Rightmove: A Quasi-Monopoly At A Reasonable Price

Summary

- Rightmove is the leading property portal in the UK, with more market share than all its main competitors combined.

- It benefits from a very strong competitive moat that is the result of a powerful brand and network effects.

- We believe shares are fairly priced and likely to deliver high-single-digit returns to long-term investors at current prices.

yujie chen

As the largest property website in the UK, Rightmove (OTCPK:RTMVY) has millions of visits every month and a huge influence in the UK property market. We believe it is an interesting investment idea given its strong market position, and efficient business model. Users are incentivized to use the platform to search for properties for sale or rent given that it is free for them, it is the real estate agencies that are charged to advertise on Rightmove.

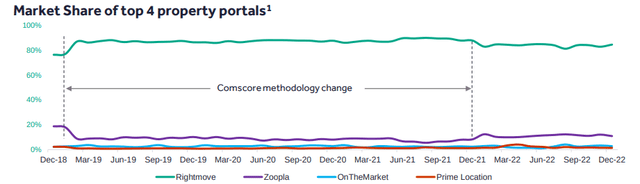

Despite a challenging housing market in the UK in the last few years, the company has continued to deliver solid results and maintain its dominant position. As can be seen below, Rightmove has more market share than all its main competitors combined. This is thanks to its powerful brand that has become a household name in the UK, and the network effect dynamics behind its competitive moat.

Rightmove Investor Presentation

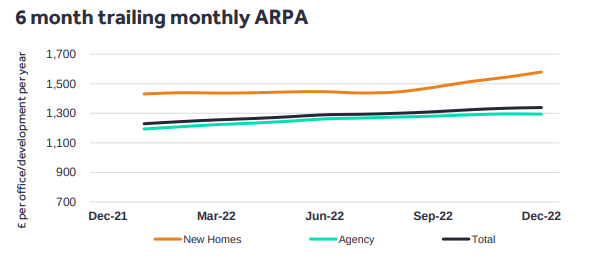

What we particularly like about its characteristics as an investment is that its strong competitive position gives it a lot of pricing power. This allows the company to consistently raise its prices without losing many customers and increase the average revenue per agency (ARPA), even during economically challenging periods. The last couple of years have been far from the best in UK housing, and yet ARPA has been trending higher as can be seen in the graph below, which also includes New Homes, a smaller part of the business that is performing very well too. New Homes is roughly 15% of the business, compared to Agency that represents about three quarters of the revenue, but has a higher ARPA.

Rightmove Investor Presentation

Competitive Moat

One of the main reasons Rightmove has become a quasi-monopoly is its strong competitive moat. This is primarily the result of network effects, since people looking for property to buy or rent will find it more convenient to use the website with the broadest offer, and agencies advertising these properties will prioritize publishing their ads in the most visited website. This creates a virtuous circle that reinforces the competitive moat, which together with a high quality website and mobile application keeps the company in the number one position.

Financials

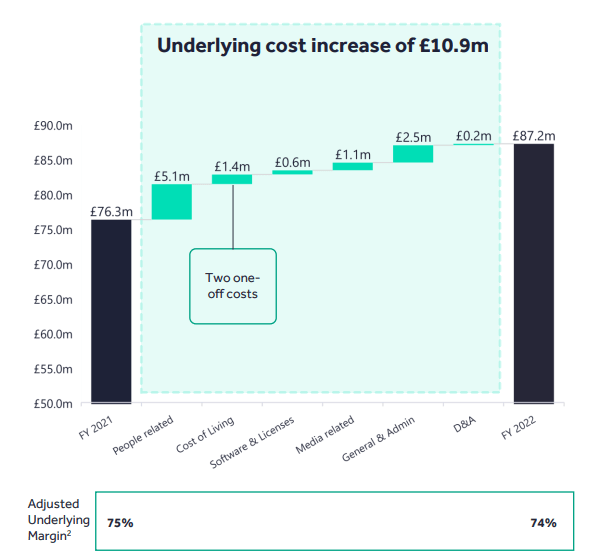

The competitive moat is reflected in extraordinary profit margins. Rightmove has an incredible operating margin of ~74%. The company has been facing some cost increases recently, mostly as a result of head count increases and inflationary pressures. Still, thanks to its ability to raise prices, the underlying margin has remained quite stable. There are very few companies in the world with this level of profit margins and pricing power, which means the company certainly deserve a premium valuation.

Rightmove Investor Presentation

Growth

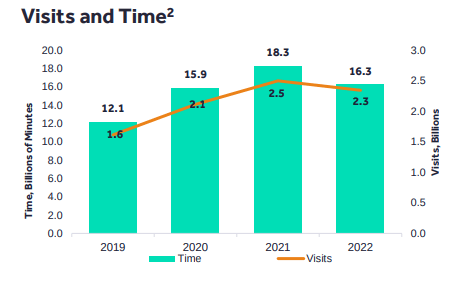

The company had a post-pandemic surge in activity, but transactions have now normalized after a record 2021. We believe the company will continue growing forward at a moderate pace, especially once the UK economy starts recovering.

