Arbor Realty: Ignore The Shorts, It's A Buy

Summary

- Arbor Realty fell victim to a short attack.

- The company delivers strong results on an operational basis.

- Credit risks exist but do not seem especially pronounced.

- A big yield, insider buying, and a new buyback authorization make ABR attractive.

- Looking for a helping hand in the market? Members of Cash Flow Club get exclusive ideas and guidance to navigate any climate. Learn More »

BernardaSv

Article Thesis

Arbor Realty Trust (NYSE:ABR) is a quality mortgage REIT that has a compelling track record. Shares are very inexpensive and offer a hefty dividend yield of 14% at current prices, thanks to a recent share price slump that was caused by a short report. I believe that fears are overblown and that ABR is an attractive investment opportunity right here.

What Happened?

Arbor Realty Trust has seen its share price decline by 24% over the last month, making it a major loser over that time frame. The company didn't announce a dividend cut in that time frame, and there weren't any bad quarterly results, either (Arbor Realty easily beat earnings estimates when it reported results in February). Instead, Arbor Realty was sold off due to two reasons. First, the troubles at Silicon Valley Bank (OTC:SIVBQ), Credit Suisse (CS), and so on, made investors wary of stocks seen as "financials", and as a mortgage REIT, Arbor Realty felt some impact from that, as did some of its peers.

Even worse, however, was the short-term share price damage from a short report by Ningi Research, a not-well-known, anonymous, short seller. Sam Kovacs did an in-depth article on the report by Ningi Research and the faults in that report, which I highly recommend reading for those interested.

When short sellers come out with short reports on stocks, especially when these short reports include huge accusations such as fraud, manipulation, and so on, the shares of the attacked company oftentimes fall in the near term, even if the short-seller's claims are not to be taken seriously. Retail investors that don't have the time to delve into the details may sell out of fear that the accusations in the short report are true, which can cause significant share price drops -- which we have now seen with Arbor Realty Trust.

The good news is that these (unjustified) share price slumps are only temporary -- when the attacked company continues to perform well on an operational basis and when high dividends continue to flow reliably, investors will eventually come back and the attacked company's shares will recover. For investors that have cash to deploy, these temporary short attack-caused share price slumps can even be a good thing, as they allow investors to enter or expand positions at highly attractive valuations, while very high dividend yields can be locked in at the same time. I believe this is the case here, with ABR.

ABR Is Doing Fine

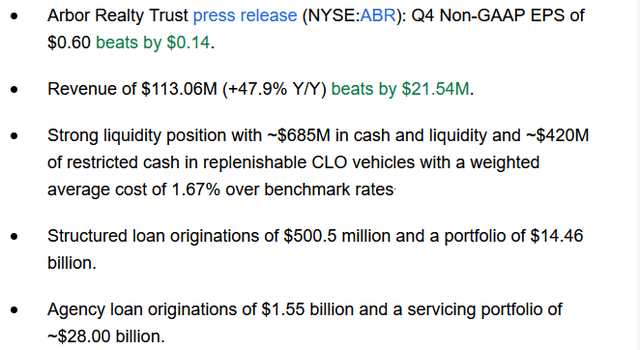

After all, Arbor Realty Trust is doing very well when it comes to its operational results. The company's most recent quarterly results from February show that Arbor Realty has done quite well during the period, despite market troubles seen over that time frame:

Not only did Arbor Realty Trust massively beat analyst expectations for the top line and the bottom line, but the company also showed compelling year-over-year growth and strong results in absolute numbers.

While ABR's loan originations in the structured loan space did decline throughout 2022, from an average of $1.9 billion per quarter in Q1-Q3 to $500 million in Q4, Arbor Realty was able to grow its loan originations in the agency loan space. There, Arbor Realty grew originations from a $1.1 billion average in Q1-Q3 to $1.6 billion in Q4. This can be seen as a good thing, I believe, as agency loans naturally are less risky than other types of loans, such as the bridge loans from ABR's structured loans business. If this trend of growing agency originations continues, while structured loan originations decline, that will cause Arbor Realty's portfolio to become more agency-heavy over time, which will de-risk operations. In turn, lower risks could result in a higher valuation eventually, as investors might be willing to pay higher earnings multiples for a company that is perceived as less risky.

Arbor Realty also continued to grow its servicing portfolio, which grew from $27 billion at the end of the third quarter to $28 billion at the end of 2022. The servicing business is fee-based and generates predictable, low-risk cash flows for Arbor Realty, making this an attractive business unit for the company. The fact that interest rates have been rising over the last year could be positive for the mortgage servicing business, as fewer house owners will refinance their existing mortgages, which means that ABR will make money for a longer time on its existing mortgage servicing rights. A similar development is seen at other mortgage REITs that have a mortgage servicing rights business, such as Rithm Capital (RITM).

