While Samsung is a well-established brand, SIUIF operates in China and may be affected by US government sanctions. Fortunately, Axcelis has been able to obtain export licenses thus far - but we can't tell how the situation will evolve in the future. Another chipmaker, Yangtze Memory Technologies Co., Ltd. ("YMTC"), was placed on the Entity List in 2022, where the company doesn't have the ability to obtain a license, effectively losing the customer.

These outlined risks are reflected in our risk estimate of the business of 1.7 (Beta), and along with the enterprise risk premium of 6.25% result in a cost of capital a.k.a required return of 14% - significantly higher than the 8% to 10% currently expected for U.S. companies.

Outlook

In the latest earnings release, President and CEO Mary Puma commented,

" …robust demand for the Purion product family, we delivered record quarterly and annual revenues, and we surpassed our $850M revenue model. For the full year 2023 Axcelis revenues are expected to exceed $1 billion dollars, and we are introducing a new long-term implant only model with revenue of $1.3 billion dollars that we believe is achievable within the next 2 to 3 years."

According to management, for the full year 2023, they are anticipating revenue of more than $1B, with gross margins of 44%, as projected in the $1B model, factoring in expected supply chain cost and product mix improvements in the second half of the year. This outlook ties in well with our expectations of continued innovation and process improvements and is in-line with analysts' estimates for the company which estimate $100M increases in revenue per year.

Valuation

We have conducted our valuation based on our analysis thus far, however the company has multiple uncertainties and investors may find themselves in a completely different scenario than we projected. If you want to test out different assumptions, you can copy and tweak our model directly by changing the values in the "Input" and "Output" tabs.

