Erste Group Bank: We Are Back To Neutral

Summary

- Solid Liquidity Coverage Ratio and CET1.

- We prefer other EU banks within our coverage.

- On a tangible book value, Erste is fully priced in. We decide to move the company's rating from buy to neutral.

J2R/iStock Editorial via Getty Images

Here at the Lab, we still see an undervaluation in the European banking sector, earnings-per-share momentum is expected to remain positive in the near term, and shareholders' remuneration should continue to be supportive (at the aggregate level, we still see a 2023 total return on equity of 10.5%: 7.8% dividend yield and 2.7% buyback). The vast majority of European banks met their return on capital expectations with their FY22 results, and while dividend swap markets are now pointing to a decline, we see no reason why this should materialize. So, as we already did in 2020 (in our EU Champion Picks), we suggest investors focus on banks that are national champions with high yields and organic capital generation. The ideal bank is also able to hold deposits at a lower beta than competitors due to asset mix and franchise strength and is positioned on the defensive in credit quality deterioration. After having analyzed Raiffeisen Bank International AG (OTCPK:RAIFF, OTCPK:RAIFY), today we are back to comment on Erste Group Bank (OTCPK:EBKOF).

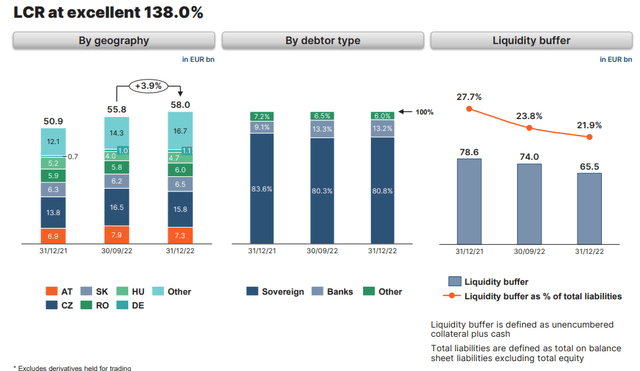

In Europe, interest rate risk is overseen by regulators through two shields: 1) the Liquidity Coverage Ratio (LCR). Under this ratio, banks must hold sufficient high-quality liquid assets (HQLA, second shield) – such as short-term government debt – that can be sold to finance a 30-day stress scenario. Hence, the stress test is regularly carried out by the ECB on credit institutions. Banks are required to hold HQLA equal to at least 100% of the expected cash flows during the stress scenario. Looking at Erste's LCR, the bank has a solid ratio of 138%.

Erste LCR

Despite that, this is an area that we might expect to see more scrutiny in the medium-term horizon. 30 days are the necessary minimum period for the adoption of corrective measures by the bank's management or supervisory authorities. However, there are fears that this could come with an opportunity cost, as banks would be forced to hold more low-yielding assets, such as cash and government bonds, rather than making more loans. Here at the Lab, it is important to highlight how financial conditions tightening could hold back economic growth and increase a recession probability. Banks are now having to deal with a higher cost of capital, limits on liquidity reserves, and a deterioration in balance sheet quality. If borrowing becomes ever more expensive, it is likely to negatively affect investments, B2C as well as SME loans & mortgages, and consequently also hiring unemployment rate. Another possibility is that the threshold limits of the deposit guarantee schemes will be revised upwards (the current limit is set at €100k). Banks pay 80 basis points of covered deposits, so if the cap is raised to €200k as in the US, this would be an additional €74 billion cost to EU banks, with Austrian, German, and Italians the most affected.

So, what's next? In short, we are back to a neutral rating. We initiated the bank with an equal weight valuation and then, over 2022, we decided to upgrade Erste at a buy, performing a plus 36.57% including its dividend payment.

Mare Evidence Lab's previous publication

Why are we back to neutral?

- Starting with the valuation, last time, we emphasized that "based on a 2023 expected Return on Tangible Equity, we valued Erste at €30 per share". Erste is currently trading at €30.44;

- Related to point 1), historically speaking, Erste's valuation was at an average of 0.8x on its tangible price/capital multiple. The company is currently trading at 0.73x (and again we are not far from its target multiple);

- If all assets/liabilities were measured at fair value, excluding loans and deposits, the greatest impact on capital ratios would be Bankinter SA (OTCPK:BKIMF), Erste Bank, and Commerzbank (OTCPK:CRZBF). Downside risks are equally important and we should not forget about that;

- Having checked ISP (OTCPK:ISNPY), BNP (OTCQX:BNPQF), UniCredit (OTCPK:UNCFF), and SocGen (OTCPK:SCGLY), we believe that there is more capital upside appreciation in these banks. In addition, Erste is yielding 6.23% compared to BNP, ISP, and SocGen which are at 7.06%, 10.12%, and 8.18% yield, respectively;

- Despite Erste's Common Equity Tier 1 ratio is solid, here at the Lab, we are confident that other EU banks provided a better risk reward. Erste already reached our target price, so we confirm a neutral rating target of €30 ($16 in ADR) per share.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.