For a mortgage REIT, credit losses and credit risks are important stats to track. Arbor Realty did relatively well there during the most recent quarter. At the end of 2022, Arbor Realty's non-performing loans totaled $7.7 million. This was up from the previous quarter's level, but this still represents a pretty small amount considering the size of ABR's portfolio and its market capitalization. These $7.7 million of non-performing loans have a little more than $5 million in related loan loss reserves, thus even if these non-performing loans turn out to be a complete loss for ABR and there's no recovery at all, the net hit for ABR's book value would be less than $3 million. For a company valued at several billion dollars, that's almost immaterial. Of course, other loans may turn out to be problematic in the future, and if the number of non-performing loans rises drastically, the future impact on ABR's book value could increase. That being said, Arbor Realty has more than $130 million in allowances for credit losses, thus non-performing loans would have to rise drastically for there to be a big hit on ABR's book value. While a deep recession can't be ruled out, I do not see it as likely. Inflation has been coming down in recent months, while job markets remain strong, which could indicate that a big recession (with larger loan losses) is unlikely.

Arbor Realty remained highly profitable, generating distributable earnings of $0.60 per share, or $2.40 annualized. That was an improvement versus the Q1-Q3 average of $0.54 per share, showcasing that things aren't getting worse for ABR -- they are actually getting better on a profit basis. Looking at GAAP profits instead of distributable earnings, Arbor Realty did well, too, with $1.67 in per-share profits for the year. While dividend coverage, relative to the distributable earnings that ABR generated, was pretty strong, the company nevertheless decided against a dividend increase.

A Change In The Shareholder Return Strategy

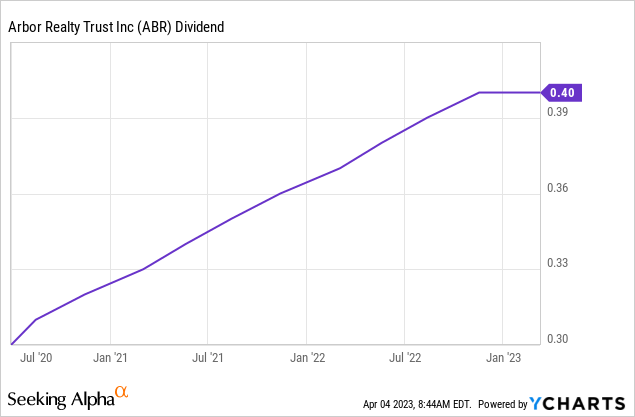

This was a change in its strategy, as Arbor Realty had increased the dividend very reliably -- once per quarter -- for some time, as we can see in the following chart:

This has stopped now, but I don't see this as a reason to worry. After all, the dividend yield is pretty high today, at 14%, so no dividend growth is needed for ABR to be a compelling income pick. In fact, even if the dividend were to shrink going forward, one could argue that ABR would still be a solid income pick, under the condition that the dividend decline rate is not too high. But I doubt that there will be any dividend declines, as the dividend coverage is strong and since ABR has significant liquidity reserves.

Instead, the decision to stop the dividend increases can likely be explained by several other arguments. First, ABR didn't get any respect for its dividend growth track record, as its share price has underperformed despite the compelling and reliable dividend growth.

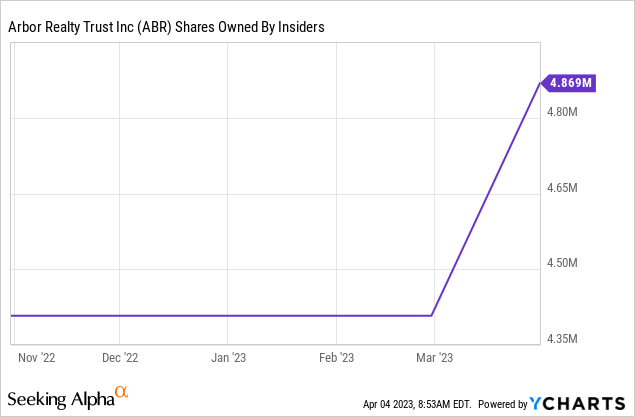

Second, stopping the dividend increases, at least for now, frees up cash for other purposes. And Arbor Realty found a great way to utilize that cash: The company has announced a share repurchase program for $50 million at the end of March, which covers more than 2% of the current market capitalization. At the current price and dividend yield, these buybacks seem highly compelling to me. They will be accretive to future earnings per share, and one can argue that ABR immediately generates a 14% cash-on-cash return by taking its own 14%-yielding shares off the market. After all, ABR does not need to pay dividends for the shares that it has bought back. As long as Arbor Realty remains as cheap and high-yielding as it is today, I hope the company will continue to prioritize buybacks over dividend growth while maintaining the dividend at the current level. Once its share price recovers and the valuation expands, Arbor Realty can then move back towards the old model of utilizing growing profits for dividend increases. The buyback authorization can also be seen as a message to the market and short sellers such as Ningi Research. When the company buys back its own shares, it sees them as undervalued, thereby contradicting the claims of short-sellers. The fact that insiders have been adding to their ABR positions can be seen in the same way:

Insiders are buying via the company's buyback authorization (indirectly), and directly, via their own accounts. They seem to disagree with the shorts, and they are putting their money where their mouth is. As an ABR shareholder, I find this very reassuring.

Takeaway

ABR fell victim to a short attack, but the company's underlying results are healthy and the dividend looks great. With buybacks in place and with insiders adding to their positions, I believe that there is a good chance that the shorts' claims turn out to be wrong. The share price drop is providing a good opportunity to enter or expand a position in Arbor Realty Trust.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABR, RITM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.