GoodRx Holdings: Growth To Inflect Only In FY24

Summary

- Post 4Q22 results, due to uncertainty surrounding grocer headwinds, my recommendation is to cut existing positions and hold in the short term.

- The FY23 outlook is positive, with the core Prescription Transaction business expected to inflect back to historical growth in 2H22.

- Since growth is expected to inflect in FY24, I expect the stock price to remain rangebound until then.

Solskin

Thesis

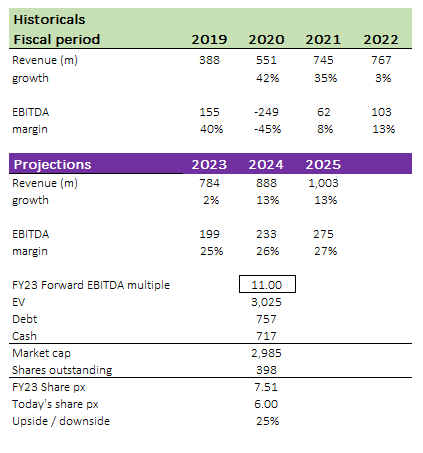

My recommendation was to go long GoodRx Holdings (NASDAQ:GDRX) early this year in January. The original thesis was that in a disjointed final market, GDRX stands out to me as a multi-faceted, multi-product platform that is already providing benefits to both consumers and its industry partners in the form of cost savings and increased convenience. The target price back then was $6.67 on a forward EBITDA multiple of 11x. I believe the thesis is slowly being recognized by the market as the share price is up 17% since my initiation, inching towards my target price. However, post the 4Q22 results, due to the elevated short-term uncertainty (discussed more below), I am recommending to cut existing GDRX stock position and to a hold rating for the short term.

There were a few bright spots in the 4Q22 numbers. First, management presented the company's primary strategic goals, which included, among other things, strengthening their connection with direct consumers, making better use of data to reach more customers, expanding their partner positioning, and maintaining their cost-cutting footing in the Rx market. Secondly, it was commendable that management has been emphasizing the growth of the platform. More specifically, I believe there is growth potential at Sam's Club Pharmacies. Finally, management did a good job of shifting investor attention to the long-term story, in which there is continued optimism regarding the large addressable market opportunities surrounding the creation of saving outcomes for the consumer (a point I agree with and have discussed in my initiation post). Despite all the upside potential, my short-term recommendation is to wait until 4Q23 before jumping in. This is because the grocer issue will continue to present a series of headwinds. This grocer problem has a range of possible outcomes, but I'd rather not take any chances. In my opinion, the GDRX equity story is crystal clear; investors are hoping for a pick-up in growth, which most estimates put at happening in FY24. Given this dynamic, I believe a lot of investors are simply waiting on the sidelines until 4Q23 before they reassess the situation. If this was not the case, the share price would have already reacted (upwards). The fact that it has not tells me the market is still focused on what is going to happen between now and 4Q23.

In the long run, I continue to believe that GDRX will become a key platform which provides cost savings to consumers and increases volumes for its industry partners in a fragmented US healthcare market. All of these combines to drive strong growth and margins expansion, but that part of the equity story is not in focus today.

4Q results

In a nutshell, the results for 4Q22 were better than I had anticipated. In terms of numbers, 4Q22 $184 million in revenue was above expectations but still down 14% from the same period a year ago. The grocer crisis was one of the contributing factor in the decline, accounting for $45 million in negative headwind. While I do not anticipate GDRX making up for lost volume at this supermarket chain, I was heartened to see Rx volumes in pharmacies ex-Kroger increase by 12.5%, 450 bps more than the 8% y/y growth in 3Q22. The fact that net adds increased sequentially in 4Q22, following four quarters of muted trends, is an evidence that underlying performance seems to still be performing well. Overall, flu activity had a slightly positive impact on volume, but this was offset by unfavorable weather conditions. The subscription business also showed modest growth, but Manufacturer Solutions' 23% year-over-year revenue decline highlights the company's ongoing difficulties. Finally, management has increased its emphasis on operating efficiently, resulting in an Adjusted EBITDA of $50 million with a margin of 27%. While I applaud GDRX's efforts to boost profits, I worry that slashing S&M spending even further will hinder the company's ability to bring in new customers and slow its rate of expansion. I guess this is a question market today that we need to continue monitoring. Management ability to balance profit and growth would also be tested in the coming quarters.

FY23 outlook

The management's initial forecast for 1Q23 and FY23 exceeded market expectations. The grocer problem will be a constraint for the rest of the first half of the year, but beginning in the second quarter, the Prescription Transaction business will see much less competition. As previously mentioned, pharmacy sales outside of Kroger grew 12.5% year-over-year in 4Q22. I anticipate the core PTR business will inflect back to historical growth in 2H22, with MAC growth picking up in the second half as well.

Valuation

As shown in my updated model below, growth is expected to inflect in FY24, which is where all of the upsides would come from. I believe the gap between my expected intrinsic value and the current share price will gradually close beginning in 2H23 as investors gain more insight into the progress of growth (via 1Q23 and 2Q23 results + any positive commentary). Until then, I believe the stock price will remain rangebound for the foreseeable future.

Own model

Conclusion

In conclusion, while my original recommendation to go long on GDRX in January was based on the company's strong multi-faceted platform, delivering cost savings and convenience to consumers and industry partners alike, I am now recommending to cut existing positions and hold in the short term due to elevated uncertainty surrounding the grocer headwinds. Until investors gain more insight into the progress of growth, I believe the stock price will remain rangebound. In the long run, I continue to believe in GDRX's potential as a key platform in the fragmented US healthcare market, driving strong growth and margin expansion.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.