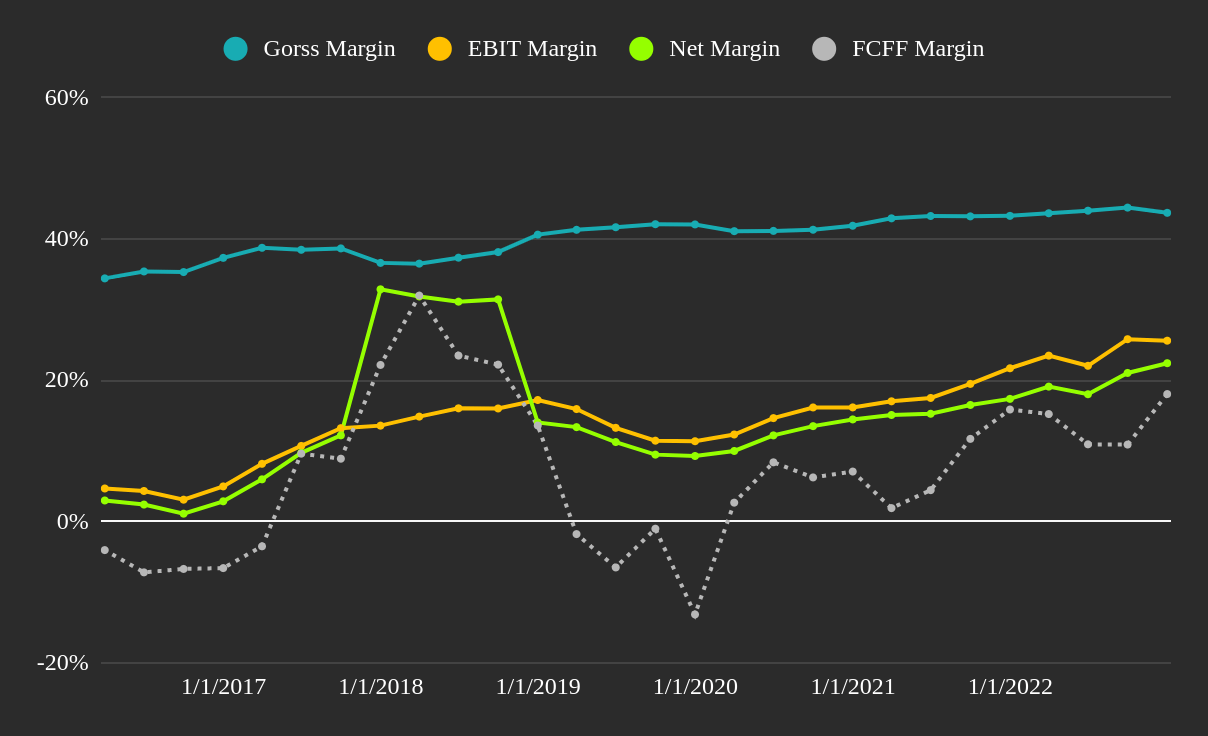

Margins

One of the key drivers of value, besides the discussed revenue growth, are the profitability margins. The company has impressive and growing margins, which indicate a good scalability of the business model, driven by demand and price increases.

Axcelis' TTM Profit Margins (Author Image with Data from FMP)

While we think that margins will further increase in the future, and have modeled a 30% operating profit margin in year 10, this type of increase has the ability to attract competitors, so the company will need to stay on top of R&D in order to protect these margins in the future.

Model

The problem with equipment sales is that there is an inherent cyclicality in the industry, and it is risky to build up valuation models in high-demand periods. After customers spend their allocated CapEx on equipment, Axcelis will need to expand their client base or offer new generation products which take multiple years to produce.

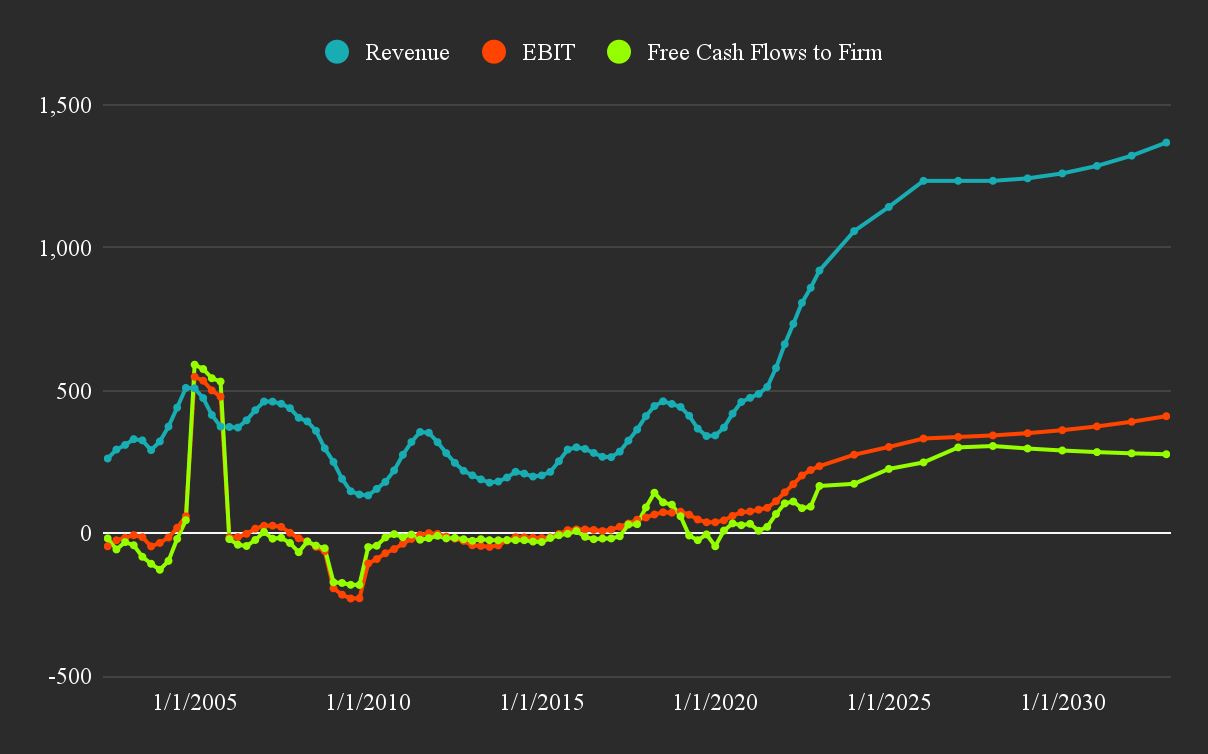

Our Model for Acxelis' Future Performance (Author Image with Data from FMP)