Rightmove Investor Presentation

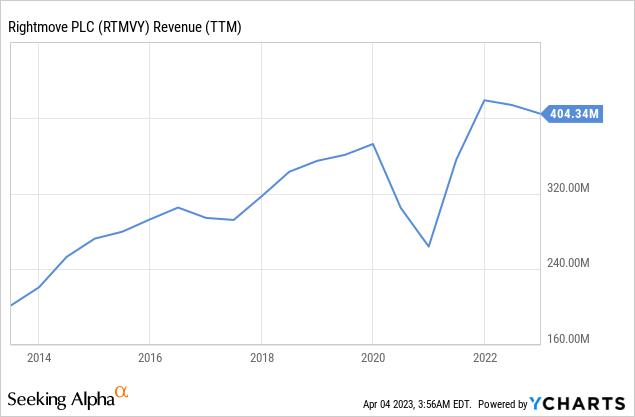

Revenue has been growing nicely, with a dip during the worst part of the Covid period given that the company decided to provide support to its customers making some concessions. Revenue has roughly doubled in the past decade, which corresponds to a 7-8% CAGR. Going forward we believe this can continue for some time given the strong pricing power the company has, moderate organic growth, and the development of new products and services.

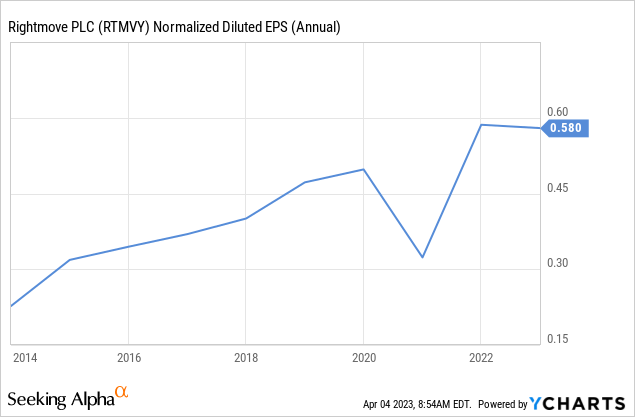

Earnings per share have grown a little bit faster than revenue thanks to operating leverage, and aggressive share buybacks by the company. Going forward we believe the company could realistically grow EPS at an 8-9% CAGR.

Valuation

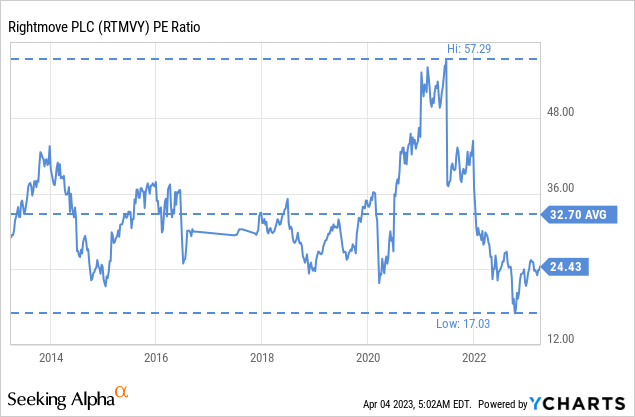

At first glance shares do no look particularly cheap, trading with a price/earnings ratio of ~24x. Still, this is a significant discount to the ten year average p/e ratio of ~32x. On the bright side, most of the earnings are returned to shareholders through a modest dividend that currently yields ~1.5%, and most of the remaining earnings are given back through very significant buybacks.

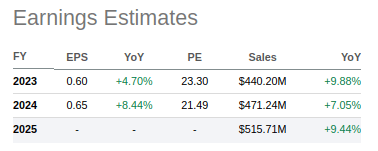

Analysts expect the company will return to 8-9% EPS growth by FY2024, with the UK housing market likely on a more solid footing by then.

Seeking Alpha

Our preferred way to value the shares is to calculate the net present value of our estimates for future earnings. This gives us a fair value per ADR of ~$12.4, which is slightly lower than the current price. If we instead use a 9% discount rate we get a price very close to where it is currently trading. In other words, we believe shares are currently priced to deliver high single digit returns for long-term investors.

| EPS | Discounted @ 10% | |

| FY 23E | 0.60 | 0.55 |

| FY 24E | 0.65 | 0.50 |

| FY 25E | 0.71 | 0.45 |

| FY 26E | 0.77 | 0.44 |

| FY 27E | 0.84 | 0.44 |

| FY 28E | 0.92 | 0.44 |

| FY 29E | 1.00 | 0.43 |

| FY 30E | 1.09 | 0.43 |

| FY 31E | 1.19 | 0.42 |

| FY 32E | 1.30 | 0.42 |

| FY 33E | 1.41 | 0.42 |

| Terminal Value @ 4% terminal growth | 23.53 | 7.50 |

| NPV | $12.43 |

Risks

One risk we see with an investment in Rightmove is if the company falls behind in maintaining a cutting-edge experience for its users and advertisers in terms of technology and UX/UI. Given the strong network effects, a competitor would have to improve on the experience significantly before a large number of users move to their site. In the short to medium term the biggest risk is probably that of a recession in the UK.

Conclusion

Rightmove benefits from a quasi-monopoly position as the go-to platform people use to research property in the UK. This gives them terrific financials and pricing power, and has allowed the company to grow revenue and earnings at a very healthy rate. The company benefits from a strong brand and network effects, that result in a very strong competitive moat. We believe shares are reasonably priced, and estimate long-term investors could be looking at high single digit returns at current prices. Growth should return to more normal levels once the UK economy and its housing market recover. In the meantime shareholders benefit from a small dividend and very generous share buybacks. We are therefore starting coverage on Rightmove with a 'Buy' rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.