KONE: No Longer A Buy As Recovery Is Again Postponed

Summary

- We downgrade our rating on KONE from Buy to Hold, following disappointment from 2022 results and the new 2023 outlook.

- Shares are at 31.9x 2022 EPS and have a 3.7% dividend yield after EPS fell by 24% in 2022 due to a decline in sales in China.

- EBIT grew year-on-year in Q4, service sales have continued growing, and the benefits of price hikes and cost cuts are materializing.

- The main problem is the Chinese market, which represents 30% of KONE's sales, is expected to decline by another 10% in 2023.

- With shares at €47.72, our reduced forecasts show a total return of only 24% (8.4% annualized) by 2025 year-end. Avoid.

Viktorcvetkovic/iStock via Getty Images

Introduction

We are downgrading our rating on KONE Oyj (OTCPK:KNYJY) from Buy to Hold, as we now expect a slower earnings recovery following disappointment from 2022 results and the new 2023 outlook.

KONE's share price has fallen 6% since Q4 2022 results were released on January 26:

| KONE Share Price (Last 1 Year)  Source: Google Finance (05-Apr-23). |

We initiated our Buy rating originally in June 2020. KONE's share price is currently 22% lower after just under three years (the actual loss is 12% after dividends), and more than 35% below their all-time high of over €75 in October 2020.

KONE shares are trading at 31.9x 2022 EPS and have a 3.7% Dividend Yield. Management outlook implies a return to earnings growth in 2023, and Q4 2022 EBIT was in fact higher year-on-year. Growth in Maintenance sales has remained consistent, the benefits of past pricing increases and cost actions have gradually come through, and KONE is implementing another €100m of cost cuts in 2023. The Chinese market, which still represented 30% of sales in 2022, is the biggest unknown - expected to start to recover towards the end of H1 2023, but still shrinking 10% for 2023 overall. We cut our forecasts to represent a slower recovery where EPS only returns to its 2021 level in 2025. This would imply a total return of only 24% (8.4% annualized) by 2025 year-end, and we downgrade our rating to Hold accordingly.

KONE is scheduled to report Q1 2023 results on April 26.

KONE Stock Valuation

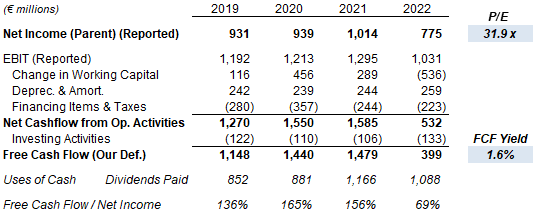

At €47.72, relative to 2022 financials, KONE stock is trading at a 31.9x P/E and a 1.6% Free Cash Flow ("FCF") Yield:

| KONE Earnings, Cashflows & Valuation (2019-22)  Source: KONE company filings. |

KONE's Net Income to Parent (and EPS) fell by 24% in 2022, largely due to a decline in New Equipment sales in China.

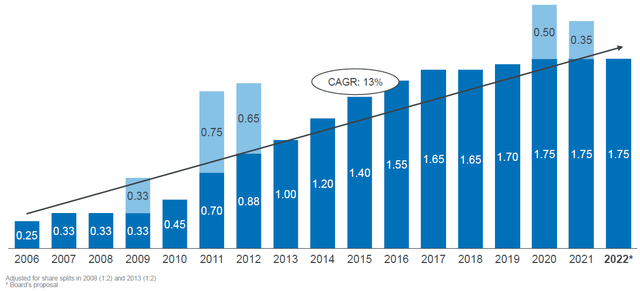

The 2022 dividend was €1.75, implying a Dividend Yield of 3.7%. The regular dividend has remained flat at €1.75 since 2020, but a special dividend of €0.50 in 2020 was cut to €0.35 in 2021 and not repeated in 2022:

| KONE Class B Dividend Per Share (Since 2006)  Source: KONE results presentation (Q4 2022). |

(KONE has 2 classes of shares, Classes A and B, with only Class B being publicly traded. Class A has 10 times the voting rights and a dividend that is typically 1.0-2.5% lower than Class B's.)

The cost of the 2022 dividend (€904m) exceeded KONE's Net Income (€775m) and FCF (€399m) for the year, and was funded by cash reserves. The dividend was paid in March, after KONE's Net Cash had already fallen from €2.16bn to €1.31bn during 2022.

