6 High-Yield ETFs For Up To 60% Gains In The Coming Recession

Summary

- The economic data indicates a mild recession is likely to begin within two to four months.

- While the actual economic contraction is likely to be mild, the stock market is likely to be disappointed by a Fed that isn't going to cut anytime soon.

- This kind of exchange-traded fund is the best short-term strategy for anyone looking to buy low-risk blue-chip that are likely to soar 20% to 60% in the coming recession.

- Here are six high-yield ETFs that provide maximum long-term hedging power in this and future recessions.

- 30% of the time dry powder boosts long-term returns, specifically in bear markets. Rebalancing during this recession is a way to potentially buy one to three years worth of blue-chip stocks within 10% of the ultimate bottom in the coming months.

- Looking for a helping hand in the market? Members of The Dividend Kings get exclusive ideas and guidance to navigate any climate. Learn More »

Mykola Sosiukin

This article was published on Dividend Kings on Monday, April 3rd.

---------------------------------------------------------------------------------------

A recession has been top of mind for investors for several months now. And for a good reason.

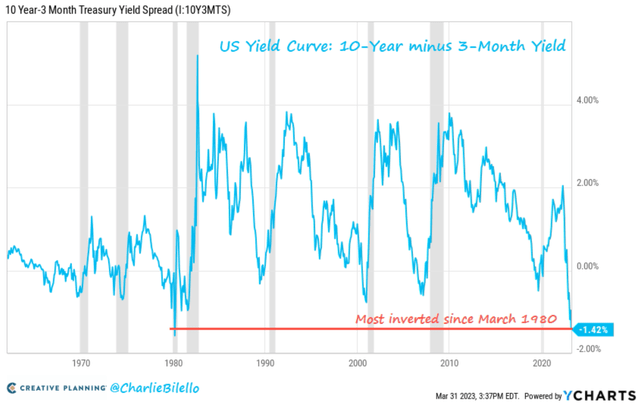

According to studies from the NY, San Francisco, and Dallas Fed, the 3-10 yield curve is the most accurate recession forecasting tool in history. And right now, it's the most inverted it's been in 43 years.

Which means the highest recession risk in 43 years.

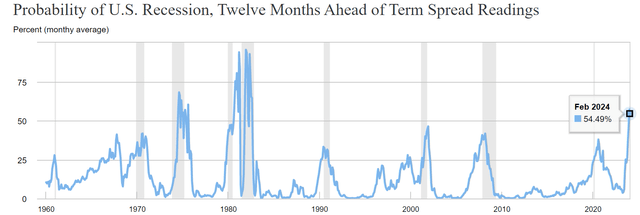

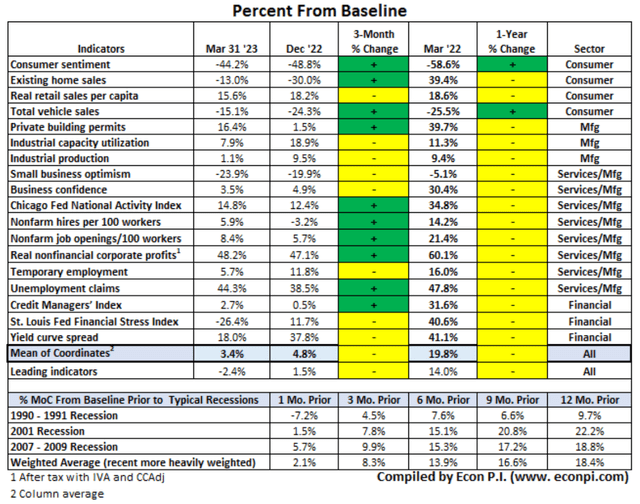

And the economic data backs up what the bond market is saying: a recession could start between July and September.

The economic data says that a recession could begin within two to four months, around July.

