Kodiak Gas Services Begins U.S. IPO Effort

Summary

- Kodiak Gas Services has filed to raise investment from a U.S. IPO.

- The firm provides compression services for natural gas and oil drilling in the Permian Basin and Eagle Ford Shale regions.

- KGS has grown revenue and operating profit in the most recent full year period.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

grandriver/E+ via Getty Images

A Quick Take On Kodiak Gas Services, Inc.

Kodiak Gas Services, Inc. (KGS) has filed to raise $100 million in an IPO of its common stock, according to an S-1 registration statement.

The firm provides compression services for natural gas and oil exploration in the United States.

When we learn management's assumptions about IPO pricing and valuation, I'll provide a final opinion.

Kodiak Overview

Montgomery, Texas-based Kodiak Gas Services, Inc. was founded to develop a fleet of large horsepower compression systems for use under fixed-price contracts with medium to large E&P firms active in the Permian Basin and Eagle Ford Shale regions.

Management is headed by founder, President and CEO Mickey McKee, who has been with the firm since its inception in 2011 and was previously the SVP of Sales and Engineering at CDM Resource Management, a provider of contract natural gas compression systems.

Kodiak currently operates a fleet of compression systems, with 81% producing at least 1,000 horsepower each.

As of December 31, 2022, Kodiak has booked fair market value investment of $34 million in equity and $2.7 billion in debt from investors, including EQT Fund.

Kodiak - Customer Acquisition

Selling, G&A expenses as a percentage of total revenue have risen slightly as revenues have increased, as the figures below indicate:

Selling, G&A | Expenses vs. Revenue |

Period | Percentage |

Year Ended Dec. 31, 2022 | 6.3% |

Year Ended Dec. 31, 2021 | 6.2% |

(Source - SEC)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A expense, was 2.3x in the most recent reporting period. (Source - SEC)