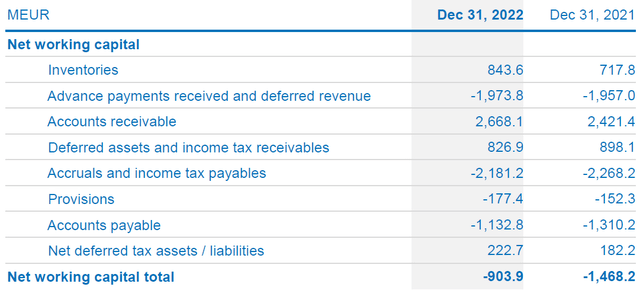

2022 FCF was more than €1bn lower year-on-year, partly due to a lower EBIT (€264m) but mostly due to working capital cashflows being €825 worse (resulting in a €536m outflow). Timing on Accounts Payable, an increase in Accounts Receivable (particularly in China) and higher Inventories all contributed to the deterioration:

| KONE Working Capital (2022 vs. Prior Year)  Source: KONE results presentation (Q4 2022). |

KONE expects to "start to return to a more normalized development in our cash generation" "in the coming quarters".

Outlook Implies Return to Growth in 2023

For KONE's 2023 outlook, management unusually did not provide specific figures on sales and EBIT, instead giving general comments including:

- Sales to be "at a similar level as in the previous year" "at comparable exchange rates"

- Adjusted EBIT Margin "is expected to start to recover"

These comments imply a return to earnings growth in 2023 at constant currency. (As of Q4 2022 results, management was not expecting currencies to have a large impact on profitability.)

EBIT Growth Has Resumed in Q4 2022

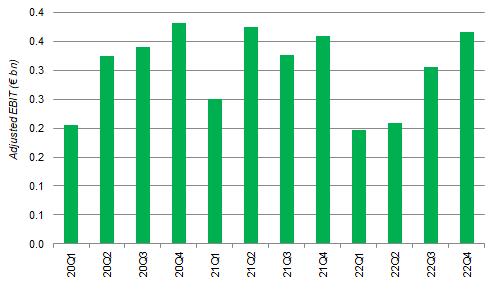

KONE's Adjusted EBIT has in fact returned to growth in Q4 2022, rising 19.4% sequentially and 1.6% year-on-year:

| KONE Adjusted EBIT by Quarter (2020-22)  Source: KONE company filings. |

The key factor for Adjusted EBIT growth in Q4 was a stabilization in Adjusted EBIT Margin, which fell only 50 bps year-on-year (from 13.0% to 12.5%), compared to a decline of nearly 340 bps in Q1-3 (from 12.3% to 8.9%).

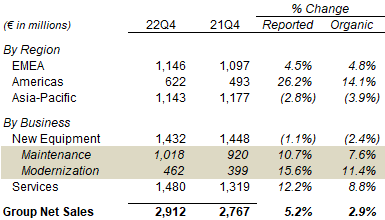

Sales growth was also better in Q4, at +2.9% organically (+5.2% reported), compared to -3.4% organically (+3.2% reported) for Q1-3. The improvement was driven by a smaller decline in New Equipment sales, better Modernization sales and Maintenance sales again growing at high-single-digits:

| KONE Net Sales By Region & Business (Q4 2022 vs. Prior Year)  Source: KONE results release (Q4 2022). |

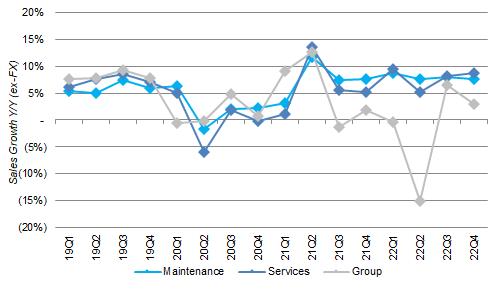

Growth in KONE's high-margin Maintenance sales has remained consistent (at between 7.6% and 8.7% each quarter in 2022), driven by the continuing growth in units (up 5.4% in 2022), price as well as growth in value-add services:

| KONE Sales Growth By Quarter (ex. Currency) (Since 2019)  Source: KONE company filings. |

The benefits of past pricing increases and cost actions have gradually come through, with orders outside China having returned to their 2020 year-end margin level. As CEO Henrik Ehrnrooth stated on the earnings call:

"Price increases did go well last year, and it meant that our margins of our orders received improved compared to sequentially and end of 2021. So, when we look at outside of China, we had set ourselves a target of getting our margins of our new orders to a similar level where we were towards the end of 2020. And that is what we achieved."

Price increases in Maintenance do not yet fully reflect the elevated inflation levels in 2022, as many contracts have price adjustments that happen once a year based on the inflation index at the time. This means there should be a further "catch-up" benefit in price during 2023. CFO Ilkka Hara made this point again on the call:

"And in the markets where we have maintenance contracts which are tied to some kind of inflation index, Naturally, that index last year did not fully reflect yet the inflation we've seen because inflation was just picking up. So in those markets, the inflation now has been a bigger part and then gave us a good environment for escalations."

Pricing has continued to be "challenging" in China, though this was partly offset by a decline in commodity costs there.

KONE is implementing another €100m of cost cuts in 2023, including by merging its two European regional units into one and cutting about 1,000 jobs, with "some tens of millions" of benefit in 2023 and the full benefit in 2024.