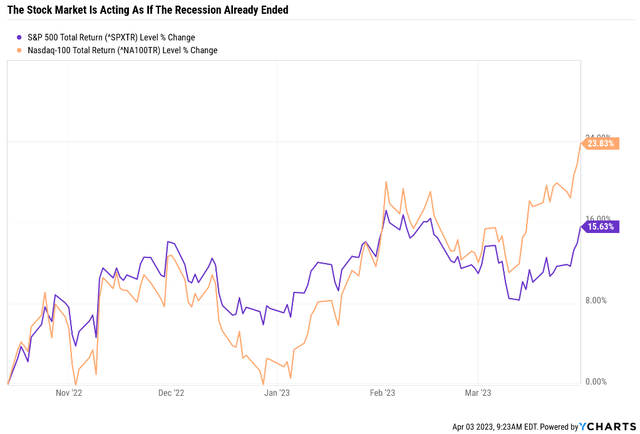

Does This Look Like A Stock Market That's Priced In A Recession?

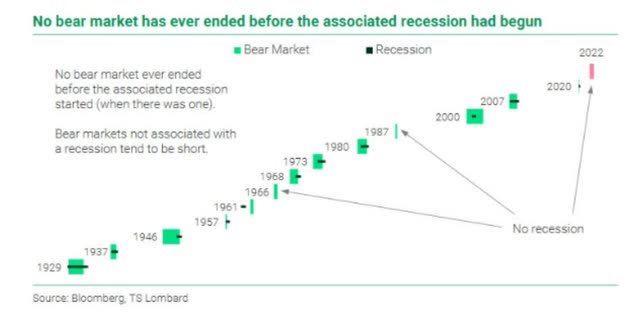

So far, the bottom of this bear market was on October 13th. How often has the market bottomed this far ahead of a recession?

It would be unprecedented for the October 2022 low to be the final bottom, if we get a recession in 2023.

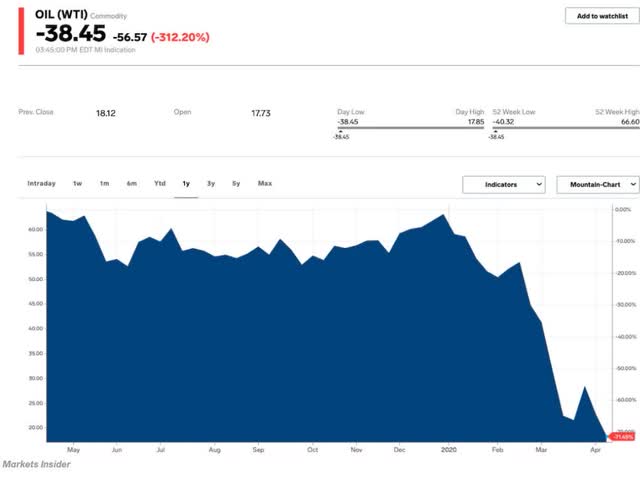

That doesn't mean it can't actually happen. After all, how many oil executives though negative oil prices were possible? It happened in April 2020.

How many bond traders thought risk-free government bonds could fall 50% in two days? It happened to UK 50-year treasuries in September of 2022.

- that week UK bonds traded with 5X the volatility of crypto.

But prudent investing isn't based on hoping and dreaming of very long shots. It's about doing what's most likely to work over the long-term.

S&P Potential Bear Market Bottom Scenarios

| Earnings Decline | S&P Trough Earnings | Historical Trough PE Of 14 | Decline From Current Level | Peak Decline From Record Highs |

| 0% | 227 | 3180 | 22.6% | -34.0% |

| 5% | 216 | 3021 | 26.5% | -37.3% |

| 10% | 204 | 2862 | 30.4% | -40.6% |

| 13% (average since WWII) | 198 | 2766 | 32.7% | -42.6% |

| 15% | 193 | 2703 | 34.2% | -43.9% |

| 20% | 182 | 2544 | 38.1% | -47.2% |

(Source: Dividend Kings S&P Valuation Tool)

Outside of the Great Recession, stocks tend to bottom at 13 to 15X trough earnings.

- historical bear market bottom range of 2,400 to 3,400.

According to Fidelity, during periods of elevated inflation, earnings often fall very little in recessions or sometimes don't fall at all.

However, the market often prices stocks at a lower PE during such times.