As we can't be sure if the industry expansion trend will continue beyond 2025, we have opted to model a subsequent flat period to account for the uncertainty of future projections. It still seems that there is a good case for continued industry expansion, which is why we didn't go for a downtrend, as has been the case historically. The past two decades should give overly bullish investors pause when extrapolating future growth rates.

Looking at the current market cap of $4.3B, it seems that the recent jump in EBIT and revenue is already priced-in, and investors are left forecasting what will happen after this period ends. One point of uncertainty that is revealed from the company's history is the lack of profits in most of the last two decades, which may also reflect management's dedication to shareholders. This is why we feel that a 14% discount rate for the estimated free cash flows is warranted and possibly optimistic.

Intrinsic Value

Given all of this, we have estimated an intrinsic value for Axcelis Technologies, Inc. of $3B or $90 per share with a positive 1-Y outlook of $140 per share, implying a 5% upside. In order for Axcelis Technologies, Inc. to create additional value, it needs to beat our current model, which is why we cannot rate it more than a hold.

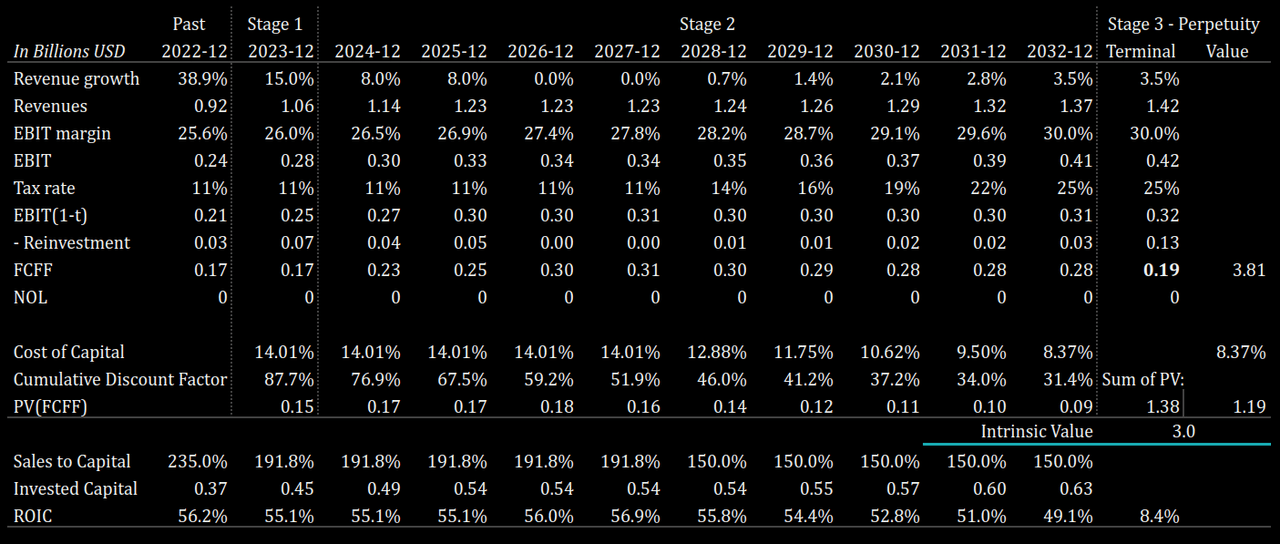

The table below shows the details of our valuation and our expectations for Axcelis:

Valuation Table for Axcelis (Author Image with Data from FMP)