Kodiak's Market & Competition

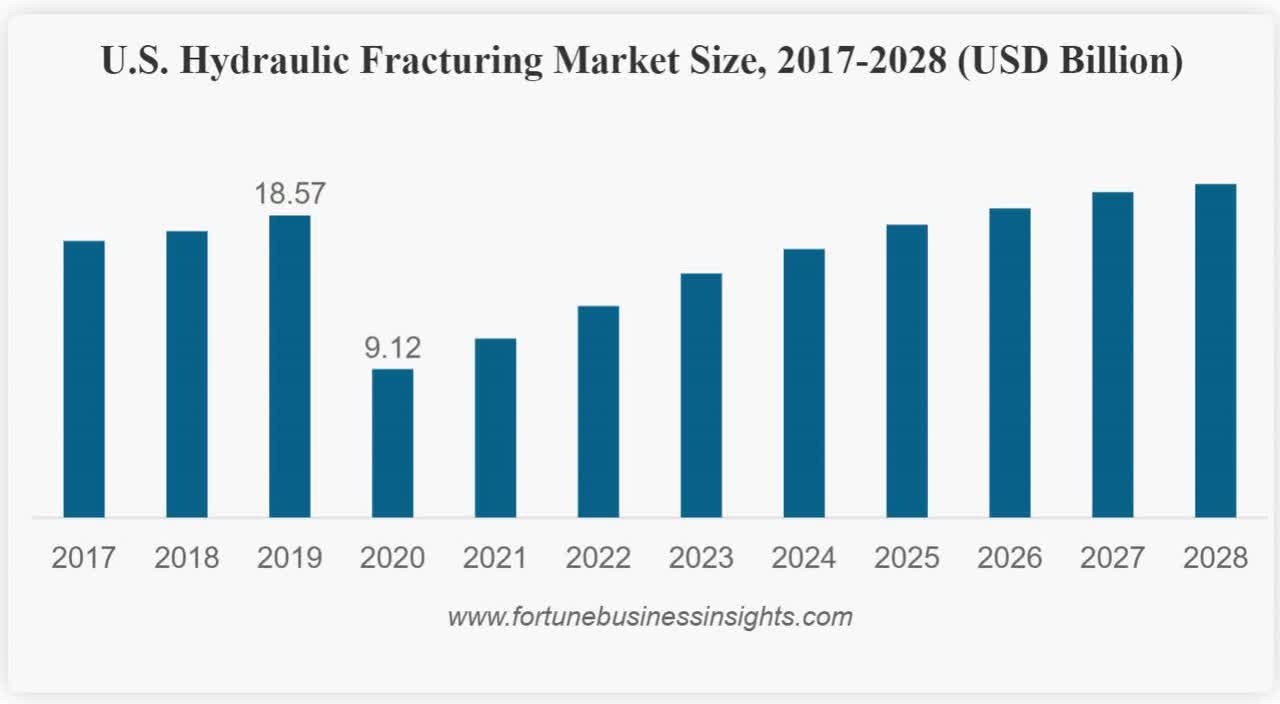

According to a 2021 market research report by Fortune Business Insights, the global hydraulic fracturing market was an estimated $11.7 billion in 2020 and is forecast to reach $28.9 billion by 2028.

This represents a forecast CAGR of 9.5% from 2021 to 2028.

The main drivers for this expected growth are the continued growth of natural gas and oil products for energy and other uses, along with improved technological aspects of the industry.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. hydraulic fracturing market:

U.S. Hydraulic Fracturing Market (Fortune Business Insights)

Major competitive or other industry participants include the following:

Halliburton

Schlumberger

Baker Hughes

ProFrac Holdings

Weatherford

Others

Kodiak Gas Services, Inc. Financial Performance

The company's recent financial results can be summarized as follows:

Growing topline revenue

Increasing gross profit but decreasing gross margin

Higher operating profit

Reduced cash flow from operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 707,913,000 | 16.7% |

Year Ended Dec. 31, 2021 | $ 606,375,000 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $ 440,562,000 | 11.2% |

Year Ended Dec. 31, 2021 | $ 396,198,000 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | 62.23% | -4.8% |

Year Ended Dec. 31, 2021 | 65.34% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Year Ended Dec. 31, 2022 | $ 222,091,000 | 31.4% |

Year Ended Dec. 31, 2021 | $ 188,955,000 | 31.2% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Year Ended Dec. 31, 2022 | $ 106,265,000 | 15.0% |

Year Ended Dec. 31, 2021 | $ 180,963,000 | 25.6% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Year Ended Dec. 31, 2022 | $ 219,846,000 | |

Year Ended Dec. 31, 2021 | $ 249,978,000 | |

(Source - SEC)

As of December 31, 2022, Kodiak had $20.4 million in cash and $3.0 billion in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($31.4 million).

Kodiak Gas Services, Inc. IPO Details

Kodiak intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may be higher.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds from this offering to repay borrowings outstanding under the Term Loan and to use any remaining proceeds for general corporate purposes. The maturity date of the Term Loan is September 22, 2028. The interest rate on borrowings under the Term Loan was 10.67% and 7.13% as of December 31, 2022 and 2021, respectively.

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management believes that any legal proceedings would not have a material adverse effect on the firm's financial condition or operations.

The listed bookrunners of the IPO are Goldman Sachs (GS), J.P. Morgan (JPM), Barclays (BCS) and numerous other investment banks.

Commentary About Kodiak's IPO

KGS is seeking U.S. public capital market investment to pay down its substantial debt load.

The company's financials have produced increasing topline revenue, growing gross profit but lower gross margin, higher operating profit but decreased cash flow from operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($31.4 million).

Selling, G&A expenses as a percentage of total revenue has risen slightly as revenue has increased; its Selling, G&A efficiency multiple was 2.3x in the most recent reporting period.

The firm currently plans to pay dividends according to its Board of Directors' decision process. The firm's ABL Facility contains restrictions on the payment of dividends.

Kodiak's CapEx Ratio indicates it has spent heavily on capital expenditures, exceeding its recent full-year operating cash flow.

The market opportunity for providing well compression services in the Permian Basin and Eagle Ford Shale regions is large and expected to grow steadily in the coming years.

Goldman Sachs is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 48.3% since their IPO. This is a top-tier performance for all major underwriters during the period.

Risks to the company's outlook as a public company include the recent volatility in oil & gas product pricing and elevated interest rates, which can make servicing the company's debt load more expensive.

When we learn management's assumptions about IPO pricing and valuation, I'll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.