NURE: A Rare REIT ETF Built For An Uncertain Rate Environment

Summary

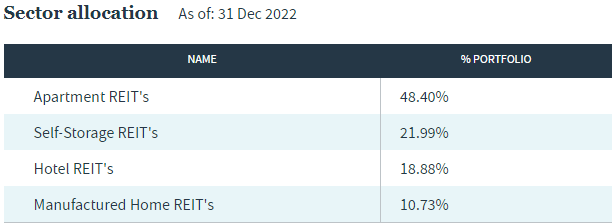

- NURE provides exposure to US real estate investment trusts (REITs) with short-term leases, including apartments, hotels, self-storage facilities, and manufactured home properties.

- Short-term REITs have reduced rate sensitivity relative to longer-term REITs.

- Down 25% from its high, there's long-term value, but I'm limiting my rating to Hold since all REITs are suspect right now.

sl-f

The biggest struggle I see with the REIT market right now is whether their stock prices can climb in an era of persistent increases in interest rates. The Federal Reserve increased rates by another quarter point in March and there is debate about how much more the Fed may need to raise. This trend is particularly detrimental to REITs due to their capital-intensive nature.

However, the Nuveen Short-Term REIT ETF (BATS:NURE) could be a viable investment option for REIT investors in the near future, even if it is not an ideal new buy candidate right now. NURE focuses on short-term REITs such as apartments, single-family rentals, hotels, self-storage facilities, and manufactured homes, which have shorter lease terms and can reprice more quickly, similar to short-term bonds. Nevertheless, due to the challenges facing these property types and the overall economic uncertainty, I am rating NURE a Hold for now. It is simply a victim of its sector at the moment. But that will change, and when it does, I'd expect to give it serious consideration for an upgraded rating.

A viable income-generating investment with healthy net operating income (NOI) trends

REITs may provide diversification and long-term risk-adjusted returns, since they typically offer lower volatility and higher income rather than high growth. NURE delivers a decent dividend yield in today's equity market (around 3.0%, which is about double that of the S&P 500 Index) with potential for capital appreciation.

Additionally, NURE's heavy allocation to residential REITs and self-storage REITs may support future returns. S&P Global Market Intelligence reported that self-storage REITs and residential REITs experienced the most robust same-store NOI growth in Q4 2022 and 2022 of all REIT sectors. Same-store NOI evaluates a firm's performance in its existing sites, disregarding any influence from new acquisitions or developments.

Short-term leases are not exempt from secular challenges

NURE's portfolio is heavily invested in apartments, comprising almost half of its holdings. However, rental prices for apartments across the US have been decreasing since October 2022, with only a slight increase of 0.3% in February. Although high-interest rates may make renting more favorable than owning, this may not be sufficient to support the returns of apartment REITs.

Around 20% of NURE is composed of Hotel REITs, which typically exhibit cyclical performance. The recovery of this sector could be further hindered by the sluggish economy as business travel remains below pre-pandemic levels. Moreover, leisure travel, which is a discretionary expense, tends to follow cyclical patterns.

Nuveen

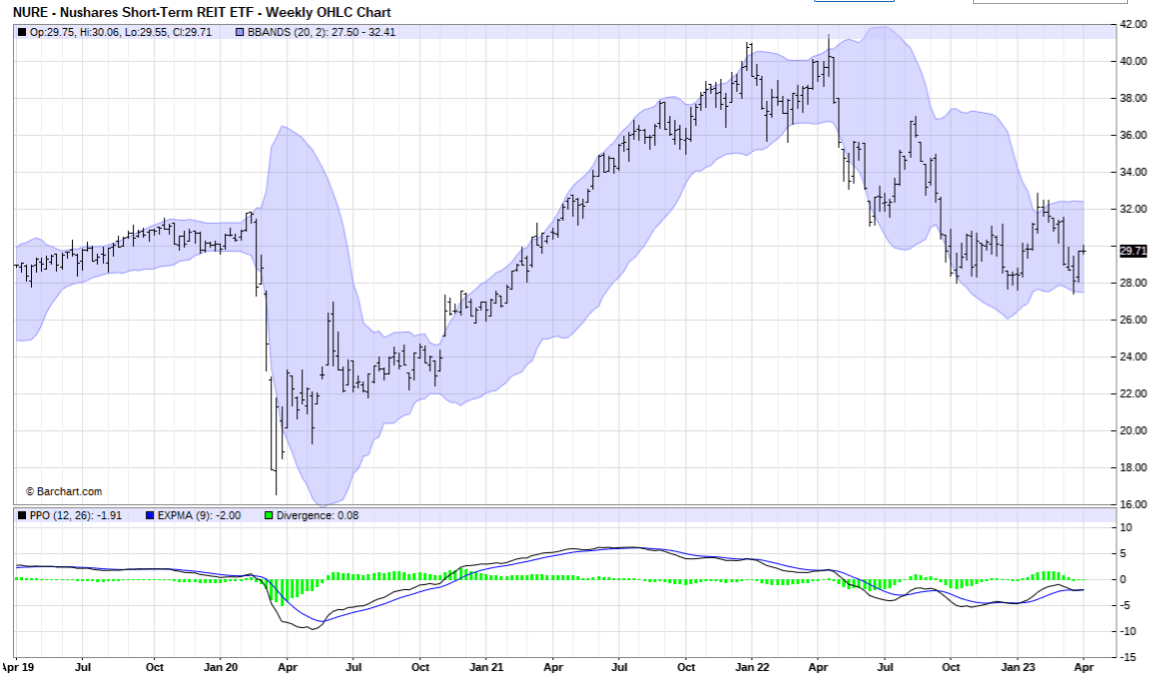

Price trend analysis

Not surprisingly, given the turmoil surrounding the sector since rates started to climb, NURE's price has been trapped in a trading range. This concurs with my fundamental evaluation of this ETF, in that it is not one to bail on at this point. However, there is no clear catalyst that would prompt me to expect more than a trading range performance for at least a little while. At a 3% dividend yield, that's not enough for me to pound the table, since riskless T-Bills yield more.

Barchart

Current investment opinion

NURE's price has also been affected by market conditions, currently down over 25% from its 52-week high. While this decline may present a long-term value opportunity, it is important to note that the entire REIT sector is currently suspect. Therefore, I am limiting my rating for NURE to Hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.