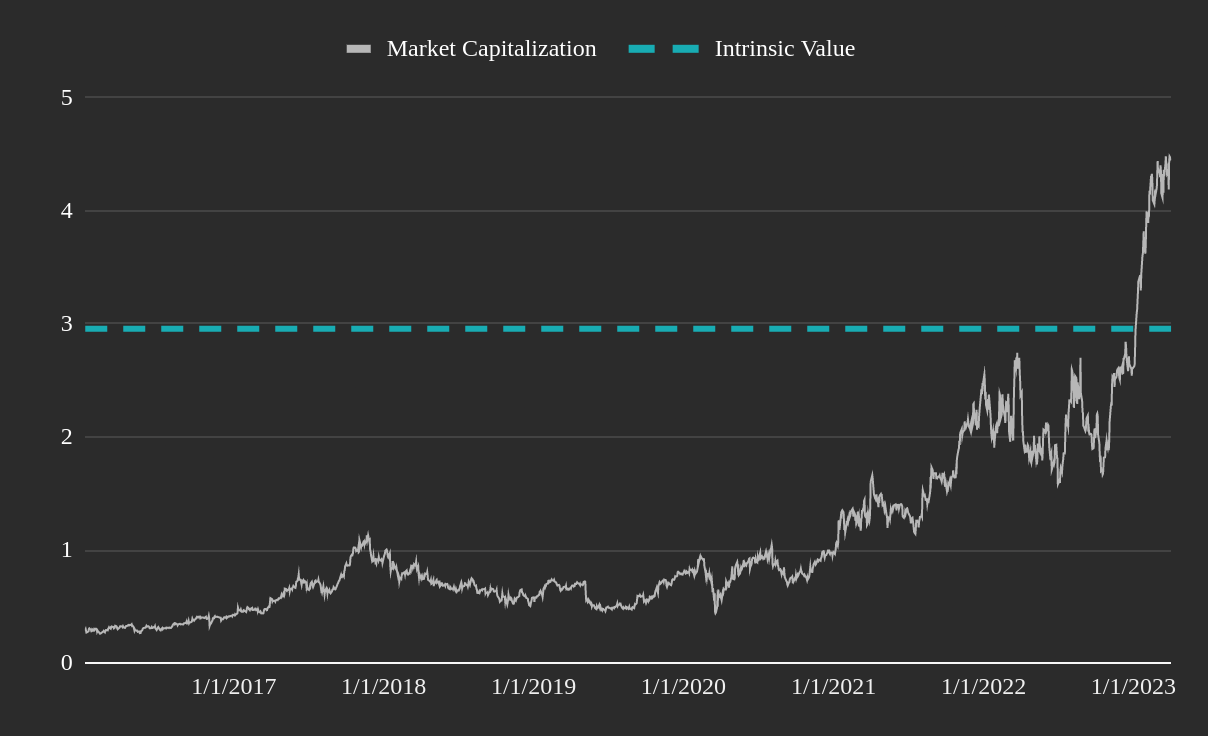

The chart below shows the resulting value line for Axcelis:

Our Intrinsic Value Estimate for Axcelis (Author Image with Data from FMP)

As we can see, Axcelis Technologies, Inc. had an unprecedented surge in market capitalization, which necessitates an elevated industry demand in order to be sustained. While we see increased application in EVs, the electrification of automobiles, IoT and fab capacity expansion, this jump is too risky to consider as a point from which investors can expect further upside.

Risks

Below, we outline the key risk factors investors should consider when analyzing Axcelis Technologies, Inc.

- The export blacklist to Chinese companies may persist/intensify, impacting the number of valid customers.

- The company's management has a lacking history of providing shareholder returns and may seek to capitalize on the sudden spike in the stock price.

- While the semiconductor industry demand may increase, many fabs have already spent a good portion of their allocated CapEx for equipment and may not need as much ion implantation in the near term.

- Smaller competitors may not be impacted by the export restrictions, and may be in a good position to target some of Axcelis' customers.

- Axcelis already has a high market share that can be sustained by persistent technological superiority, which may necessitate high future R&D and CapEx investments.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.