- 3,000 to 3,500 is the blue-chip consensus range for the final market bottom.

In other words, a 17% to 35% decline is possible for stocks during the coming recession.

Want To Laugh At The Recession? Buy Bonds!

Wall Street runs on probabilities, not certainties, so I NEVER recommend selling all your stocks and trying to nail the bottom.

Remember that the range of likely outcomes is very wide.

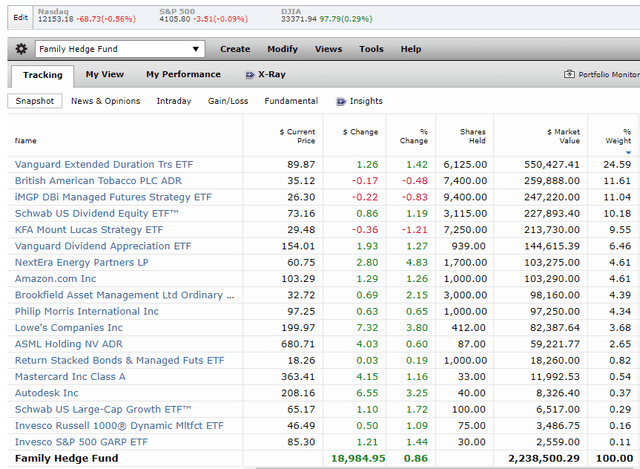

My family has a complex risk profile due to a lot of medical bills and health uncertainty for my grandparents and parents.

So did we sell all our stocks and hide in cash? Just because stocks are likely to fall a lot lower before the new bull market begins?

Nope, we have over $1.2 million in the world's best blue-chips and use hedges to protect ourselves from the likely recession freight train that's bearing down on us in 2023.

Today I want to explain why five high-yield bond ETFs are the ideal hedges for the coming recession. Here they are in terms of duration.

- PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ZROZ) 26 duration 3.4% yield

- Vanguard Extended Duration Treasury ETF (EDV) 24 duration 3.9% yield

- iShares 20+ Year Treasury Bond ETF (TLT) 17.6 duration 3.7% yield

- SPDR Portfolio Long Term Treasury ETF (SPTL) 16.1 duration 3.8% yield

- Vanguard Long-Term Treasury ETF (VGLT) 16.1 duration 3.9% yield

- iShares 20+ Year Treasury Bond UCITS ETF (LON:IDTL) 17.6 duration 3.7% yield (for European Investors).

Why Long Bonds Are The Ultimate "Buy And Hold Forever" Bear Market Hedge

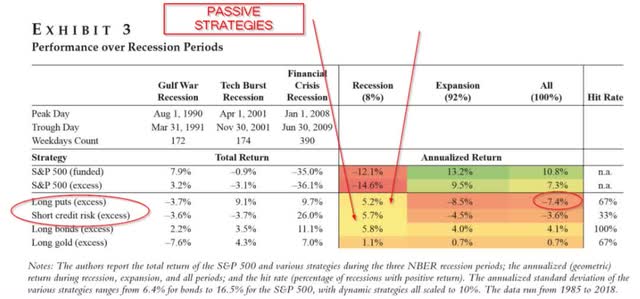

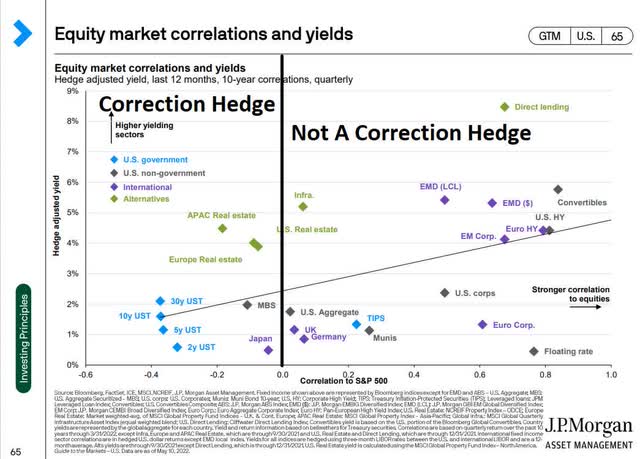

According to a study from Duke, long-duration US Treasuries are the best passive hedging asset you can own in recessions.

They generate the best positive gains while delivering the best long-term positive gains across the entire economic cycle.

US treasuries work better than any other risk-free bond, with the highest negative correlation to stocks.

The longer the duration the more hedging power a bond has.

Duration just means how rate sensitive a bond (or any stock) is.

A 30-year Treasury has a duration of 29.85 if you always own just the most recent one (called "on the run" bonds).

In other words, for every 1% change in 30-year Treasury yields, a 30-year bond will go up or down about 30%.

| Year | S&P | Bonds | Cash | Long Bonds | RSBT | DBMF | KMLM |

| 2022 | -18.1% | -13.1% | 2.0% | -39.4% | 21.8% | 21.5% | 30.4% |

| 2008 | -37.0% | 5.9% | 1.4% | 55.5% | 24.5% | 13.1% | 40.4% |

| 2002 | -22.1% | 9.9% | 1.6% | 36.9% | 31.9% | 12.9% | -9.2% |

| Average | -25.7% | 0.9% | 1.7% | 17.7% | 26.1% | 15.8% | 20.5% |

(Source: DK Research Terminal) RSBT, DBMF, and KMLM are managed futures.

In a year like 2022, the worst bond crash in US history, caused by rates rising from their lowest level in history at the fastest rate in 42 years, bonds are not a great hedge.

But outside of stagflation hell periods, there is nothing like long bonds to hedge a portfolio.

| Crisis Period | US Stocks | Bonds | Long Bonds | Cash | RSBT | DBMF | KMLM |

| December 2021 to September 2022 | -25% | -14.4% | -44.8% | 0.6% | 28.7% | 31.6% | 44.8% |

| January 2020 to March 2020 | -20% | -2.6% | 20.3% | 0.3% | 0.3% | -0.8% | 13.9% |

| October 2007 to February 2009 | -50% | 6.1% | 24.0% | 2.5% | 25.9% | 13.5% | 37.4% |

| August 2000 to December 2002 | -41% | 33.4% | 149.6% | 11.2% | 78.6% | 28.8% | 30.4% |

| Average | -34% | 5.6% | 37.3% | 3.6% | 33.4% | 18.3% | 31.6% |

(Source: DK Research Terminal) RSBT, DBMF, and KMLM are managed futures.

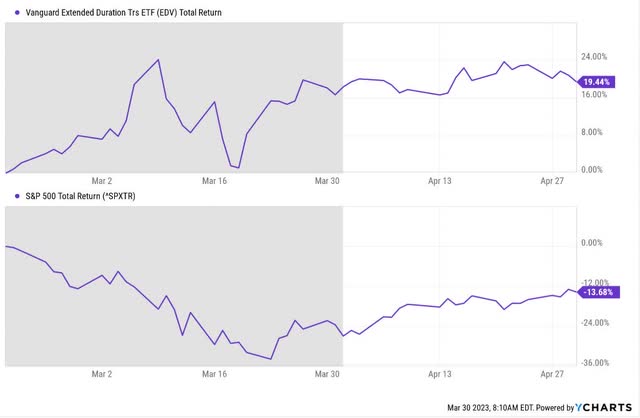

What Kind Of Returns Might Long Bonds Generate During The 2023 Recession? 20% To 60%, While Stocks, Could Fall 15% to 35%

What makes bonds so wonderful is that forecasting returns is very easy, it's all about interest rates.

If you know a bond's duration, then it will almost perfectly track its index Treasury yield.

So what do economists think will happen in the coming recession? According to Toronto Dominion's head of interest rate strategy, 30-year yields should bottom at 1.5% to 2.5% in the coming recession.

- Possibly 0.5% to 1.5% if the US defaults on its debt between June and September.

So what does that mean for these six high-yield long bond ETFs?

- 1.2% to 2.2% yield compression for the underlying bonds

- and 16 to 26 duration, depending on the ETF

- up to 3.2% yield compression in the event of a U.S. default.

According to TD, in the coming recession, these long bond ETFs have a 19% to 57% upside and up to 83% upside in case of a US debt default.

Think these numbers are too good to be true? Don't think that anything can possibly soar this much when the markets are crashing? Let's consider three examples using EDV, the bond ETF I use.

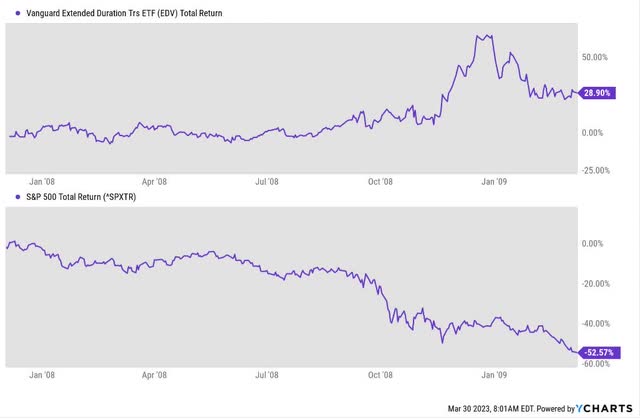

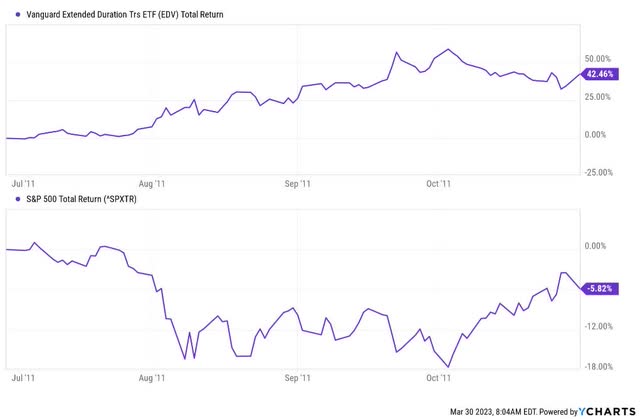

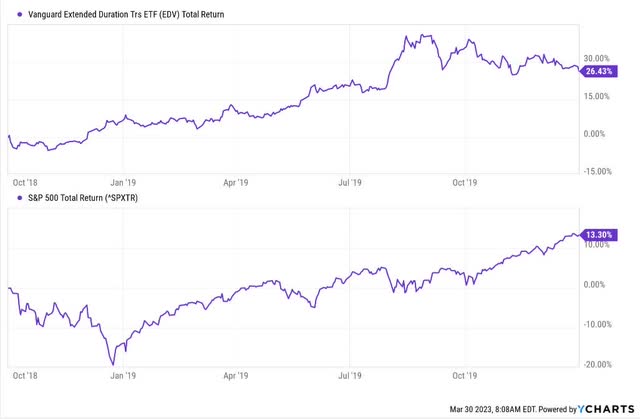

During the Great Recession, EDV soared as much as 60% at the height of the panic.

During the 2011 debt ceiling crisis, it soared as much as 50% while stocks fell a peak intra-day decline of 22%.

During the 2018 recessionary scare, bear market EDV was up modestly while stocks fell 21%, including 17% in three weeks. And even after the market took off, EDV continued rallying for another six months.

During the Pandemic, the ultimate black swan event, stocks fell as much as 34% in a month. EDV was up 16% during that time.

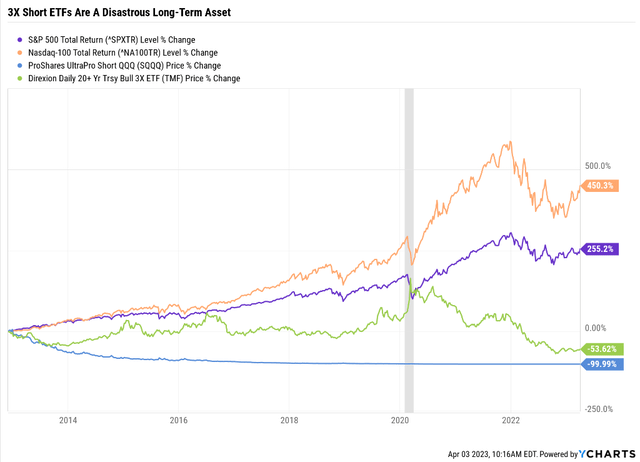

What About 3X Bond ETFs? Or 3X Inverse ETFs?

So if long-duration US Treasuries are the best hedges, why not consider something even more potent? How about 3X inverse ETFs (SQQQ) or 3X long-duration bonds (TMF)?

While these can certainly serve as a short-term hedge, they don't make good long-term "buy and hold forever" assets.

I'm interested in owning buy-and-hold forever assets, so I don't have to obsess over when to start hedging or take hedges off.

"Remember, my son, that any man who is a bear on the future of this country will go broke.” - JPMorgan, 1908

The stock market is the best-performing asset class in history and if you're going to short the market 3X over the long-term you will lose all your money.

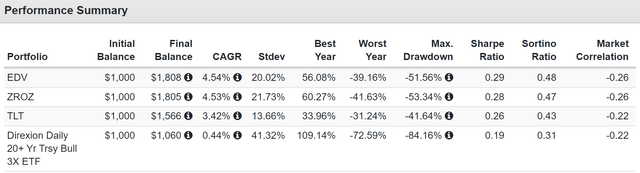

What about 3X long bonds?

Total Returns Since 2009

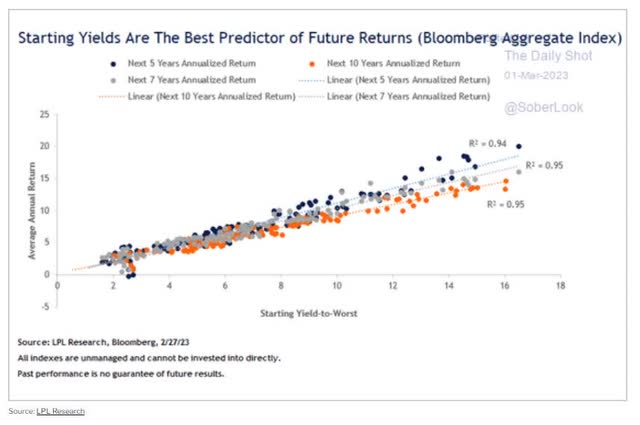

Historically, long bonds deliver about 4% long-term returns, and that's what you can expect if you buy them today.

The starting yield on bonds pretty much tells you the long-term returns.

But note how TMF didn't deliver 3X the returns of long bond ETFs like TLT. Thanks to the much higher volatility, it barely delivered positive returns, due to a 73% crash in 2022 and a peak decline of 84%.

Bottom Line: In The Coming Recession, Bonds Will Be The New Hotness

I'm hardly the only one who is buying bonds these days.

Morgan Stanley, JPMorgan, Schwab, and TD are all going long US treasuries right now.

Why not just own 100% stocks? That's a fine option for a very specific kind of investor, such as someone putting money into a 401K they don't plan to touch for decades.

But if your risk profile is like most retiree's, then some allocation to bonds and other kinds of hedges are reasonable and prudent.

And hedges can make sense for younger investors too. Why?

Because 30% of the time it makes sense to have dry powder available, specifically during bear markets.

And do you know what you can do with the best hedging asset in a recession when it's up 20% to 60%? Rebalance into the world's best blue-chips, during a big sell-off.

In an upcoming video special report, I'll be showing Dividend Kings members exactly how I plan to let the bond market tell me an optimal time to rebalance my excess bonds into stocks.

Why bother? Other than my family's complex risk profile and medical expenses? How about because by being overweight long bonds going into recession potentially will let us buy one to three YEARS worth of stock dollar-cost-averaging within 10% of the final market bottom.

Remember how dry powder boosts long-term returns 30% of the time? When you're sitting on a mountain of excess bonds, which are likely to soar while stocks are falling, that's one of the most reasonable and prudent ways to harness the power of diversification, the only "free lunch" on Wall Street.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EDV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Dividend Kings owns EDV and ZROZ in our portfolios.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.