China Remains the Biggest Unknown

The Chinese market is the biggest unknown and responsible for the relatively weak outlook for 2023. New Equipment sales in China are important to profitability, unlike those outside China, because the former is high-margin.

Management stated that China still represented approximately 30% of KONE's sales and 35% of its orders received in 2022 (though down from 40% and 35% respectively in 2021). The mix in Chinese sales has remained at around 85% New Equipment and 15% Services, with a margin that was "above group level slightly".

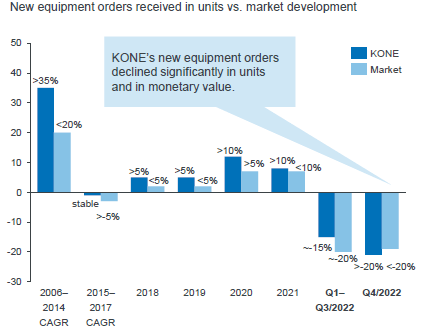

KONE's New Equipment sales in China fell by more than 20% in Q4, worse than in Q1-3 and slightly worse than the market, as the company continued to prioritise margin over volume:

| China New Equipment Sales Growth - KONE vs. Market (Since 2006)  Source: KONE results presentation (Q4 2022). |

The decline was the result of both COVID-19 disruptions and liquidity problems among Chinese property developers, the latter in turn the result of longstanding credit issues. Both are set to improve - China has ended its "zero COVID" policy in early December, and KONE believes that new government policies are now more supportive of the sector, as CEO Henrik Ehrnrooth explained on the call:

"Towards the end of the quarter, first, we saw an abolishment of all COVID restrictions, an opening of the market which we believe will have a positive impact now … At the same time, we have seen a lot of policy announcements to improve the situation for developers to enable them to refinance themselves, to get financing, to be able to drive the whole property sector forward. So those have clearly created much more optimism and, therefore, there are encouraging signs for the market."

KONE's outlook assumes the Chinese market will start to recover towards the end of H1 2023, though still shrinking 10% for 2023 overall. This is hard to predict and we believe may be a reason behind the less-specific nature of management's outlook for 2023. Things can turn out to be much better or much worse than guided.

KONE Stock Forecasts

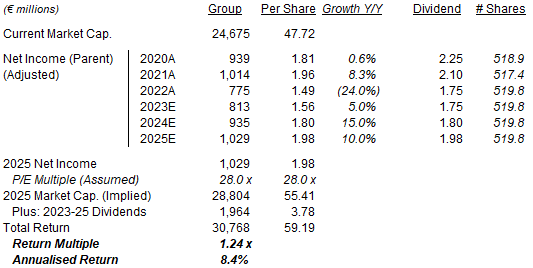

KONE's 2022 Net Income was 2% lower than our forecasts in December, and we also cut our forecasts to represent a slower recovery in line with management outlook for 2023. Our assumptions now include:

- 2022 Net Income (to Parent) of €775m (was €791m)

- 2023 Net Income rebound of 5% (was 15%)

- 2024 Net Income rebound of 15% (was 11%)

- 2025 Net Income growth of 10% (was 7%)

- 2023 dividend of €1.75 (was €€2.51)

- Thereafter dividends to be on a Payout Ratio of 100% (unchanged)

- Share count to be flat (unchanged)

- 2025 year-end P/E of 28.0x (unchanged)

The overall result is that our forecasted EPS now only returns to its 2021 level in 2025 (was 2024), and our new 2025 forecast EPS of €1.98 is 5% lower than before (€2.09):

| KONE Illustrative Return Forecasts  Source: Librarian Capital estimates. |

With shares at €47.72, we expect a total return of 24% (8.4% annualized) by 2025 year-end, which is below our usual requirement for a 10% annualized return.

Is KONE A Buy? Conclusion

We downgrade our rating on KONE to Hold as its forecasted return is below our requirements. Avoid for now.

We still expect KONE's long-term EPS growth to be in the high-single-digits once earnings have normalized. To return to a Buy rating, we would need evidence that earnings will recover faster, potentially from either more bullish expectations on China or a more explicit timetable on aspiration to return to a 16% Adjusted EBIT Margin.

Otis Is a Superior Alternative

Our preferred pick in the elevator industry is Otis Worldwide (OTIS), which is less exposed to China, has more ongoing self-help actions, and is cheaper:

- China generated just 19% of Otis' total sales, including one third of its New Equipment sales, in 2022

- Otis's Adjusted EPS grew by 7.5% year-on-year in 2022 and is guided to grow by another 5.5-10% in 2023

- Otis shares have a 25.1x P/E and a 3.7% FCF Yield relative to 2022 EPS (but have a lower Dividend Yield of 1.4%)

With Otis shares at $80.63, our forecasts indicate a total return of 50% (16.2% annualized) by 2025 year-end.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.