- News

- City News

- bengaluru News

- Bengaluru bizman shows villa on paper, pockets Rs 5 crore loan

Trending Topics

Bengaluru bizman shows villa on paper, pockets Rs 5 crore loan

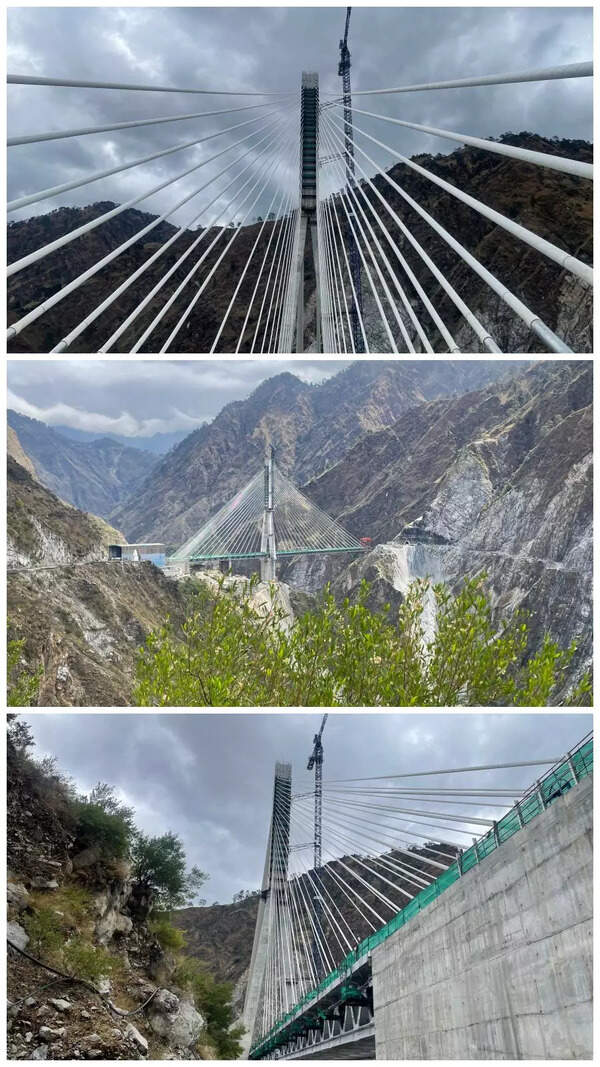

Representative image

BENGALURU: A city-based businessman allegedly availed cash credit facility up to Rs 5 crore by duping the bankers with forged documents. The Anti-Corruption Bureau (ACB) wing of the Central Bureau of Investigation probing the case has named eight people, including the businessman, two advocates and a valuer of properties, in the First Information Report.

The other suspects named in the FIR have been accused of helping Suresh Gowda, proprietor of Pristine Enterprises, Rajajinagar, avail the facility by providing forged documents of a villa on the city outskirts, considered to be a collateral security.

A complaint in this regard was filed by Sumathindra Reddy Puli, regional manager, State Bank of India-regional business office, KG Road.

Puli stated that Suresh Gowda applied for a credit facility of Rs 5 crore for his business in March 2017 and for collateral security, offered a villa at Nallurahalli, saying he will be purchasing it. Gowda produced documents, including the sale deed made between him and the owners of the villa. The sale deed was executed on March 27, 2017.

Later, officials from the bank, accompanied by Gowda and sellers of the villa, visited the property on March 25, 2017. "Gowda showed us a constructed villa and the sellers too agreed that it was the same property. It was valued by an empanelled valuer of the bank. Finally, with a green signal from two advocates, who made the Title Investigation Report (TIR), the credit facility was sanctioned," the FIR stated.

However, officials from the bank discovered the cheating in July 2019 when Gowda's bank accounts turned into non-performing assets (NPA). "The officials found that no such villa existed. For availing the loan, Gowda and the others had shown a villa in a different property in the same location. The accused in collusion with the valuer and the advocates deceived the bank and caused a loss of Rs 8.6 crore," the complaint read.

The empty land, documents of which were forged, was already pledged with a private finance firm for a loan. According to the complaint, the advocates made a false title investigation report. "The advocates failed to comment and exercise due diligence with regard to the discrepancy in the sale consideration in the agreement of sale, construction agreement and absolute sale deed," the complaint read.

The other suspects named in the FIR have been accused of helping Suresh Gowda, proprietor of Pristine Enterprises, Rajajinagar, avail the facility by providing forged documents of a villa on the city outskirts, considered to be a collateral security.

A complaint in this regard was filed by Sumathindra Reddy Puli, regional manager, State Bank of India-regional business office, KG Road.

Puli stated that Suresh Gowda applied for a credit facility of Rs 5 crore for his business in March 2017 and for collateral security, offered a villa at Nallurahalli, saying he will be purchasing it. Gowda produced documents, including the sale deed made between him and the owners of the villa. The sale deed was executed on March 27, 2017.

Later, officials from the bank, accompanied by Gowda and sellers of the villa, visited the property on March 25, 2017. "Gowda showed us a constructed villa and the sellers too agreed that it was the same property. It was valued by an empanelled valuer of the bank. Finally, with a green signal from two advocates, who made the Title Investigation Report (TIR), the credit facility was sanctioned," the FIR stated.

However, officials from the bank discovered the cheating in July 2019 when Gowda's bank accounts turned into non-performing assets (NPA). "The officials found that no such villa existed. For availing the loan, Gowda and the others had shown a villa in a different property in the same location. The accused in collusion with the valuer and the advocates deceived the bank and caused a loss of Rs 8.6 crore," the complaint read.

The empty land, documents of which were forged, was already pledged with a private finance firm for a loan. According to the complaint, the advocates made a false title investigation report. "The advocates failed to comment and exercise due diligence with regard to the discrepancy in the sale consideration in the agreement of sale, construction agreement and absolute sale deed," the complaint read.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE